Your Features of personal accident insurance images are ready in this website. Features of personal accident insurance are a topic that is being searched for and liked by netizens now. You can Download the Features of personal accident insurance files here. Download all free photos and vectors.

If you’re looking for features of personal accident insurance images information related to the features of personal accident insurance keyword, you have visit the right blog. Our site frequently gives you hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

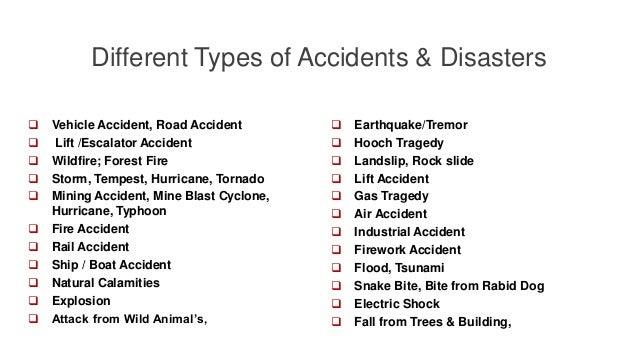

Features Of Personal Accident Insurance. Certain policies also provide cover the hospitalization due to. Personal accident insurance policies come with a disability coverage that effectively supports and protects you financially against any accidental mishap. Common injuries the severity of injuries depends on lots of things, for example speed, seatbelt use, what the car made contact with,. If you are the victim of a road accident, a personal accident cover gives you the following advantages:

5 Updates And Features On The Grab App That�s Good News From ohmychannel.com

5 Updates And Features On The Grab App That�s Good News From ohmychannel.com

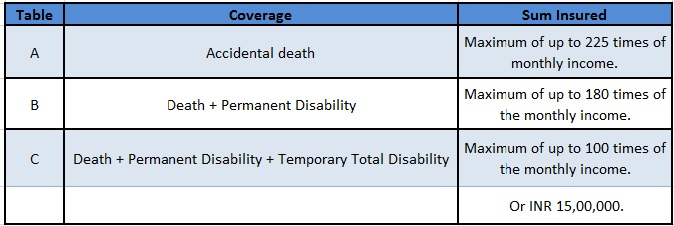

If you are the victim of a road accident, a personal accident cover gives you the following advantages: Certain policies also provide cover the hospitalization due to. Another interesting feature of a personal accident insurance is that it also provides cover in case of temporary total disablement. Now you can protect your entire family with personal accident insurance against accidental injuries.the policy provides the benefits to you and your family,for accidental death,permanent disability,broken bones,burns due to an accident.it also provides benefit of. Coverage goes up to ₹50 lakh. Key features of group accidental insurance policy an accidental insurance policy for employees can be given to clubs, corporates, associations, institutions, and firms.

Coverage goes up to ₹50 lakh.

It has the domestic coverage and beauty of personal accident. Coverage goes up to ₹50 lakh. Key features of group accidental insurance policy an accidental insurance policy for employees can be given to clubs, corporates, associations, institutions, and firms. Personal accident insurance of rs. Nice interface and easy process. It has the domestic coverage and beauty of personal accident.

Source: wishpolicy.com

Source: wishpolicy.com

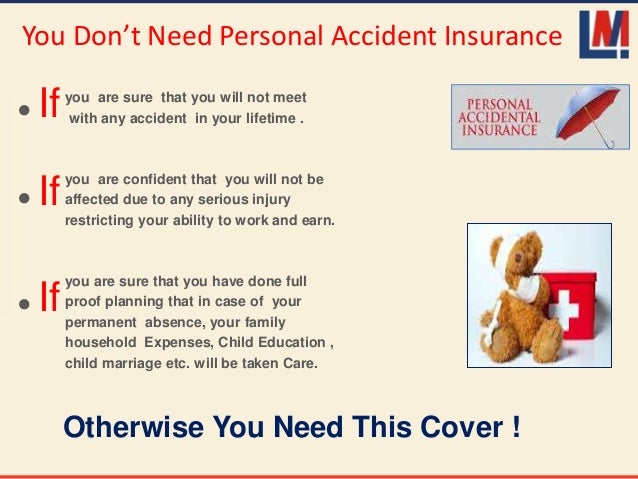

Personal accident insurnace plans are cheap and provide good cover for situations not covered by other plans. Insurance emporium (formerly known as e&l) has personal accident insurance for £7.56 per month and kbis’ bespoke british eventing package is £13.75 per month. This policy ensures the financial stability of an individual and his family if he/she gets injured or unfortunately dies in an accident. Personal accident insurance has many benefits, which are: A personal accident insurance policy covers the loss of life, limb or general disablement caused due to an accident while travelling.

Source: slideshare.net

Source: slideshare.net

These days, leading insurance companies in singapore also offer coverage for insect and animal bites and food poisoning in their personal accident insurance. Coverage goes up to ₹50 lakh. This policy ensures the financial stability of an individual and his family if he/she gets injured or unfortunately dies in an accident. 2 lakh that covers accidental death and total permanent disability. Personal accident insurance policy provides complete financial protection to the insured members against uncertainties such as accidental death, accidental bodily injuries, and partial/total disabilities, permanent as well as temporary disabilities resulting from an accident.

Source: pinterest.com

Source: pinterest.com

This group can be formed by an employer for his/her employees, organization, travel company, banks and other service providers for customers. Nice interface and easy process. Common injuries the severity of injuries depends on lots of things, for example speed, seatbelt use, what the car made contact with,. Personal accident cover offers financial compensation for a range of injuries to help you and others recover. Features of personal accident insurance policy made to protect your family, just like you do.

Source: magazine-cover.com

Source: magazine-cover.com

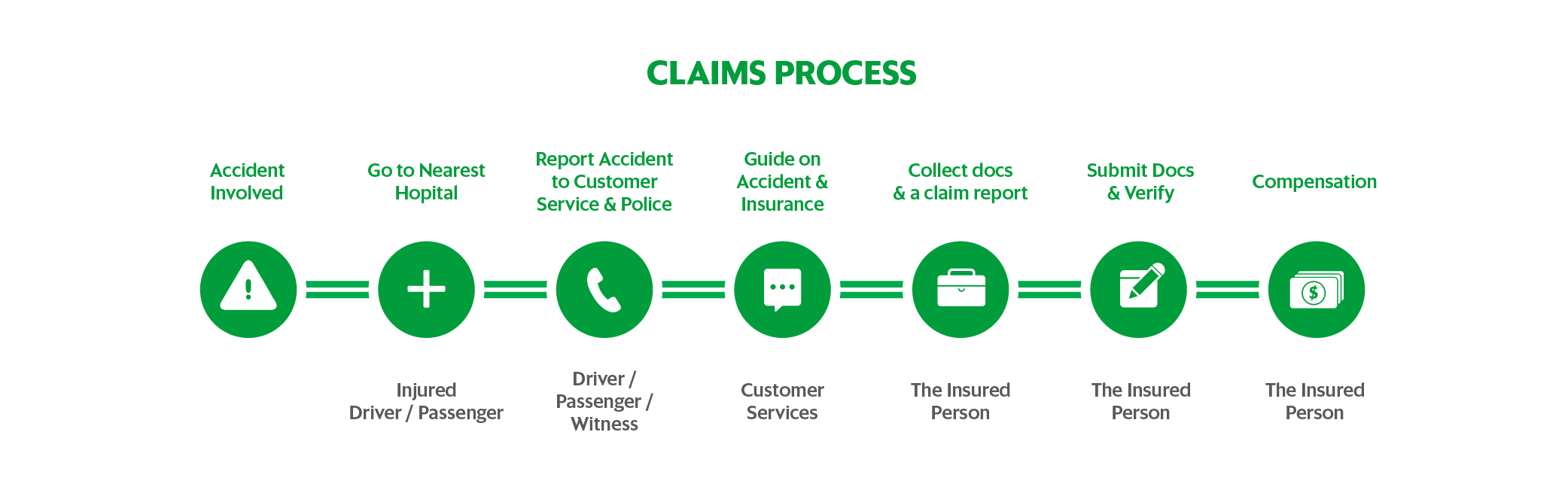

Coverage goes up to ₹25 lakh. The process to register a claim for your bajaj allianz personal accident policy is very easy. 2 lakh that covers accidental death and total permanent disability. No hassles and great comparison. Peace of mind and family security in the event of an accident that causes death or renders you disabled, it would have a significant impact on your earning potential.

Source: wishpolicy.com

Source: wishpolicy.com

Insurance emporium (formerly known as e&l) has personal accident insurance for £7.56 per month and kbis’ bespoke british eventing package is £13.75 per month. Gives coverage against death or permanent total disablement (ptd) due to an accident. 1 crore family cover cover your family members for a defined percentage of your chosen si protection that grows every year Coverage goes up to ₹50 lakh. If you are the victim of a road accident, a personal accident cover gives you the following advantages:

Source: slideshare.net

Source: slideshare.net

Personal accident insurance policy provides complete financial protection to the insured members against uncertainties such as accidental death, accidental bodily injuries, and partial/total disabilities, permanent as well as temporary disabilities resulting from an accident. Personal accident cover offers financial compensation for a range of injuries to help you and others recover. Key features of group accidental insurance policy an accidental insurance policy for employees can be given to clubs, corporates, associations, institutions, and firms. Some plans also provide an educational fund for dependent children of the insured in case of his/her permanent disablement or death. 1 crore family cover cover your family members for a defined percentage of your chosen si protection that grows every year

Source: escolabressolelrial.blogspot.com

Source: escolabressolelrial.blogspot.com

Key features of group accidental insurance policy an accidental insurance policy for employees can be given to clubs, corporates, associations, institutions, and firms. Personal accident insurance policies come with a disability coverage that effectively supports and protects you financially against any accidental mishap. Insurance emporium (formerly known as e&l) has personal accident insurance for £7.56 per month and kbis’ bespoke british eventing package is £13.75 per month. 1 crore family cover cover your family members for a defined percentage of your chosen si protection that grows every year It has the domestic coverage and beauty of personal accident.

Source: policydunia.com

Source: policydunia.com

Another interesting feature of a personal accident insurance is that it also provides cover in case of temporary total disablement. Any kind of partial, temporary or permanent disability suffered by the policyholder is. These days, leading insurance companies in singapore also offer coverage for insect and animal bites and food poisoning in their personal accident insurance. Pamultiple personal accident insurance plan the plan provides you with tailored coverage for children, adults and the elderly to meet the accidental risk exposures. Coverage goes up to ₹25 lakh.

Source: coverfox.com

Source: coverfox.com

Any kind of partial, temporary or permanent disability suffered by the policyholder is. Personal accident cover offers financial compensation for a range of injuries to help you and others recover. Now you can protect your entire family with personal accident insurance against accidental injuries.the policy provides the benefits to you and your family,for accidental death,permanent disability,broken bones,burns due to an accident.it also provides benefit of. All you need to do is go online, download the claims form from the official website of bajaj health insurance, fill the form correctly and then finally submit this claim form with the required documents at any branch of bajaj allianz health insurance company. If you are the victim of a road accident, a personal accident cover gives you the following advantages:

Source: slideshare.net

Source: slideshare.net

Gives coverage against death or permanent total disablement (ptd) due to an accident. It has the domestic coverage and beauty of personal accident. Common injuries the severity of injuries depends on lots of things, for example speed, seatbelt use, what the car made contact with,. This group can be formed by an employer for his/her employees, organization, travel company, banks and other service providers for customers. The core feature of personal accident insurance is to provide coverage in case of an accident in which the policyholder suffers serious bodily injuries or dismemberment, which can lead to disability or even death.

Source: slideshare.net

Source: slideshare.net

Common injuries the severity of injuries depends on lots of things, for example speed, seatbelt use, what the car made contact with,. The process to register a claim for your bajaj allianz personal accident policy is very easy. Key features of group accidental insurance policy an accidental insurance policy for employees can be given to clubs, corporates, associations, institutions, and firms. All you need to do is go online, download the claims form from the official website of bajaj health insurance, fill the form correctly and then finally submit this claim form with the required documents at any branch of bajaj allianz health insurance company. Now you can protect your entire family with personal accident insurance against accidental injuries.the policy provides the benefits to you and your family,for accidental death,permanent disability,broken bones,burns due to an accident.it also provides benefit of.

Source: wishpolicy.com

Source: wishpolicy.com

All you need to do is go online, download the claims form from the official website of bajaj health insurance, fill the form correctly and then finally submit this claim form with the required documents at any branch of bajaj allianz health insurance company. The core feature of personal accident insurance is to provide coverage in case of an accident in which the policyholder suffers serious bodily injuries or dismemberment, which can lead to disability or even death. A personal accident insurance policy covers the loss of life, limb or general disablement caused due to an accident while travelling. Peace of mind and family security in the event of an accident that causes death or renders you disabled, it would have a significant impact on your earning potential. Pamultiple personal accident insurance plan the plan provides you with tailored coverage for children, adults and the elderly to meet the accidental risk exposures.

Source: moneysense.ph

Source: moneysense.ph

Personal accident cover offers financial compensation for a range of injuries to help you and others recover. Another interesting feature of a personal accident insurance is that it also provides cover in case of temporary total disablement. Key features of group accidental insurance policy an accidental insurance policy for employees can be given to clubs, corporates, associations, institutions, and firms. Pamultiple personal accident insurance plan the plan provides you with tailored coverage for children, adults and the elderly to meet the accidental risk exposures. If you are the victim of a road accident, a personal accident cover gives you the following advantages:

Source: slideshare.net

Source: slideshare.net

Personal accident insurance policies come with a disability coverage that effectively supports and protects you financially against any accidental mishap. Common injuries the severity of injuries depends on lots of things, for example speed, seatbelt use, what the car made contact with,. Covers your medical expenses when your basic insurance plan falls short. Personal accident insurance is a very nice insurance policy as it covers the person in and out. Features of personal accident insurance policy made to protect your family, just like you do.

Source: igreenrisk.com

Source: igreenrisk.com

All you need to do is go online, download the claims form from the official website of bajaj health insurance, fill the form correctly and then finally submit this claim form with the required documents at any branch of bajaj allianz health insurance company. All you need to do is go online, download the claims form from the official website of bajaj health insurance, fill the form correctly and then finally submit this claim form with the required documents at any branch of bajaj allianz health insurance company. Nice interface and easy process. Personal accident insurance policy provides complete financial protection to the insured members against uncertainties such as accidental death, accidental bodily injuries, and partial/total disabilities, permanent as well as temporary disabilities resulting from an accident. If you are the victim of a road accident, a personal accident cover gives you the following advantages:

Source: slideshare.net

Source: slideshare.net

Features of personal accident insurance policy made to protect your family, just like you do. 24x7 global coverage no matter where in the world you are, you can be covered for up to rs. Coverage goes up to ₹25 lakh. Features of personal accident insurance policy made to protect your family, just like you do. 2 lakh that covers accidental death and total permanent disability.

Source: securenow.in

Source: securenow.in

The process to register a claim for your bajaj allianz personal accident policy is very easy. If you are the victim of a road accident, a personal accident cover gives you the following advantages: Now you can protect your entire family with personal accident insurance against accidental injuries.the policy provides the benefits to you and your family,for accidental death,permanent disability,broken bones,burns due to an accident.it also provides benefit of. Personal accident insurance offers financial compensation in the event of bodily injuries leading to total/partial disability or death caused due to accidents. Personal accident insurance has many benefits, which are:

Source: shriramgi.com

Source: shriramgi.com

Personal accident insurance has many benefits, which are: Some plans also provide an educational fund for dependent children of the insured in case of his/her permanent disablement or death. All you need to do is go online, download the claims form from the official website of bajaj health insurance, fill the form correctly and then finally submit this claim form with the required documents at any branch of bajaj allianz health insurance company. If you are the victim of a road accident, a personal accident cover gives you the following advantages: Covers your medical expenses when your basic insurance plan falls short.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title features of personal accident insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.