Your Fdic insurance changes 2013 images are ready in this website. Fdic insurance changes 2013 are a topic that is being searched for and liked by netizens today. You can Download the Fdic insurance changes 2013 files here. Find and Download all free photos and vectors.

If you’re looking for fdic insurance changes 2013 pictures information linked to the fdic insurance changes 2013 keyword, you have come to the right blog. Our website always provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

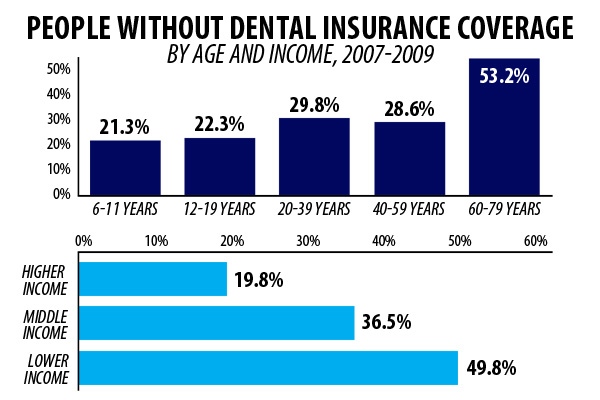

Fdic Insurance Changes 2013. Between 2011 and 2013, the highest rate of growth in prepaid card use was among unbanked households: Key findings and implications from the 2013 survey key findings. Under the rule, the fdic provides adjustments to the risk based premium formula and certain of its risk ratios, and. The ffiec and the agencies encourage you to review the proposal and comment on those aspects of interest to you.

Insurance Coverage Fdic Insurance Coverage 2013 From insurancecoverageiwakebu.blogspot.com

Insurance Coverage Fdic Insurance Coverage 2013 From insurancecoverageiwakebu.blogspot.com

Previously, it was temporarily increased from $100,000 to $250,000 only until december 31st, 2009. Deposits at all banks will still be insured up to $250,000 through 2013 under the fdic�s general deposit insurance rules, so the vast majority of consumers don�t need to worry. The fdic’s october 10, 2013 financial institutions letter, which includes an “advisory statement on director and officer liability insurance policies, exclusions and indemnification for civil money penalties” (here), advises bank directors and officers to be wary of the addition of policy exclusions to their d&o insurance policies and. Between 2011 and 2013, the highest rate of growth in prepaid card use was among unbanked households: With congress failing to take action to extend unlimited coverage, as of jan.1, 2013, fdic insurance available to iolta accounts is limited to the standard amount of $250,000 per owner of the funds (client), per financial institution, assuming that the account is properly designated as a trust account and proper accounting of each client’s funds is maintained. That increased fdic coverage is set to expire on 12/31/2009.

Beginning january 1, 2013, all of a depositor�s accounts at an insured depository institution, including all.

The standard fdic deposit insurance coverage amount of at least $250,000 per depositor at each insured institution is still in effect. The higher fdic limits have been extended through 2013. Deposits at all banks will still be insured up to $250,000 through 2013 under the fdic�s general deposit insurance rules, so the vast majority of consumers don�t need to worry. Under the rule, the fdic provides adjustments to the risk based premium formula and certain of its risk ratios, and. Effective june 26, 2020, the fdic adopted a final rule to mitigate the effect on deposit insurance assessments when an insured institution participates in either or both the paycheck protection program (ppp) and money market mutual fund liquidity facility (mmlf). No administrative hearings scheduled for june 2013;

Source: japantimes.co.jp

Source: japantimes.co.jp

Thus, assuming that these changes aren’t extended or made permanent, the coverage limits will fall back to their original values in just over a year. May 31, 2013 fdic makes public april enforcement actions; Absent a change in law, beginning january 1, 2013, the fdic no longer will provide separate, unlimited deposit insurance coverage for nibtas at. Currently, the fdic insures approximately $9 trillion of deposits in virtually every bank and thrift across the country. Effective june 26, 2020, the fdic adopted a final rule to mitigate the effect on deposit insurance assessments when an insured institution participates in either or both the paycheck protection program (ppp) and money market mutual fund liquidity facility (mmlf).

Source: chicagotribune.com

Source: chicagotribune.com

The proposed changes to these reports, which are described in the attached federal register notice, are consistent with the revised regulatory capital rules approved by the agencies during july 2013. Then in 2010, the lawmakers approved a permanent increase to the $250,000 coverage amount. Beginning january 1, 2013, all of a depositor�s accounts at an insured depository institution, including all. In 2013, 27.1 percent of unbanked households had ever used prepaid cards, up from 17.8 percent. That increased fdic coverage is set to expire on 12/31/2009.

Source: mybanktracker.com

Source: mybanktracker.com

Key findings and implications from the 2013 survey key findings. Their use was more common among unbanked and unbanked and underbanked households. With congress failing to take action to extend unlimited coverage, as of jan.1, 2013, fdic insurance available to iolta accounts is limited to the standard amount of $250,000 per owner of the funds (client), per financial institution, assuming that the account is properly designated as a trust account and proper accounting of each client’s funds is maintained. The unlimited insurance coverage is available to all depositors, including consumers, businesses, and government entities. 1, 2013, fdic insurance available to iolta accounts will be $250,000 per owner of the funds (client), per financial institution, assuming that the account is properly designated as a trust account and proper

Source: webroot.com

Source: webroot.com

Absent a change in law, beginning january 1, 2013, the fdic no longer will provide separate, unlimited deposit insurance coverage for nibtas at. May 31, 2013 fdic makes public april enforcement actions; The proposed changes to these reports, which are described in the attached federal register notice, are consistent with the revised regulatory capital rules approved by the agencies during july 2013. The standard fdic deposit insurance coverage amount of at least $250,000 per depositor at each insured institution is still in effect. On january 1, 2014, the standard insurance amount will return to $100,000 per depositor for all account categories except for iras and other certain retirement.

Source: street-cents.com

Source: street-cents.com

The fdic’s october 10, 2013 financial institutions letter, which includes an “advisory statement on director and officer liability insurance policies, exclusions and indemnification for civil money penalties” (here), advises bank directors and officers to be wary of the addition of policy exclusions to their d&o insurance policies and. Under the rule, the fdic provides adjustments to the risk based premium formula and certain of its risk ratios, and. Notice of changes in temporary fdic insurance for transaction accounts. May 30, 2013 fdic issues third quarter 2013 cra examination schedule; No administrative hearings scheduled for june 2013;

Source: bankinfosecurity.com

Source: bankinfosecurity.com

On january 1, 2014, the standard insurance amount will return to $100, 000 per depositor for all account categories except for iras and other certain retirement accounts which will remain at $250, 000 per depositor. Their use was more common among unbanked and unbanked and underbanked households. In 2013, 27.1 percent of unbanked households had ever used prepaid cards, up from 17.8 percent. May 30, 2013 fdic issues third quarter 2013 cra examination schedule; Key findings and implications from the 2013 survey key findings.

Source: fdicbanksinsured.com

Source: fdicbanksinsured.com

Use the navigation on the left to explore these findings in more detail. As background, the $250,000 fdic insurance limit has previously been extended through december 31, 2013, and the transaction account guarantee program has previously been extended through december 31, 2010, with the fdic maintaining the right to further extend through december 31, 2011. Absent a change in law, beginning january 1, 2013, the fdic no longer will provide separate, unlimited deposit insurance coverage for nibtas at. Notice of changes in temporary fdic insurance for transaction accounts. The unlimited insurance coverage is available to all depositors, including consumers, businesses, and government entities.

Source: consumerist.com

Source: consumerist.com

But starting friday, checking account balances that exceed $250,000 will no longer be covered under the fdic�s transaction account guarantee program at some banks. On january 1, 2014, the standard insurance amount will return to $100,000 per depositor for all account categories except for iras and other certain retirement. In 2013, 12.0 percent of all households had ever used prepaid cards. The proposed changes to these reports, which are described in the attached federal register notice, are consistent with the revised regulatory capital rules approved by the agencies during july 2013. On january 1, 2014, the standard insurance amount will return to $100, 000 per depositor for all account categories except for iras and other certain retirement accounts which will remain at $250, 000 per depositor.

Source: arstechnica.com

Source: arstechnica.com

May 31, 2013 fdic makes public april enforcement actions; Deposits at all banks will still be insured up to $250,000 through 2013 under the fdic�s general deposit insurance rules, so the vast majority of consumers don�t need to worry. In 2013, 27.1 percent of unbanked households had ever used prepaid cards, up from 17.8 percent. 7.7 percent of households in the united states were unbanked in. Their use was more common among unbanked and unbanked and underbanked households.

Source: thompsonburton.com

Source: thompsonburton.com

Between 2011 and 2013, the highest rate of growth in prepaid card use was among unbanked households: May 31, 2013 fdic makes public april enforcement actions; Key findings from the 2013 fdic survey of unbanked and underbanked households. Currently, the fdic insures approximately $9 trillion of deposits in virtually every bank and thrift across the country. 1, 2013, fdic insurance available to iolta accounts will be $250,000 per owner of the funds (client), per financial institution, assuming that the account is properly designated as a trust account and proper

Source: dlshowonline.com

Source: dlshowonline.com

On january 1, 2014, the standard insurance amount will return to $100,000 per depositor for all account categories except for iras and other certain retirement. Previously, it was temporarily increased from $100,000 to $250,000 only until december 31st, 2009. 31, 2009, but was extended and then made. Their use was more common among unbanked and unbanked and underbanked households. Key findings and implications from the 2013 survey key findings.

Source: delawareplacebank2.com

Source: delawareplacebank2.com

In 2008, congress passed a law increasing the basic fdic coverage from $100,000 to $250,000, but only through 2013. The fdic’s october 10, 2013 financial institutions letter, which includes an “advisory statement on director and officer liability insurance policies, exclusions and indemnification for civil money penalties” (here), advises bank directors and officers to be wary of the addition of policy exclusions to their d&o insurance policies and. Currently, the fdic insures approximately $9 trillion of deposits in virtually every bank and thrift across the country. The new limit was to remain in effect until dec. Use the navigation on the left to explore these findings in more detail.

Source: insurancecoverageiwakebu.blogspot.com

Source: insurancecoverageiwakebu.blogspot.com

As background, the $250,000 fdic insurance limit has previously been extended through december 31, 2013, and the transaction account guarantee program has previously been extended through december 31, 2010, with the fdic maintaining the right to further extend through december 31, 2011. On january 1, 2014, the standard insurance amount will return to $100, 000 per depositor for all account categories except for iras and other certain retirement accounts which will remain at $250, 000 per depositor. Their use was more common among unbanked and unbanked and underbanked households. Currently, the fdic insures approximately $9 trillion of deposits in virtually every bank and thrift across the country. No administrative hearings scheduled for june 2013;

Source: haikudeck.com

Source: haikudeck.com

May 31, 2013 fdic makes public april enforcement actions; On january 1, 2014, the standard insurance amount will return to $100,000 per depositor for all account categories except for iras and other certain retirement. The proposed changes to these reports, which are described in the attached federal register notice, are consistent with the revised regulatory capital rules approved by the agencies during july 2013. Beginning january 1, 2013, all of a depositor�s accounts at an insured depository institution,. Beginning january 1, 2013, all of a depositor�s accounts at an insured depository institution, including all.

Source: regproject.org

Source: regproject.org

May 30, 2013 fdic issues third quarter 2013 cra examination schedule; The new limit was to remain in effect until dec. 1, 2013, fdic insurance available to iolta accounts will be $250,000 per owner of the funds (client), per financial institution, assuming that the account is properly designated as a trust account and proper Previously, it was temporarily increased from $100,000 to $250,000 only until december 31st, 2009. Key findings from the 2013 fdic survey of unbanked and underbanked households.

Source: webroot.com

Source: webroot.com

The ffiec and the agencies encourage you to review the proposal and comment on those aspects of interest to you. May 30, 2013 fdic issues third quarter 2013 cra examination schedule; Their use was more common among unbanked and unbanked and underbanked households. Earlier this fall, fdic insurance limits increased from $100k to $250k. In 2013, 12.0 percent of all households had ever used prepaid cards.

Source: gobankingrates.com

Source: gobankingrates.com

Notice of changes in temporary fdic insurance for transaction accounts. The new limit was to remain in effect until dec. Between 2011 and 2013, the highest rate of growth in prepaid card use was among unbanked households: Key findings and implications from the 2013 survey key findings. Beginning january 1, 2013, all of a depositor�s accounts at an insured depository institution, including all.

Source: slideserve.com

Source: slideserve.com

With congress failing to take action to extend unlimited coverage, as of jan.1, 2013, fdic insurance available to iolta accounts is limited to the standard amount of $250,000 per owner of the funds (client), per financial institution, assuming that the account is properly designated as a trust account and proper accounting of each client’s funds is maintained. The unlimited insurance coverage is available to all depositors, including consumers, businesses, and government entities. Their use was more common among unbanked and unbanked and underbanked households. Beginning january 1, 2013, all of a depositor�s accounts at an insured depository institution, including all. The higher fdic limits have been extended through 2013.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fdic insurance changes 2013 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.