Your Fdic insured deposit sweep program fdic images are ready in this website. Fdic insured deposit sweep program fdic are a topic that is being searched for and liked by netizens today. You can Download the Fdic insured deposit sweep program fdic files here. Download all free images.

If you’re looking for fdic insured deposit sweep program fdic pictures information connected with to the fdic insured deposit sweep program fdic keyword, you have visit the ideal site. Our website frequently gives you suggestions for downloading the highest quality video and picture content, please kindly search and find more enlightening video articles and graphics that match your interests.

Fdic Insured Deposit Sweep Program Fdic. Money markets, except those that are fdic insured, aimed to keep value at $1 each. Approximately 40% of all u.s. That’s a government organization that basically guarantees your money will be paid back to you if the bank holding it goes out of business. 2 fdic, unsafe and unsound banking practices:

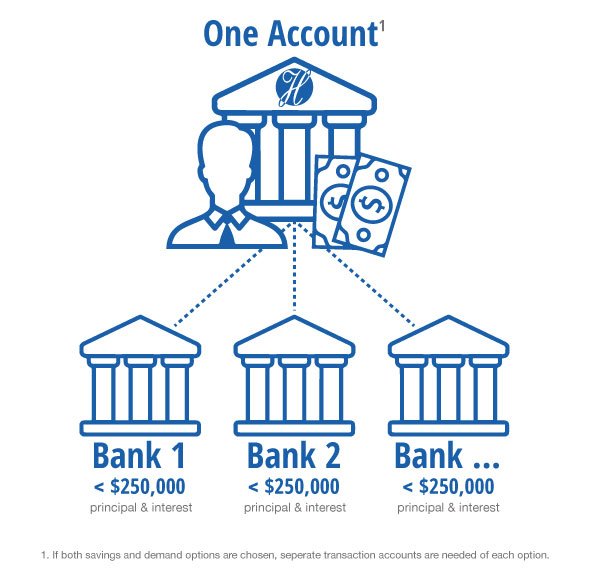

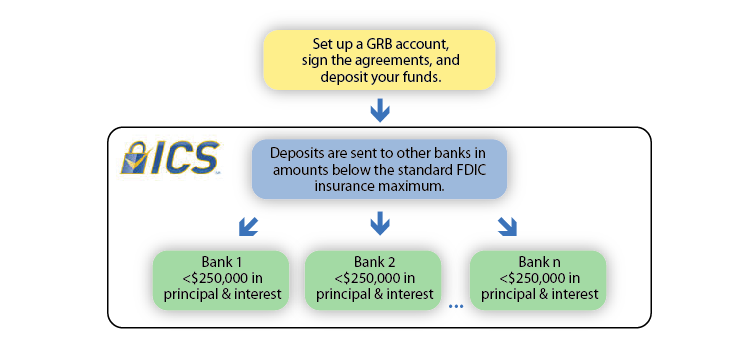

What is fdic sweep program? 2 fdic, unsafe and unsound banking practices: Most investment companies then use multiple banks for this so you�re actually covered for over $1mm. Insured sweep deposits are a subset of the larger category of brokered deposits. Since fdic insurance coverage is currently limited to $250,000 per qualified customer account per banking institution, fidelity may use several banks, rather than just one, to maximize your fdic coverage. How does the nm fdic insured deposit program fit into your plan?

Your money is possibly a.

Most investment companies then use multiple banks for this so you�re actually covered for over $1mm. Uninvested cash in your account is automatically deposited to the fdic sweep program. If something terrible happens, you still get your money back. Insured sweep deposits are a subset of the larger category of brokered deposits. Since fdic insurance coverage is currently limited to $250,000 per qualified customer account per banking institution, fidelity may use several banks, rather than just one, to maximize your fdic coverage. Your money is possibly a.

Source: insuredcashsweep.com

Source: insuredcashsweep.com

That’s a government organization that basically guarantees your money will be paid back to you if the bank holding it goes out of business. Uninvested cash in your account is automatically deposited to the fdic sweep program. What is fdic sweep program? As part of its automatic cash sweep program, lpl financial offers two bank deposit sweep programs which take available cash balances (from securities transactions, dividend and interest payments, cash deposits, and other activities) in clients’ eligible accounts and automatically deposits them (which we refer to as. The fund has an expense ratio of 0.42% and an interest rate of 1.25%.

Source: optracker436.weebly.com

Source: optracker436.weebly.com

Money from newly opened fidelity accounts will be placed into spaxx automatically. Insured sweep deposits are a subset of the larger category of brokered deposits. If something terrible happens, you still get your money back. Cash contributed to or received in your account is held in the core account (the “cash balance”). It�ll be insured by the federal deposit insurance corporation (fdic) for up to $4.0 million 1, 2 and unlike many other programs, pays a consistent return regardless of the.

Source: blog.umb.com

Source: blog.umb.com

It is offered through our clearing partner, apex clearing corporation. If your insured bank deposit balance nears the fdic limit at one of these banks, any additional cash is deposited at the next bank on a list of program banks to help ensure you don�t exceed current limits. Money markets, except those that are fdic insured, aimed to keep value at $1 each. (they actually insure up to $250,000 per account). Since fdic insurance coverage is currently limited to $250,000 per qualified customer account per banking institution, fidelity may use several banks, rather than just one, to maximize your fdic coverage.

Source: heritagebankna.com

Source: heritagebankna.com

If your insured bank deposit balance nears the fdic limit at one of these banks, any additional cash is deposited at the next bank on a list of program banks to help ensure you don�t exceed current limits. The nm fdic insured deposit program is the primary product in our cash sweep program and will earn a daily interest rate for your uninvested assets. Brokered deposits restrictions, 85 fed. Since fdic insurance coverage is currently limited to $250,000 per qualified customer account per banking institution, fidelity may use several banks, rather than just one, to maximize your fdic coverage. This program doesn’t impact your account terms or access to your cash deposited in either your bank account or savings account and you may benefit from additional fdic insurance if you have balances over $250,000.

Source: blog.umb.com

Source: blog.umb.com

Since fdic insurance coverage is currently limited to $250,000 per qualified customer account per banking institution, fidelity may use several banks, rather than just one, to maximize your fdic coverage. This program doesn’t impact your account terms or access to your cash deposited in either your bank account or savings account and you may benefit from additional fdic insurance if you have balances over $250,000. (they actually insure up to $250,000 per account). Banks use brokered deposits as a funding source, according to the latest figures from the fdic. Sweep funding comes from uninvested cash balances held in customer accounts at source companies, such as broker.

Source: wedbush.com

Source: wedbush.com

How does the nm fdic insured deposit program fit into your plan? If your insured bank deposit balance nears the fdic limit at one of these banks, any additional cash is deposited at the next bank on a list of program banks to help ensure you don�t exceed current limits. (they actually insure up to $250,000 per account). Theapplicablefdic insurance limit depends on a number of factors. Your money is possibly a.

Source: psitsnotmoldde.blogspot.com

Source: psitsnotmoldde.blogspot.com

Uninvested money in your stash account (aka your available cash balance) is automatically transferred to the sweep program. Theapplicablefdic insurance limit depends on a number of factors. Insured sweep deposits are a subset of the larger category of brokered deposits. Sweep funding comes from uninvested cash balances held in customer accounts at source companies, such as broker. (they actually insure up to $250,000 per account).

Source: grbbank.com

Source: grbbank.com

The nm fdic insured deposit program is the primary product in our cash sweep program and will earn a daily interest rate for your uninvested assets. Upon opening your account, you will have the opportunity to enroll in the fdic insured deposit sweep program. Money markets, except those that are fdic insured, aimed to keep value at $1 each. 2 fdic, unsafe and unsound banking practices: Cash contributed to or received in your account is held in the core account (the “cash balance”).

Source: psitsnotmoldde.blogspot.com

Source: psitsnotmoldde.blogspot.com

That’s a government organization that basically guarantees your money will be paid back to you if the bank holding it goes out of business. The fund has an expense ratio of 0.42% and an interest rate of 1.25%. If you make a deposit to your account (by check, ach, wire, etc.), it may take up to two business days before your deposit sweeps into an fdic insured deposits, and such deposits will constitute free credit balances until they are swept. It�ll be insured by the federal deposit insurance corporation (fdic) for up to $4.0 million 1, 2 and unlike many other programs, pays a consistent return regardless of the. If something terrible happens, you still get your money back.

Source: altruist.com

Source: altruist.com

Our insured bank deposit sweep program allows eligible ibkr clients to obtain up to $2,500,000 of fdic insurance 4 in addition to existing $250,000 sipc coverage 4 for total coverage of $2,750,000. Theapplicablefdic insurance limit depends on a number of factors. Our insured bank deposit sweep program allows eligible ibkr clients to obtain up to $2,500,000 of fdic insurance 4 in addition to existing $250,000 sipc coverage 4 for total coverage of $2,750,000. It is offered through our clearing partner, apex clearing corporation. Since fdic insurance coverage is currently limited to $250,000 per qualified customer account per banking institution, fidelity may use several banks, rather than just one, to maximize your fdic coverage.

Source: npa1.org

Source: npa1.org

What is fdic sweep program? Theapplicablefdic insurance limit depends on a number of factors. As part of its automatic cash sweep program, lpl financial offers two bank deposit sweep programs which take available cash balances (from securities transactions, dividend and interest payments, cash deposits, and other activities) in clients’ eligible accounts and automatically deposits them (which we refer to as. Insured sweep deposits are a subset of the larger category of brokered deposits. Approximately 40% of all u.s.

Source: wordspick.com

Source: wordspick.com

Uninvested cash in your account is automatically deposited to the fdic sweep program. If something terrible happens, you still get your money back. This rule codifies the fdic�s practices for determining deposit and other account balances at a failed insured depository institution. Upon opening your account, you will have the opportunity to enroll in the fdic insured deposit sweep program. How a sweep program works.

Cash contributed to or received in your account is held in the core account (the “cash balance”). The nm fdic insured deposit program is the primary product in our cash sweep program and will earn a daily interest rate for your uninvested assets. This rule codifies the fdic�s practices for determining deposit and other account balances at a failed insured depository institution. If you make a deposit to your account (by check, ach, wire, etc.), it may take up to two business days before your deposit sweeps into an fdic insured deposits, and such deposits will constitute free credit balances until they are swept. Most investment companies then use multiple banks for this so you�re actually covered for over $1mm.

Source: psitsnotmoldde.blogspot.com

Source: psitsnotmoldde.blogspot.com

If you make a deposit to your account (by check, ach, wire, etc.), it may take up to two business days before your deposit sweeps into an fdic insured deposits, and such deposits will constitute free credit balances until they are swept. Your money is possibly a. If you make a deposit to your account (by check, ach, wire, etc.), it may take up to two business days before your deposit sweeps into an fdic insured deposits, and such deposits will constitute free credit balances until they are swept. Money markets, except those that are fdic insured, aimed to keep value at $1 each. This rule codifies the fdic�s practices for determining deposit and other account balances at a failed insured depository institution.

Source: interactivebrokers.co.uk

Source: interactivebrokers.co.uk

Theapplicablefdic insurance limit depends on a number of factors. If your insured bank deposit balance nears the fdic limit at one of these banks, any additional cash is deposited at the next bank on a list of program banks to help ensure you don�t exceed current limits. Uninvested money in your stash account (aka your available cash balance) is automatically transferred to the sweep program. Uninvested cash in your account is automatically deposited to the fdic sweep program. It�ll be insured by the federal deposit insurance corporation (fdic) for up to $4.0 million 1, 2 and unlike many other programs, pays a consistent return regardless of the.

Source: interactivebrokers.com

Source: interactivebrokers.com

(they actually insure up to $250,000 per account). The fund has an expense ratio of 0.42% and an interest rate of 1.25%. Your money is possibly a. 2 fdic, unsafe and unsound banking practices: Money from newly opened fidelity accounts will be placed into spaxx automatically.

Source: interactivebrokers.com

Source: interactivebrokers.com

Insured sweep deposits are a subset of the larger category of brokered deposits. 2 fdic, unsafe and unsound banking practices: Clients continue earning the same competitive interest rates 1 currently applied to cash held in ibkr accounts. The nm fdic insured deposit program is the primary product in our cash sweep program and will earn a daily interest rate for your uninvested assets. Money from newly opened fidelity accounts will be placed into spaxx automatically.

Source: timetoast.com

Source: timetoast.com

That’s a government organization that basically guarantees your money will be paid back to you if the bank holding it goes out of business. What is fdic sweep program? It also includes disclosure requirements for certain sweep accounts. Insured sweep deposits are a subset of the larger category of brokered deposits. Uninvested cash in your account is automatically deposited to the fdic sweep program.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fdic insured deposit sweep program fdic by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.