Your Features of group insurance policy images are ready in this website. Features of group insurance policy are a topic that is being searched for and liked by netizens now. You can Get the Features of group insurance policy files here. Get all free images.

If you’re searching for features of group insurance policy images information connected with to the features of group insurance policy topic, you have pay a visit to the right blog. Our website always provides you with suggestions for seeking the highest quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

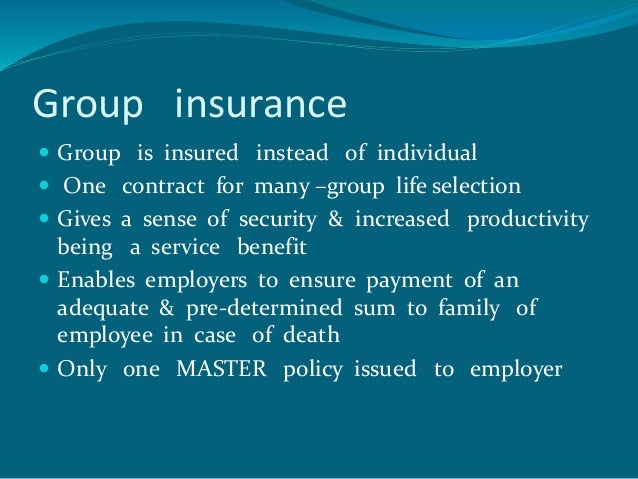

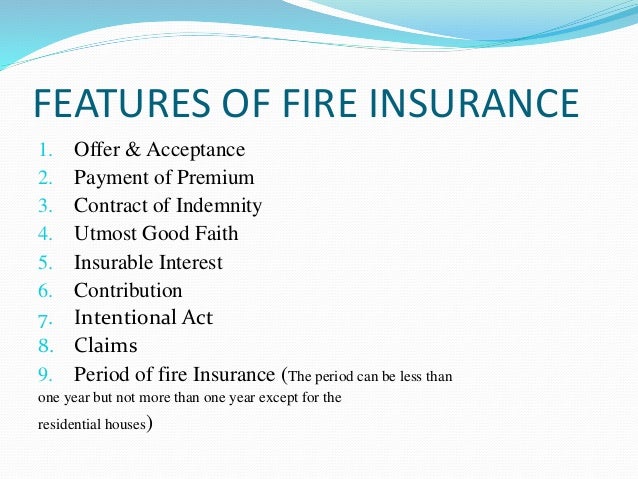

Features Of Group Insurance Policy. In the states of florida and new york, the ncmic malpractice insurance plan is issued by ncmic risk retention group, inc. Since insurance policies are standard forms, they feature boilerplate language which is similar across a wide variety of different types of insurance policies. Under a group insurance policy, an employer will purchase a master contract from an insurance company. A single premium is charged for a group travel insurance policy.

Group Insurance Schemes Group Term Life Insurance Policy From canarahsbclife.com

Group Insurance Schemes Group Term Life Insurance Policy From canarahsbclife.com

There are primarily seven different types of insurance policies when it comes to life insurance. Except for corporate policies, most group travel insurance policies have the following features: Group coverage can help reduce the problem of adverse selection by creating a pool of people eligible to purchase insurance who belong to the group for reasons other than. An entity has a group creditor policy with a bank that allows the entity to market and sell insurance coverage to individuals that are customers of the bank. Features of group life insurance policy. Given below are the key features of a group term insurance plan.

Group personal accident insurance, as the name suggests, is a group insurance policy that covers accident mainly for the employees under corporate group insurance.it is available for both, the employees and board or owner of a company.

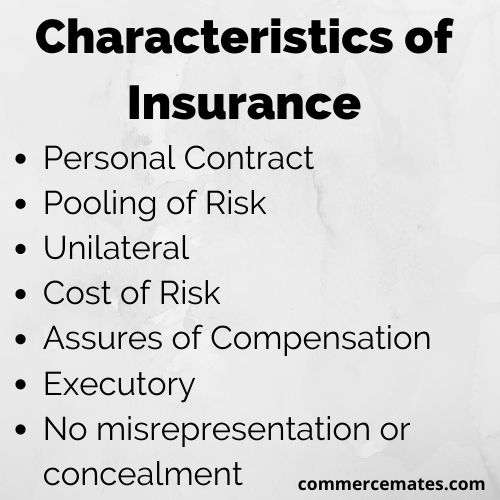

Individual insurance individual insurance is a contract between the individual and the insurance company, called the insurer. Most insurance companies in india have introduced group insurance policies to. Such a plan is more affordable due to a greater number of staff below the same insurance policy, which leads to a reduction in administrative expenditures. Features of group life insurance policy. Group coverage can help reduce the problem of adverse selection by creating a pool of people eligible to purchase insurance who belong to the group for reasons other than. Below are some of the most attractive features of a group insurance scheme:

Source: insurancesamadhan.com

Source: insurancesamadhan.com

Under a group insurance policy, an employer will purchase a master contract from an insurance company. Features of group life insurance policy. In the states of florida and new york, the ncmic malpractice insurance plan is issued by ncmic risk retention group, inc. Features of cigna ttk prohealth group insurance policy. This insurance provides comprehensive financial protection against hefty expenses incurred due to the disablement of.

Source: canarahsbclife.com

Source: canarahsbclife.com

Group insurance policies page 6 of 9 group creditor policy 14. The premium will be based on the number of members and the amount of coverage offered. All group insurance plans consist of certain features that make it different from an individual insurance policy. The facts and circumstances of. It is intended to provide monetary guarantee to the beneficiary of the covered under the group term life insurance.

Source: howtostartanllc.com

Source: howtostartanllc.com

The cost can be paid in full or in part by the members, group leader, or both. Group insurance is an insurance that covers a group of people, for example the members of a society or professional association, or the employees of a particular employer for the purpose of taking insurance. Group term life insurance schemes offer financial independence to the concerned employee’s family in the event of death. Features of group life insurance policy. Under a group insurance policy, an employer will purchase a master contract from an insurance company.

Source: slideshare.net

Source: slideshare.net

Group term life insurance schemes offer financial independence to the concerned employee’s family in the event of death. There are primarily seven different types of insurance policies when it comes to life insurance. The terms and conditions of ncmic�s malpractice insurance plan are fully explained in the policy. Individual insurance individual insurance is a contract between the individual and the insurance company, called the insurer. The key features of the hdfc ergo group health insurance policy are:

Source: banktheories.com

Source: banktheories.com

Group health insurance in india is simply an insurance package an organisation buys for the benefit of its employees. Will be covered under the policy Group insurance is an insurance that covers a group of people, for example the members of a society or professional association, or the employees of a particular employer for the purpose of taking insurance. Group term life insurance schemes offer financial independence to the concerned employee’s family in the event of death. Group health insurance in india is simply an insurance package an organisation buys for the benefit of its employees.

Source: canarahsbclife.com

Source: canarahsbclife.com

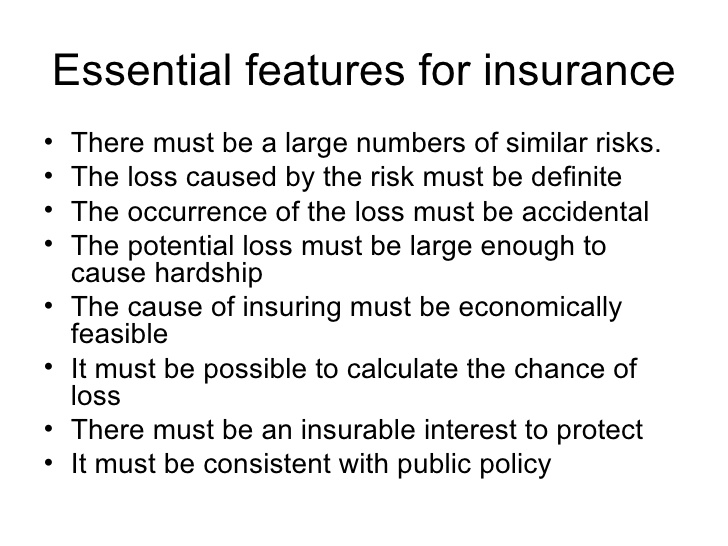

And, of course, whole life policy premiums are typically higher than term premiums. A group health insurance policy is valid for the employees as long as they work for the organization that purchased the policy. Types of life insurance policies. The most important feature of every insurance plan is the cooperation of a large number of persons who, in effect, agree to share the financial loss arising due to a particular risk that is insured. Features of group travel insurance policy.

Source: sundaysphotopaper.blogspot.com

Source: sundaysphotopaper.blogspot.com

Features of group life insurance policy. The most common group life insurance plans use annual renewable term insurance (art) as it provides the lowest cost life insurance coverage. General features of various group insurance schemes. Will be covered under the policy The group term life insurance policy covers death.

Source: eljardindelosclasicos.blogspot.com

Source: eljardindelosclasicos.blogspot.com

Group insurance policies page 6 of 9 group creditor policy 14. The most important feature of every insurance plan is the cooperation of a large number of persons who, in effect, agree to share the financial loss arising due to a particular risk that is insured. Since insurance policies are standard forms, they feature boilerplate language which is similar across a wide variety of different types of insurance policies. Let us explain how it works. An entity has a group creditor policy with a bank that allows the entity to market and sell insurance coverage to individuals that are customers of the bank.

Source: insurancematerial.com

Source: insurancematerial.com

To pay the premium, all group members must contribute in one. However, most conversion options limit the conversion to whole life policies rather than term policies; The most common group life insurance plans use annual renewable term insurance (art) as it provides the lowest cost life insurance coverage. And will include room charges, boarding charges, medicine and drugs costs including costs for specialists like anaesthetist, surgeons, specialist fees, and, consultation, etc. Z understand the meaning of group insurance z recall the types of group insurance policies z list out the special features of each policy 6.2 group insurance vs.

Source: eljardindelosclasicos.blogspot.com

Source: eljardindelosclasicos.blogspot.com

Z understand the meaning of group insurance z recall the types of group insurance policies z list out the special features of each policy 6.2 group insurance vs. The average group health insurance policy costs a little more than $7,400 for an individual annually, with employers paying approximately 80% and employees paying the difference. The primary advantage gained by an employee under group insurance is the affordable feature of the policy, as compared to an individual insurance scheme. This insurance provides comprehensive financial protection against hefty expenses incurred due to the disablement of. However, the members included under this scheme can also choose to make.

Source: canarahsbclife.com

Source: canarahsbclife.com

All group insurance plans consist of certain features that make it different from an individual insurance policy. Features of group life insurance policy. The key features of the hdfc ergo group health insurance policy are: A group health insurance policy is valid for the employees as long as they work for the organization that purchased the policy. The policy covers hospitalization caused by sickness or accidents.

Source: eljardindelosclasicos.blogspot.com

Source: eljardindelosclasicos.blogspot.com

The average group health insurance policy costs a little more than $7,400 for an individual annually, with employers paying approximately 80% and employees paying the difference. Given below are the key features of a group term insurance plan. Individual insurance individual insurance is a contract between the individual and the insurance company, called the insurer. [1] the insurance policy is generally an integrated contract, meaning that it includes all forms associated with the agreement between the insured and insurer. The most common group life insurance plans use annual renewable term insurance (art) as it provides the lowest cost life insurance coverage.

Source: eljardindelosclasicos.blogspot.com

Source: eljardindelosclasicos.blogspot.com

If an employee leaves the organization, the coverage ends. In the states of florida and new york, the ncmic malpractice insurance plan is issued by ncmic risk retention group, inc. Group insurance policies page 6 of 9 group creditor policy 14. Below are some of the most attractive features of a group insurance scheme: Group insurance may offer life cover, health cover, and/or other types of personal insurance.

Source: sundaysphotopaper.blogspot.com

Source: sundaysphotopaper.blogspot.com

Features of group life insurance policy. The most common group life insurance plans use annual renewable term insurance (art) as it provides the lowest cost life insurance coverage. Types of life insurance policies. This insurance provides comprehensive financial protection against hefty expenses incurred due to the disablement of. Z understand the meaning of group insurance z recall the types of group insurance policies z list out the special features of each policy 6.2 group insurance vs.

Source: eljardindelosclasicos.blogspot.com

Source: eljardindelosclasicos.blogspot.com

Features of cigna ttk prohealth group insurance policy. The cost can be paid in full or in part by the members, group leader, or both. Group health insurance in india is simply an insurance package an organisation buys for the benefit of its employees. Let us explain how it works. Below are some of the most attractive features of a group insurance scheme:

Source: eljardindelosclasicos.blogspot.com

Source: eljardindelosclasicos.blogspot.com

The average group health insurance policy costs a little more than $7,400 for an individual annually, with employers paying approximately 80% and employees paying the difference. Group insurance is an insurance that covers a group of people, for example the members of a society or professional association, or the employees of a particular employer for the purpose of taking insurance. Group insurance policies page 6 of 9 group creditor policy 14. Will be covered under the policy Most insurance companies in india have introduced group insurance policies to.

Source: eljardindelosclasicos.blogspot.com

Source: eljardindelosclasicos.blogspot.com

The terms and conditions of ncmic�s malpractice insurance plan are fully explained in the policy. There are primarily seven different types of insurance policies when it comes to life insurance. It is intended to provide monetary guarantee to the beneficiary of the covered under the group term life insurance. In the states of florida and new york, the ncmic malpractice insurance plan is issued by ncmic risk retention group, inc. Such a group of persons may be brought together voluntarily or through publicity or solicitation of the agents.

Source: commercemates.com

Source: commercemates.com

Group insurance covers a defined group of people, for example members of a professional association, or a society or employees of an organization. Group term life insurance schemes offer financial independence to the concerned employee’s family in the event of death. Group term life insurance policy refers to the insurance coverage that is provided to a group of people. In the states of florida and new york, the ncmic malpractice insurance plan is issued by ncmic risk retention group, inc. And, of course, whole life policy premiums are typically higher than term premiums.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title features of group insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.