Your Fintech insurance images are available. Fintech insurance are a topic that is being searched for and liked by netizens now. You can Get the Fintech insurance files here. Get all royalty-free photos.

If you’re looking for fintech insurance images information connected with to the fintech insurance keyword, you have pay a visit to the ideal blog. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly search and locate more enlightening video articles and images that fit your interests.

Fintech Insurance. Fintech global is the world’s leading provider of fintech information services, b2b media products and industry events. Changes to regulation, perception to corporate responsibility and increased media attention towards fintechs have focused the importance of effective operational, financial and technology risk. We inform, promote and connect fintech buyers, sellers, investors and innovators worldwide. From payment processing to alternative investing to expedited lending, the fintech and regtech industry has introduced innovation to financial related transactions where banks have otherwise been slow to expand.

Fintech surge to watch for in 2020 AZ Big Media From azbigmedia.com

Fintech surge to watch for in 2020 AZ Big Media From azbigmedia.com

Popular features of mobile applications include a policy overview section, premium. As already mentioned, a fintech company’s ability to manage and incorporate innovative technology into its services can be both its bread and butter and its downfall.cyber liability insurance will cover the company in the event of a data breach or cyber attack including ransomware demands. Our fintech team provides cover for a range of fintech companies, including those offering digital banking, money transfer, trading, investments, lending, account information services, and payment initiation services. Many insurance companies are aware of and embracing this shift in consumer demand. Fintech innovations refer to the variety of emerging technologies and innovative business models that have the potential to transform the insurance business. From payment processing to alternative investing to expedited lending, the fintech and regtech industry has introduced innovation to financial related transactions where banks have otherwise been slow to expand.

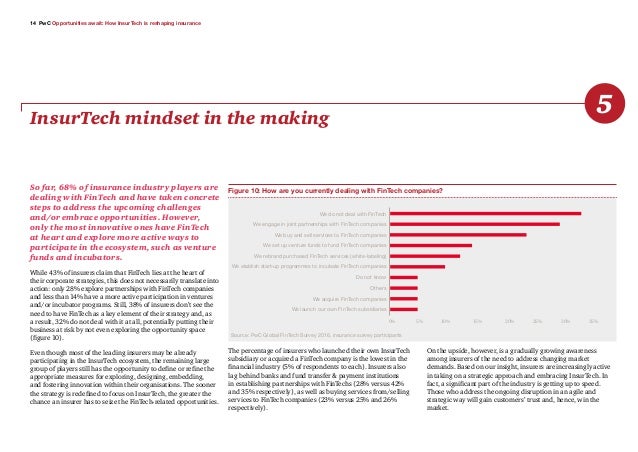

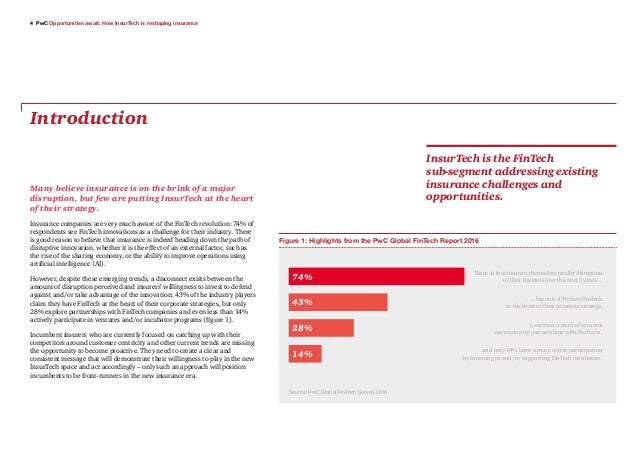

Insurance companies are very much aware of the fintech revolution:

Combining the known value of items with the advanced computer models we can now generate it’s possible to more accurately assess the chance of a risk occurring and provide a realistic price. In the insurance sector, the. For fintech organisations, insurance policies can be a hugely important part of overall risk management. As a fintech company, the risk landscape that your company operates within is exactly as its name implies. Describe by attachment the formal procedures in place relating to the following: Fintech developments are potentially disruptive and may have a significant impact on the insurance market.

Source: fintechnews.ch

Source: fintechnews.ch

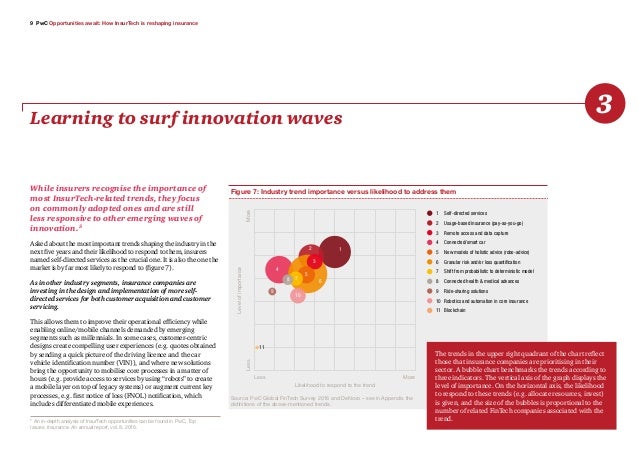

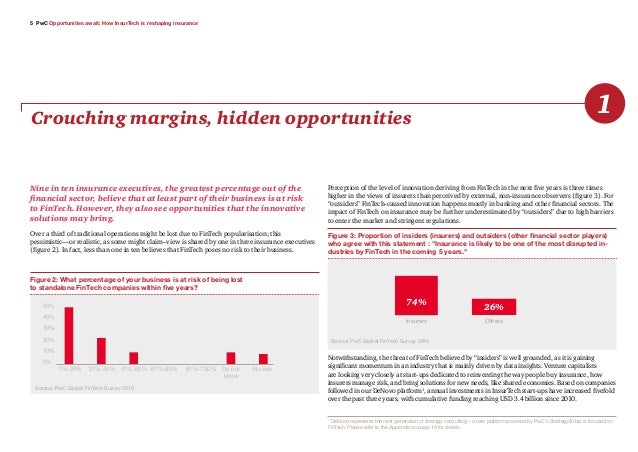

We inform, promote and connect fintech buyers, sellers, investors and innovators worldwide. Insurers should look to the banking institutions that have successfully entered the fintech space as inspiration for digitisation. The lauw fintech policy offers a comprehensive solution to. 74% of respondents see fintech innovations as a challenge for their industry. Insurance industry and presents an overview of their potential impacts on the insurance and sector supervisory approaches.

Source: fintechnews.sg

Source: fintechnews.sg

The conceived complexity around life insurance means that much of the. As the fintech industry continues to boom, so. As already mentioned, a fintech company’s ability to manage and incorporate innovative technology into its services can be both its bread and butter and its downfall.cyber liability insurance will cover the company in the event of a data breach or cyber attack including ransomware demands. Insurance companies are very much aware of the fintech revolution: Our modular policy gives clients the flexibility to choose the covers that suit them, including professional liability, directors and officers liability, theft and cyber.

Source: slideshare.net

Source: slideshare.net

From payment processing to alternative investing to expedited lending, the fintech and regtech industry has introduced innovation to financial related transactions where banks have otherwise been slow to expand. The conceived complexity around life insurance means that much of the. Many insurance companies are aware of and embracing this shift in consumer demand. Some of the core themes and the supervisory considerations that need to be addressed as the role of technology in insurance evolves are the following. Insurtechs are optimizing the use of innovative insurance apps to make more people insured.

Source: slideshare.net

Source: slideshare.net

Changes to regulation, perception to corporate responsibility and increased media attention towards fintechs have focused the importance of effective operational, financial and technology risk. The conceived complexity around life insurance means that much of the. Many insurance companies are aware of and embracing this shift in consumer demand. The urgency for financial services to offer digital products hit the world hard and moved faster than originally anticipated. We inform, promote and connect fintech buyers, sellers, investors and innovators worldwide.

Source: slideshare.net

Source: slideshare.net

74% of respondents see fintech innovations as a challenge for their industry. Combining the known value of items with the advanced computer models we can now generate it’s possible to more accurately assess the chance of a risk occurring and provide a realistic price. A) r isk management, quality control and / or compliance programmes. Pwc, • google, national highway traffic safety administration, pwc, Rather than panicking at the potential threat of insurtech and fintech competition, insurers are looking at these startups as catalysts for innovation.

Source: slideshare.net

Source: slideshare.net

Fintech developments are potentially disruptive and may have a significant impact on the insurance market. In the insurance sector, the. Many insurance companies are aware of and embracing this shift in consumer demand. The conceived complexity around life insurance means that much of the. From payment processing to alternative investing to expedited lending, the fintech and regtech industry has introduced innovation to financial related transactions where banks have otherwise been slow to expand.

Source: slideshare.net

Source: slideshare.net

We inform, promote and connect fintech buyers, sellers, investors and innovators worldwide. The insurtech companies featured on the 2021 forbes fintech 50 are innovating in a space that has long been associated with antiquated processes and. Combining the known value of items with the advanced computer models we can now generate it’s possible to more accurately assess the chance of a risk occurring and provide a realistic price. As already mentioned, a fintech company’s ability to manage and incorporate innovative technology into its services can be both its bread and butter and its downfall.cyber liability insurance will cover the company in the event of a data breach or cyber attack including ransomware demands. However, it is currently too uncertain an area to adequately assess and understand the extent to which these potential developments could affect the insurance market and its supervision.

Source: slideshare.net

Source: slideshare.net

Describe by attachment the formal procedures in place relating to the following: The rise of fintech, changing consumer behavior, and advanced technologies are disrupting the insurance industry. Pwc, • google, national highway traffic safety administration, pwc, A) r isk management, quality control and / or compliance programmes. Insurance is a somewhat slow adopter of technology, and many fintech startups are partnering with traditional insurance companies to help automate processes and expand coverage.

Source: slideshare.net

Source: slideshare.net

For fintech organisations, insurance policies can be a hugely important part of overall risk management. Our modular policy gives clients the flexibility to choose the covers that suit them, including professional liability, directors and officers liability, theft and cyber. 74% of respondents see fintech innovations as a challenge for their industry. Insurance is a somewhat slow adopter of technology, and many fintech startups are partnering with traditional insurance companies to help automate processes and expand coverage. Fintech firms have also entered the large insurance market as well, but offering better services than conventional insurers.

Source: embroker.com

Source: embroker.com

Most insurtech firms are involved in distributing insurance. Fintech coverage is a key part of risk management strategies. In the insurance sector, the. Changes to regulation, perception to corporate responsibility and increased media attention towards fintechs have focused the importance of effective operational, financial and technology risk. Popular features of mobile applications include a policy overview section, premium.

Source: slideshare.net

Source: slideshare.net

However, it is currently too uncertain an area to adequately assess and understand the extent to which these potential developments could affect the insurance market and its supervision. A) r isk management, quality control and / or compliance programmes. General insurance is one area that is quickly improving with fintech technology. Fintech developments in the insurance industry, 21 february 2017 page 6 of 45. Reliance on networks, systems, data, cloud technology, and outsourced service providers exposes a fintech to an array of risks.

Source: azbigmedia.com

Source: azbigmedia.com

The conceived complexity around life insurance means that much of the. A) r isk management, quality control and / or compliance programmes. Most insurtech firms are involved in distributing insurance. The rise of fintech, changing consumer behavior, and advanced technologies are disrupting the insurance industry. There is a good reason to believe that insurance is indeed heading down the path of disruptive innovation, whether it is the effect of an external factor, such as the rise of the sharing economy, or.

Source: slideshare.net

Source: slideshare.net

Describe by attachment the formal procedures in place relating to the following: The detailed discussion and conclusions for each of the product related scenarios are covered in section 5. Rather than panicking at the potential threat of insurtech and fintech competition, insurers are looking at these startups as catalysts for innovation. Insurtechs are optimizing the use of innovative insurance apps to make more people insured. Insurers should look to the banking institutions that have successfully entered the fintech space as inspiration for digitisation.

Source: coruscatesolution.com

Source: coruscatesolution.com

Fintech coverage is a key part of risk management strategies. We inform, promote and connect fintech buyers, sellers, investors and innovators worldwide. The rise of fintech, changing consumer behavior, and advanced technologies are disrupting the insurance industry. However, it is currently too uncertain an area to adequately assess and understand the extent to which these potential developments could affect the insurance market and its supervision. Fintech innovations refer to the variety of emerging technologies and innovative business models that have the potential to transform the insurance business.

Source: krify.co

Source: krify.co

Typically, fintech insurance is a packaged product consisting of professional indemnity, directors and officers liability, cyber and crime insurance, covering your fintech business from an. Rather than panicking at the potential threat of insurtech and fintech competition, insurers are looking at these startups as catalysts for innovation. For fintech organisations, insurance policies can be a hugely important part of overall risk management. Here are five ways that’s happening. Our fintech team provides cover for a range of fintech companies, including those offering digital banking, money transfer, trading, investments, lending, account information services, and payment initiation services.

Source: slideshare.net

Source: slideshare.net

Fintech companies are minimizing inefficiencies by using artificial intelligence (ai) to automate. Here are five ways that’s happening. The insurtech companies featured on the 2021 forbes fintech 50 are innovating in a space that has long been associated with antiquated processes and. Fintech developments are potentially disruptive and may have a significant impact on the insurance market. Combining the known value of items with the advanced computer models we can now generate it’s possible to more accurately assess the chance of a risk occurring and provide a realistic price.

Source: slideshare.net

Source: slideshare.net

Popular features of mobile applications include a policy overview section, premium. Insurance industry and presents an overview of their potential impacts on the insurance and sector supervisory approaches. From mobile car insurance to wearables for health insurance, the industry is. A) r isk management, quality control and / or compliance programmes. For fintech organisations, insurance policies can be a hugely important part of overall risk management.

Source: embroker.com

Source: embroker.com

Specialist insurance coverage protects the value of the business and can provide security in the event of any threats of litigation. The urgency for financial services to offer digital products hit the world hard and moved faster than originally anticipated. Smartphone applications can be designed with businesses, their clients, or both in mind and can streamline traditional insurance processes considerably. As already mentioned, a fintech company’s ability to manage and incorporate innovative technology into its services can be both its bread and butter and its downfall.cyber liability insurance will cover the company in the event of a data breach or cyber attack including ransomware demands. Most insurtech firms are involved in distributing insurance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fintech insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.