Your Fiduciary bond insurance images are available. Fiduciary bond insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Fiduciary bond insurance files here. Get all royalty-free images.

If you’re searching for fiduciary bond insurance images information linked to the fiduciary bond insurance interest, you have visit the right site. Our site always provides you with suggestions for downloading the highest quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

Fiduciary Bond Insurance. It’s a person that’s been given power over another party’s interests and assets. To prevent damage, as a result, the court may require anyone with a fiduciary responsibility to another party to get a fiduciary bond. The max bond amount required under erisa for any one plan official is $500,000 per plan. Fiduciary liability policy pays the amount a company is legally liable to pay as a result of a breach of contract or mismanagement of a fiduciary duty.

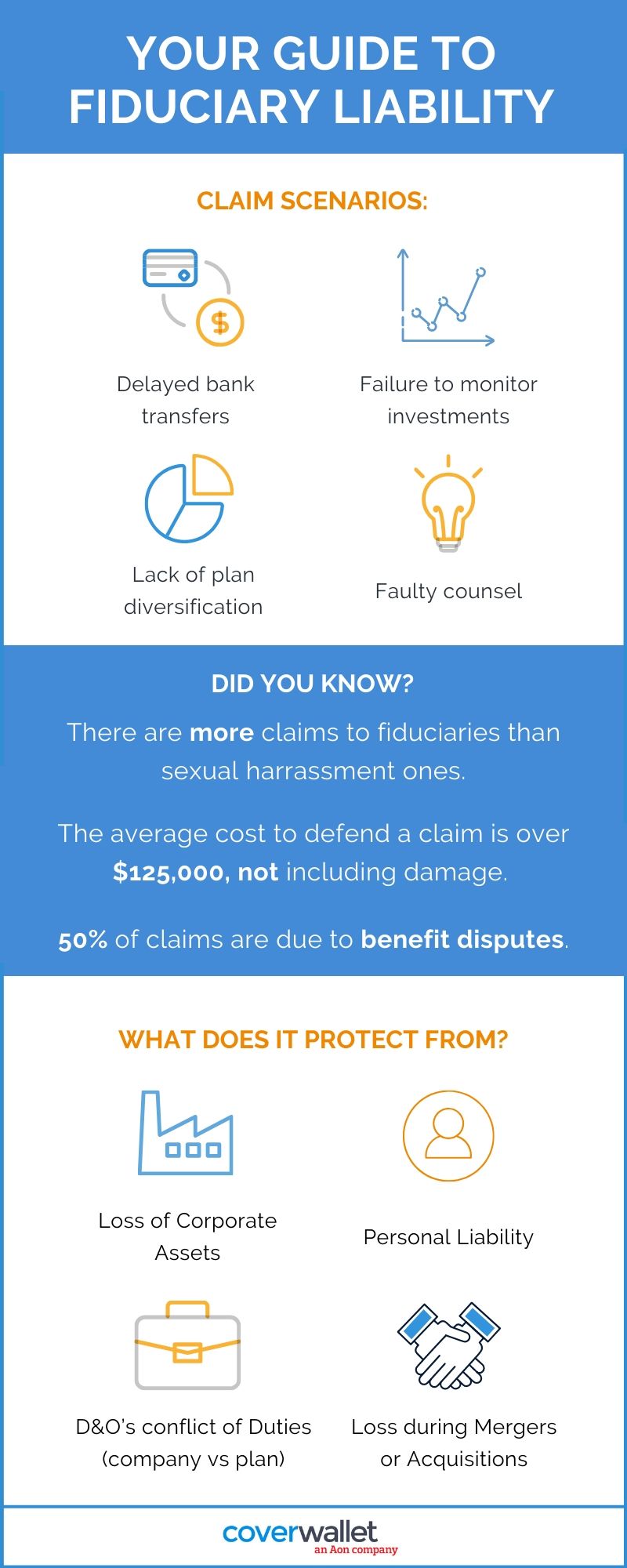

What Is Fiduciary Liability? CoverWallet an AON Company From coverwallet.com

What Is Fiduciary Liability? CoverWallet an AON Company From coverwallet.com

Fiduciary bond insurance provides funds to cover the result of mismanagement in the administration and/or investment of employee benefits and pensions. Fiduciary bonds are often required by estate administrators, trustees, estate executors, and others. Another important difference is that while a fidelity bond is designed to protect against fraud, fiduciary liability insurance specifically carves out fraudulent acts and does not provide coverage for them. In some specific cases courts or statutory requirements may call for a fiduciary bond; Keep in mind that erisa bonds are not fiduciary bonds, even though the terms are often used interchangeably. Fiduciary liability policies and fiduciary bonds.

If the individual fiduciary is being protected, coverage is likely provided by fiduciary liability insurance.

Fiduciary bonds are often required by estate administrators, trustees, estate executors, and others. Fidelity bonds are required and amounts are reported on form 5500, schedule h, part iv, line 4e. The fiduciary liability ins urance policy (flip) is designed to protect fiduciaries against breach of fiduciary duty claims and more. It’s a person that’s been given power over another party’s interests and assets. Thus, the purpose of a fiduciary bond (also known as a probate bond) is to protect those who have an interest in what the fiduciary has been given authority to oversee. Simply stated, if the employee benefit plan is the entity insured, coverage is likely provided by a fidelity bond.

Source: blog.rpag.com

Source: blog.rpag.com

The fiduciary is often called a guardian or conservator if he handles the affairs of a minor or an incapacitated person. The erisa bonds will protect the plan itself, while fiduciary liability insurance protects the people in charge of the plan. In these situations the bond is often referred to as a probate bond, sometimes a judicial bond, and sometimes a court bond. Through a fiduciary bond, a bond company contracts to cover the loss whenever a representative, guardian, administrator, executor, or any person in similar capacity commits a mistake or malfeasance and thereby. The max bond amount required under erisa for any one plan official is $500,000 per plan.

Source: wesolowskiagency.com

Source: wesolowskiagency.com

In some specific cases courts or statutory requirements may call for a fiduciary bond; Fiduciary bonds are often required by estate administrators, trustees, estate executors, and others. Contact an insurance agent at welch, graham & ogden insurance today to answer any questions about fiduciary bond or for a free review and insurance quote for fiduciary bond. It’s a person that’s been given power over another party’s interests and assets. Fiduciary bonds provide guarantees that certain individuals in positions of trust will carry out duties faithfully and honestly.

Source: fbanational.com

Source: fbanational.com

If the individual fiduciary is being protected, coverage is likely provided by fiduciary liability insurance. The bond protects against fraud, embezzlement, or dishonest acts carried out by a fiduciary. Another important difference is that while a fidelity bond is designed to protect against fraud, fiduciary liability insurance specifically carves out fraudulent acts and does not provide coverage for them. Contrary to popular belief, erisa bonds and employee benefits liability (ebl) The max bond amount required under erisa for any one plan official is $500,000 per plan.

Source: suretybondsdirect.com

Source: suretybondsdirect.com

Fidelity bonds are required and amounts are reported on form 5500, schedule h, part iv, line 4e. Fiduciary bonds provide guarantees that certain individuals in positions of trust will carry out duties faithfully and honestly. Coverage under insurance products protects the executor of the estate; Another important difference is that while a fidelity bond is designed to protect against fraud, fiduciary liability insurance specifically carves out fraudulent acts and does not provide coverage for them. Fiduciary bonds are often required by estate administrators, trustees, estate executors, and others.

Source: koleyjessen.com

Source: koleyjessen.com

If the individual fiduciary is being protected, coverage is likely provided by fiduciary liability insurance. Simply stated, if the employee benefit plan is the entity insured, coverage is likely provided by a fidelity bond. Fiduciary liability policies and fiduciary bonds. Fiduciary bonds are often required by estate administrators, trustees, estate executors, and others. Fiduciary bonds provide guarantees that certain individuals in positions of trust will carry out duties faithfully and honestly.

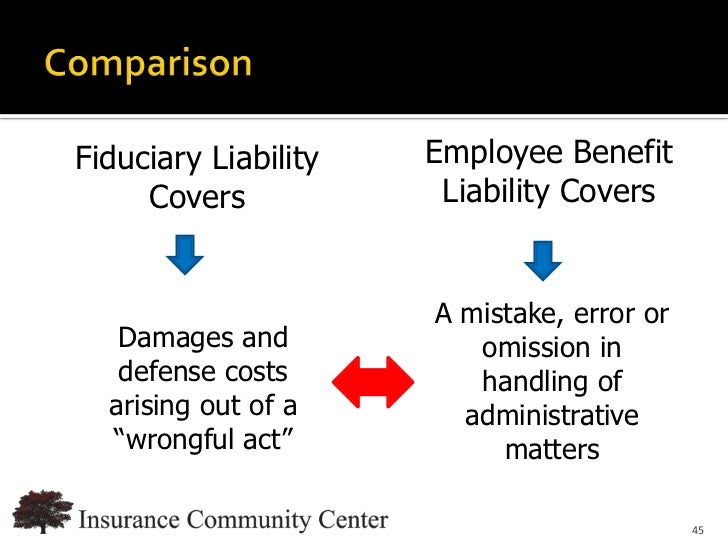

Source: slideshare.net

Source: slideshare.net

Fiduciary bond insurance provides funds to cover the result of mismanagement in the administration and/or investment of employee benefits and pensions. Another important difference is that while a fidelity bond is designed to protect against fraud, fiduciary liability insurance specifically carves out fraudulent acts and does not provide coverage for them. It is the only type of insurance that does so. Contact an insurance agent at welch, graham & ogden insurance today to answer any questions about fiduciary bond or for a free review and insurance quote for fiduciary bond. Fiduciary bonds are not “will insurance” products*.

Source: 401kspecialistmag.com

Source: 401kspecialistmag.com

The bond protects against fraud, embezzlement, or dishonest acts carried out by a fiduciary. In some specific cases courts or statutory requirements may call for a fiduciary bond; Fiduciary bonds are not “will insurance” products*. The fidelity bond protects the plan and its participants, while fiduciary liability insurance typically protects the plan’s fiduciaries from claims of a breach of fiduciary responsibilities. Fiduciary liability & fidelity bond coverage.

Source: 401ktv.com

Source: 401ktv.com

They do not pay the legal or liability expenses of the fiduciary and have a specialized scope of coverage. A fiduciary bond guarantees the fiduciary will adequately perform the duties in the roll of fiduciary. Fiduciary bonds are often required by estate administrators, trustees, estate executors, and others. Through a fiduciary bond, a bond company contracts to cover the loss whenever a representative, guardian, administrator, executor, or any person in similar capacity commits a mistake or malfeasance and thereby. If the individual fiduciary is being protected, coverage is likely provided by fiduciary liability insurance.

Source: thehartford.com

Source: thehartford.com

The erisa bonds will protect the plan itself, while fiduciary liability insurance protects the people in charge of the plan. Fiduciary bonds are often required by estate administrators, trustees, estate executors, and others. The fiduciary liability bond, on the other hand, is not a requirement under erisa but is an extra protection for fiduciaries against losses caused by breaches of fiduciary duties. Erisa requires plans to have a fidelity bond (also referred to as a fiduciary bond) covering every person who handles funds or other property of such plan. The myth of coverage under erisa bonds and ebl insurance.

Source: tra401k.com

Source: tra401k.com

Fiduciary bonds are often required by estate administrators, trustees, estate executors, and others. Contact an insurance agent at welch, graham & ogden insurance today to answer any questions about fiduciary bond or for a free review and insurance quote for fiduciary bond. This bond serves to protect the plan’s assets from fiduciaries misusing or mishandling the funds in any way. This insurance is not required by erisa, but many fiduciaries seek to have this coverage for their own protection. The fidelity bond protects the plan and its participants, while fiduciary liability insurance typically protects the plan’s fiduciaries from claims of a breach of fiduciary responsibilities.

Source: issuu.com

Source: issuu.com

Fiduciary bonds are often required by estate administrators, trustees, estate executors, and others. A fiduciary bond is a form of insurance protection ordered by a court to guarantee the faithful performance of a personal representative. Fiduciary bond insurance provides funds to cover the result of mismanagement in the administration and/or investment of employee benefits and pensions. Fiduciary bonds a fiduciary is a person appointed by the court to handle the affairs of persons who are not able to do so themselves. Fiduciary bonds are often required by estate administrators, trustees, estate executors, and others.

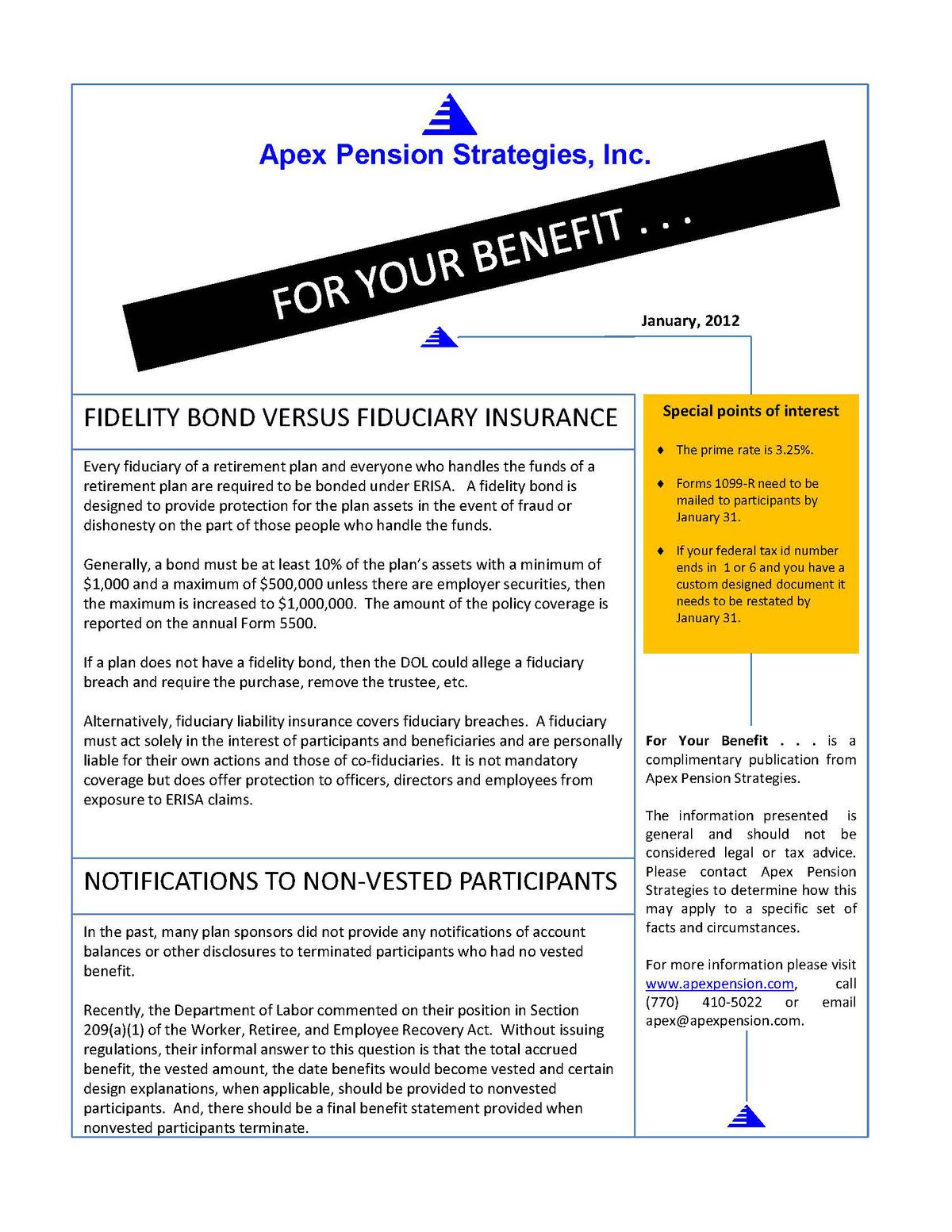

Source: apexpension.com

Source: apexpension.com

The bond protects against fraud, embezzlement, or dishonest acts carried out by a fiduciary. Fiduciary liability policy pays the amount a company is legally liable to pay as a result of a breach of contract or mismanagement of a fiduciary duty. To prevent damage, as a result, the court may require anyone with a fiduciary responsibility to another party to get a fiduciary bond. There are two types of fiduciary insurance: Through a fiduciary bond, a bond company contracts to cover the loss whenever a representative, guardian, administrator, executor, or any person in similar capacity commits a mistake or malfeasance and thereby.

Source: rpgconsultants.com

Source: rpgconsultants.com

They do not pay the legal or liability expenses of the fiduciary and have a specialized scope of coverage. If the individual fiduciary is being protected, coverage is likely provided by fiduciary liability insurance. Erisa requires plans to have a fidelity bond (also referred to as a fiduciary bond) covering every person who handles funds or other property of such plan. Fiduciary bonds are legal instruments that act as insurance to protect heirs, beneficiaries or other creditors when a fiduciary commits acts of fraud, embezzlement or other forms of dishonesty. It is the only type of insurance that does so.

Source: plannersinsurance.com

Source: plannersinsurance.com

The fiduciary liability bond, on the other hand, is not a requirement under erisa but is an extra protection for fiduciaries against losses caused by breaches of fiduciary duties. Simply stated, if the employee benefit plan is the entity insured, coverage is likely provided by a fidelity bond. Erisa requires plans to have a fidelity bond (also referred to as a fiduciary bond) covering every person who handles funds or other property of such plan. The fiduciary liability bond, on the other hand, is not a requirement under erisa but is an extra protection for fiduciaries against losses caused by breaches of fiduciary duties. Fiduciary liability insurance is not required and should not be.

Source: wealthadvisors.com

Source: wealthadvisors.com

This bond serves to protect the plan’s assets from fiduciaries misusing or mishandling the funds in any way. A fiduciary bond is a form of insurance protection ordered by a court to guarantee the faithful performance of a personal representative. In some specific cases courts or statutory requirements may call for a fiduciary bond; Coverage under insurance products protects the executor of the estate; To prevent damage, as a result, the court may require anyone with a fiduciary responsibility to another party to get a fiduciary bond.

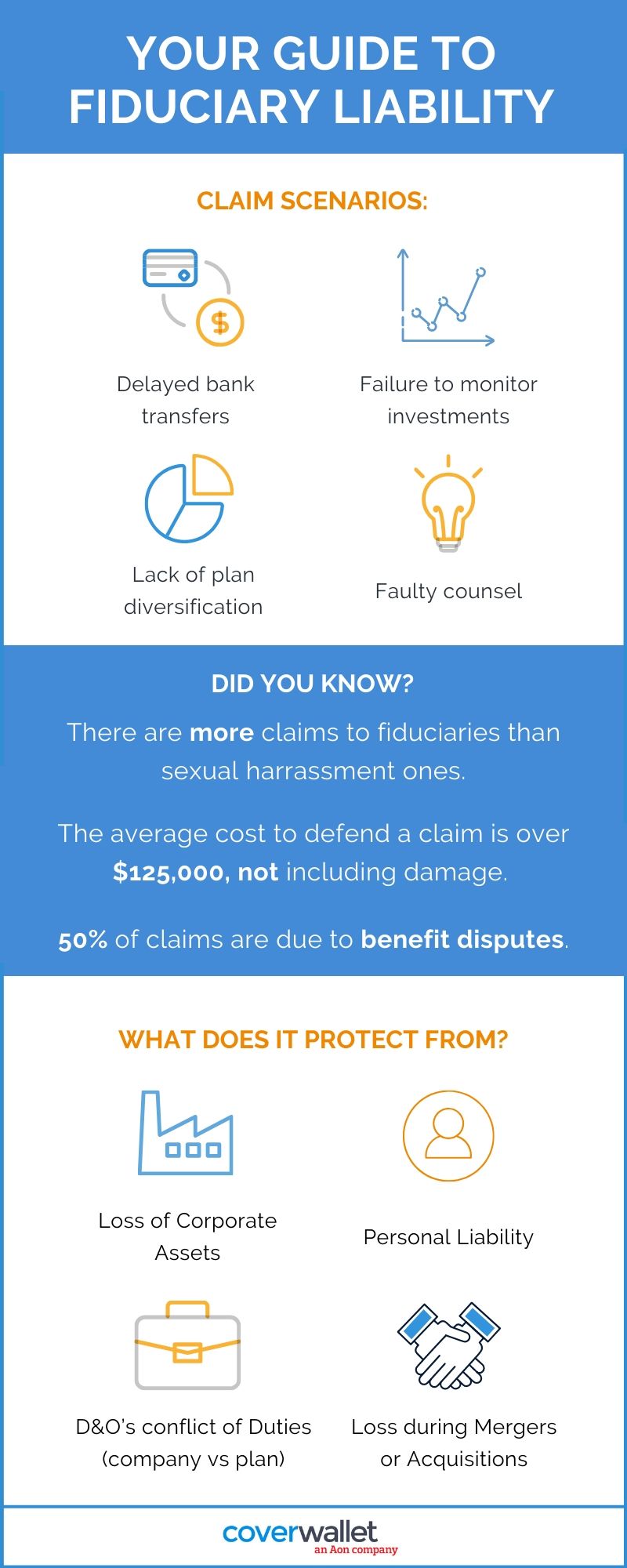

Source: coverwallet.com

Source: coverwallet.com

Another important difference is that while a fidelity bond is designed to protect against fraud, fiduciary liability insurance specifically carves out fraudulent acts and does not provide coverage for them. The myth of coverage under erisa bonds and ebl insurance. It’s a person that’s been given power over another party’s interests and assets. Thus, the purpose of a fiduciary bond (also known as a probate bond) is to protect those who have an interest in what the fiduciary has been given authority to oversee. Fiduciary liability insurance protects companies against errors, omissions and “breach of fiduciary duty” claims in managing and administering employee benefit plans.

Source: coverwallet.com

Source: coverwallet.com

The bond protects against fraud, embezzlement, or dishonest acts carried out by a fiduciary. Another important difference is that while a fidelity bond is designed to protect against fraud, fiduciary liability insurance specifically carves out fraudulent acts and does not provide coverage for them. The bond protects against fraud, embezzlement, or dishonest acts carried out by a fiduciary. As a result, fiduciary liability insurance is usually much more expensive than fidelity bond coverage. The fiduciary liability ins urance policy (flip) is designed to protect fiduciaries against breach of fiduciary duty claims and more.

Source: smithbondsurety.com

Source: smithbondsurety.com

Thus, the purpose of a fiduciary bond (also known as a probate bond) is to protect those who have an interest in what the fiduciary has been given authority to oversee. In some specific cases courts or statutory requirements may call for a fiduciary bond; Fiduciary bonds provide guarantees that certain individuals in positions of trust will carry out duties faithfully and honestly. Fiduciary liability insurance protects companies against errors, omissions and “breach of fiduciary duty” claims in managing and administering employee benefit plans. Fiduciary bonds are often required by estate administrators, trustees, estate executors, and others.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fiduciary bond insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.