Your Financial consultant vs insurance agent images are ready. Financial consultant vs insurance agent are a topic that is being searched for and liked by netizens now. You can Download the Financial consultant vs insurance agent files here. Get all free vectors.

If you’re looking for financial consultant vs insurance agent pictures information related to the financial consultant vs insurance agent interest, you have pay a visit to the ideal site. Our site always provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

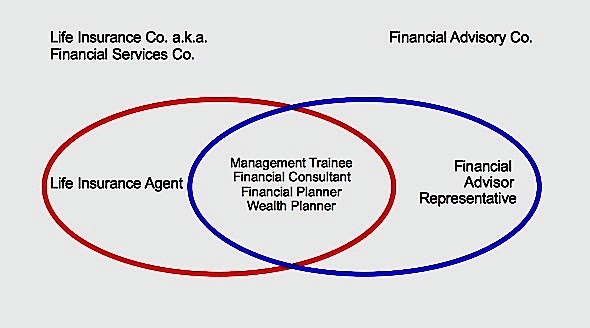

Financial Consultant Vs Insurance Agent. So, what about titles like certified financial planner (cfp), chartered financial consultant (chfc), associate financial consultant (afc), or chartered life underwriter (clu)? They are paid — often by commission — directly by the health insurer after you enroll in a plan. Some also offer investment management. Your business is “you being an insurance agent”.

Financial Analyst vs. Financial Consultant Careers From investopedia.com

Financial Analyst vs. Financial Consultant Careers From investopedia.com

So, what about titles like certified financial planner (cfp), chartered financial consultant (chfc), associate financial consultant (afc), or chartered life underwriter (clu)? Insurance agents who obtain this designation can use it to provide comprehensive financial plans for clients and show them how their various insurance needs. A health insurance agent or producer usually works with a single insurer. Anyone who provides advice on a financial topic is an �advisor� to them, said jim lorenzen, a certified financial. This profession is closely related to financial advisors. In some cases, a financial consultant may have more financial planning experience than the typical financial advisor.

Financial consultants usually provide investment services as well, though.

To sell insurance, an agent helps consumers select the right insurance to buy, but represents the insurance company in the transaction. Therefore, it is a question of fact. The agent must understand the tax and legal aspects of the products they sell and how they are designed to. Health insurance brokers are licensed and regulated by individual states. There are two types of insurance agents: In some cases, a financial consultant may have more financial planning experience than the typical financial advisor.

Source: thefinance.sg

Source: thefinance.sg

They often offer a number of services, with their financial advice being based on the client’s specific needs and goals. To sell insurance, an agent helps consumers select the right insurance to buy, but represents the insurance company in the transaction. Unlike an insurance broker, an insurance agent only targets to increase the sales of the insurer by bringing more clients on board. A good insurance agent knows much more than how to sell a policy. Your business is “you being an insurance agent”.

Source: facircle.blogspot.com

Source: facircle.blogspot.com

Don’t go further than a decade behind when describing your job history, unless you’re applying for an executive position; Such insurance consultant may not sell insurance, without being separately licensed as an insurance agent or broker. A financial professional or firm that offers advice, data and analysis to help clients pick and manage investments. Some also offer investment management. These are internationally recognised certifications that signify an agent’s knowledge in finance, insurance and.

Source: investopedia.com

Source: investopedia.com

This profession is closely related to financial advisors. Anyone who provides advice on a financial topic is an �advisor� to them, said jim lorenzen, a certified financial. Being an insurance agent you are a franchisee of the insurance company you represent. Stockbrokers, insurance agents, realtors, loan officers, bankers, investment advisers, estate planners, and tax and accounting professionals are all prime candidates for this credential. Any financial professional who desires to increase his or her knowledge and competence can benefit greatly from obtaining the chfc designation.

Source: investopedia.com

Source: investopedia.com

They may be involved solely in offering insurance policies, or they may provide a variety of services including risk management, consulting or advisory services. An individual who is not licensed as an insurance consultant, agent or broker may not charge a fee for providing insurance consulting services. Again, though, it�s hard to distinguish between financial advisors and insurance agents with a hard and fast definition, of being good and the other bad; So, what about titles like certified financial planner (cfp), chartered financial consultant (chfc), associate financial consultant (afc), or chartered life underwriter (clu)? These are internationally recognised certifications that signify an agent’s knowledge in finance, insurance and.

Source: compareinsurancesonline.ca

Source: compareinsurancesonline.ca

Additional certifications for financial planners. They act as the sales representatives for the company and its financial products. Health insurance brokers are licensed and regulated by individual states. As insurance agents, at the time you become coded, you will be advised by your respective insurance companies to register your business. Some also offer investment management.

Source: thebalance.com

Source: thebalance.com

A health insurance agent or producer usually works with a single insurer. Combine job responsibilities as well as achievements with numbers in results when you describe your past work; Brokers, insurance agents, accountants and other qualified professionals who generally assess the financial situation of clients and then create a plan to help them reach financial goals. Your business is “you being an insurance agent”. Stockbrokers, insurance agents, realtors, loan officers, bankers, investment advisers, estate planners, and tax and accounting professionals are all prime candidates for this credential.

Source: youtube.com

Source: youtube.com

A financial professional or firm that offers advice, data and analysis to help clients pick and manage investments. People tend to be more loyal to a good insurance representative than they are to a stockbroker because the insurance representative is protecting them in case of a disaster, whereas a broker’s job is to let the client make more money and unfortunately there are higher chances for a broker to lose a client’s money than an insurance representative. As insurance agents, at the time you become coded, you will be advised by your respective insurance companies to register your business. An independent agent also sells various financial products like property insurance, casualty insurance, life insurance, etc. This profession is closely related to financial advisors.

Source: ironpointinsurance.com

Source: ironpointinsurance.com

Captive agents typically represent only one insurer. Therefore, it is a question of fact. Detailed claims, distribution and productivity benchmarking along lines of business, market, customer and risk segments that are used to identify optimization. Any financial professional who desires to increase his or her knowledge and competence can benefit greatly from obtaining the chfc designation. As insurance agents, at the time you become coded, you will be advised by your respective insurance companies to register your business.

Source: huntersure.com

Source: huntersure.com

You might neglect to notice. Insurance agents who obtain this designation can use it to provide comprehensive financial plans for clients and show them how their various insurance needs. A good insurance agent knows much more than how to sell a policy. An independent agent also sells various financial products like property insurance, casualty insurance, life insurance, etc. They often offer a number of services, with their financial advice being based on the client’s specific needs and goals.

Source: moneycrashers.com

Source: moneycrashers.com

Insurance agents who obtain this designation can use it to provide comprehensive financial plans for clients and show them how their various insurance needs. A good insurance agent knows much more than how to sell a policy. As insurance agents, at the time you become coded, you will be advised by your respective insurance companies to register your business. To sell insurance, an agent helps consumers select the right insurance to buy, but represents the insurance company in the transaction. An insurance agent directly represents an insurance company and focuses on selling insurance products to consumers on behalf of the company.

Source: soleraam.com

Source: soleraam.com

An insurance agent is a professional who sells an insurance company’s products to consumers for a commission. There are two types of insurance agents: Any financial professional who desires to increase his or her knowledge and competence can benefit greatly from obtaining the chfc designation. Additional certifications for financial planners. An independent agent also sells various financial products like property insurance, casualty insurance, life insurance, etc.

Source: angel-of-darknes-fanfiction.blogspot.com

Source: angel-of-darknes-fanfiction.blogspot.com

Health insurance brokers are licensed and regulated by individual states. This is because, in the last few decades, lines have blurred between professions in financial advisory. Your business is “you being an insurance agent”. Also known as financial advisors, financial consultants provide advice to clients on taxes, retirement planning, investments, and insurance decisions to help clients achieve their financial objectives. Such insurance consultant may not sell insurance, without being separately licensed as an insurance agent or broker.

![[Kannada] Insurance Agent Vs Financial Advisor Money [Kannada] Insurance Agent Vs Financial Advisor Money](https://i.ytimg.com/vi/o4bJTmo1B3U/maxresdefault.jpg) Source: youtube.com

Source: youtube.com

Again, though, it�s hard to distinguish between financial advisors and insurance agents with a hard and fast definition, of being good and the other bad; A good insurance agent advising based on products that he or she is selling from their company could offer more value compared to a financial adviser simply recommending the cheapest products, which may or may not even be suitable in the first place. Your business is “you being an insurance agent”. An insurance agent directly represents an insurance company and focuses on selling insurance products to consumers on behalf of the company. A dedicated team of insurance technology experts who work with clients to transform it, transform insurance companies, and transform insurance ecosystems.

Source: investopedia.com

Source: investopedia.com

A health insurance agent or producer usually works with a single insurer. Also known as financial advisors, financial consultants provide advice to clients on taxes, retirement planning, investments, and insurance decisions to help clients achieve their financial objectives. Stockbrokers, insurance agents, realtors, loan officers, bankers, investment advisers, estate planners, and tax and accounting professionals are all prime candidates for this credential. These are internationally recognised certifications that signify an agent’s knowledge in finance, insurance and. An individual who is not licensed as an insurance consultant, agent or broker may not charge a fee for providing insurance consulting services.

Source: investopedia.com

Source: investopedia.com

An insurance agent directly represents an insurance company and focuses on selling insurance products to consumers on behalf of the company. Unlike an insurance broker, an insurance agent only targets to increase the sales of the insurer by bringing more clients on board. Being an insurance agent you are a franchisee of the insurance company you represent. A dedicated team of insurance technology experts who work with clients to transform it, transform insurance companies, and transform insurance ecosystems. In some cases, a financial consultant may have more financial planning experience than the typical financial advisor.

Source: cosmo.ph

Source: cosmo.ph

People tend to be more loyal to a good insurance representative than they are to a stockbroker because the insurance representative is protecting them in case of a disaster, whereas a broker’s job is to let the client make more money and unfortunately there are higher chances for a broker to lose a client’s money than an insurance representative. People tend to be more loyal to a good insurance representative than they are to a stockbroker because the insurance representative is protecting them in case of a disaster, whereas a broker’s job is to let the client make more money and unfortunately there are higher chances for a broker to lose a client’s money than an insurance representative. Don’t go further than a decade behind when describing your job history, unless you’re applying for an executive position; Being an insurance agent you are a franchisee of the insurance company you represent. So, what about titles like certified financial planner (cfp), chartered financial consultant (chfc), associate financial consultant (afc), or chartered life underwriter (clu)?

Source: dollarsandsense.sg

Source: dollarsandsense.sg

This is because, in the last few decades, lines have blurred between professions in financial advisory. Therefore, it is a question of fact. Also known as financial advisors, financial consultants provide advice to clients on taxes, retirement planning, investments, and insurance decisions to help clients achieve their financial objectives. Detailed claims, distribution and productivity benchmarking along lines of business, market, customer and risk segments that are used to identify optimization. The agent must understand the tax and legal aspects of the products they sell and how they are designed to.

Source: franciscanministries.org

Source: franciscanministries.org

Being an insurance agent you are a franchisee of the insurance company you represent. Additional certifications for financial planners. An insurance agent directly represents an insurance company and focuses on selling insurance products to consumers on behalf of the company. Any financial professional who desires to increase his or her knowledge and competence can benefit greatly from obtaining the chfc designation. Insurance agents who obtain this designation can use it to provide comprehensive financial plans for clients and show them how their various insurance needs.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title financial consultant vs insurance agent by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.