Your Fidelity guarantee insurance cover images are ready. Fidelity guarantee insurance cover are a topic that is being searched for and liked by netizens now. You can Find and Download the Fidelity guarantee insurance cover files here. Find and Download all free photos.

If you’re looking for fidelity guarantee insurance cover images information related to the fidelity guarantee insurance cover topic, you have come to the right blog. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

Fidelity Guarantee Insurance Cover. For example, if an employee forges your signature on a check and your business sustains financial losses, then you could claim the loss with your fidelity guarantee insurance. As fidelity insurance strategy ensures the business against loss emerging because of a demonstration of extortion or unscrupulousness submitted by workers, it becomes significant for organizations to purchase fidelity insurance cover to have assurance against such dangers. Here is an overview of your coverage. After purchasing the fidelity guarantee insurance cover, it is imperative to take time to review the policy document.

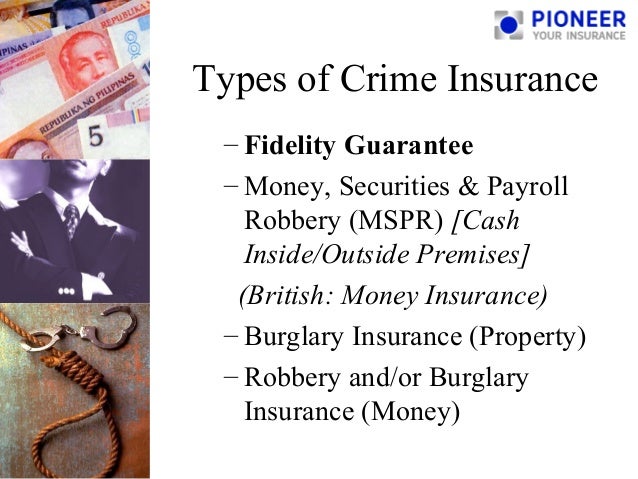

Fidelity Guarantee Insurance Pioneer Your Insurance From pioneer.com.ph

During uninterrupted employment of such employees. It also extends to cover loss of stock resulting from dishonesty of employees in the course of their employment. This policy is suitable for employees occupying positions of trust such as. Fidelity insurance offers coverage with a broad definition of ‘employees’ coverage under fidelity insurance will start for the insured event on or. For any loss arising from fraudulent embezzlement or fraudulent. A fidelity insurance policy covers losses sustained by the employer as a result of an act of forgery, fraud or dishonesty from an employee.

This policy is suitable for employees occupying positions of trust such as.

You will be require to give us the maximum amount of money you will entrust in the custody of your principal employees e.g. You will be require to give us the maximum amount of money you will entrust in the custody of your principal employees e.g. Fidelity coverage, sometimes known as a fidelity bond, is a type of insurance that will protect a business owner against the theft of money, property, forgery or fraud by an employee. After purchasing the fidelity guarantee insurance cover, it is imperative to take time to review the policy document. For example, if an employee forges your signature on a check and your business sustains financial losses, then you could claim the loss with your fidelity guarantee insurance. The loss can be of money or goods, for the duration of the policy.

Source: pioneer.com.ph

A fidelity insurance policy covers losses sustained by the employer as a result of an act of forgery, fraud or dishonesty from an employee. In connection with the occupation and duties of such employees. It also extends to cover loss of stock resulting from dishonesty of employees in the course of their employment. This cover indemnifies the employer against direct pecuniary loss resulting from dishonesty, failure in the loyal performance of a duty from the employees. It is an essential form of cover for most businesses.

Source: es.slideshare.net

Source: es.slideshare.net

To safeguard your interests from unscrupulous people hdfc ergo’s fidelity guarantee insurance ensures that organizations do not suffer because of a few bad apples among them. For any loss arising from fraudulent embezzlement or fraudulent. It�s the kind of policy you might take out on your chief accountant or your cfo. The loss can be of money or goods, for the duration of the policy. Fidelity guarantee insurance can also be known as employee dishonesty cover.

Source: shservice.weebly.com

Source: shservice.weebly.com

The insured is covered against a direct pecuniary loss sustained by reason of any act of fraud/dishonesty committed. What is fidelity guarantee insurance a fidelity guarantee as issued by the insurers is a contract of insurance and also a contract of guarantee to which the general principles of insurance apply. The loss can be of money or goods, for the duration of the policy. Fidelity guarantee insurance would cover the amount that you are liable to compensate the other party for. Understanding the policy conditions, warranties, and excluded risks will ensure proper mitigation of risks.

Source: genoa.co.za

Source: genoa.co.za

The cover may be required in respect of. It does not guarantee the employees honesty but it guarantees that if the employer suffers any direct financial loss arising out of the… The insured is covered against a direct pecuniary loss sustained by reason of any act of fraud/dishonesty committed. Fidelity guarantee insurance (fgi) exists to safeguard your firm or organisation against theft of the firm’s own money, securities or property by an employee, partner, contractor or volunteer. This policy broadly covers pecuniary loss sustained as a result of act of fraud or dishonesty in respect of monies or goods of the employer committed by the employees in the course of performance of their duties.

Source: nsbrokers.com

Source: nsbrokers.com

Frauds and dishonesty in contractual obligations are a part of the business world. This cover indemnifies the employer against direct pecuniary loss resulting from dishonesty, failure in the loyal performance of a duty from the employees. A collective policy covers a group of named employees with a stated amount set for each individual.; To safeguard your interests from unscrupulous people hdfc ergo’s fidelity guarantee insurance ensures that organizations do not suffer because of a few bad apples among them. Here is an overview of your coverage.

Source: legacyinsurance.co.ug

Source: legacyinsurance.co.ug

The cover may be required in respect of. Fidelity coverage, sometimes known as a fidelity bond, is a type of insurance that will protect a business owner against the theft of money, property, forgery or fraud by an employee. During uninterrupted employment of such employees. This policy covers your financial loss or loss of goods arising from fraud or dishonesty by your employees in the following ways: This policy broadly covers monetary loss.

Source: ceylinco-insurance.com

Source: ceylinco-insurance.com

You will be require to give us the maximum amount of money you will entrust in the custody of your principal employees e.g. Frauds and dishonesty in contractual obligations are a part of the business world. After purchasing the fidelity guarantee insurance cover, it is imperative to take time to review the policy document. Here is an overview of your coverage. This policy covers your financial loss or loss of goods arising from fraud or dishonesty by your employees in the following ways:

Source: amanainsurance.com

Source: amanainsurance.com

In connection with the occupation and duties of such employees. Fidelity guarantee insurance policy this covers the insured against losses suffers as a result of employees dishonest, misappropriations of funds and fraudulent conversion of the company’s fund. Liability to defrauded business partner one of your employees colludes with an employee working for a business partner. Fidelity guarantee insurance would cover the amount that you are liable to compensate the other party for. In connection with the occupation and duties of such employees.

Source: pinterest.com

Source: pinterest.com

Fidelity guarantee insurance (fgi) exists to safeguard your firm or organisation against theft of the firm’s own money, securities or property by an employee, partner, contractor or volunteer. Fidelity guarantee insurance policy this covers the insured against losses suffers as a result of employees dishonest, misappropriations of funds and fraudulent conversion of the company’s fund. This policy is suitable for employees occupying positions of trust such as. Fidelity guarantee insurance will indemnify the insured against the loss of money or other property belonging to the insured or for which the insured is legally responsible as the direct result of any act of fraud or dishonesty committed by the employee as described in the schedule. In connection with the occupation and duties of such employees.

Source: statusib.co.za

Source: statusib.co.za

This policy covers your financial loss or loss of goods arising from fraud or dishonesty by your employees. Following are the advantages presented by fidelity insurance. Frauds and dishonesty in contractual obligations are a part of the business world. The insured is covered against a direct pecuniary loss sustained by reason of any act of fraud/dishonesty committed. Here is an overview of your coverage.

It also extends to cover loss of stock resulting from dishonesty of employees in the course of their employment. During uninterrupted employment of such employees. For example, if an employee forges your signature on a check and your business sustains financial losses, then you could claim the loss with your fidelity guarantee insurance. Fidelity guarantee insurance policy provides cover against the financial loss suffered by the insured as a result of fraud/dishonesty of employees of the insured up to the maximum limit selected for insurance per employee. A floater policy sets limits on what the insurer will pay for one individual and a total amount for all employees.

Source: sainsuranceng.com

Source: sainsuranceng.com

It�s the kind of policy you might take out on your chief accountant or your cfo. It also extends to cover loss of stock resulting from dishonesty of employees in the course of their employment. A treasurer (volunteer or employed) is found to have taken funds for her own use. After purchasing the fidelity guarantee insurance cover, it is imperative to take time to review the policy document. Understanding the policy conditions, warranties, and excluded risks will ensure proper mitigation of risks.

Source: mibja.com

Source: mibja.com

This policy covers your financial loss or loss of goods arising from fraud or dishonesty by your employees in the following ways: Fidelity guarantee insurance is particularly important for businesses that have several employees handling clients, suppliers or other third parties wherein money is exchanged with the client. Who needs fidelity guarantee insurance? This policy broadly covers monetary loss. During uninterrupted employment of such employees.

Source: convoy.com.hk

This policy is suitable for employees occupying positions of trust such as. For example, if an employee forges your signature on a check and your business sustains financial losses, then you could claim the loss with your fidelity guarantee insurance. Following are the advantages presented by fidelity insurance. A fidelity guarantee insurance policy will typically cover any losses of an employer due to an act of fraud, dishonesty, stolen money or goods or forgery of an employee. Both workers conspire to defraud your business partner of $50,000 by cashing out fake cheques, and.

Source: providecover.com

Source: providecover.com

Following are the advantages presented by fidelity insurance. During uninterrupted employment of such employees. The cover may be required in respect of. We conduct a detailed analysis of the insurance policies you buy through us. Fidelity guarantee insurance can also be known as employee dishonesty cover.

Source: lifelia1.blogspot.com

Source: lifelia1.blogspot.com

During uninterrupted employment of such employees. Understanding the policy conditions, warranties, and excluded risks will ensure proper mitigation of risks. Who needs fidelity guarantee insurance? The loss can be of money or goods, for the duration of the policy. In connection with the occupation and duties of such employees.

Source: lifelia1.blogspot.com

Source: lifelia1.blogspot.com

Fidelity guarantee insurance policy this covers the insured against losses suffers as a result of employees dishonest, misappropriations of funds and fraudulent conversion of the company’s fund. In connection with the occupation and duties of such employees. We conduct a detailed analysis of the insurance policies you buy through us. A floater policy sets limits on what the insurer will pay for one individual and a total amount for all employees. Both workers conspire to defraud your business partner of $50,000 by cashing out fake cheques, and.

Source: securityinsured.co.uk

Source: securityinsured.co.uk

A fidelity guarantee insurance policy will typically cover any losses of an employer due to an act of fraud, dishonesty, stolen money or goods or forgery of an employee. This process is an integral part of. It�s the kind of policy you might take out on your chief accountant or your cfo. During uninterrupted employment of such employees. Fidelity coverage, sometimes known as a fidelity bond, is a type of insurance that will protect a business owner against the theft of money, property, forgery or fraud by an employee.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fidelity guarantee insurance cover by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.