Your Federal employee long term care insurance cost images are ready in this website. Federal employee long term care insurance cost are a topic that is being searched for and liked by netizens now. You can Get the Federal employee long term care insurance cost files here. Download all free images.

If you’re looking for federal employee long term care insurance cost images information related to the federal employee long term care insurance cost topic, you have come to the right site. Our website frequently gives you hints for seeing the highest quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

Federal Employee Long Term Care Insurance Cost. Federal employees and retirees who participate in the federal long term care insurance program (fltcip) are in for some serious sticker shock. Cost without long term care insurance. Long term care also includes the supervision you might need due to a. To get ballpark figures of how much long term care insurance costs, check out our online calculator.

Benefits Overview From das.ohio.gov

Cost without long term care insurance. To get ballpark figures of how much long term care insurance costs, check out our online calculator. Where would someone receive care? Costs are based on the john hancock 2018 cost of care survey. these costs are meant to provide general guidelines. However, if you remain on the same health plan before and after retirement, your total yearly premiums and benefits will remain the same. Federal employees and retirees who participate in the federal long term care insurance program (fltcip) are in for some serious sticker shock.

The cost of long term care can be expensive and vary greatly depending on the type of care you receive, the place it�s provided, and where you live.

Each section includes common questions to help guide you to the information you need. *the daily cost for home care is based on 6 hours per day. Each section includes common questions to help guide you to the information you need. Long term care is care that you need if you can no longer perform the everyday tasks of bathing, dressing, transferring, toileting, continence, and eating by yourself due to a chronic illness, injury, disability, or the aging process. Fers and csrs federal employee retirement benefits are generous, however they will cost you retirement dollars, especially for health and life insurance coverage. The federal long term care insurance program (fltcip) costs increase significantly if you opt for the compounded inflation coverage, the 4% or 5% automatic compound inflation option (acio).

Source: pinterest.com

Source: pinterest.com

The federal long term care insurance program. Retirees pay their portion on a monthly basis. The federal long term care insurance program (fltcip) costs increase significantly if you opt for the compounded inflation coverage, the 4% or 5% automatic compound inflation option (acio). Although it is the largest single long term care insurance program in the country, it is not open to the general public. Actual costs for specific providers may be different.

Source: das.ohio.gov

As a federal employee, you may be able to enroll in health, dental, vision and life insurance, flexible spending accounts, and apply for long term care insurance. No matter where you are in your career, consider the prospect of needing long term care, and how applying for long term care insurance coverage under the federal long term care insurance program (fltcip) may help. The cost of long term care can be expensive and vary greatly depending on the type of care you receive, the place it�s provided, and where you live. Retirees pay their portion on a monthly basis. Each section includes common questions to help guide you to the information you need.

Source: myfederalretirement.com

Source: myfederalretirement.com

The federal long term care insurance program. To get ballpark figures of how much long term care insurance costs, check out our online calculator. The cost of long term care can be expensive and vary greatly depending on the type of care you receive, the place it�s provided, and where you live. As a federal employee, you may be able to enroll in health, dental, vision and life insurance, flexible spending accounts, and apply for long term care insurance. Although it is the largest single long term care insurance program in the country, it is not open to the general public.

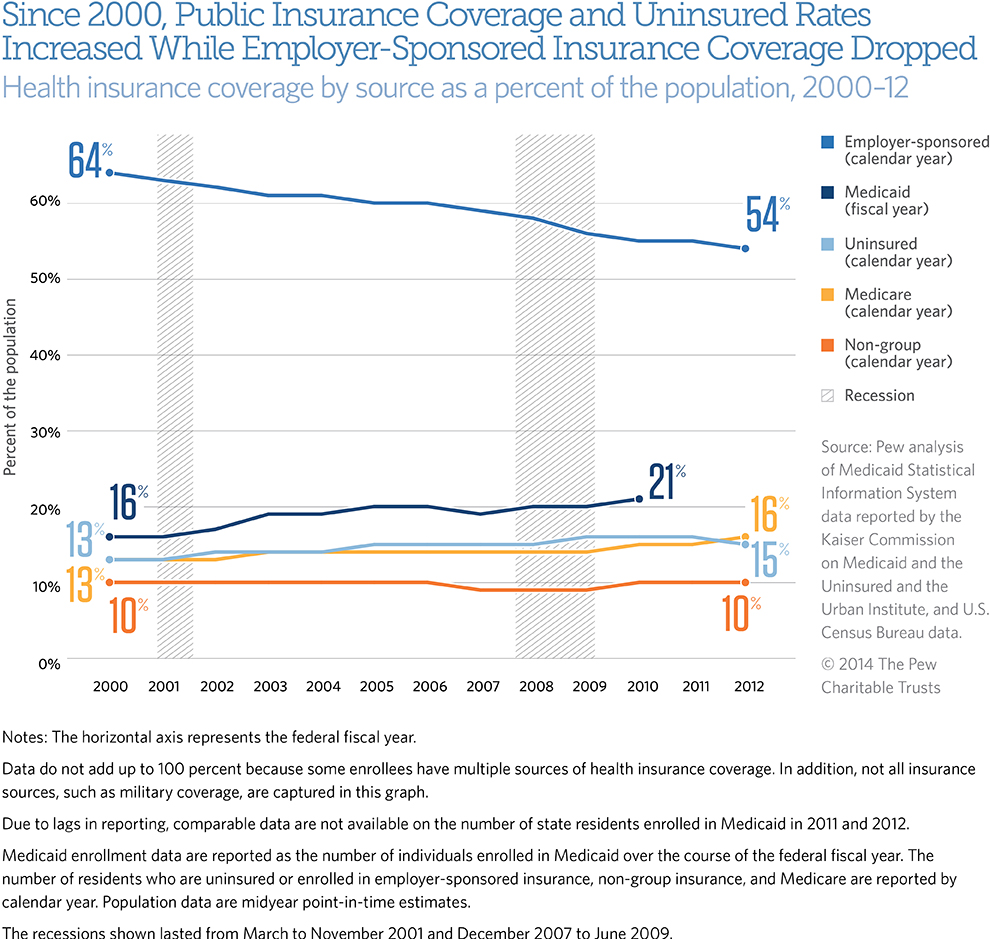

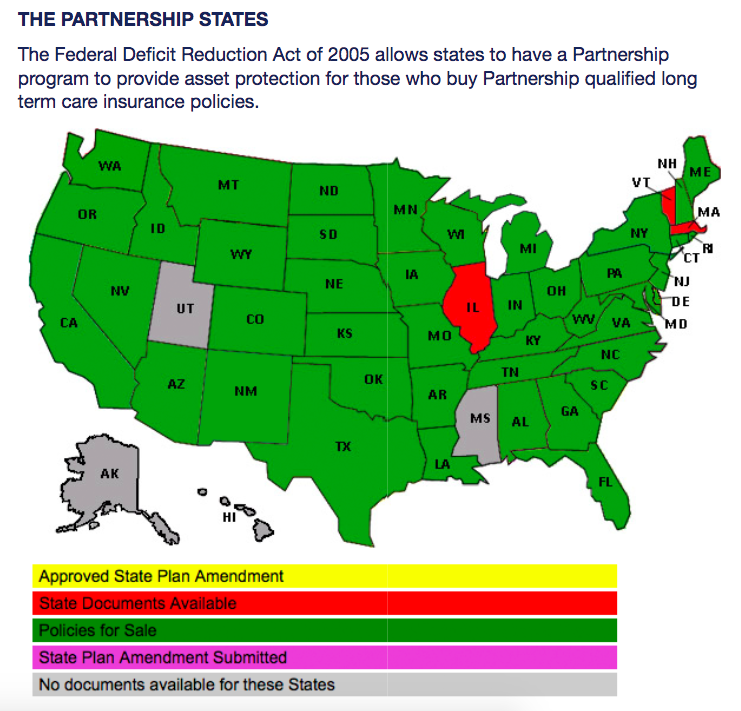

Source: pewtrusts.org

Source: pewtrusts.org

We recommend that you consult with a financial advisor for specific advice about your long term care planning. Although it is the largest single long term care insurance program in the country, it is not open to the general public. To get ballpark figures of how much long term care insurance costs, check out our online calculator. Each section includes common questions to help guide you to the information you need. The federal long term care insurance program is sponsored by the us office of personnel management, underwritten by john hancock life & health insurance company, and administered by long term care partners, llc.

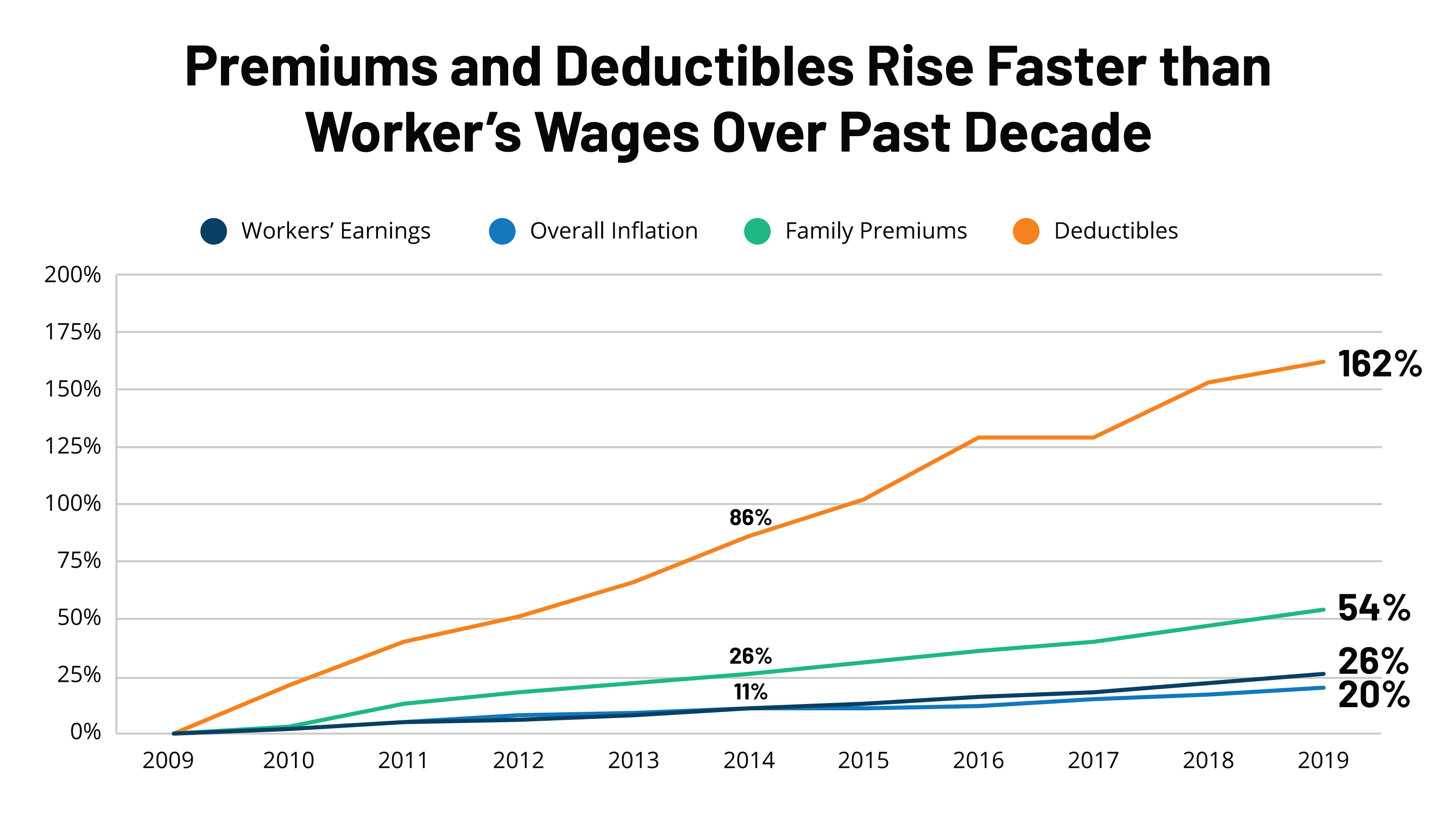

Source: kff.org

Source: kff.org

Where would someone receive care? These plans offer comparable coverage to what is available from a host of. This plan provides a simple long term care plan for federal employees and their spouses. New and newly eligible employees have 60 days from the date you. Federal employees have access to a long term care program called the fltcp 2.0.

Source: kff.org

Source: kff.org

The cost of long term care can be expensive and vary greatly depending on the type of care you receive, the place it�s provided, and where you live. However, federal employees pay their portion of the premium on a biweekly basis. Cost without long term care insurance. The federal long term care insurance program. The health insurance premiums remain the same both before and after retirement.

Source: kff.org

Source: kff.org

These plans offer comparable coverage to what is available from a host of. As a federal employee, you may be able to enroll in health, dental, vision and life insurance, flexible spending accounts, and apply for long term care insurance. These plans offer comparable coverage to what is available from a host of. We recommend that you consult with a financial advisor for specific advice about your long term care planning. No matter where you are in your career, consider the prospect of needing long term care, and how applying for long term care insurance coverage under the federal long term care insurance program (fltcip) may help.

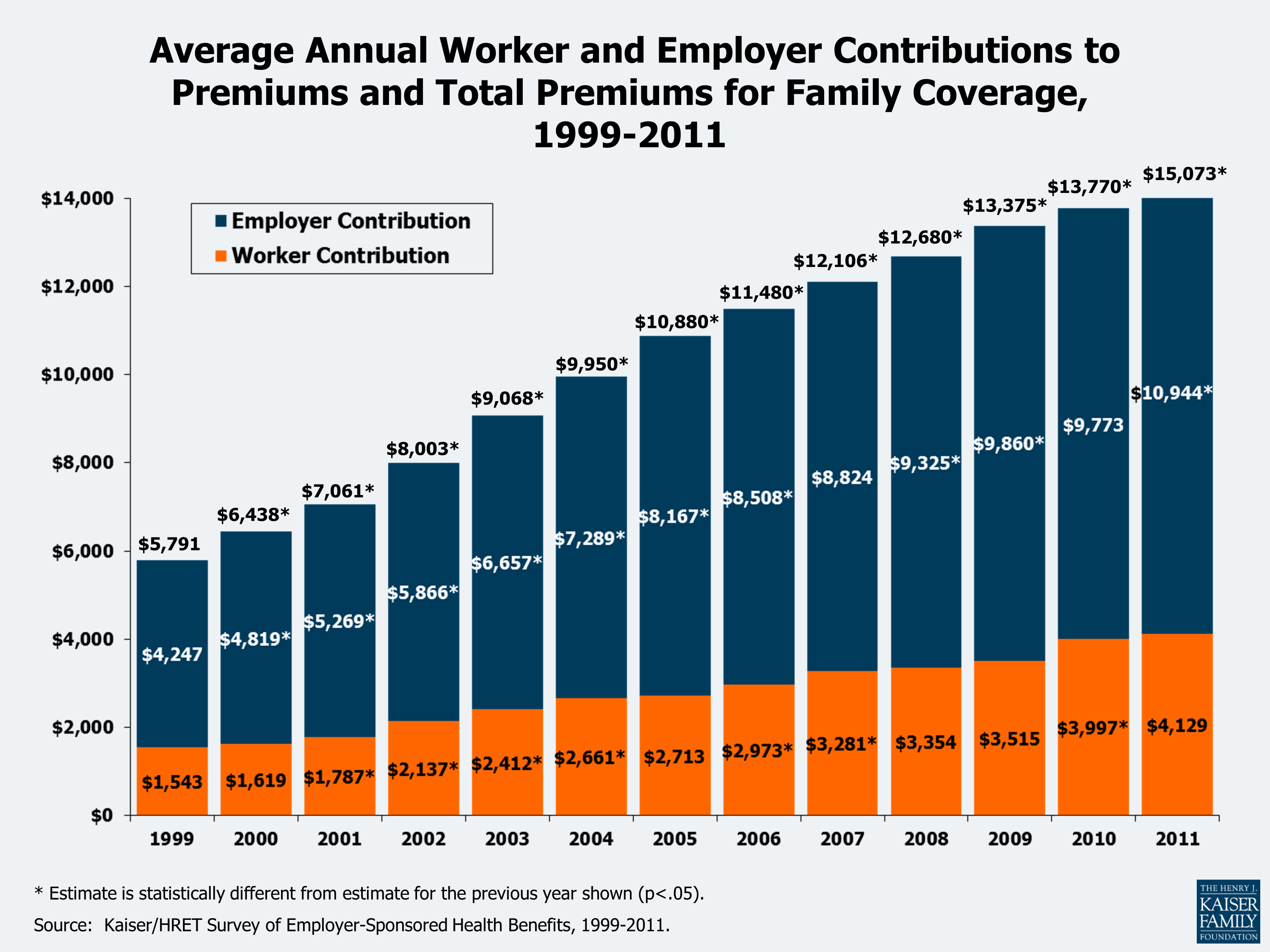

Source: benefitnews.com

Source: benefitnews.com

Federal employees and retirees who participate in the federal long term care insurance program (fltcip) are in for some serious sticker shock. Uncle sam will continue federal employee�s health benefits, as long as you were enrolled in the program for the last five years of your service, however you must pay the same monthly. Every two years under the fpo plan i receive a letter offering to either increase our premium and daily benefit amount, reject the offer and maintain. Actual costs for specific providers may be different. Long term care is care that you need if you can no longer perform the everyday tasks of bathing, dressing, transferring, toileting, continence, and eating by yourself due to a chronic illness, injury, disability, or the aging process.

Source: healthlifemedia.com

Source: healthlifemedia.com

The cost of long term care can be expensive and vary greatly depending on the type of care you receive, the place it�s provided, and where you live. The health insurance premiums remain the same both before and after retirement. Most federal employees (check with your human resources office if you are unsure of your eligibility), annuitants regardless of fehb eligibility, and their qualifying relatives, including: Costs are based on the john hancock 2018 cost of care survey. these costs are meant to provide general guidelines. For example, the national average cost for a semiprivate room in a nursing home is $92,710 1 per year.

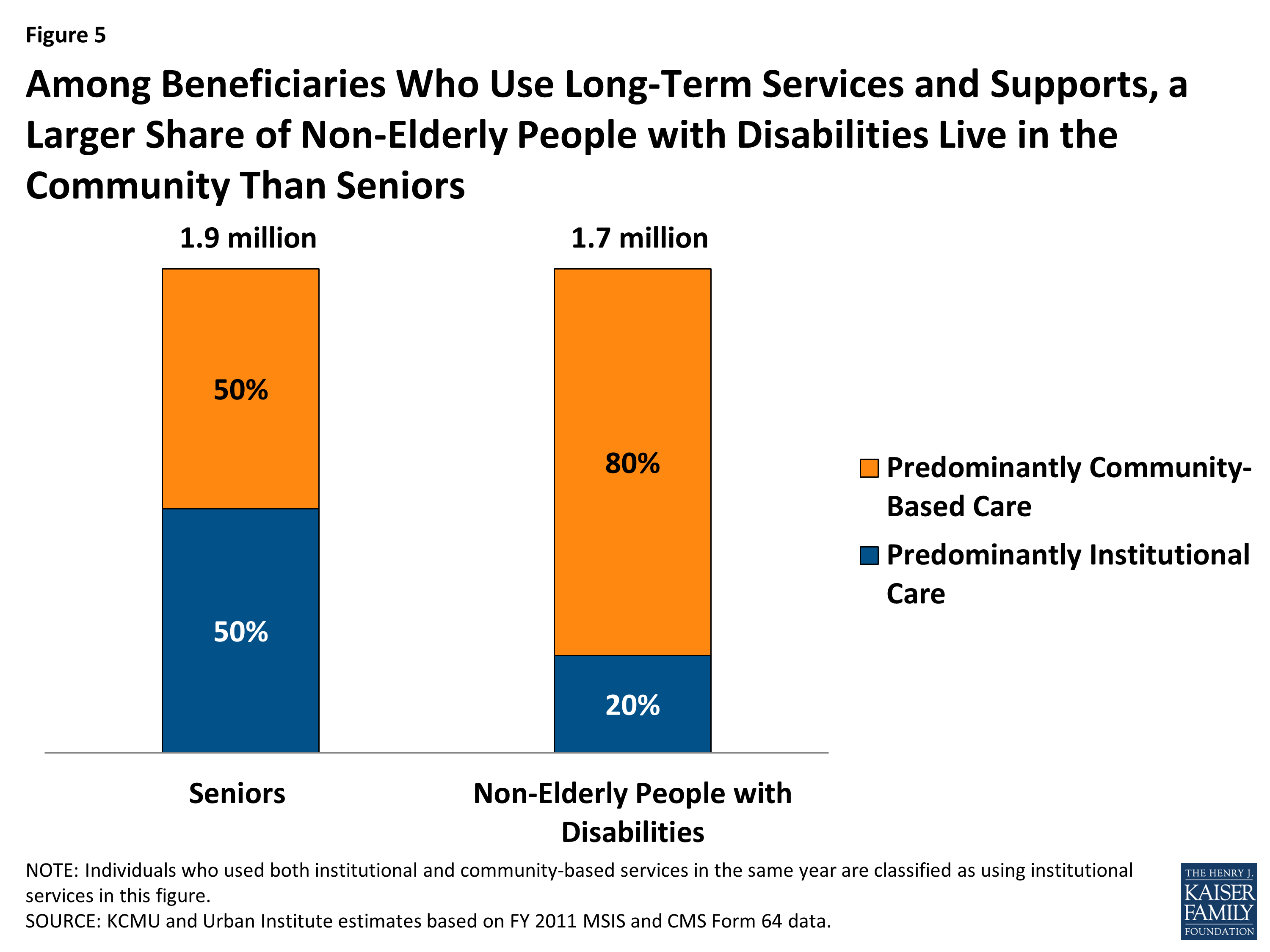

Source: kff.org

Source: kff.org

However, federal employees pay their portion of the premium on a biweekly basis. Although it is the largest single long term care insurance program in the country, it is not open to the general public. We recommend that you consult with a financial advisor for specific advice about your long term care planning. Long term care is care that you need if you can no longer perform the everyday tasks of bathing, dressing, transferring, toileting, continence, and eating by yourself due to a chronic illness, injury, disability, or the aging process. Every two years under the fpo plan i receive a letter offering to either increase our premium and daily benefit amount, reject the offer and maintain.

Source: va.org

Source: va.org

Federal long term care insurance program. Actual costs for specific providers may be different. Where would someone receive care? To get ballpark figures of how much long term care insurance costs, check out our online calculator. The federal long term care insurance program is sponsored by the us office of personnel management, underwritten by john hancock life & health insurance company, and administered by long term care partners, llc.

Source: hrmorning.com

Source: hrmorning.com

Costs are based on the john hancock 2018 cost of care survey. these costs are meant to provide general guidelines. The federal long term care insurance program is sponsored by the us office of personnel management, underwritten by john hancock life & health insurance company, and administered by long term care partners, llc. The federal long term care insurance program (fltcip) costs increase significantly if you opt for the compounded inflation coverage, the 4% or 5% automatic compound inflation option (acio). Fers and csrs federal employee retirement benefits are generous, however they will cost you retirement dollars, especially for health and life insurance coverage. Federal employees have access to a long term care program called the fltcp 2.0.

Source: fmechamber.org

Source: fmechamber.org

*the daily cost for home care is based on 6 hours per day. Federal employees and retirees who participate in the federal long term care insurance program (fltcip) are in for some serious sticker shock. The federal long term care insurance program is sponsored by the us office of personnel management, underwritten by john hancock life & health insurance company, and administered by long term care partners, llc. New and newly eligible employees have 60 days from the date you. We recommend that you consult with a financial advisor for specific advice about your long term care planning.

Source: newsroom.lfg.com

Source: newsroom.lfg.com

Fers and csrs federal employee retirement benefits are generous, however they will cost you retirement dollars, especially for health and life insurance coverage. Federal employees retirement system (fers) * thrift savings plan (tsp) * federal erroneous retirement corrections coverage act (fercca) * insurance information. Actual costs for specific providers may be different. You can find information about each program by clicking on one of the links below. However, if you remain on the same health plan before and after retirement, your total yearly premiums and benefits will remain the same.

Source: milfordfederal.com

Source: milfordfederal.com

However, if you remain on the same health plan before and after retirement, your total yearly premiums and benefits will remain the same. This plan provides a simple long term care plan for federal employees and their spouses. New and newly eligible employees have 60 days from the date you. To get ballpark figures of how much long term care insurance costs, check out our online calculator. Where would someone receive care?

Source: govexec.com

Source: govexec.com

Costs are based on the john hancock 2018 cost of care survey. these costs are meant to provide general guidelines. As a federal employee, you may be able to enroll in health, dental, vision and life insurance, flexible spending accounts, and apply for long term care insurance. *the daily cost for home care is based on 6 hours per day. The federal long term care insurance program. For example, the national average cost for a semiprivate room in a nursing home is $92,710 1 per year.

Source: neckerman.com

Source: neckerman.com

Where would someone receive care? Federal employees retirement system (fers) * thrift savings plan (tsp) * federal erroneous retirement corrections coverage act (fercca) * insurance information. Costs are based on the john hancock 2018 cost of care survey. these costs are meant to provide general guidelines. Actual costs for specific providers may be different. For example, the national average cost for a semiprivate room in a nursing home is $92,710 1 per year.

Source: polacountryando.blogspot.com

Source: polacountryando.blogspot.com

The federal long term care insurance program (fltcip) provides long term care insurance to help pay for costs of care when enrollees need help with activities they perform every day, or you have a severe cognitive impairment, such. No matter where you are in your career, consider the prospect of needing long term care, and how applying for long term care insurance coverage under the federal long term care insurance program (fltcip) may help. Long term care is care that you need if you can no longer perform the everyday tasks of bathing, dressing, transferring, toileting, continence, and eating by yourself due to a chronic illness, injury, disability, or the aging process. To get ballpark figures of how much long term care insurance costs, check out our online calculator. The cost of long term care can be expensive and vary greatly depending on the type of care you receive, the place it�s provided, and where you live.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title federal employee long term care insurance cost by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.