Your Filing insurance claim for roof images are ready. Filing insurance claim for roof are a topic that is being searched for and liked by netizens now. You can Download the Filing insurance claim for roof files here. Find and Download all royalty-free photos.

If you’re searching for filing insurance claim for roof pictures information related to the filing insurance claim for roof keyword, you have come to the right site. Our website frequently gives you hints for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

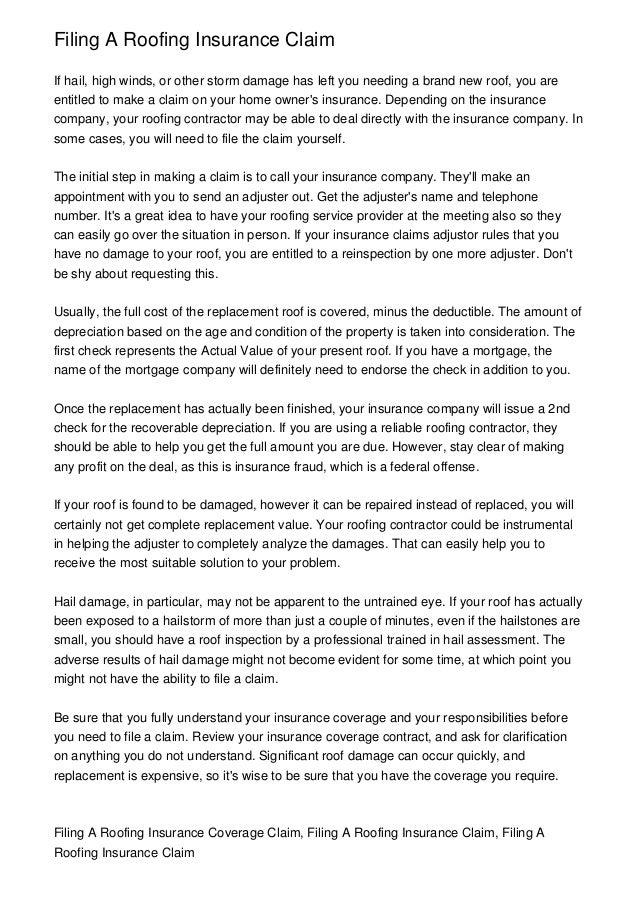

Filing Insurance Claim For Roof. When filing insurance claims for roof repairs or replacements due to storm damage, it is important that homeowners remember these things: Have representation at the adjuster meeting. Unfortunately, filing an insurance claim is often a more complex process than it. You will need to file a claim.

Does Filing a Roof Damage Insurance Claim Affect My From cbroofing.com

Does Filing a Roof Damage Insurance Claim Affect My From cbroofing.com

You don’t need to have massive damage to your roof to file an insurance claim. Tips for filing a roof claim. This homeowner’s guide should give you the confidence you need to file a roof claim when the time comes. Many insurance companies send an inspector to the filer’s home to investigate and verify the roof damage claim. If you have an older roof, it is possible they may cover a portion of it if not the entire roof. This could limit your compensation.

Additionally, if you have hail or other functional damage to your roof, you might have a roof leak that can cause hidden interior damage or mold.

File a claim with your homeowner’s insurance within 30 days! File your insurance claim with your homeowner’s insurance provider. Roofs are expensive to replace after a major storm has damaged them, so be prepared for your insurance company to not pay full price upfront when filing an insurance claim. If so, discuss with your insurance claim specialist if they will cover costs to temporarily fix the issue to mitigate further damages. Once this is done, the roof should be ok until repairs can be made. The first good step in making a roof claim is to try to understand your policy.

Source: travelvos.blogspot.com

Source: travelvos.blogspot.com

You don’t need to have massive damage to your roof to file an insurance claim. It�s important to inspect your roof and surrounding property for damage right away, as insurance policies typically include a statute of limitations time frame with a deadline for how long after an incident you can file a claim. They’ll need to send out an insurance claims examiner to take a look at the damage and determine just how much you’re owed for your roof. Because insurance companies tend to raise premiums after claims are filed, many professionals recommend not filing a claim unless the cost of repair is three times as much as the deductible. Many insurance companies send an inspector to the filer’s home to investigate and verify the roof damage claim.

Source: lifetimeroofing.com

Source: lifetimeroofing.com

Some homeowners expect their roof to be repaired or replaced as soon as they file an insurance claim. If you have a roofer make repairs first, you may not be able to prove the extent of the damage to your insurer. Roi will be the expert on your side fighting for you. Make sure you ask your insurance agent the necessary questions in order to get anything and everything done in a timely manner. Filing an insurance claim for roof damages.

Source: slideshare.net

Source: slideshare.net

Tips for filing a roof claim. If they determine the cause of damage to be from wear and tear, aging, or the poor condition of your roof, then your policy will not cover the damage apart from the cost of what is typically considered normal maintenance. The first thing you need to do is write down the date of the storm. Roofs are expensive to replace after a major storm has damaged them, so be prepared for your insurance company to not pay full price upfront when filing an insurance claim. If your deductible is $2,000, and your repair is only going to cost $1,500, your claim won’t be covered —.

Source: signatureexteriorsinc.com

Source: signatureexteriorsinc.com

Spring winds and tornadoes, summer hail storms and lightning strikes, heavy fall rains and the snow and ice of winter may all cause major roof damage. Your insurer needs to move fast. You will need to file a claim. How to file a roof damage insurance claim. They can search for damages on your roof and write a report for your insurance firm.

Source: mrroof.com

Source: mrroof.com

Have representation at the adjuster meeting. File your insurance claim with your homeowner’s insurance provider. When filing insurance claims for roof repairs or replacements due to storm damage, it is important that homeowners remember these things: They can search for damages on your roof and write a report for your insurance firm. Starting the process of filing a claim can vary somewhat depending on your insurance company but the steps typically include:

Source: absoluteroofingllc.com

Source: absoluteroofingllc.com

Most homeowner’s insurance policies provide some level of coverage for roof damage. One of the most important things you can do during the insurance claim process is find a credible roofing firm, like roi construction, with insurance claims expertise to carry out a roof inspection. And if you’ve never filed an insurance claim for roof damage, it can feel intimidating. Unfortunately, this is far from the case. Once this is done, the roof should be ok until repairs can be made.

Source: azroofingworks.com

Source: azroofingworks.com

That’s why you need to expect the insurance claim process to be long and move slowly. Every season brings conditions that can damage a roof. On the other hand, property owners may. When to file a roof replacement claim. Unfortunately, filing an insurance claim is often a more complex process than it.

Source: crownremodelingllc.com

Source: crownremodelingllc.com

Have representation at the adjuster meeting. The first thing you need to do is write down the date of the storm. Filing an insurance claim for roof damages. However, your insurance company isn’t going to seek you out and excitedly hand out money after a storm. Instead, your roofing company will get the damaged areas tarped and secured to protect your home and your wallet.

Source: summitroofing.com

Source: summitroofing.com

Unfortunately, this is far from the case. Before filing a claim on your roof, make sure it’s for a covered expense. If there is damage that is not covered by your policy, then you may want to consider using an umbrella policy. The first thing you need to do is write down the date of the storm. Filing an insurance claim for roof damages.

Source: ritco.com

Let’s get to the 4 things you can expect when filing an insurance claim for roof damage. Instead, your roofing company will get the damaged areas tarped and secured to protect your home and your wallet. Spring winds and tornadoes, summer hail storms and lightning strikes, heavy fall rains and the snow and ice of winter may all cause major roof damage. If you experience storm damage to your roof, give first american roofing a call right away. Filing an insurance claim for roof damages.

Source: bretthayse.com

Source: bretthayse.com

The first good step in making a roof claim is to try to understand your policy. Every season brings conditions that can damage a roof. However, a severe storm can change this in a single night. Roofs are expensive to replace after a major storm has damaged them, so be prepared for your insurance company to not pay full price upfront when filing an insurance claim. Spring winds and tornadoes, summer hail storms and lightning strikes, heavy fall rains and the snow and ice of winter may all cause major roof damage.

Source: rogershomeimprovements.com

Source: rogershomeimprovements.com

Many insurance companies send an inspector to the filer’s home to investigate and verify the roof damage claim. If you have any damage to your roof, it is acceptable to contact your insurance provider. However, your insurance company isn’t going to seek you out and excitedly hand out money after a storm. One of the most important things you can do during the insurance claim process is find a credible roofing firm, like roi construction, with insurance claims expertise to carry out a roof inspection. Are you dealing with unexpected roof damage?

Source: trublueroofingnc.com

Source: trublueroofingnc.com

How to file a roof damage insurance claim. If there is damage that is not covered by your policy, then you may want to consider using an umbrella policy. This could limit your compensation. They can search for damages on your roof and write a report for your insurance firm. If you have any damage to your roof, it is acceptable to contact your insurance provider.

Source: medium.com

Source: medium.com

They will usually foot the bill for such temporary repairs so they are not paying more for further damage repair in the future. How to file a roof damage insurance claim. The insurance claim specialist will ask if your property is still susceptible to damage. Most homeowner’s insurance policies provide some level of coverage for roof damage. Your insurer needs to move fast.

Source: rgbconstructionservices.com

Source: rgbconstructionservices.com

You don’t need to have massive damage to your roof to file an insurance claim. How to file a roof damage insurance claim. Preparing to file a claim. This homeowner’s guide should give you the confidence you need to file a roof claim when the time comes. This could limit your compensation.

Source: cbroofing.com

Source: cbroofing.com

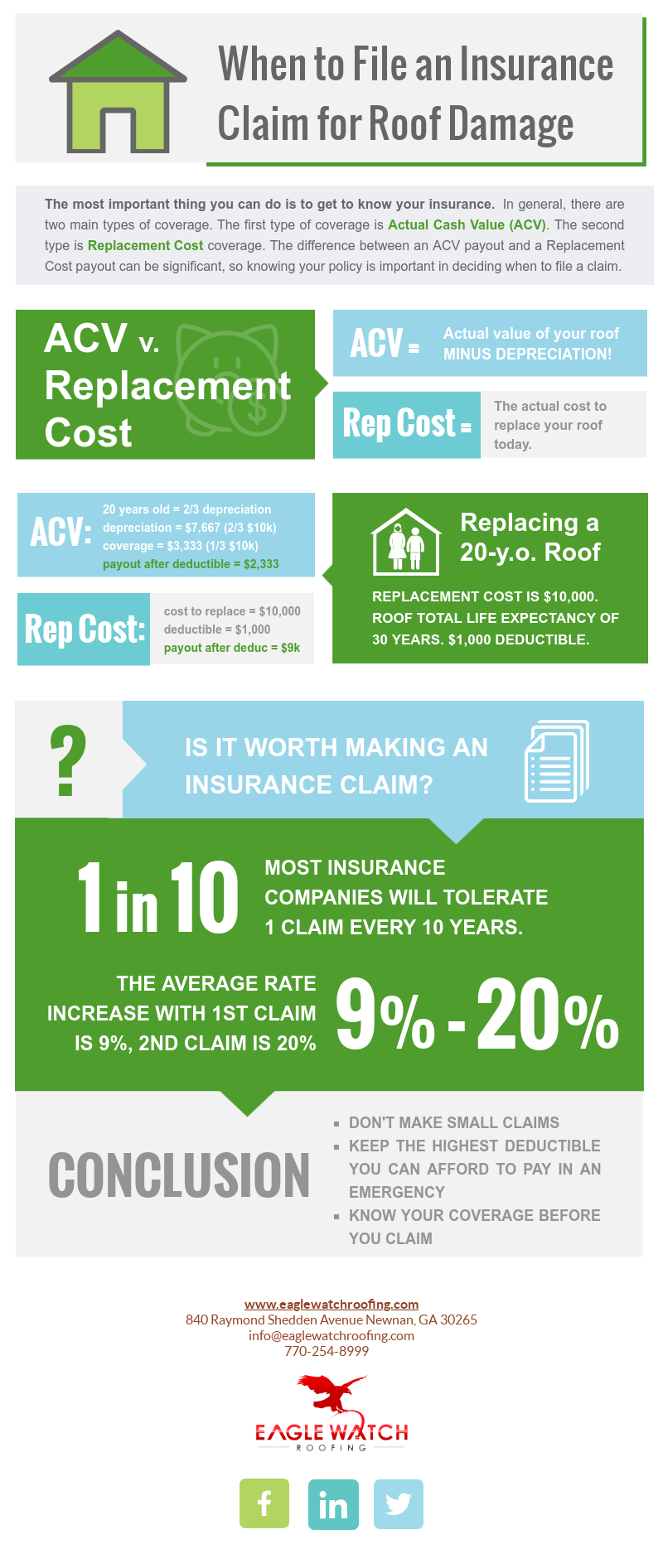

Many insurance companies send an inspector to the filer’s home to investigate and verify the roof damage claim. When to file a roof replacement claim. Your insurer needs to move fast. It�s important to inspect your roof and surrounding property for damage right away, as insurance policies typically include a statute of limitations time frame with a deadline for how long after an incident you can file a claim. Because insurance companies tend to raise premiums after claims are filed, many professionals recommend not filing a claim unless the cost of repair is three times as much as the deductible.

Source: eaglewatchroofing.com

Source: eaglewatchroofing.com

Unfortunately, filing an insurance claim is often a more complex process than it. Many insurance companies will try and confuse property owners with technical roofing terminology. Because insurance companies tend to raise premiums after claims are filed, many professionals recommend not filing a claim unless the cost of repair is three times as much as the deductible. When not to file a claim. Acting fast after the damage occurs is important for getting your claim moving.

Source: coxroofing.com

Source: coxroofing.com

If your deductible is $2,000, and your repair is only going to cost $1,500, your claim won’t be covered —. If there is damage that is not covered by your policy, then you may want to consider using an umbrella policy. They’ll need to send out an insurance claims examiner to take a look at the damage and determine just how much you’re owed for your roof. If you experience storm damage to your roof, give first american roofing a call right away. File your insurance claim with your homeowner’s insurance provider.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title filing insurance claim for roof by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.