Your Features of general insurance images are ready in this website. Features of general insurance are a topic that is being searched for and liked by netizens now. You can Download the Features of general insurance files here. Get all royalty-free photos.

If you’re searching for features of general insurance images information connected with to the features of general insurance keyword, you have visit the ideal site. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Features Of General Insurance. It insures everything apart from life. The tangible assets are susceptible to damages and a need to protect the economic value of the assets is needed. Life insurance is a unique financial product that can achieve various financial objectives. Additionally, some health insurance policies provided by the insurance companies in india also cover certain critical illnesses with the help of fixed benefit plans that.

General insurance From slideshare.net

General insurance From slideshare.net

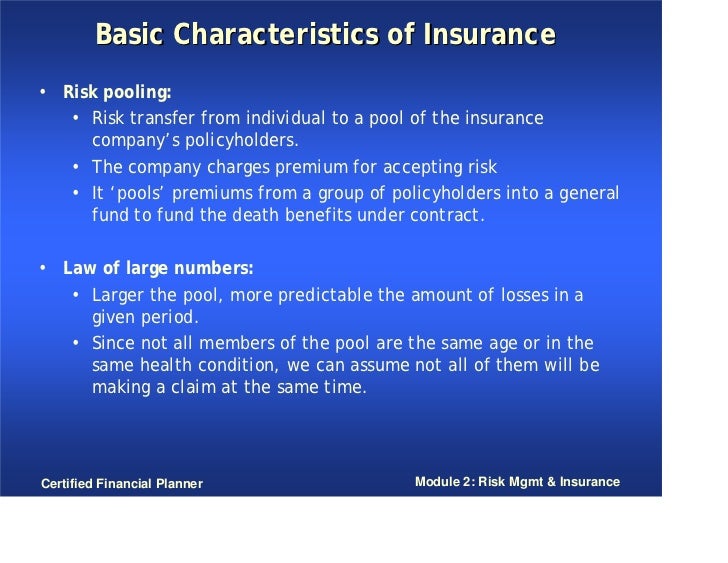

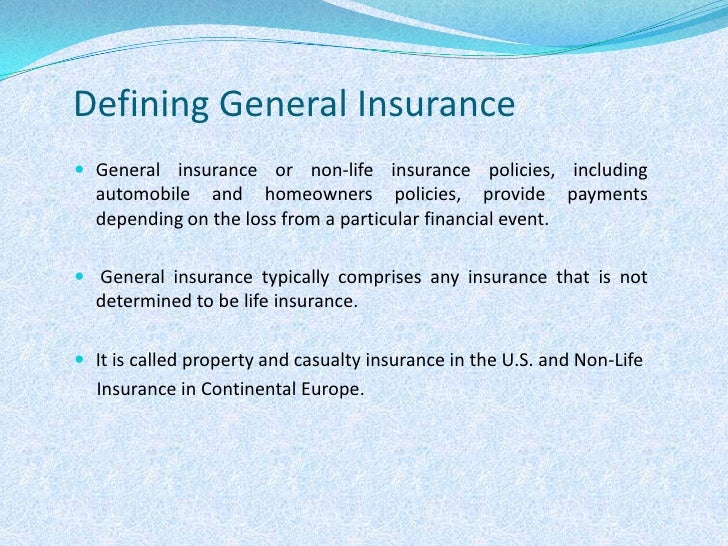

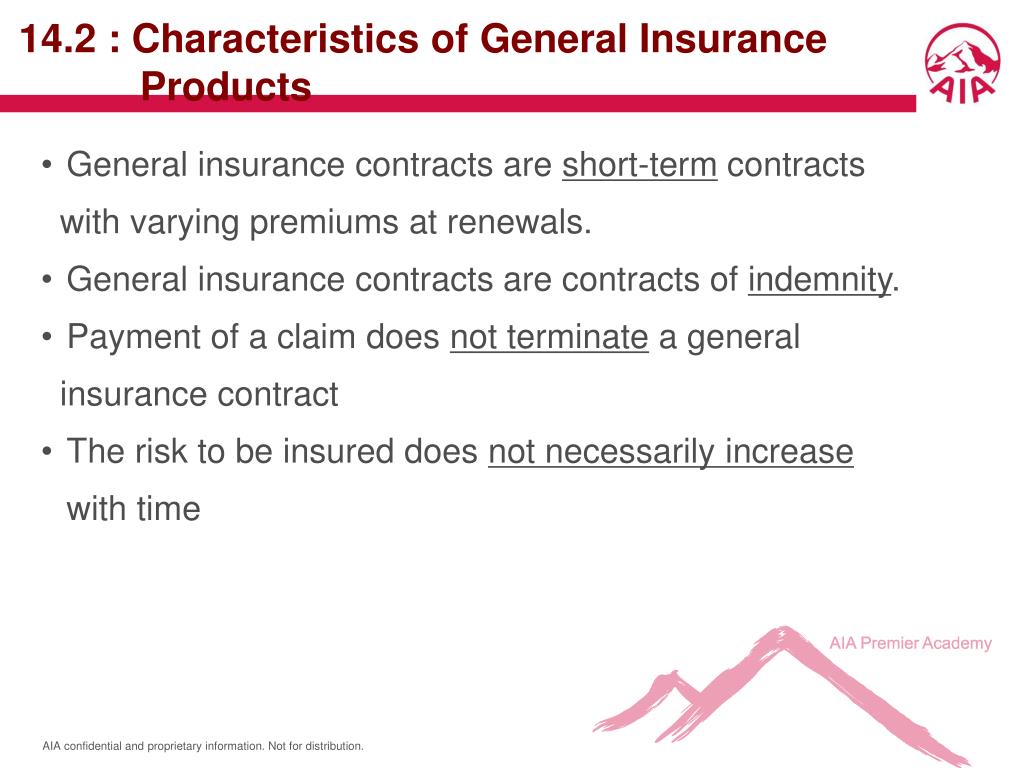

Insurance is a contractual agreement between two parties in which one party promise to protect another party from uncertainties and losses. It is called property and casualty insurance in the u.s. Whereas general insurance can be termed as indemnity’s contract. Therefore, a general insurance company is to prepare separate revenue account for each individual unit. Top 10 features of life insurance policy. Essentially, a general health insurance policy pays for all the hospitalization expenses if they fall within the sum assured by the insurance policy provided by the insurer or insurance company.

General insurance policies are issued for a short period, say, for a year.

It can be a health insurance, a car insurance, two wheeler insurance or a travel insurance. Insurance is a contractual agreement between two parties in which one party promise to protect another party from uncertainties and losses. Banks and financial organisations work by taking and then lending money. Life insurance is acknowledged as an investment, and it is not a contract of indemnity. Insurance is a device to share the financial losses which might befall an individual or his family on the happening of a specified event. General insurance includes the insurance related to health, home, marine, auto, travel, agriculture etc.

Source: slideshare.net

Source: slideshare.net

The policyholder receives the benefits of the insurance coverage. For this purpose, general insurance products are bought as they provide protection against unforeseeable contingencies. Additionally, some health insurance policies provided by the insurance companies in india also cover certain critical illnesses with the help of fixed benefit plans that. Insurance is a device to share the financial losses which might befall an individual or his family on the happening of a specified event. Let have a look on all the types of.

Source: slideserve.com

Source: slideserve.com

General insurance products come in various types covering a wide range of risks such as health insurance, motor insurance, marine insurance, liability insurance, travel insurance and commercial insurance etc. The valuable things of people are protected by general insurance. Life insurance is also known as the private insurance. What is a general insurance. The insurance company promises to pay the assured sum to cover the loss related to the vehicle, medical treatments, fire, theft, or even financial problems during travel.

Source: testesuperdesportivos.blogspot.com

Source: testesuperdesportivos.blogspot.com

General insurance products come in various types covering a wide range of risks such as health insurance, motor insurance, marine insurance, liability insurance, travel insurance and commercial insurance etc. Therefore, a general insurance company is to prepare separate revenue account for each individual unit. Life insurance is acknowledged as an investment, and it is not a contract of indemnity. Hence, the insurance company cannot guarantee against death or prevent death but can agree to pay a stipulated sum in the event of death happening at an earlier date than agreed upon. This category of insurance covers all types of insurance other than life insurance.

Source: slideserve.com

Source: slideserve.com

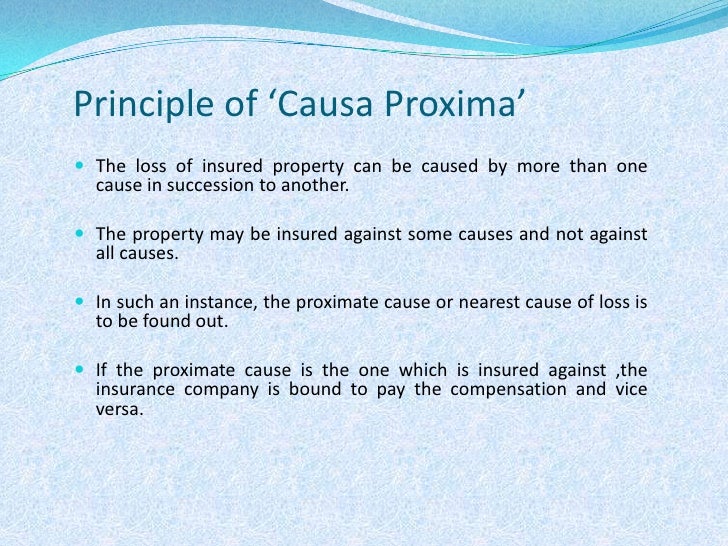

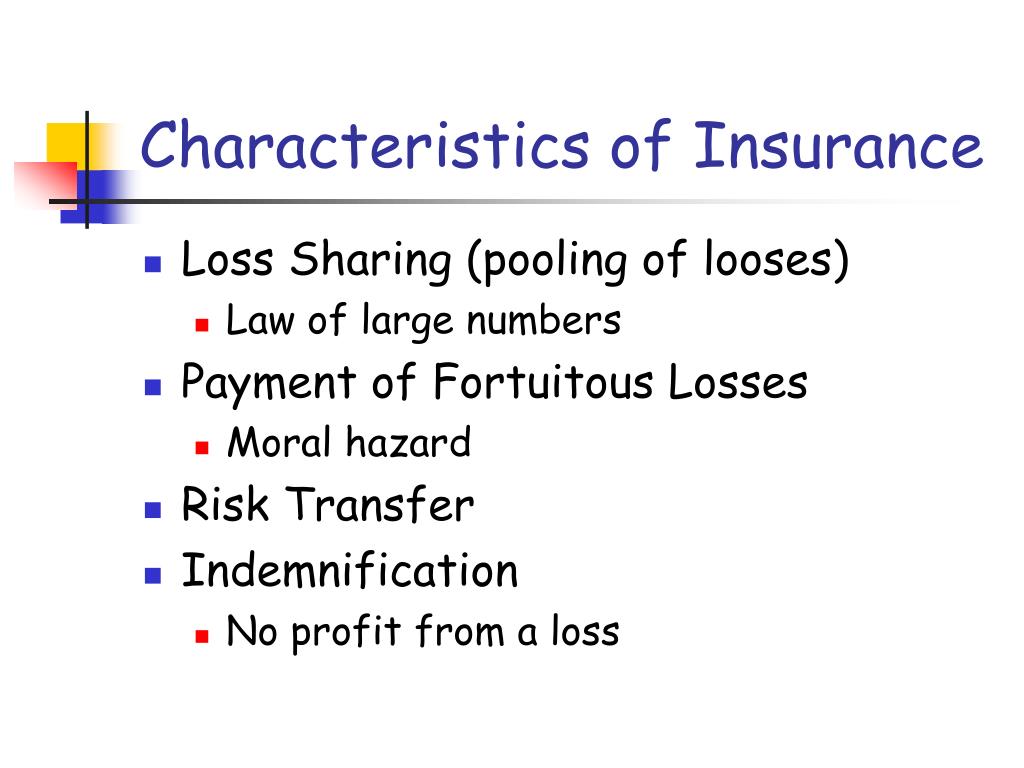

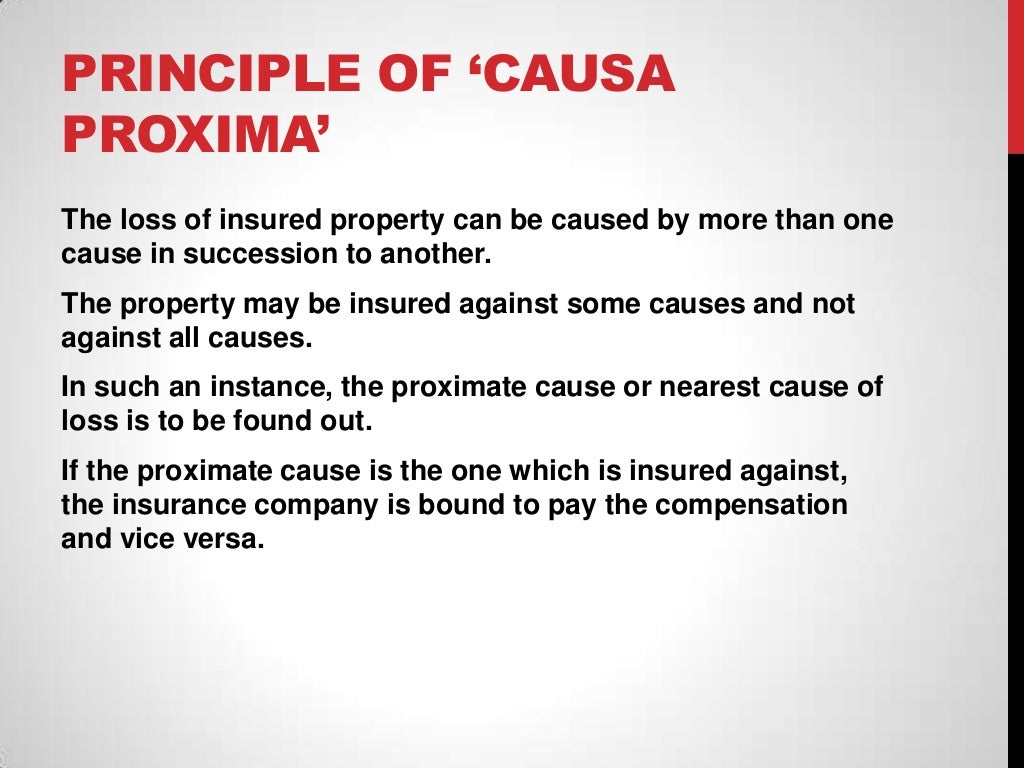

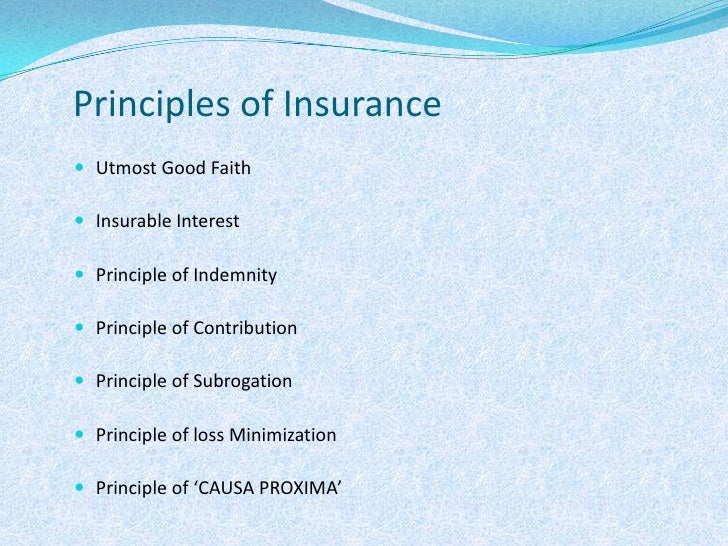

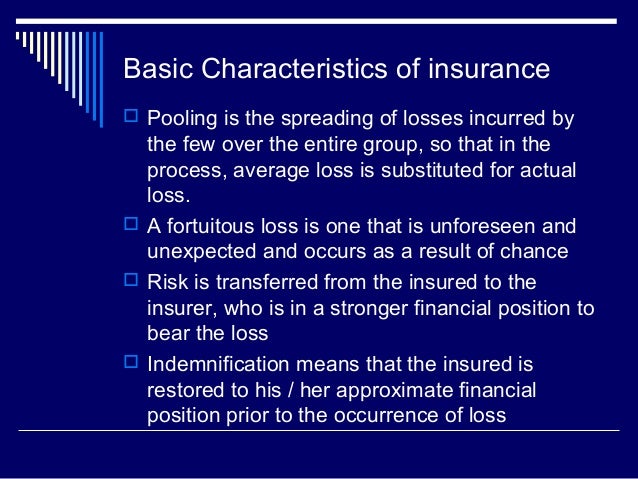

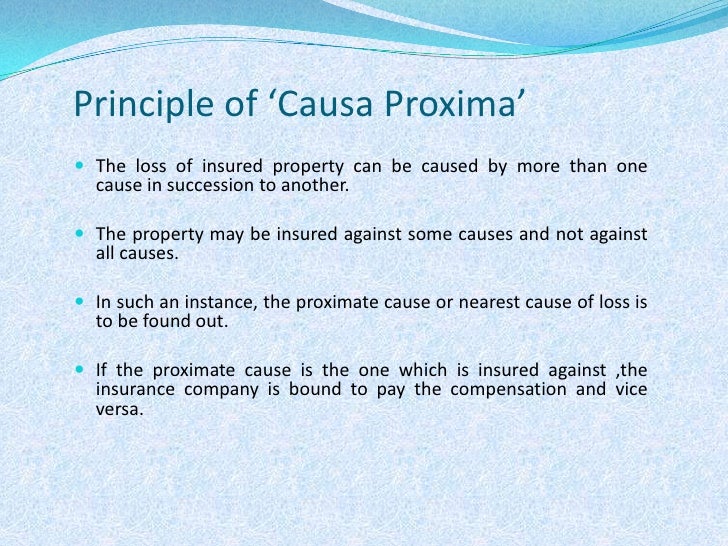

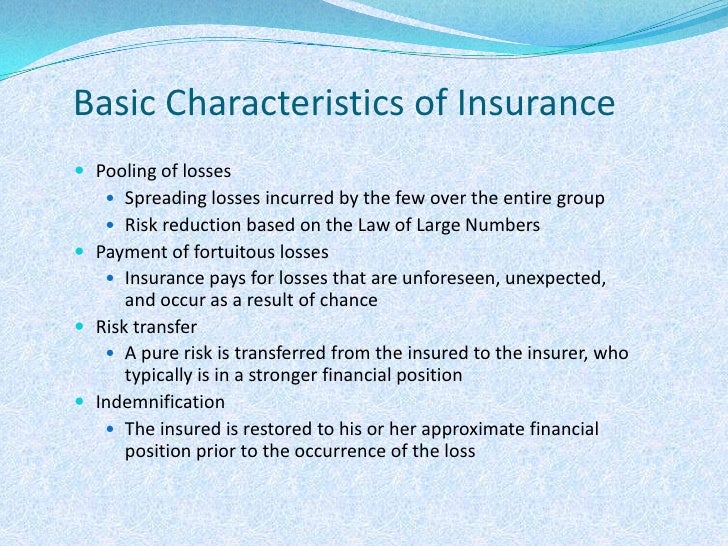

And private or life insurance as the name indicate is the insurance of life. As such, general insurance plans provide you financial security even in the case of contingencies; It is important to protect one’s property, which It is called property and casualty insurance in the u.s. The insurance has the following characteristics which are, generally, observed in case of life, marine, fire and general insurances.

Source: slideshare.net

Source: slideshare.net

General insurance covers the loss or damages caused to all the assets and liabilities. Life insurance is also known as the private insurance. Here are 10 features of life insurance policy discussed below: In some cases, general insurance plans are mandatory by law. General insurance products come in various types covering a wide range of risks such as health insurance, motor insurance, marine insurance, liability insurance, travel insurance and commercial insurance etc.

Source: slideshare.net

Source: slideshare.net

Top 10 features of life insurance policy. In some cases, general insurance plans are mandatory by law. It is called property and casualty insurance in the u.s. Yet they often know very little about the features of their. General insurance products come in various types covering a wide range of risks such as health insurance, motor insurance, marine insurance, liability insurance, travel insurance and commercial insurance etc.

Source: slideshare.net

Source: slideshare.net

The policyholder receives the benefits of the insurance coverage. The insurance company promises to pay the assured sum to cover the loss related to the vehicle, medical treatments, fire, theft, or even financial problems during travel. Therefore, a general insurance company is to prepare separate revenue account for each individual unit. Hence, the insurance company cannot guarantee against death or prevent death but can agree to pay a stipulated sum in the event of death happening at an earlier date than agreed upon. It can be a health insurance, a car insurance, two wheeler insurance or a travel insurance.

Source: cacc-cins.blogspot.com

Source: cacc-cins.blogspot.com

In some cases, general insurance plans are mandatory by law. As such, general insurance plans provide you financial security even in the case of contingencies; General insurance covers the loss or damages caused to all the assets and liabilities. General insurance typically comprises any insurance that is not determined to be life insurance. Life insurance is a unique financial product that can achieve various financial objectives.

Source: slideshare.net

Source: slideshare.net

It is an insurance product that does not cover life. Insurance is a device to share the financial losses which might befall an individual or his family on the happening of a specified event. For this purpose, general insurance products are bought as they provide protection against unforeseeable contingencies. Suitable general insurance covers are necessary for every family. What is a general insurance.

Source: slideshare.net

Source: slideshare.net

The tangible assets are susceptible to damages and a need to protect the economic value of the assets is needed. From the above explanation, we can find the following characteristics, which are generally observed in life, marine, fire, and general insurances. When a person takes life insurance, he nominates his dependents to receive the policy amount in the event of his death, prior to the stipulated or agreed period. Whereas general insurance can be termed as indemnity’s contract. General insurance products come in various types covering a wide range of risks such as health insurance, motor insurance, marine insurance, liability insurance, travel insurance and commercial insurance etc.

Source: insurance-companies.co

Source: insurance-companies.co

General insurance is the insurance other than the life insurance. Insurance is a contractual agreement between two parties in which one party promise to protect another party from uncertainties and losses. The insurer will protect the insured from the financial liability in case of loss. It offers financial compensation on any loss other than death. General insurance typically comprises any insurance that is not determined to be life insurance.

Source: slideserve.com

Source: slideserve.com

What is a general insurance. It can be utilized as a financial cover for your beloved family and dependents, provide a second source of income during retirement, and build a corpus for the child�s future higher education and marriage. Insurance is a device to share the financial losses which might befall an individual or his family on the happening of a specified event. Life insurance is a unique financial product that can achieve various financial objectives. It offers financial compensation on any loss other than death.

Source: slideshare.net

Source: slideshare.net

It is called property and casualty insurance in the u.s. Top 10 features of life insurance policy. It offers financial compensation on any loss other than death. From the above explanation, we can find the following characteristics, which are generally observed in life, marine, fire, and general insurances. General insurance includes the insurance related to health, home, marine, auto, travel, agriculture etc.

Source: slideshare.net

Source: slideshare.net

Therefore, a general insurance company is to prepare separate revenue account for each individual unit. The tangible assets are susceptible to damages and a need to protect the economic value of the assets is needed. A general insurance policy falls in the latter category. The valuable things of people are protected by general insurance. A general insurance is a contract that offers financial compensation on any loss other than death.

Source: slideshare.net

Source: slideshare.net

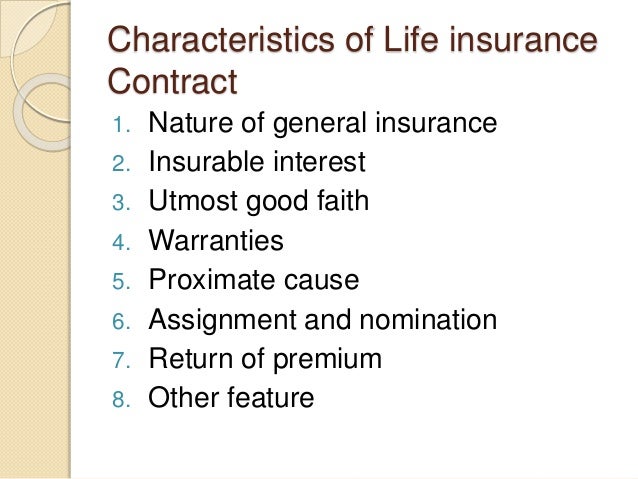

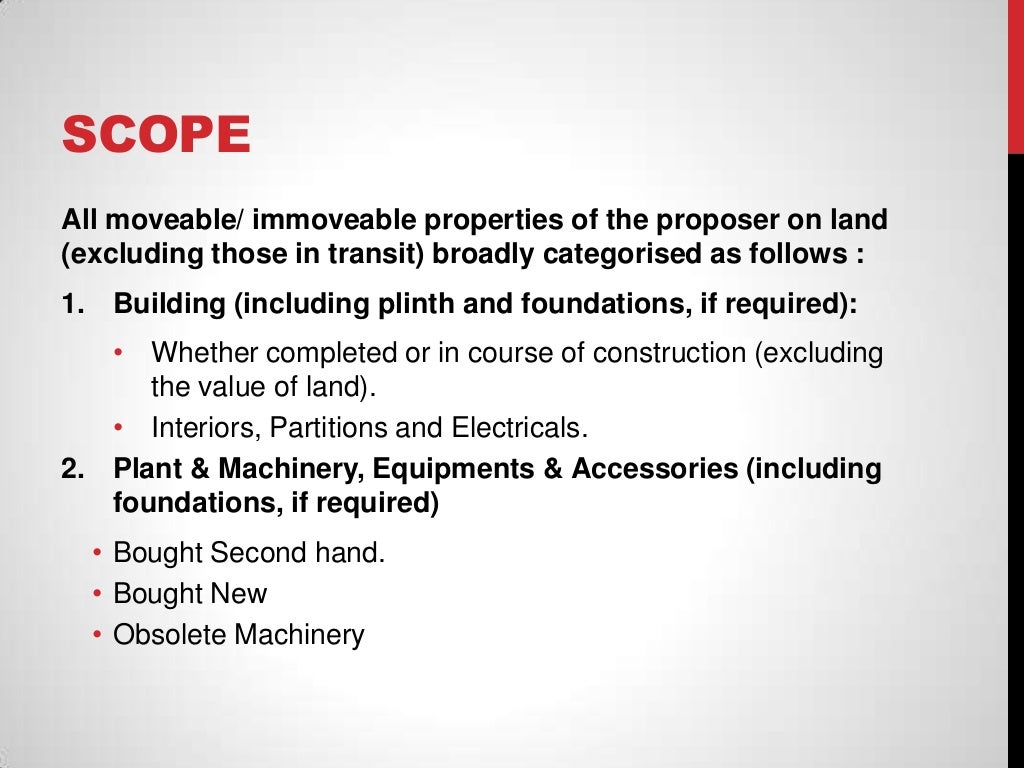

General insurance comprises of insurance of property against fire, burglary etc, personal insurance such as accident and health insurance, and liability insurance which covers legal liabilities. When a person takes life insurance, he nominates his dependents to receive the policy amount in the event of his death, prior to the stipulated or agreed period. Life insurance is also known as the private insurance. Yet they often know very little about the features of their. General insurance policies are issued for a short period, say, for a year.

Source: slideshare.net

Source: slideshare.net

Here are 10 features of life insurance policy discussed below: Nature of the policy : There are primarily seven different types of insurance policies when it comes to life insurance. Here are 10 features of life insurance policy discussed below: A general insurance policy falls in the latter category.

Source: slideshare.net

Source: slideshare.net

It offers financial compensation on any loss other than death. Let have a look on all the types of. General insurance products come in various types covering a wide range of risks such as health insurance, motor insurance, marine insurance, liability insurance, travel insurance and commercial insurance etc. Insurance is a device to share the financial losses which might befall on an individual or his family on the happening of a specified event. Life insurance is also known as the private insurance.

Source: slideshare.net

Source: slideshare.net

Hence, the insurance company cannot guarantee against death or prevent death but can agree to pay a stipulated sum in the event of death happening at an earlier date than agreed upon. Additionally, some health insurance policies provided by the insurance companies in india also cover certain critical illnesses with the help of fixed benefit plans that. Hence, the insurance company cannot guarantee against death or prevent death but can agree to pay a stipulated sum in the event of death happening at an earlier date than agreed upon. It offers financial compensation on any loss other than death. Life insurance is also known as the private insurance.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title features of general insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.