Your Fdic insured deposit sweep program vs money market reddit images are available. Fdic insured deposit sweep program vs money market reddit are a topic that is being searched for and liked by netizens now. You can Find and Download the Fdic insured deposit sweep program vs money market reddit files here. Find and Download all free images.

If you’re looking for fdic insured deposit sweep program vs money market reddit pictures information connected with to the fdic insured deposit sweep program vs money market reddit topic, you have visit the ideal site. Our site frequently gives you suggestions for viewing the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

Fdic Insured Deposit Sweep Program Vs Money Market Reddit. Fdic protects in the case of a bank run, which is a situation where everyone is pulling their money out of the bank, but because the bank holds investments with your money, they basically become an insolvent business and your money poofs out of existence. While the fdic insurance coverage limit at each bank is $250,000, $5,000 is reserved for accrued interest. Deposits and proceeds from trades will be held in the core position and are generally available immediately for trading. What is a “bank deposit sweep” program?

Are Money Market Accounts Fdic Insured news word From lovewordssss.blogspot.com

Are Money Market Accounts Fdic Insured news word From lovewordssss.blogspot.com

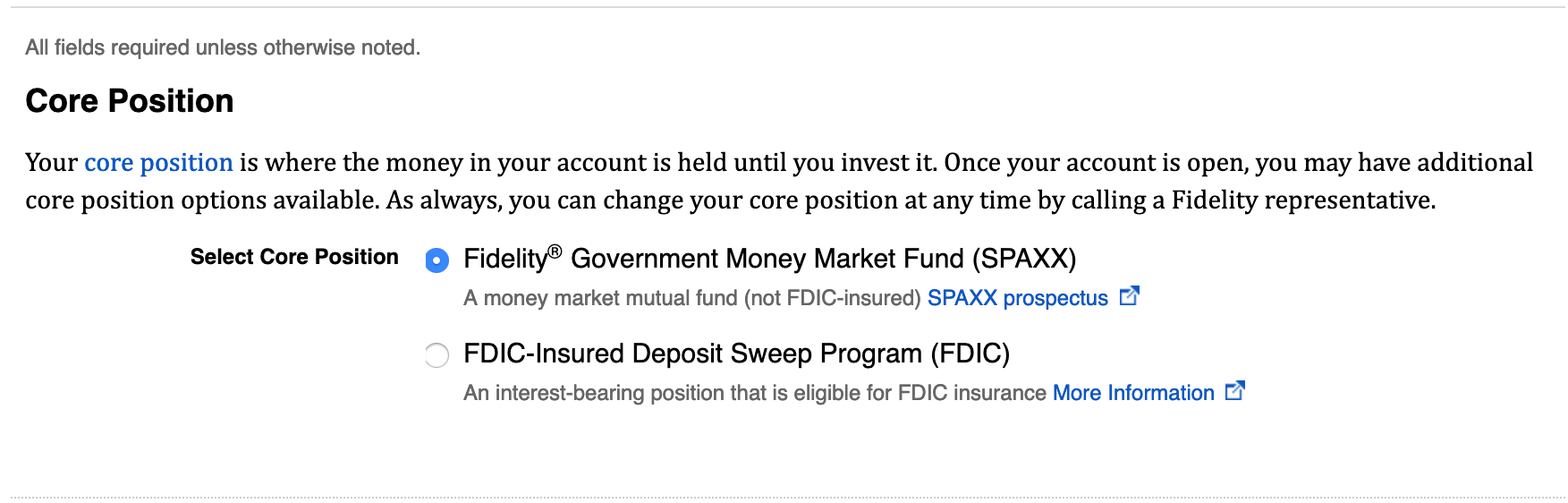

The first option appears to basically just be similar to a bank account (and it is fdic insured like bank accounts). That’s a government organization that basically guarantees your money will be paid back to you if the bank holding it goes out of business. The program bank list can change over time. The first $245,000 swept into. It may be of interst to you. Your money is possibly a.

Fdic insured deposit programs are not covered by the sipc.

That’s a government organization that basically guarantees your money will be paid back to you if the bank holding it goes out of business. Fdic protects in the case of a bank run, which is a situation where everyone is pulling their money out of the bank, but because the bank holds investments with your money, they basically become an insolvent business and your money poofs out of existence. Fdic insured deposit sweep program vs money market domain_10 written by harkless dampt1969 monday, november 8, 2021 add comment edit 10 auto insurance hacks to save you money Fdic insured deposit sweep program vs money market domain_10 written by washington thandrell sunday, 7 november 2021 add comment edit a high return is what every investor is after, but it�s not the only factor that matters. The following thread was posted by another contributor on the fidelity family forum. An investment in any money market fund is not insured or guaranteed by the fdic or any government agency.

Source: smallbusiness.yahoo.com

Source: smallbusiness.yahoo.com

For instance, my brokerage offers fdic coverage up to $500,000 for individuals and $1,000,000. Deposits and proceeds from trades will be held in the core position and are generally available immediately for trading. The first $245,000 swept into. This can occur if a sudden loss in trust of banks occurs, often due to political change. Fdic protects in the case of a bank run, which is a situation where everyone is pulling their money out of the bank, but because the bank holds investments with your money, they basically become an insolvent business and your money poofs out of existence.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

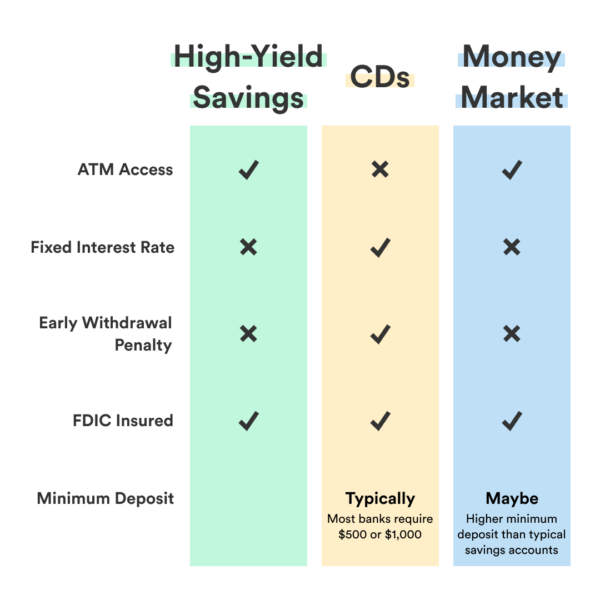

While the fdic insurance coverage limit at each bank is $250,000, $5,000 is reserved for accrued interest. Most investment companies then use multiple banks for this so you�re actually covered for over $1mm. So your cash is “insured”, but in exchange you likely get a lower interest rate. This core account is not fdic insured, but generally provides a higher yield in comparison to the sweep program discussed earlier. Fdic is a government insurance program that makes sure you get paid back if the bank goes out of business.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

Does this mean these funds must be reported as a deposit on the call report or thrift financial report? Fdic insured deposit programs are not covered by the sipc. The federal deposit insurance corporation (fdic) is an independent government agency created by congress in 1933 to maintain stability and confidence in the nation’s banking system. Most investment companies then use multiple banks for this so you�re actually covered for over $1mm. As of today, the fdic account is also paying… you guessed:

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

Cash sweep product yields fluctuate. This can occur if a sudden loss in trust of banks occurs, often due to political change. Fdic insured deposit sweep program vs money market domain_10 written by washington thandrell sunday, 7 november 2021 add comment edit a high return is what every investor is after, but it�s not the only factor that matters. This core account is not fdic insured, but generally provides a higher yield in comparison to the sweep program discussed earlier. The insured deposit program has rates that are competitive with certain government and treasury money market sweep funds.

Source: smallbusiness.yahoo.com

Source: smallbusiness.yahoo.com

Cash sweep product yields fluctuate. Money from newly opened fidelity accounts will be placed into spaxx automatically. Uninvested money in your stash account (aka your available cash balance) is automatically transferred to the sweep program. Money market funds are subject to sipc coverage limits, but money market funds are not insured against market loss. Fdic insured deposit sweep program vs money market domain_10 written by harkless dampt1969 monday, november 8, 2021 add comment edit 10 auto insurance hacks to save you money

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

Sweep option in which you participate from one option to another, including changes between money market funds and bank deposit sweep programs. Money markets, except those that are fdic insured, aimed to keep value at $1 each. While the fdic insurance coverage limit at each bank is $250,000, $5,000 is reserved for accrued interest. Fdic is a government insurance program that makes sure you get paid back if the bank goes out of business. Most investment companies then use multiple banks for this so you�re actually covered for over $1mm.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

Fdic is a government insurance program that makes sure you get paid back if the bank goes out of business. Fdic insured deposit sweep program vs money market domain_10 written by harkless dampt1969 monday, november 8, 2021 add comment edit 10 auto insurance hacks to save you money While the fdic insurance coverage limit at each bank is $250,000, $5,000 is reserved for accrued interest. The program bank list can change over time. Your core position fidelity® government money market fund (spaxx) your cash is invested in a mutual fund and earns daily dividends, which are paid to you monthly.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

A hierarchical list of program banks (the “program bank list”) will be assigned to your account. The second option is a money market fund. Fdic insured deposit sweep program vs money market domain_10 written by harkless dampt1969 monday, november 8, 2021 add comment edit 10 auto insurance hacks to save you money The following thread was posted by another contributor on the fidelity family forum. Fdic protects in the case of a bank run, which is a situation where everyone is pulling their money out of the bank, but because the bank holds investments with your money, they basically become an insolvent business and your money poofs out of existence.

Source: smallbusiness.yahoo.com

Source: smallbusiness.yahoo.com

The agency insures deposits and retirement accounts in member institutions up to $250,000 per depositor. Fdic is a government insurance program that makes sure you get paid back if the bank goes out of business. The following thread was posted by another contributor on the fidelity family forum. For example, a customer with $500,000 cash balance would have: The fund has an expense ratio of 0.42% and an interest rate of 1.25%.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fdic insured deposit sweep program vs money market reddit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.