Your Financial and non financial risk in insurance images are available. Financial and non financial risk in insurance are a topic that is being searched for and liked by netizens today. You can Download the Financial and non financial risk in insurance files here. Get all royalty-free vectors.

If you’re searching for financial and non financial risk in insurance images information connected with to the financial and non financial risk in insurance keyword, you have pay a visit to the right site. Our website always gives you suggestions for seeing the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

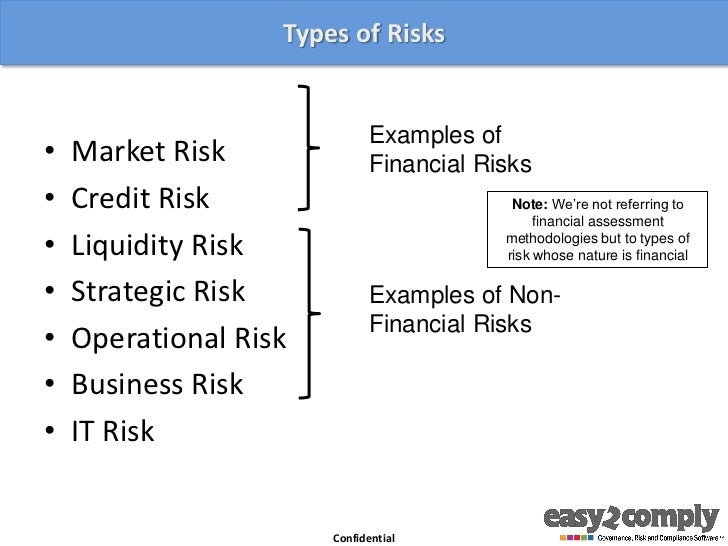

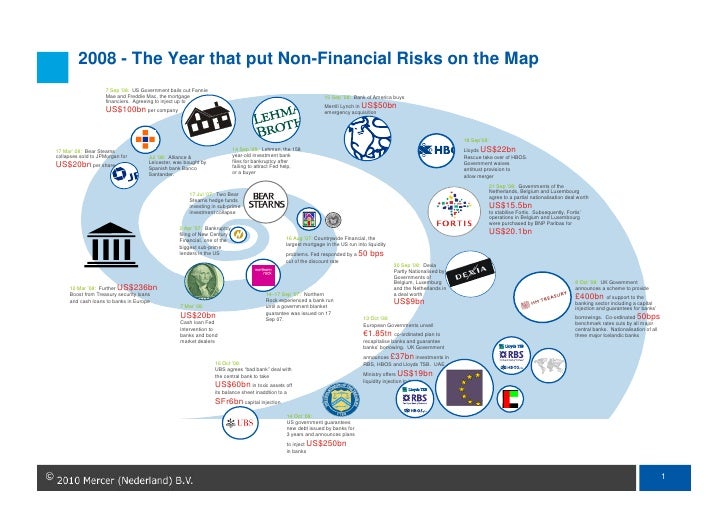

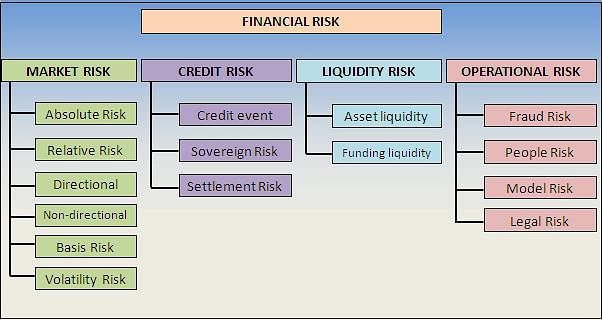

Financial And Non Financial Risk In Insurance. Which cannot be associated or viewed in money terms. Insurance executives know the potential harm these risks can do to their organizations. Market value risk (interest rate risk, exchange prices, equity prices, commodity prices, etc.) credit risk (downgrade, default, credit spread risk) liquidity risk. Unlike other types of risk, operational risks are not revenue driven, incurred knowingly or capable of.

NonFinancial Risks A focus on Operational Risk From slideshare.net

NonFinancial Risks A focus on Operational Risk From slideshare.net

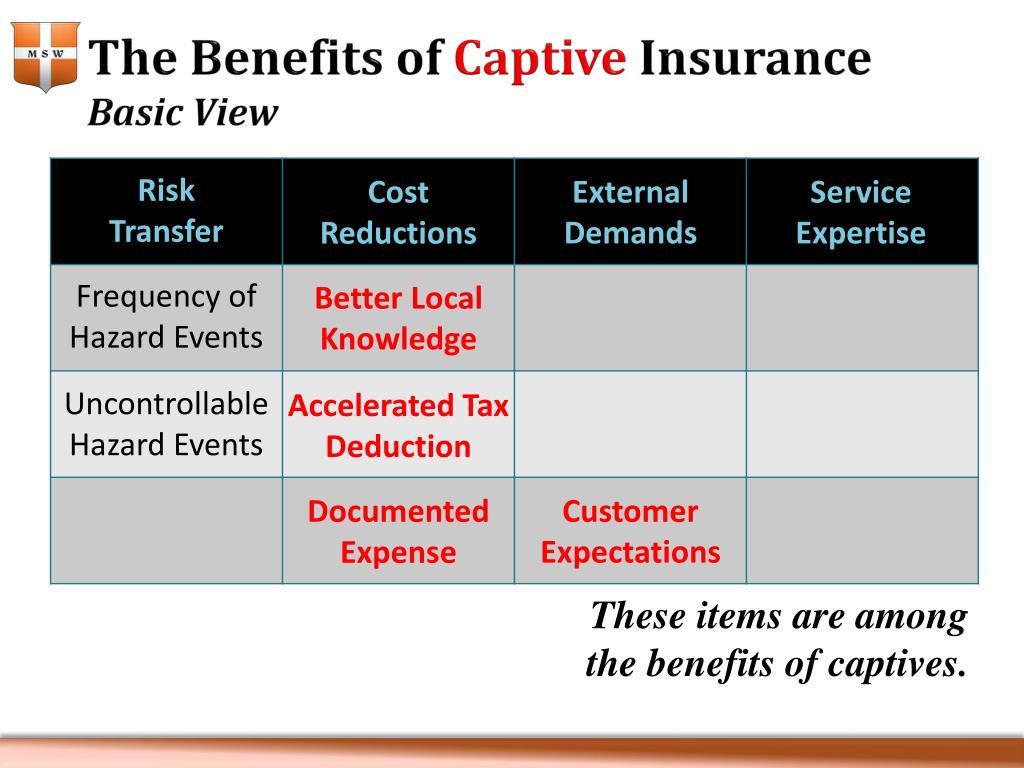

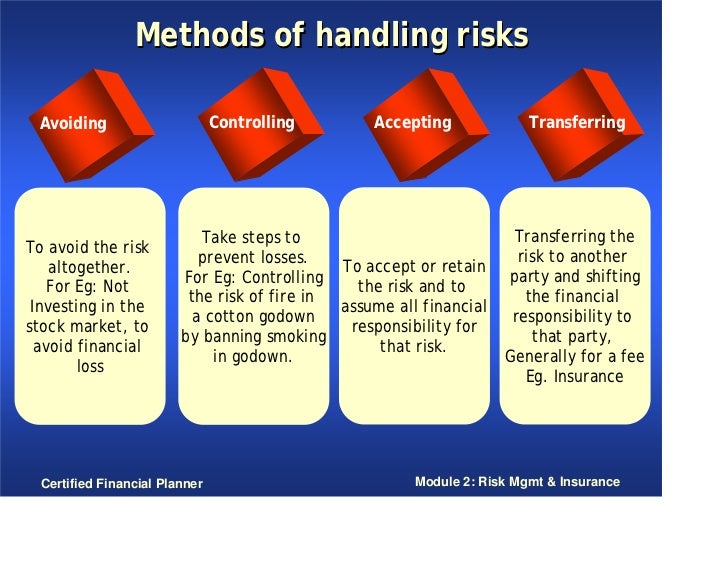

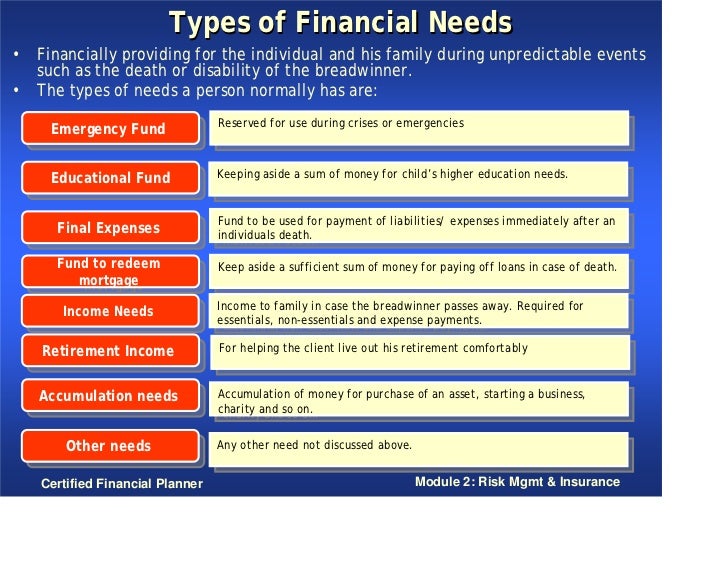

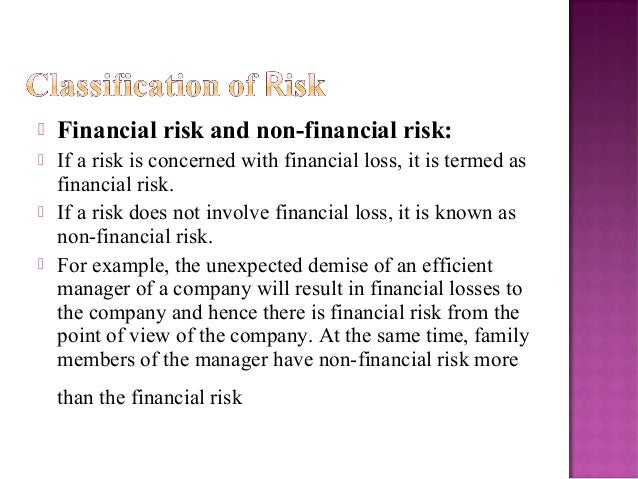

In this type of risk, loss of a person/thing is compensated by paying money to the person after proper assessment of loss. Specialized financial risk and insurance risk management for financial and insurance institutions. Nfr is a broad term that is usually defined by exclusion, that is, any risks other than the traditional financial risks of market, credit, and liquidity. Financial risk generally arises due to instability and losses in the. This negative definition resembles the initial definition of operational risk, and it depends on the bank or cooperation whether or not they use the term operational risk synchronously with nfr. Financial institutions need to implement a holistic risk management framework that includes a comprehensive risk taxonomy describing different types of risks, and a robust risk.

This is easy to see in the case of material damage to property, theft of property or lost business profit

Non financial risk we believe that a robust business aligned risk management strategy can be a competitive advantage for sustainable growth and development. Financial risk generally relates to the odds of losing money. Financial risk as the term suggests is the risk that involves financial loss to firms. Insurance executives know the potential harm these risks can do to their organizations. In this type of risk, loss of a person/thing is compensated by paying money to the person after proper assessment of loss. Our flexible and creative financial risk management strategy will address and adapt to your changing global and local needs.

Source: insurancejournal.com

Source: insurancejournal.com

Market value risk (interest rate risk, exchange prices, equity prices, commodity prices, etc.) credit risk (downgrade, default, credit spread risk) liquidity risk. Market value risk (interest rate risk, exchange prices, equity prices, commodity prices, etc.) credit risk (downgrade, default, credit spread risk) liquidity risk. Financial risk generally arises due to instability and losses in the. This is easy to see in the case of material damage to property, theft of property or lost business profit It includes other risk types such as security risks, legal risks, fraud, environmental risks and physical risks (major power failures, infrastructure shutdown etc.).

Source: slideshare.net

Source: slideshare.net

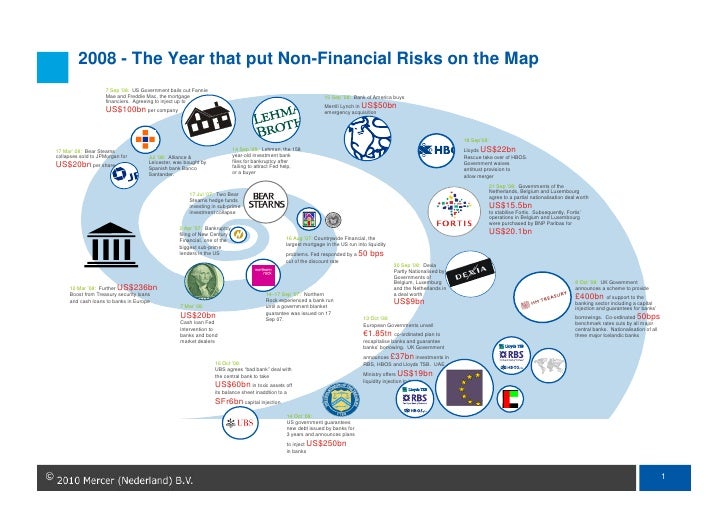

In recent times, these risks have increasingly become the root cause of significant losses. Nfr is a broad term that is usually defined by exclusion, that is, any risks other than the traditional financial risks of market, credit, and liquidity. I define financial risk as all risks defined from events in the financial markets that affect all participants. Financial risk generally arises due to instability and losses in the. Unlike other types of risk, operational risks are not revenue driven, incurred knowingly or capable of.

Source: slideserve.com

Source: slideserve.com

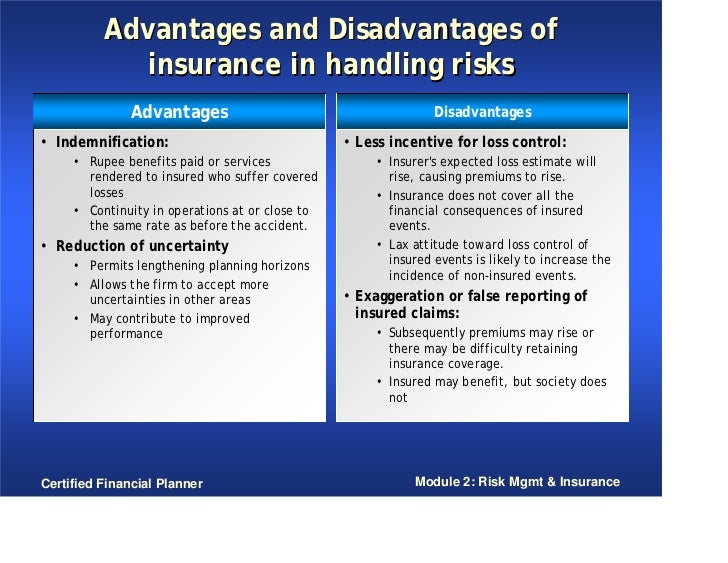

136 this chapter was prepared mainly by bruce white. I define financial risk as all risks defined from events in the financial markets that affect all participants. But each of these techniques has its own limitations and disadvantages — including a high cost. Risk also includes various factors, which may affect desired results of operations or provide. The financial risk most commonly referred to is the possibility that a company�s cash flow.

Source: slideshare.net

Source: slideshare.net

The financial risk most commonly referred to is the possibility that a company�s cash flow. These types of risks are not under the control of firms. Specialized financial risk and insurance risk management for financial and insurance institutions. Which cannot be associated or viewed in money terms. Hence, we are focused on helping our client take risks to create value and manage risks to preserve the value.

Source: slideshare.net

Source: slideshare.net

Financial institutions need to implement a holistic risk management framework that includes a comprehensive risk taxonomy describing different types of risks, and a robust risk. 136 this chapter was prepared mainly by bruce white. Financial and non financial risk financial risk includes those risks whose outcomes can be measured in monetary terms. Financial risk generally relates to the odds of losing money. Serious misconduct, execution risk, key personnel risk, fraud, failing it systems, cyberattacks, data leakage, faulty model assumptions, reputational crises:

Source: thenile.com.au

Source: thenile.com.au

These are various types of risks in insurance: Financial risk generally arises due to instability and losses in the. It includes other risk types such as security risks, legal risks, fraud, environmental risks and physical risks (major power failures, infrastructure shutdown etc.). Financial institutions need to implement a holistic risk management framework that includes a comprehensive risk taxonomy describing different types of risks, and a robust risk. The finance and insurance industry has undeniably seen a turbulent 2020, yet given the underlying conditions many are surprised at.

Source: waytess.com

Source: waytess.com

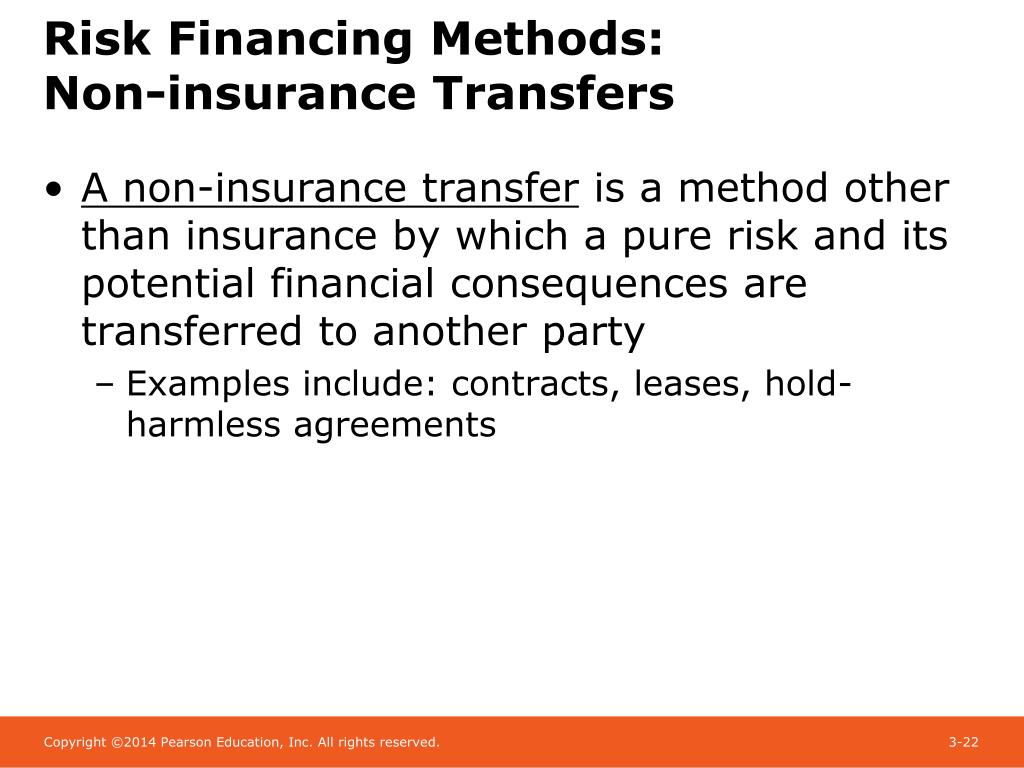

Aon invests in the latest tools and analytics to understand, forecast and address your emerging financial and insurance risks. The finance and insurance industry has undeniably seen a turbulent 2020, yet given the underlying conditions many are surprised at. This negative definition resembles the initial definition of operational risk, and it depends on the bank or cooperation whether or not they use the term operational risk synchronously with nfr. Financial risk is a term applicable to the individual, business and government, risk means the probability of losing money in investment or in case of government and business inability to pay off its debt taken from various financial institutions. A risk is anything that if it occurs, the resultant consequences thereof will be.

Source: slideserve.com

Source: slideserve.com

I define financial risk as all risks defined from events in the financial markets that affect all participants. Financial institutions need to implement a holistic risk management framework that includes a comprehensive risk taxonomy describing different types of risks, and a robust risk. A risk is anything that if it occurs, the resultant consequences thereof will be. This negative definition resembles the initial definition of operational risk, and it depends on the bank or cooperation whether or not they use the term operational risk synchronously with nfr. Financial risk generally arises due to instability and losses in the.

Source: slideshare.net

Source: slideshare.net

136 this chapter was prepared mainly by bruce white. These types of risks are not under the control of firms. This is easy to see in the case of material damage to property, theft of property or lost business profit But each of these techniques has its own limitations and disadvantages — including a high cost. Financial institutions need to implement a holistic risk management framework that includes a comprehensive risk taxonomy describing different types of risks, and a robust risk.

Source: koganpage.com

Source: koganpage.com

Non financial risk we believe that a robust business aligned risk management strategy can be a competitive advantage for sustainable growth and development. It includes other risk types such as security risks, legal risks, fraud, environmental risks and physical risks (major power failures, infrastructure shutdown etc.). Unlike other types of risk, operational risks are not revenue driven, incurred knowingly or capable of. Financial risk generally relates to the odds of losing money. This is easy to see in the case of material damage to property, theft of property or lost business profit

Source: capgemini.com

Source: capgemini.com

This negative definition resembles the initial definition of operational risk, and it depends on the bank or cooperation whether or not they use the term operational risk synchronously with nfr. Financial and non financial risk financial risk includes those risks whose outcomes can be measured in monetary terms. Financial risk generally relates to the odds of losing money. These types of risks are not under the control of firms. It includes other risk types such as security risks, legal risks, fraud, environmental risks and physical risks (major power failures, infrastructure shutdown etc.).

Source: slideshare.net

Source: slideshare.net

Serious misconduct, execution risk, key personnel risk, fraud, failing it systems, cyberattacks, data leakage, faulty model assumptions, reputational crises: Financial and non financial risk financial risk includes those risks whose outcomes can be measured in monetary terms. In recent times, these risks have increasingly become the root cause of significant losses. Financial risk generally relates to the odds of losing money. Financial risk generally arises due to instability and losses in the.

Source: slideserve.com

Source: slideserve.com

This is easy to see in the case of material damage to property, theft of property or lost business profit Non financial risk we believe that a robust business aligned risk management strategy can be a competitive advantage for sustainable growth and development. It includes other risk types such as security risks, legal risks, fraud, environmental risks and physical risks (major power failures, infrastructure shutdown etc.). This negative definition resembles the initial definition of operational risk, and it depends on the bank or cooperation whether or not they use the term operational risk synchronously with nfr. Market value risk (interest rate risk, exchange prices, equity prices, commodity prices, etc.) credit risk (downgrade, default, credit spread risk) liquidity risk.

Source: slideshare.net

Source: slideshare.net

Project finance risks through syndications, the use of club deals, and the credit default swap (cds) market, among other means. Aon invests in the latest tools and analytics to understand, forecast and address your emerging financial and insurance risks. Non financial risk we believe that a robust business aligned risk management strategy can be a competitive advantage for sustainable growth and development. Market value risk (interest rate risk, exchange prices, equity prices, commodity prices, etc.) credit risk (downgrade, default, credit spread risk) liquidity risk. Specialized financial risk and insurance risk management for financial and insurance institutions.

Source: slideshare.net

Source: slideshare.net

136 this chapter was prepared mainly by bruce white. The finance and insurance industry has undeniably seen a turbulent 2020, yet given the underlying conditions many are surprised at. The financial risk most commonly referred to is the possibility that a company�s cash flow. These types of risks are not under the control of firms. Financial institutions need to implement a holistic risk management framework that includes a comprehensive risk taxonomy describing different types of risks, and a robust risk.

Source: simplilearn.com

Source: simplilearn.com

It includes other risk types such as security risks, legal risks, fraud, environmental risks and physical risks (major power failures, infrastructure shutdown etc.). Non financial risk we believe that a robust business aligned risk management strategy can be a competitive advantage for sustainable growth and development. Financial risk generally relates to the odds of losing money. Financial risk is a term applicable to the individual, business and government, risk means the probability of losing money in investment or in case of government and business inability to pay off its debt taken from various financial institutions. Risk also includes various factors, which may affect desired results of operations or provide.

Source: slideshare.net

Source: slideshare.net

Financial risk generally arises due to instability and losses in the. In this type of risk, loss of a person/thing is compensated by paying money to the person after proper assessment of loss. Non financial risk we believe that a robust business aligned risk management strategy can be a competitive advantage for sustainable growth and development. 136 this chapter was prepared mainly by bruce white. These types of risks are not under the control of firms.

Source: aranca.com

Source: aranca.com

Nfr is a broad term that is usually defined by exclusion, that is, any risks other than the traditional financial risks of market, credit, and liquidity. Financial risk generally arises due to instability and losses in the. Non financial risk we believe that a robust business aligned risk management strategy can be a competitive advantage for sustainable growth and development. Nfr is a broad term that is usually defined by exclusion, that is, any risks other than the traditional financial risks of market, credit, and liquidity. The financial risk most commonly referred to is the possibility that a company�s cash flow.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title financial and non financial risk in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.