Your Financial underwriting in life insurance images are ready in this website. Financial underwriting in life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Financial underwriting in life insurance files here. Find and Download all free vectors.

If you’re searching for financial underwriting in life insurance images information connected with to the financial underwriting in life insurance interest, you have come to the right blog. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

Financial Underwriting In Life Insurance. An underwriter works on behalf of the life insurance company to evaluate your application details, health information, and lifestyle to give you an insurance classification based on risk, which determines your premium. The process generally takes between two weeks and two months to complete. The insurance companies codify a set of procedures which must be followed before accepting any new business. Financial information provided by the applicant on the application or a questionnaire financial needs analysis copy of the empire life concept that was used an inspection report.

You may be surprised to find out that all the best life insurance companies require financial underwriting of prospective applicants when applying for coverage typically around $100,001 or more. Life insurance companies need to ensure insurable interest is present and want to ensure that the amount of coverage requested is justified. Financial underwriting when applying for life insurance is part of the process with all life insurance companies. Life insurance underwriting guide financial underwriting financial underwriting is the evaluation of the proposed insured’s personal and business financial background. Life insurance financial underwriting [comprehensive guide] updated october 20, 2020 you may be surprised to find out that all the best life insurance companies require financial underwriting of prospective applicants when applying for. Today’s life insurance customer demands a faster and more convenient quoting and buying experience.

Life insurance companies rely on insurance underwriters to determine the risk they face in selling you a policy.

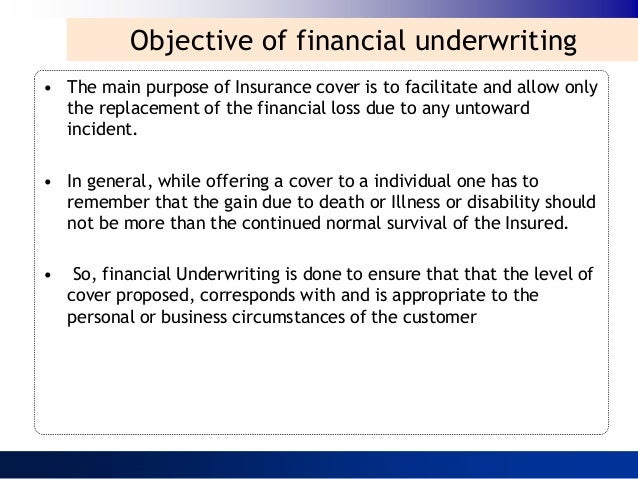

Underwriting tools include but are not limited to any of the following: Financial underwriting is a key component for risk assessment. • sources of income include earned income such age It helps determine the insurance need and validates the coverage and premium amount based on the individual or corporate financial profile. After you apply for life insurance, you go through a process called underwriting with the insurance company. Financial underwriting for life insurance.

Source: quantiphi.com

Source: quantiphi.com

After that, you’ll know if you’ve been approved or denied for the life insurance for which you applied. Life insurance companies need to ensure insurable interest is present and want to ensure that the amount of coverage requested is justified. The insurance companies codify a set of procedures which must be followed before accepting any new business. • inspection report with third party verification for amounts $10 million and over. Life & health financial underwriting guidelines personal insurance purpose requirements underwriting guidelines income replacement • applicable financial questions on the application.

Source: actuaries.digital

Source: actuaries.digital

Financial underwriting is a risk assessment tool used by life insurers to determine the amount of cover that is reasonable for your situation. Life insurance companies rely on insurance underwriters to determine the risk they face in selling you a policy. For life insurance, underwriters assess the risk of early death. When one’s life insurance exceeds his or her economic value, this is a. Life insurance underwriting accelerate and streamline the underwriting process.

![Life Insurance Financial Underwriting Guide]](https://www.insuranceandestates.com/wp-content/uploads/Financial-Underwriting-Life-Insurance.jpg “Life Insurance Financial Underwriting Guide]") Source: insuranceandestates.com

Underwriting tools include but are not limited to any of the following: An underwriter works on behalf of the life insurance company to evaluate your application details, health information, and lifestyle to give you an insurance classification based on risk, which determines your premium. For health insurance, they asses the risk of illness or injury. Financial underwriting is a key component for risk assessment. Today’s life insurance customer demands a faster and more convenient quoting and buying experience.

Source: mortgagefinancegazette.com

Source: mortgagefinancegazette.com

With mortgage protection insurance, underwriters assess both the risk of death and illness/injury. Financial information provided by the applicant on the application or a questionnaire financial needs analysis copy of the empire life concept that was used an inspection report. It often goes overlooked but it a critical consideration, especially for larger cases and some business situations. There are broadly two parts to underwriting: The following are guidelines to assist you when working with your clients to determine the appropriate insurance need,

Financial underwriting guidelines for life insurance every application for individually underwritten life insurance includes an income factor being used to prevent or reduce speculation. In some cases—usually when the amount of life insurance benefit is high—the insurer goes the extra mile to evaluate the financial background of a prospect. The process generally takes between two weeks and two months to complete. Life insurance underwriting is the process of accepting the proposal of the customer based on the guidelines formulated by the insurance company. You may be surprised to find out that all the best life insurance companies require financial underwriting of prospective applicants when applying for coverage typically around $100,001 or more.

Source: locallifeagents.com

Source: locallifeagents.com

The following are guidelines to assist you when working with your clients to determine the appropriate insurance need, Financial underwriting is a key component for risk assessment. Life insurance financial underwriting [comprehensive guide] updated october 20, 2020 you may be surprised to find out that all the best life insurance companies require financial underwriting of prospective applicants when applying for. As heather milligan, senior vice president, life underwriting at lincoln financial group, explains, “underwriters are starting to own implementation of ai programs and are driving automation priorities by working on rule engines and their interfaces. During the analysis we need to confirm that the need for insurance in force with our company and other carriers as well as applied for is reasonable

The following are guidelines to assist you when working with your clients to determine the appropriate insurance need, The factors that a provider of life insurance considers before issuing a policy and determining how much the premium should be. With mortgage protection insurance, underwriters assess both the risk of death and illness/injury. When a new proposal comes to the insurance company its underwriting department scrutinizes the proposal. Life & health financial underwriting guidelines personal insurance purpose requirements underwriting guidelines income replacement • applicable financial questions on the application.

Source: slideshare.net

Source: slideshare.net

Financial underwriting is a key component for risk assessment. Essentially, financial underwriting is when an applicant has to justify to the life insurance company why they are applying for that amount of coverage. The process generally takes between two weeks and two months to complete. You may be surprised to find out that all the best life insurance companies require financial underwriting of prospective applicants when applying for coverage typically around $100,001 or more. During the analysis we need to confirm that the need for insurance in force with our company and other carriers as well as applied for is reasonable

Source: instamojo.com

Source: instamojo.com

For health insurance, they asses the risk of illness or injury. Essentially, financial underwriting is when an applicant has to justify to the life insurance company why they are applying for that amount of coverage. Life insurance financial underwriting [comprehensive guide] updated october 20, 2020 you may be surprised to find out that all the best life insurance companies require financial underwriting of prospective applicants when applying for. With mortgage protection insurance, underwriters assess both the risk of death and illness/injury. As heather milligan, senior vice president, life underwriting at lincoln financial group, explains, “underwriters are starting to own implementation of ai programs and are driving automation priorities by working on rule engines and their interfaces.

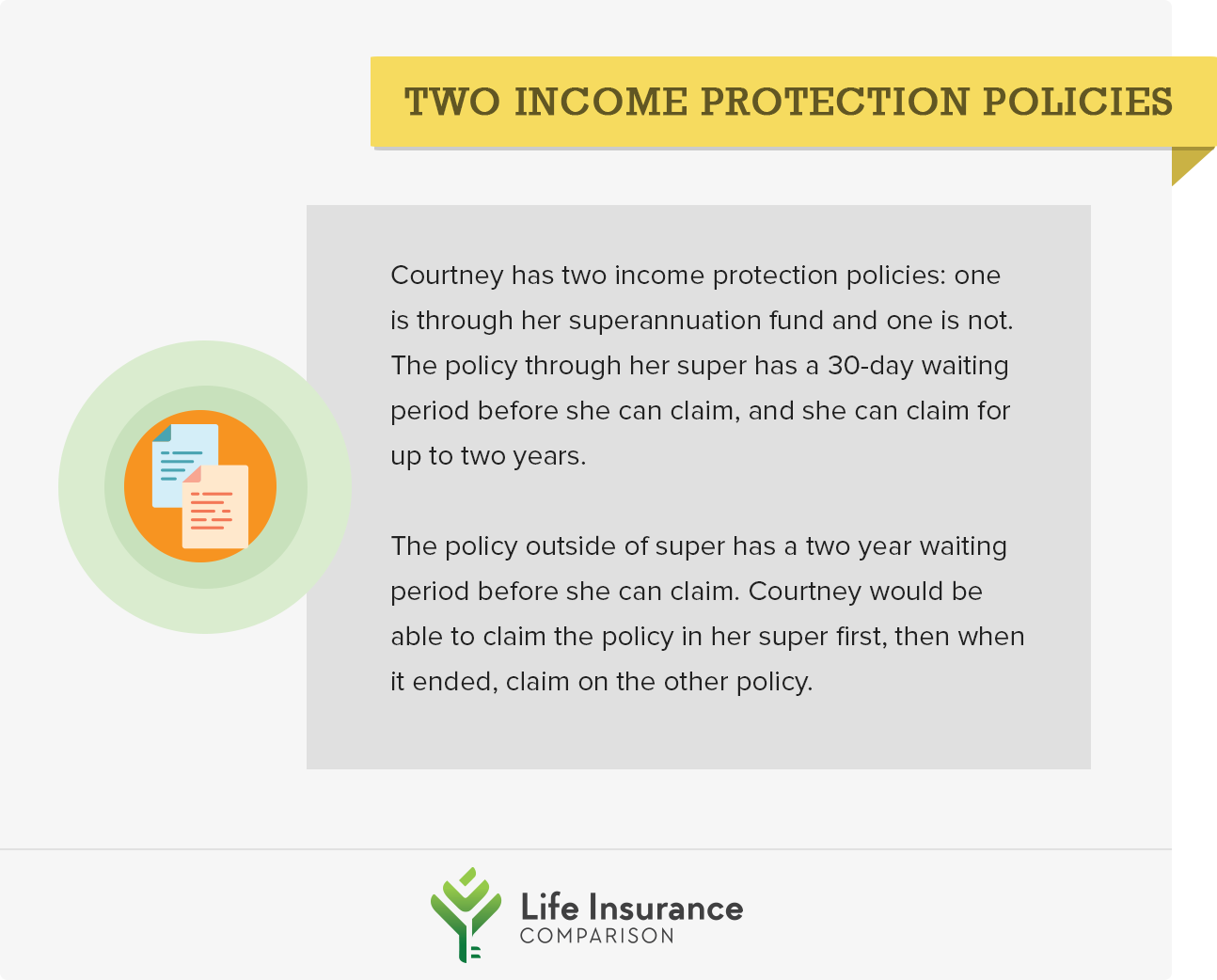

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

Underwriting tools include but are not limited to any of the following: The primary purpose of life insurance is to provide funds to help replace the economic Financial underwriting is a risk assessment tool used by life insurers to determine the amount of cover that is reasonable for your situation. The factors that a provider of life insurance considers before issuing a policy and determining how much the premium should be. For life insurance, underwriters assess the risk of early death.

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

The factors that a provider of life insurance considers before issuing a policy and determining how much the premium should be. Financial information provided by the applicant on the application or a questionnaire financial needs analysis copy of the empire life concept that was used an inspection report. For health insurance, they asses the risk of illness or injury. The primary purpose of life insurance is to provide funds to help replace the economic Life insurance financial underwriting [comprehensive guide] updated october 20, 2020 you may be surprised to find out that all the best life insurance companies require financial underwriting of prospective applicants when applying for.

Source: youtube.com

Source: youtube.com

• inspection report with third party verification for amounts $10 million and over. The primary purpose of life insurance is to provide funds to help replace the economic The insurance companies codify a set of procedures which must be followed before accepting any new business. In some cases—usually when the amount of life insurance benefit is high—the insurer goes the extra mile to evaluate the financial background of a prospect. Today’s life insurance customer demands a faster and more convenient quoting and buying experience.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

Life insurance underwriting accelerate and streamline the underwriting process. Underwriting factors in life insurance are used to estimate how likely a potential policyholder is to die before issuing the policy becomes profitable for the insurer. For life insurance, underwriters assess the risk of early death. Life insurance companies need to ensure insurable interest is present and want to ensure that the amount of coverage requested is justified. What is life insurance underwriting?

Source: compareclub.com.au

Source: compareclub.com.au

When a new proposal comes to the insurance company its underwriting department scrutinizes the proposal. Essentially, financial underwriting is when an applicant has to justify to the life insurance company why they are applying for that amount of coverage. • inspection report with third party verification for amounts $10 million and over. That’s because when most people think about life insurance underwriting, the first factors to come to mind are usually age, gender, and medical history. Life insurance companies need to ensure insurable interest is present and want to ensure that the amount of coverage requested is justified.

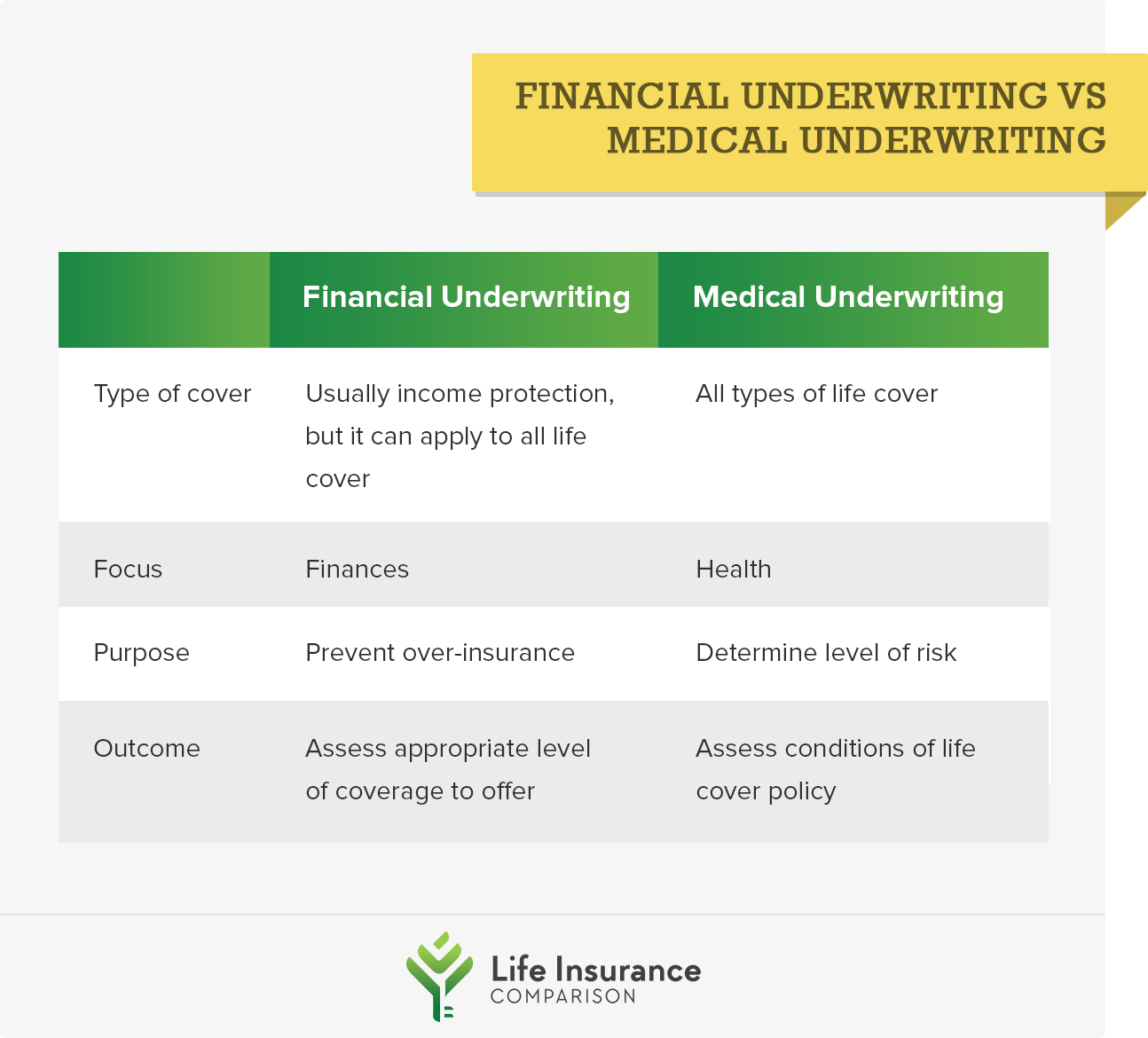

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

Underwriting tools include but are not limited to any of the following: Financial underwriting when applying for life insurance is part of the process with all life insurance companies. Insurance companies use the underwriting process for various types of insurance. Life insurance companies need to ensure insurable interest is present and want to ensure that the amount of coverage requested is justified. Factors include age, gender, whether or not the potential policyholder smokes, and so forth.

Source: pinterest.com

Source: pinterest.com

• inspection report with third party verification for amounts $10 million and over. The factors that a provider of life insurance considers before issuing a policy and determining how much the premium should be. For life insurance, underwriters assess the risk of early death. As heather milligan, senior vice president, life underwriting at lincoln financial group, explains, “underwriters are starting to own implementation of ai programs and are driving automation priorities by working on rule engines and their interfaces. Factors include age, gender, whether or not the potential policyholder smokes, and so forth.

Source: riskquoter.com

Source: riskquoter.com

It helps determine the insurance need and validates the coverage and premium amount based on the individual or corporate financial profile. After you apply for life insurance, you go through a process called underwriting with the insurance company. For life insurance, the underwriter looks at data like your health and medical history as well as lifestyle information like your hobbies and financial ability. Financial underwriting is a risk assessment tool used by life insurers to determine the amount of cover that is reasonable for your situation. Life insurance underwriting guide financial underwriting financial underwriting is the evaluation of the proposed insured’s personal and business financial background.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title financial underwriting in life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.