Your Fha flood insurance requirements images are available. Fha flood insurance requirements are a topic that is being searched for and liked by netizens today. You can Download the Fha flood insurance requirements files here. Download all free images.

If you’re searching for fha flood insurance requirements images information connected with to the fha flood insurance requirements topic, you have come to the right blog. Our website frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that fit your interests.

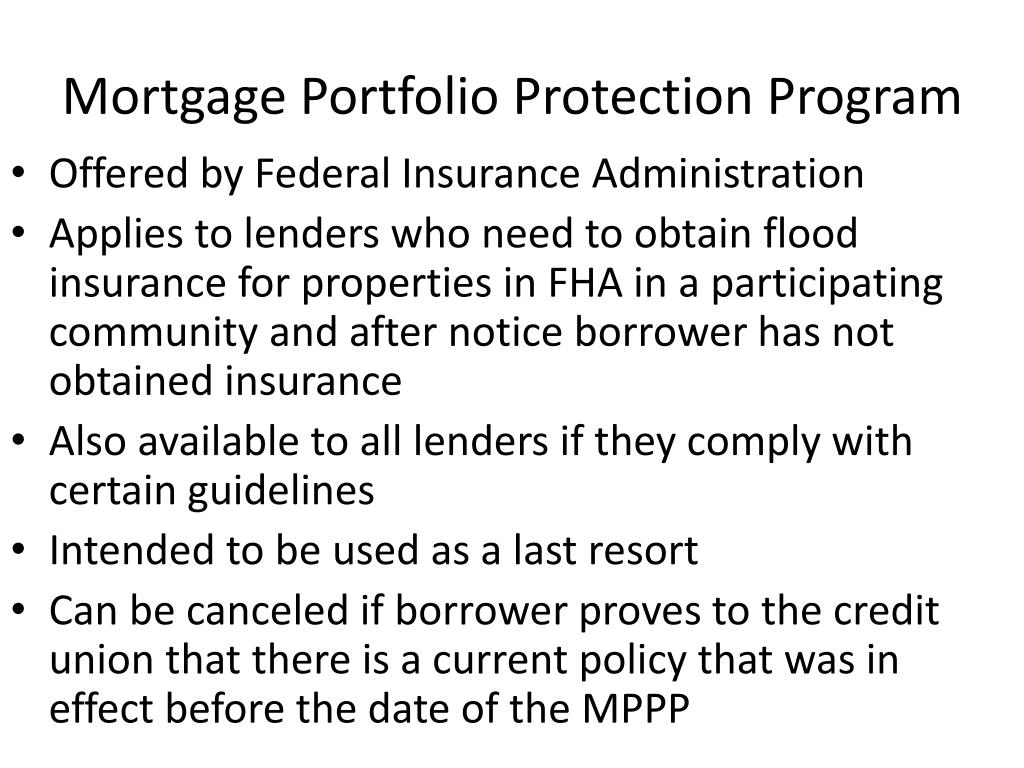

Fha Flood Insurance Requirements. Fha flood insurance deductible requirements. 2022 mip rates for fha loans over 15 years Previously, the maximum deductible for a flood insurance policy for an fha house loan could not exceed $1,000 or 1% of the face value of the policy. Federal law requires flood insurance for all federal loans if the property is located in an sfha.

Realtors® Applaud FHA Effort to Expand Private Flood From rezillafl.com

Realtors® Applaud FHA Effort to Expand Private Flood From rezillafl.com

The condominium association or hoa must maintain and carry. O a flood insurance policy, provided the governing documents require the unit owners to maintain individual flood insurance. For fha loans to buy existing construction properties in a sfha, similar nfip insurance is required as a condition of loan approval. Previously, the maximum deductible for a flood insurance policy for an fha house loan could not exceed $1,000 or 1% of the face value of the policy. Federal law requires flood insurance for all federal loans if the property is located in an sfha. Fha requires both upfront and annual mortgage insurance for all borrowers, regardless of the amount of down payment.

The unpaid principal balance (upb) of the loan (or loan amount at the time of origination).

The unpaid principal balance (upb) of the loan (or loan amount at the time of origination). Mortgage insurance is a policy that protects lenders against losses that result from defaults on home mortgages. 2022 mip rates for fha loans over 15 years The unpaid principal balance (upb) of the loan (or loan amount at the time of origination). Extent of flood insurance coverage required. Flood insurance is a separate policy from homeowners.

Source: floodinsuranceguru.com

Source: floodinsuranceguru.com

Department of housing and urban development 451 7th street, sw washington, dc 20410 re: (sba), federal housing administration (fha), and the department of veterans affairs (va). Let’s examine what the rules in hud 4000.1 say about flood insurance for existing construction. Federal law requires flood insurance for all federal loans if the property is located in an sfha. The condominium association or hoa must maintain and carry.

Source: iamagazine.com

Extent of flood insurance coverage required. Flood insurance is a separate policy from homeowners. Previously, the maximum deductible for a flood insurance policy for an fha house loan could not exceed $1,000 or 1% of the face value of the policy. Fha flood insurance deductible requirements. Fha requirements mortgage insurance (mip) for fha insured loan.

Source: homebridgewholesale.com

Source: homebridgewholesale.com

Flood insurance required (if property remains in sfha) flood insurance required (if property remains in sfha) flood insurance required (if property remains in sfha) author: Fha loan rules also say that “insurance under the nfip” is also a requirement and a condition of loan approval. Flood insurance required (if property remains in sfha) flood insurance required (if property remains in sfha) flood insurance required (if property remains in sfha) author: Fha requires both upfront and annual mortgage insurance for all borrowers, regardless of the amount of down payment. Flood insurance regulations are designed to protect the property owner’s interest.

Source: newamericanfunding.com

Source: newamericanfunding.com

Extent of flood insurance coverage required. Department of housing and urban development 451 7th street, sw washington, dc 20410 re: Federal law requires flood insurance for all federal loans if the property is located in an sfha. Fha loan rules also say that “insurance under the nfip” is also a requirement and a condition of loan approval. Fha requirements mortgage insurance (mip) for fha insured loan.

Source: nahbnow.com

Source: nahbnow.com

Fha insurance protects mortgage lenders the fha does not lend […] Flood insurance is a separate policy from homeowners. The federal housing administration (fha) loan program has specific insurance requirements for borrowers and lenders alike. Previously, the maximum deductible for a flood insurance policy for an fha house loan could not exceed $1,000 or 1% of the face value of the policy. Extent of flood insurance coverage required.

.png#keepProtocol “FHA Push Back on Private Flood Insurance”) Source: floodinsuranceguru.com

That have mortgages secured by fha. Fha loan rules have standards for new construction and existing construction homes; According to the fha official site, rules for flood insurance include the following requirement of the lender: The federal housing administration (fha) loan program has specific insurance requirements for borrowers and lenders alike. In fact, the entire program is built around insurance — and it comes in different forms.

Source: mortgage.info

Source: mortgage.info

Fha requirements mortgage insurance (mip) for fha insured loan. Extent of flood insurance coverage required. Fha requirements mortgage insurance (mip) for fha insured loan. Department of housing and urban development 451 7th street, sw washington, dc 20410 re: 2022 mip rates for fha loans over 15 years

Source: premierflood.com

Source: premierflood.com

Fha requires both upfront and annual mortgage insurance for all borrowers, regardless of the amount of down payment. Fha requires both upfront and annual mortgage insurance for all borrowers, regardless of the amount of down payment. On behalf of the undersigned organizations we wish to bring to your attention an important issue regarding federal housing administration (fha) flood insurance requirements. Fha flood insurance deductible requirements. Flood insurance is a separate policy from homeowners.

Source: fhaloankigagohi.blogspot.com

Source: fhaloankigagohi.blogspot.com

Department of housing and urban development 451 7th street, sw washington, dc 20410 re: Flood insurance required (if property remains in sfha) flood insurance required (if property remains in sfha) flood insurance required (if property remains in sfha) author: According to the fha official site, rules for flood insurance include the following requirement of the lender: Fha flood insurance deductible requirements. Fha loan rules also say that “insurance under the nfip” is also a requirement and a condition of loan approval.

Source: yesensure.com

Source: yesensure.com

Flood insurance regulations are designed to protect the property owner’s interest. Mortgage insurance is a policy that protects lenders against losses that result from defaults on home mortgages. Federal law requires flood insurance for all federal loans if the property is located in an sfha. According to the fha official site, rules for flood insurance include the following requirement of the lender: Flood insurance is a separate policy from homeowners.

Source: nationalmortgagenews.com

Source: nationalmortgagenews.com

Fha loan rules also say that “insurance under the nfip” is also a requirement and a condition of loan approval. Fha loan rules have standards for new construction and existing construction homes; Fha requirements mortgage insurance (mip) for fha insured loan. The federal housing administration (fha) loan program has specific insurance requirements for borrowers and lenders alike. For fha loans to buy existing construction properties in a sfha, similar nfip insurance is required as a condition of loan approval.

Source: blog.aaronline.com

Source: blog.aaronline.com

Mortgage insurance is a policy that protects lenders against losses that result from defaults on home mortgages. Flood insurance is a separate policy from homeowners. Fha requirements mortgage insurance (mip) for fha insured loan. The federal housing administration (fha) loan program has specific insurance requirements for borrowers and lenders alike. Federal law requires flood insurance for all federal loans if the property is located in an sfha.

Source: finance-review.com

Source: finance-review.com

Such insurance is now required by law under the flood disaster protection act of 1973 with respect to fha insured properties. Maintain, where available, nfip (national flood insurance program) flood insurance coverage on the property during such time as the mortgage is insured. There is also a separate section for fha condo loans, and another for manufactured housing loans. Fha flood insurance deductible requirements. Fha loan rules have standards for new construction and existing construction homes;

Source: rezillafl.com

Source: rezillafl.com

U see the topic “fire insurance” for information regarding investment property and second home requirements. The unpaid principal balance (upb) of the loan (or loan amount at the time of origination). The condominium association or hoa must maintain and carry. That have mortgages secured by fha. Flood insurance regulations are designed to protect the property owner’s interest.

Source: fortpaynelive.blogspot.com

Source: fortpaynelive.blogspot.com

For fha loans to buy existing construction properties in a sfha, similar nfip insurance is required as a condition of loan approval. According to the fha official site, rules for flood insurance include the following requirement of the lender: Federal law requires flood insurance for all federal loans if the property is located in an sfha. Extent of flood insurance coverage required. Department of housing and urban development 451 7th street, sw washington, dc 20410 re:

Source: fortpaynelive.blogspot.com

Source: fortpaynelive.blogspot.com

U see the topic “fire insurance” for information regarding investment property and second home requirements. Flood insurance is a separate policy from homeowners. Federal law requires flood insurance for all federal loans if the property is located in an sfha. Fha flood insurance requirements dear ms. On behalf of the undersigned organizations we wish to bring to your attention an important issue regarding federal housing administration (fha) flood insurance requirements.

Source: slideserve.com

Source: slideserve.com

The federal housing administration (fha) loan program has specific insurance requirements for borrowers and lenders alike. Previously, the maximum deductible for a flood insurance policy for an fha house loan could not exceed $1,000 or 1% of the face value of the policy. On behalf of the undersigned organizations we wish to bring to your attention an important issue regarding federal housing administration (fha) flood insurance requirements. Flood insurance regulations are designed to protect the property owner’s interest. Previously, the maximum deductible for a flood insurance policy for an fha house loan could not exceed $1,000 or 1% of the face value of the policy.

Source: floodinsuranceguru.com

That have mortgages secured by fha. Such insurance is now required by law under the flood disaster protection act of 1973 with respect to fha insured properties. Fha insurance protects mortgage lenders the fha does not lend […] O a flood insurance policy, provided the governing documents require the unit owners to maintain individual flood insurance. Extent of flood insurance coverage required.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fha flood insurance requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.