Your Financial kpis for insurance companies images are ready in this website. Financial kpis for insurance companies are a topic that is being searched for and liked by netizens now. You can Find and Download the Financial kpis for insurance companies files here. Get all free photos and vectors.

If you’re searching for financial kpis for insurance companies pictures information related to the financial kpis for insurance companies interest, you have pay a visit to the right site. Our site frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and find more enlightening video articles and images that match your interests.

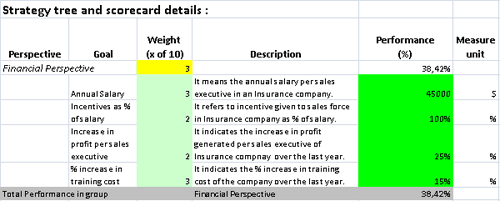

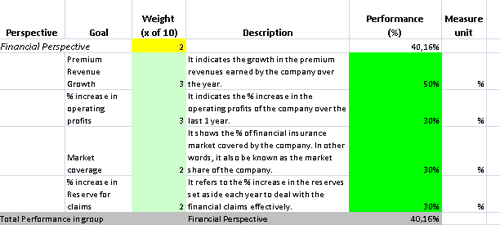

Financial Kpis For Insurance Companies. Cost per bind (also known as cost per acquisition). An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. The kpi breaks it down by policy type because each type has its characteristics.

Insurance Kpis Insurance From insurancemining.blogspot.com

Insurance Kpis Insurance From insurancemining.blogspot.com

Kpi insurance agency performance metric #1: Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. Financial kpis measure business performance against specific financial goals such as. An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. Cost per bind (also known as cost per acquisition). Comprehensive insurance kpi benchmarking reports bundles that include 10 to 80+ measured kpis.

How much it costs your agency to bind a policy or acquire a customer.

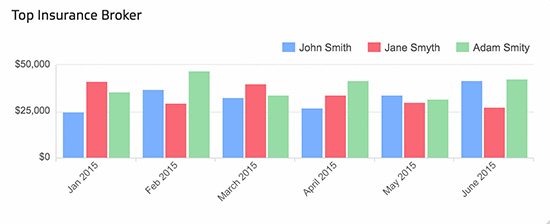

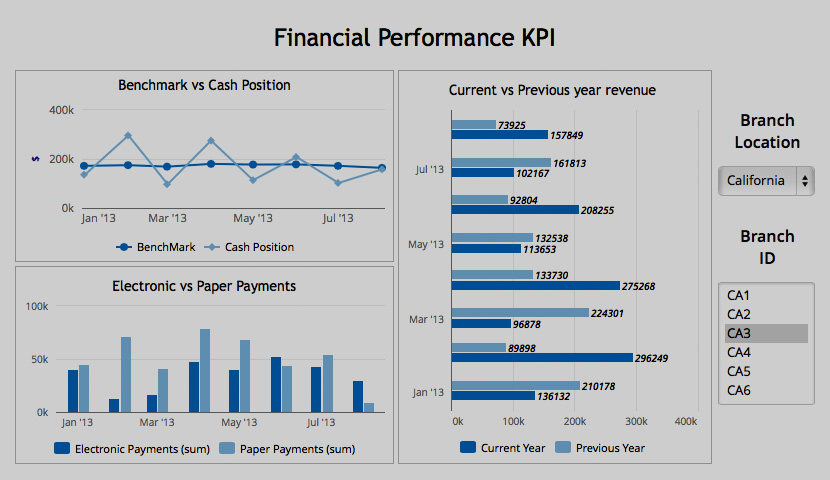

An insurance kpi dashboard is to measure the performance and efficiency of insurance agents. Financial kpis are metrics tied directly to financial values that a company uses to monitor and analyze key aspects of its business. Many kpis are ratios that measure meaningful relationships in the company’s financial data, such as the ratio of profit to revenue. This kpi measures how much time, on average, it takes to settle insurance claims. By using these insurance kpis and metrics business leaders can learn how to balance the risks and rewards that direct the future insurance business. The kpi breaks it down by policy type because each type has its characteristics.

Source: insightsoftware.com

Source: insightsoftware.com

Some insurance kpi examples are: Knowing which insurance key performance indicators (aka kpis or metrics) to track can be tricky, so make a list of the big numbers first. Cost per bind (also known as cost per acquisition). An insurance kpi dashboard is to measure the performance and efficiency of insurance agents. Afterall, customers who submit claims are at their most vulnerable and look to their insurer to make the.

Source: klipfolio.com

Source: klipfolio.com

Take our analysis for a test drive with examination of critical kpis for insurance companies. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. An insurance kpi dashboard is to measure the performance and efficiency of insurance agents. This kpi measures how much time, on average, it takes to settle insurance claims. Some insurance kpi examples are:

Source: dashboardshare.com

Source: dashboardshare.com

You should be looking at these kpis for insurance companies weekly at the very least. Within 24 hours, an akana api expert will provide a. Financial kpis are metrics tied directly to financial values that a company uses to monitor and analyze key aspects of its business. Kpi insurance agency performance metric #1: A financial insurance company transfers the risks of its customers by insuring activities and areas that are highly uncertain, allowing them to operate with more freedom and concentration.

Source: noclutter.cloud

Source: noclutter.cloud

Attending the certified insurance counselors class on agency management, i was introduced to the growth and performance standards survey published by the national alliance for insurance education, and discovered the key performance indicators (kpis) that they publish on agencies of all types and sizes. But what are the financial kpis for insurance companies using apis? When understanding market expectations for property and casualty insurance, whether at a company or industry level, here are some of the p&c insurance kpis to consider: Knowing which insurance key performance indicators (aka kpis or metrics) to track can be tricky, so make a list of the big numbers first. Cost per bind (also known as cost per acquisition).

Source: boldbi.com

Source: boldbi.com

Kpi insurance agency performance metric #1: Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. By using these insurance kpis and metrics business leaders can learn how to balance the risks and rewards that direct the future insurance business. Within 24 hours, an akana api expert will provide a. Customer satisfaction (csat) insurers can use surveys to measure the customer satisfaction of any transaction or product, but the claims process is one that insurers tend to focus on.

Source: boldbi.com

Source: boldbi.com

Example kpis for finance and insurance accounting costs accounts payable accounts payable turnover asset turnover rate average sum deposited in new deposit accounts average value of past due loans cash conversion cycle (ccc) cash dividends paid cash flow return on investments (cfroi) common stock. Complete the form to see how implementation of a full lifecycle api management solution can benefit your organization. Financial kpis are metrics tied directly to financial values that a company uses to monitor and analyze key aspects of its business. Financial kpis measure business performance against specific financial goals such as. This kpi measures how much time, on average, it takes to settle insurance claims.

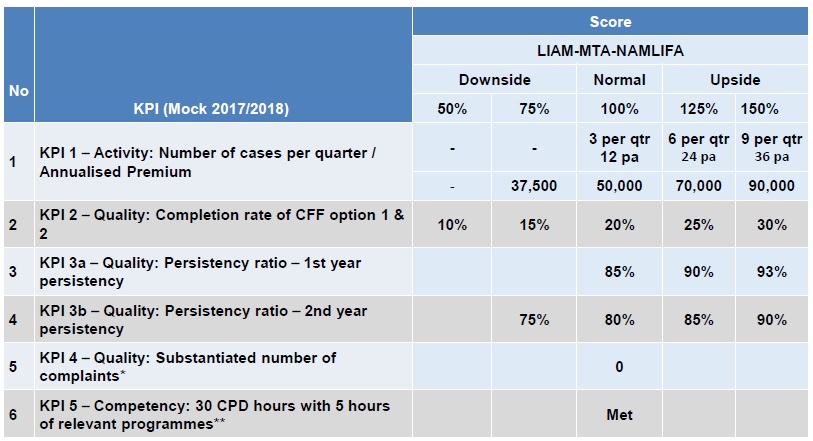

Source: abnasia.org

Definition of financial kpis for insurance company, banks or any other companies. By using these insurance kpis and metrics business leaders can learn how to balance the risks and rewards that direct the future insurance business. Kpi insurance agency performance metric #1: Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. Attending the certified insurance counselors class on agency management, i was introduced to the growth and performance standards survey published by the national alliance for insurance education, and discovered the key performance indicators (kpis) that they publish on agencies of all types and sizes.

Source: boldbi.com

Source: boldbi.com

Of these insurance kpi examples, this may be the one you’re most familiar with. Take our analysis for a test drive with examination of critical kpis for insurance companies. An insurance kpi dashboard is to measure the performance and efficiency of insurance agents. Here are the insurance kpis companies should track. You should be looking at these kpis for insurance companies weekly at the very least.

Source: strategy2act.com

Source: strategy2act.com

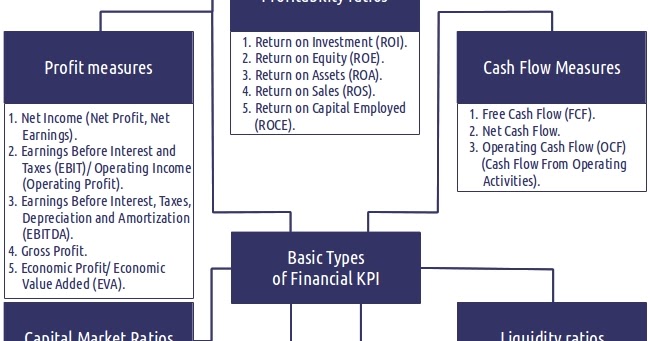

A financial kpi or metric is a measurable value that indicates a company’s financial results and performance, provides information about expenses, sales, profit, and cash flow, in order to optimize and achieve business’ financial goals and objectives. Afterall, customers who submit claims are at their most vulnerable and look to their insurer to make the. Comprehensive insurance kpi benchmarking reports bundles that include 10 to 80+ measured kpis. Here are the insurance kpis companies should track. Financial kpis for insurance companies.

Source: abinsura.blogspot.com

Source: abinsura.blogspot.com

With the advent of insurance business, the risk associated with various kinds of activities can easily be diversified by the customers, but there are certain areas that are still largely untouched by the insurance schemes and products offered by the companies Financial kpis measure business performance against specific financial goals such as. A financial insurance company transfers the risks of its customers by insuring activities and areas that are highly uncertain, allowing them to operate with more freedom and concentration. Many kpis are ratios that measure meaningful relationships in the company’s financial data, such as the ratio of profit to revenue. Some insurance kpi examples are:

Source: strategy2act.com

Source: strategy2act.com

With the advent of insurance business, the risk associated with various kinds of activities can easily be diversified by the customers, but there are certain areas that are still largely untouched by the insurance schemes and products offered by the companies Some insurance kpi examples are: The kpi breaks it down by policy type because each type has its characteristics. Definition of financial kpis for insurance company, banks or any other companies. An insurance kpi dashboard is to measure the performance and efficiency of insurance agents.

Source: abinsura.blogspot.com

Source: abinsura.blogspot.com

Opsdog.com sells insurance kpi and benchmarking data in three different ways. The kpi breaks it down by policy type because each type has its characteristics. With the advent of insurance business, the risk associated with various kinds of activities can easily be diversified by the customers, but there are certain areas that are still largely untouched by the insurance schemes and products offered by the companies Within 24 hours, an akana api expert will provide a. Analyzing financial insurance company through kpis.

Source: livemint.com

Source: livemint.com

Comprehensive insurance kpi benchmarking reports bundles that include 10 to 80+ measured kpis. Opsdog.com sells insurance kpi and benchmarking data in three different ways. Kpis can be used as indicators of a company’s financial health at any point in time. By using these insurance kpis and metrics business leaders can learn how to balance the risks and rewards that direct the future insurance business. Many kpis are ratios that measure meaningful relationships in the company’s financial data, such as the ratio of profit to revenue.

Source: sisense.com

Source: sisense.com

A simple example could be medical claims versus auto claims. Customer satisfaction (csat) insurers can use surveys to measure the customer satisfaction of any transaction or product, but the claims process is one that insurers tend to focus on. By using these insurance kpis and metrics business leaders can learn how to balance the risks and rewards that direct the future insurance business. Within 24 hours, an akana api expert will provide a. An insurance kpi dashboard is to measure the performance and efficiency of insurance agents.

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

Definition of financial kpis for insurance company, banks or any other companies. When understanding market expectations for property and casualty insurance, whether at a company or industry level, here are some of the p&c insurance kpis to consider: Some insurance kpi examples are: Financial kpis for insurance companies. A simple example could be medical claims versus auto claims.

Source: insuranceanalytics.graymatter.co.in

Source: insuranceanalytics.graymatter.co.in

Complete the form to see how implementation of a full lifecycle api management solution can benefit your organization. Knowing which insurance key performance indicators (aka kpis or metrics) to track can be tricky, so make a list of the big numbers first. This kpi measures how much time, on average, it takes to settle insurance claims. Kpis can be used as indicators of a company’s financial health at any point in time. Financial kpis measure business performance against specific financial goals such as.

Source: bscdesigner.com

Source: bscdesigner.com

An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. Many kpis are ratios that measure meaningful relationships in the company’s financial data, such as the ratio of profit to revenue. But what are the financial kpis for insurance companies using apis? The average cost per claim, sales revenue, and quotas vs. Customer satisfaction (csat) insurers can use surveys to measure the customer satisfaction of any transaction or product, but the claims process is one that insurers tend to focus on.

Source: kpi-examples.blogspot.com

Source: kpi-examples.blogspot.com

Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. Example kpis for finance and insurance accounting costs accounts payable accounts payable turnover asset turnover rate average sum deposited in new deposit accounts average value of past due loans cash conversion cycle (ccc) cash dividends paid cash flow return on investments (cfroi) common stock. A simple example could be medical claims versus auto claims. Complete the form to see how implementation of a full lifecycle api management solution can benefit your organization. An insurance kpi dashboard is to measure the performance and efficiency of insurance agents.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title financial kpis for insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.