Your Fdic insured deposit account core not covered by sipc images are available. Fdic insured deposit account core not covered by sipc are a topic that is being searched for and liked by netizens now. You can Get the Fdic insured deposit account core not covered by sipc files here. Find and Download all royalty-free images.

If you’re searching for fdic insured deposit account core not covered by sipc images information linked to the fdic insured deposit account core not covered by sipc keyword, you have visit the ideal blog. Our site frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

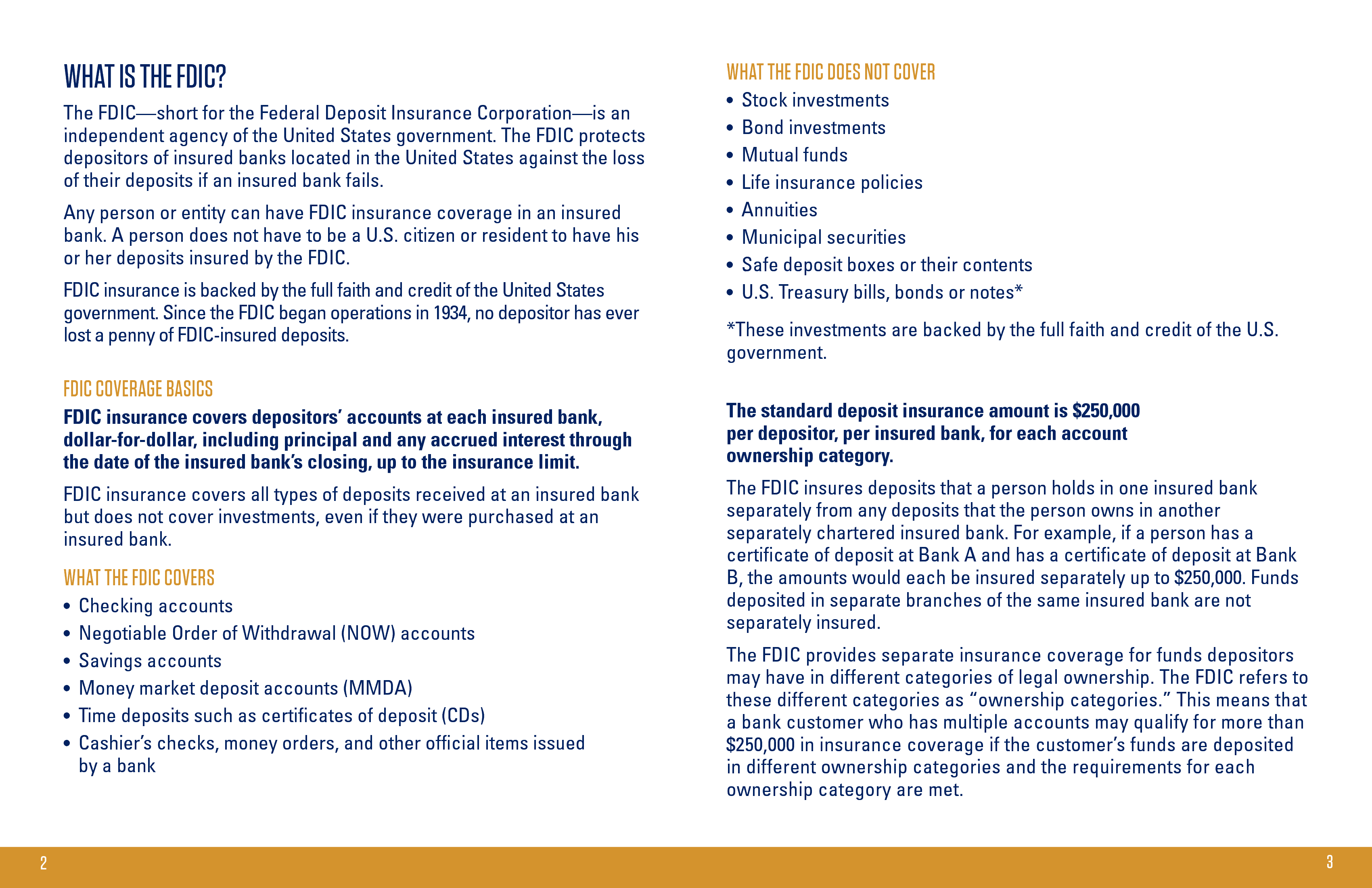

Fdic Insured Deposit Account Core Not Covered By Sipc. Fdic insurance covers all types of deposits received at an insured bank, including: Fdic insurance does not cover investments in stocks, bonds, mutual funds, life insurance policies, annuities, municipal securities, or money market funds, regardless of whether the bank that holds the investments is fdic. The fdic insurance applies only to cash and not to investments, and has a maximum $250,000 coverage. You get $500,000 of protection for all accounts at one institution and a maximum of $250,000 for cash held there.

TD Ameritrade Cash Alternatives Lifelong Learning From lifelong-learn.com

TD Ameritrade Cash Alternatives Lifelong Learning From lifelong-learn.com

Charles schwab premier bank, ssb; The sipc, meanwhile, covers up to. Fdic insured deposit account core not covered by sipc videos recently added videos recently added videos most viewed videos longest videos popular videos random videos Fdic insurance does not cover investments in stocks, bonds, mutual funds, life insurance policies, annuities, municipal securities, or money market funds, regardless of whether the bank that holds the investments is fdic. The securities investor protection corporation (sipc) is a nonprofit membership corporation that was created by federal statute in 1970. In the unlikely event that a program bank should fail, each depositor with ida balances is insured, up to the $250,000 limit, for taxable accounts, iras, and certain other retirement accounts, when aggregated with.

Fdic insurance covers all types of deposits received at an insured bank, including:

You get $500,000 of protection for all accounts at one institution and a maximum of $250,000 for cash held there. Protecting your investment accounts is where sipc insurance comes in. If you are interested in fdic deposit insurance coverage, simply make sure you are placing your funds in a deposit product at the bank. The sipc, meanwhile, covers up to. Fdic insured deposit account core not covered by sipc. What the fdic does not cover:

Source: marcus.com

Source: marcus.com

Fdic insured deposit account core not covered by sipc. In the unlikely event that a program bank should fail, each depositor with ida balances is insured, up to the $250,000 limit, for taxable accounts, iras, and certain other retirement accounts, when aggregated with. Fdic insurance covers traditional deposit accounts, and depositors do not need to apply for fdic insurance. What does “fdic insured deposit account core not covered by sipc” mean? It is important to recognize that sipc protection is not the same as protection for your cash at a federal deposit insurance corporation (fdic) insured banking institution because sipc does not protect the.

Source: lifelong-learn.com

Source: lifelong-learn.com

This system would be ideal for investors who want fdic insurance, but have more than $250,000 to protect. Checking accounts, negotiable order of withdrawal (now) accounts, savings accounts, money market deposit accounts (mmdas), certificates of deposit. The fdic provides a tool called the electronic deposit insurance estimator (edie) that consumers can use to determine what will and will not be insured, and which limits and rules apply to an account. For a copy of the other important disclosures, visit our website at ameriprise.com/disclosures or call our service line at 800.862.7919. I would like some education on roth ira.

Source: ustocktrade.com

Source: ustocktrade.com

All assets of the account holder at the depository institution will generally be counted toward the aggregate limit. All assets of the account holder at the depository institution will generally be counted toward the aggregate limit. Protecting your investment accounts is where sipc insurance comes in. Deposit products are not covered by sipc. Deposit products are fdic insured up to $250,000 per depositor, per fdic rules.

Source: lifelong-learn.com

Source: lifelong-learn.com

All assets of the account holder at the depository institution will generally be counted toward the aggregate limit. The fdic also covers certificates of deposit (cds) and money market accounts. The deposit is eligible for fdic insurance subject to fdic insurance coverage limits. Sipc does not cover losses due to a decline in value of securities. Fdic insured deposit account core not covered by sipc sipc does not protect against the decline in value of your securities.

Source: reddit.com

Source: reddit.com

All assets of the account holder at the. Fdic insured deposit account core not covered by sipc sipc does not protect against the decline in value of your securities. Fdic insured deposit account core not covered by sipc? Three of the program banks are charles schwab bank, ssb; What the fdic does not cover:

Source: marcus.com

Source: marcus.com

Fdic insurance does not cover stocks, bonds, mutual funds, money market mutual funds, life insurance policies, annuities, or municipal securities. Fdic insured deposit account core not covered by sipc sipc does not protect against the decline in value of your securities. The deposit is eligible for fdic insurance subject to fdic insurance coverage limits. However, fdic insurance does not cover the following: You can see a full list of everything covered by fdic insurance here.

Source: ottih.direct

Source: ottih.direct

This means that if vanguard were to go. The sipc, meanwhile, covers up to. It is important to recognize that sipc protection is not the same as protection for your cash at a federal deposit insurance corporation (fdic) insured banking institution because sipc does not protect the. Checking accounts, negotiable order of withdrawal (now) accounts, savings accounts, money market deposit accounts (mmdas), certificates of deposit. Fdic insurance covers all types of deposits received at an insured bank, including:

Source: lifelong-learn.com

Source: lifelong-learn.com

This means that if vanguard were to go. Fdic insured deposit account core not covered by sipc videos recently added videos recently added videos most viewed videos longest videos popular videos random videos Sipc coverage applies if the brokerage firm fails and customer assets are lost or misappropriated by the firm (e.g., if your assets can�t be transferred to another brokerage firm because they were used in the operation of the failed firm). However, fdic insurance does not cover the following: You get $500,000 of protection for all accounts at one institution and a maximum of $250,000 for cash held there.

Source: moneywiththeo.com

Source: moneywiththeo.com

In the unlikely event that a program bank should fail, each depositor with ida balances is insured, up to the $250,000 limit, for taxable accounts, iras, and certain other retirement accounts, when aggregated with. The fdic insurance applies only to cash and not to investments, and has a maximum $250,000 coverage. It is important to recognize that sipc protection is not the same as protection for your cash at a federal deposit insurance corporation (fdic) insured banking institution because sipc does not protect the. This system would be ideal for investors who want fdic insurance, but have more than $250,000 to protect. I would like some education on roth ira.

Source: sfa.speedapps.com.my

Source: sfa.speedapps.com.my

The deposit is eligible for fdic insurance subject to fdic insurance coverage limits. In the unlikely event that a program bank should fail, each depositor with ida balances is insured, up to the $250,000 limit, for taxable accounts, iras, and certain other retirement accounts, when aggregated with. If you are interested in fdic deposit insurance coverage, simply make sure you are placing your funds in a deposit product at the bank. All assets of the account holder at the. Deposit products are not covered by sipc.

Source: topratedfirms.com

Source: topratedfirms.com

The deposit at the program bank is not covered by securities investor protection corporation (sipc). This means that if vanguard were to go. Customers of banks that carry fdic insurance are able to recoup up to $250,000 per account holder per insured bank per deposit account type. You get $500,000 of protection for all accounts at one institution and a maximum of $250,000 for cash held there. Fdic insurance does not cover stocks, bonds, mutual funds, money market mutual funds, life insurance policies, annuities, or municipal securities.

Source: lifelong-learn.com

Source: lifelong-learn.com

The fdic also covers certificates of deposit (cds) and money market accounts. The deposit at the program bank is not covered by securities investor protection corporation (sipc). Fdic insurance does not cover investments in stocks, bonds, mutual funds, life insurance policies, annuities, municipal securities, or money market funds, regardless of whether the bank that holds the investments is fdic. If you are interested in fdic deposit insurance coverage, simply make sure you are placing your funds in a deposit product at the bank. Protecting your investment accounts is where sipc insurance comes in.

Source: liangquinleywm.com

Source: liangquinleywm.com

The deposit is eligible for fdic insurance subject to fdic insurance coverage limits. Sipc protection is not the same as protection for your cash at a federal deposit insurance corporation (fdic) insured banking institution because sipc does not protect the value of any security. Fdic insurance does not cover stocks, bonds, mutual funds, money market mutual funds, life insurance policies, annuities, or municipal securities. The deposit at the program bank is not covered by securities investor protection corporation (sipc). What the fdic does not cover:

Source: gobankingrates.com

Source: gobankingrates.com

The sipc, meanwhile, covers up to. I would like some education on roth ira. I�m curious because i�m also being charged 0.01% interest on the fdic insured deposit account etc. Fdic insurance does not cover stocks, bonds, mutual funds, money market mutual funds, life insurance policies, annuities, or municipal securities. Deposit products are fdic insured up to $250,000 per depositor, per fdic rules.

Source: eliseimageselise.blogspot.com

Source: eliseimageselise.blogspot.com

These limits apply to principal and accrued interest. The deposit at the program bank is not covered by securities investor protection corporation (sipc). The deposit at the program bank is not covered by securities investor protection corporation (sipc). Deposit products are not covered by sipc. The sipc, meanwhile, covers up to.

Source: onsizzle.com

Source: onsizzle.com

Three of the program banks are charles schwab bank, ssb; Fdic insured deposit account core not covered by sipc. Checking accounts, negotiable order of withdrawal (now) accounts, savings accounts, money market deposit accounts (mmdas), certificates of deposit. I would like some education on roth ira. Sipc does not provide blanket coverage, where the fdic does.

Source: lovewordssss.blogspot.com

Source: lovewordssss.blogspot.com

The deposit is eligible for fdic insurance subject to fdic insurance coverage limits. All assets of the account holder at the. This is true even if you purchased these types of. What does “fdic insured deposit account core not covered by sipc” mean? What kind of deposits are covered by fdic insurance?

Source: me.me

Source: me.me

Fdic insurance covers traditional deposit accounts, and depositors do not need to apply for fdic insurance. These limits apply to principal and accrued interest. You get $500,000 of protection for all accounts at one institution and a maximum of $250,000 for cash held there. Fdic insurance covers all types of deposits received at an insured bank, including: Balances in an ida are held at one or more banks (“program banks”), where they are insured by the federal deposit insurance corporation (fdic) against bank failure for up to $250,000 per depositor, per bank.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fdic insured deposit account core not covered by sipc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.