Your Features of term insurance images are available in this site. Features of term insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Features of term insurance files here. Download all royalty-free photos and vectors.

If you’re looking for features of term insurance pictures information connected with to the features of term insurance interest, you have come to the right site. Our website frequently provides you with suggestions for seeking the highest quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

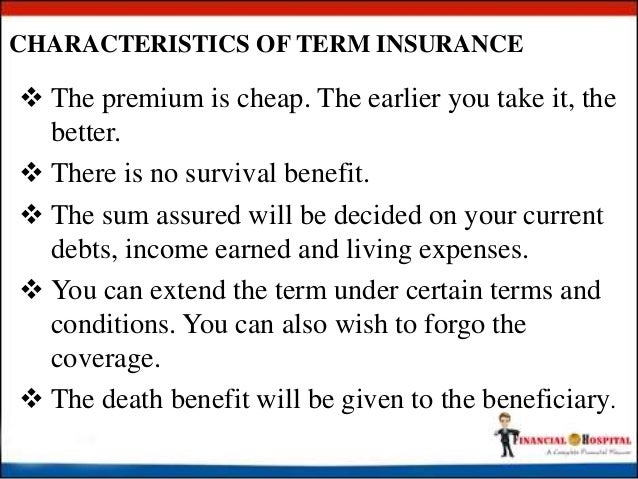

Features Of Term Insurance. The term of these policies can be as short as six months or as long as 25 years. They expect people to generally outlive the term coverage. The primary intention is to keep the family stable and happy, and ensure they. Pure term plans are mostly affordable as compared to other insurance plans.

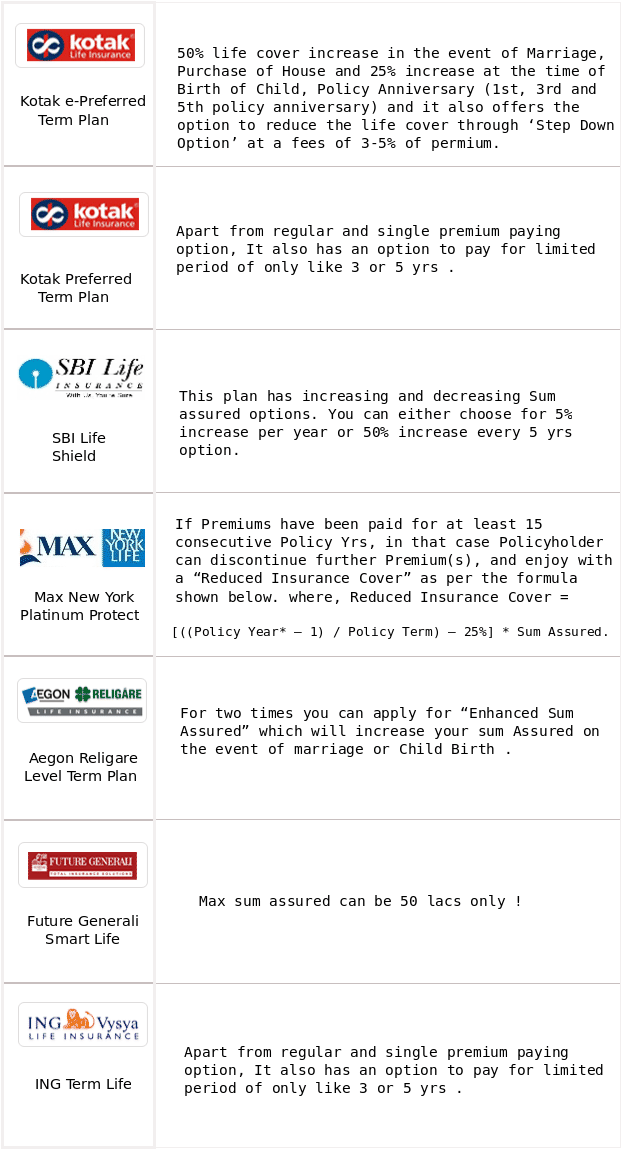

Best Term Life Insurance Policy in India 2015 From smartmoneygoal.in

Best Term Life Insurance Policy in India 2015 From smartmoneygoal.in

Insurance is the most effective risk management tool which can protect individuals and businesses from financial risks arising out of various contingencies. These plans offer life cover for the sum assured for a specified period of time, known as the policy term. Check term insurance meaning on max life insurance. One of the main features of term insurance is the ability to only buy it for as long as you need it. A term insurance plan is a type of life insurance plan for a fixed period of time/term. When deciding what term length is right for you, you’ll want to consider your immediate and future financial needs, who depends on your financial support, and how much you can afford.

Once an individual buys a term insurance plan, he/she is insured for a particular period (term) of the plan.

Here are the key features of term life: The term of these policies can be as short as six months or as long as 25 years. Term insurance is a pure life insurance product, which provides financial protection in case of death of the life insured during the term of the policy. One of the main features of term insurance is the ability to only buy it for as long as you need it. The primary intention is to keep the family stable and happy, and ensure they. A term insurance plan is the most affordable form of life insurance cover.

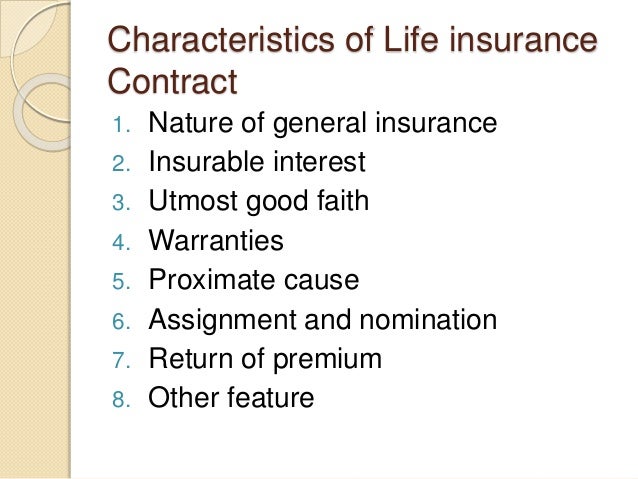

Source: slideshare.net

Source: slideshare.net

Financial protection is provided to the nominee (s)/dependent (s) in case the policyholder dies during the policy tenure. Term plans are one of the cheapest life insurance plans. Here are the key features of term life: Once an individual buys a term insurance plan, he/she is insured for a particular period (term) of the plan. Term insurance plans provide financial security to the family of the beneficiary in case of death of policy holder and also get optional coverage for critical illnesses or accidental death.

Source: relakhs.com

Source: relakhs.com

As these policies do not come with an investment component, their premium is much lower than other insurance policies. Pure term plans are mostly affordable as compared to other insurance plans. Term insurance is a type of life insurance that provides coverage for a specific period of time or years, i.e., a term. Term insurance policies provide high life cover at lower premiums. The premiums paid towards the policy are exempt from taxes under section 80c of the income tax act, 1961.

Source: financialexpress.com

Source: financialexpress.com

Insurance is the most effective risk management tool which can protect individuals and businesses from financial risks arising out of various contingencies. The sum assured that is offered by a term plan must be totally sufficient that can ensure complete coverage for your family�s needs, even in your absence. Pure term plans are mostly affordable as compared to other insurance plans. It is the least expensive life insurance coverage because the life insurance company does not expect to pay a death claim. Following is a list of important features of a term insurance plan that must be kept in mind:

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

Loan a loan is a sum of money. Here are some of the top features of term insurance plans you absolutely need to know: A type of life insurance with a limited coverage period. Important features of term insurance policy term plans are affordable. Term insurance is a pure life insurance product, which provides financial protection in case of death of the life insured during the term of the policy.

Source: in.pinterest.com

Source: in.pinterest.com

The sum assured is the total scope of coverage that is offered by a term plan. The premiums paid towards the policy are exempt from taxes under section 80c of the income tax act, 1961. Important features of term insurance policy term plans are affordable. Term insurance policies provide high life cover at lower premiums. A type of life insurance with a limited coverage period.

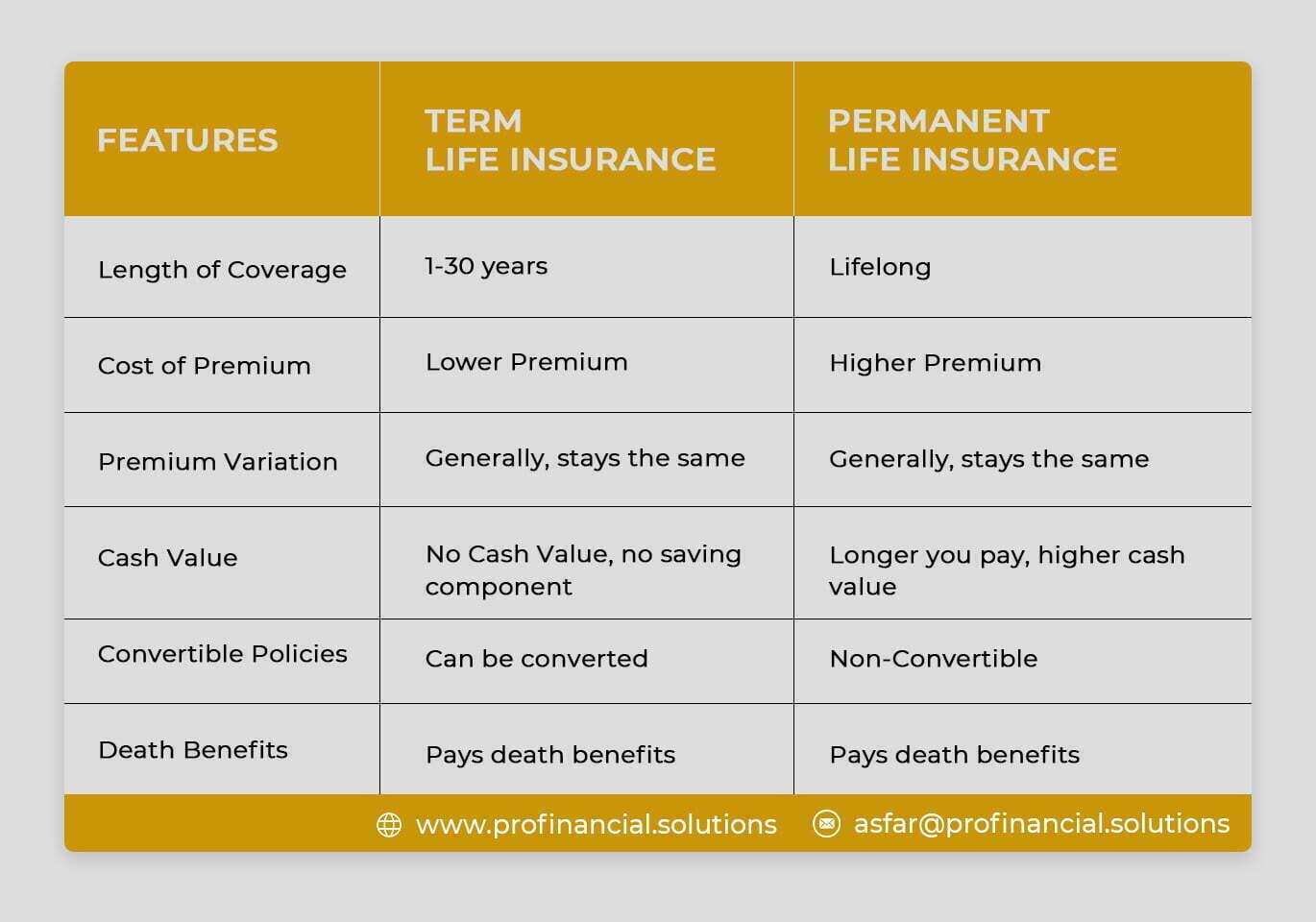

Source: profinancial.solutions

Source: profinancial.solutions

Pure term plans are mostly affordable as compared to other insurance plans. Key features of a term insurance plan the concept of term insurance is to provide coverage for a family in times of duress, especially when the income generator is absent. Decreasing term insurance, also called dta insurance, can be defined as a life insurance policy with a feature that allows for the decrease of the benefit on a monthly or yearly basis. The premiums paid towards the policy are exempt from taxes under section 80c of the income tax act, 1961. There are a number of positive features associated with term life insurance that offer a great deal of freedom to the person who is insured, allowing them to.

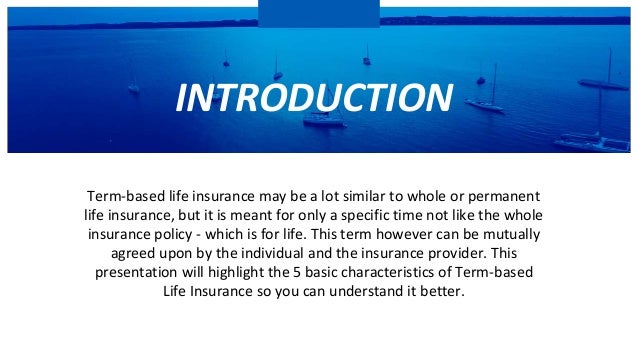

Source: slideshare.net

Source: slideshare.net

Here are some of the top features of term insurance plans you absolutely need to know: Insurance is the most effective risk management tool which can protect individuals and businesses from financial risks arising out of various contingencies. Following is a list of important features of a term insurance plan that must be kept in mind: These plans offer life cover for the sum assured for a specified period of time, known as the policy term. Term insurance is a type of life insurance that provides coverage for a specific period of time or years, i.e., a term.

Source: insurance-companies.co

Source: insurance-companies.co

Term insurance is an affordable form of life insurance. In case of the person’s demise during the term of the plan, the sum assured is paid by the insurance provider to the nominee of the policy plan. These plans offer life cover for the sum assured for a specified period of time, known as the policy term. As these policies do not come with an investment component, their premium is much lower than other insurance policies. Features of term insurance plans in indiafor nris wide policy term choice.

Source: allbankingalerts.com

Source: allbankingalerts.com

Once that period or term is up, it is up to the policy owner. Features of term insurance plans in indiafor nris wide policy term choice. The sum assured on death is a guaranteed benefit. The sum assured that is offered by a term plan must be totally sufficient that can ensure complete coverage for your family�s needs, even in your absence. Term insurance is a pure life insurance product, which provides financial protection in case of death of the life insured during the term of the policy.

Source: slideshare.net

Source: slideshare.net

Here are the key features of term life: They expect people to generally outlive the term coverage. There are a number of positive features associated with term life insurance that offer a great deal of freedom to the person who is insured, allowing them to. The sum assured on death is a guaranteed benefit. These plans offer life cover for the sum assured for a specified period of time, known as the policy term.

Source: theinvestmentmania.com

Source: theinvestmentmania.com

Once an individual buys a term insurance plan, he/she is insured for a particular period (term) of the plan. Following is a list of important features of a term insurance plan that must be kept in mind: One of the main features of term insurance is the ability to only buy it for as long as you need it. Financial protection is provided to the nominee (s)/dependent (s) in case the policyholder dies during the policy tenure. Term insurance is an affordable form of life insurance.

Source: groupeconsilium.ca

Source: groupeconsilium.ca

Decreasing term insurance, also called dta insurance, can be defined as a life insurance policy with a feature that allows for the decrease of the benefit on a monthly or yearly basis. Key features of a term insurance plan the concept of term insurance is to provide coverage for a family in times of duress, especially when the income generator is absent. Term plans are one of the cheapest life insurance plans. Insurance is the most effective risk management tool which can protect individuals and businesses from financial risks arising out of various contingencies. As these policies do not come with an investment component, their premium is much lower than other insurance policies.

Source: slideshare.net

Source: slideshare.net

There are a number of positive features associated with term life insurance that offer a great deal of freedom to the person who is insured, allowing them to. The sum assured on death is a guaranteed benefit. A term insurance plan is a type of life insurance plan for a fixed period of time/term. The sum assured that is offered by a term plan must be totally sufficient that can ensure complete coverage for your family�s needs, even in your absence. Ideally, the size of the policy also decreases over the period until the coverage period concludes or until the policy pays out.

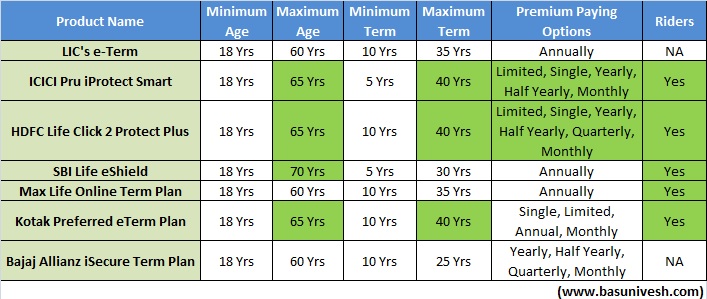

Source: basunivesh.com

Source: basunivesh.com

They expect people to generally outlive the term coverage. Features of term insurance plans in indiafor nris wide policy term choice. Term insurance is an affordable form of life insurance. Insurance definition types benefits features india. As these policies do not come with an investment component, their premium is much lower than other insurance policies.

Source: slideshare.net

Source: slideshare.net

A term insurance plan is a type of life insurance plan for a fixed period of time/term. In case of the person’s demise during the term of the plan, the sum assured is paid by the insurance provider to the nominee of the policy plan. Once an individual buys a term insurance plan, he/she is insured for a particular period (term) of the plan. Financial protection is provided to the nominee (s)/dependent (s) in case the policyholder dies during the policy tenure. The primary intention is to keep the family stable and happy, and ensure they.

Source: basunivesh.com

Source: basunivesh.com

Here are the key features of term life: The sum assured is the total scope of coverage that is offered by a term plan. Term insurance is an affordable form of life insurance. Pure term plans are mostly affordable as compared to other insurance plans. Features of term insurance plans in indiafor nris wide policy term choice.

Source: allstate.com

Source: allstate.com

When deciding what term length is right for you, you’ll want to consider your immediate and future financial needs, who depends on your financial support, and how much you can afford. Insurance definition types benefits features india. Term life is only meant to last for a set period of years and eventually expires. Ideally, the size of the policy also decreases over the period until the coverage period concludes or until the policy pays out. This type of life insurance provides a financial benefit to the nominee in case of the unfortunate demise of the insured during the policy term.

Source: jagoinvestor.com

Source: jagoinvestor.com

Features of term insurance plans in indiafor nris wide policy term choice. Decreasing term insurance, also called dta insurance, can be defined as a life insurance policy with a feature that allows for the decrease of the benefit on a monthly or yearly basis. Ideally, the size of the policy also decreases over the period until the coverage period concludes or until the policy pays out. Insurance definition types benefits features india. Key features of a term insurance plan the concept of term insurance is to provide coverage for a family in times of duress, especially when the income generator is absent.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title features of term insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.