Your Fdi in insurance sector images are ready in this website. Fdi in insurance sector are a topic that is being searched for and liked by netizens now. You can Download the Fdi in insurance sector files here. Find and Download all free photos and vectors.

If you’re searching for fdi in insurance sector images information related to the fdi in insurance sector interest, you have visit the ideal blog. Our website always gives you hints for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Fdi In Insurance Sector. The amendment bill hikes foreign direct investment (fdi) cap in the insurance sector to 49 percent from present 26 percent. Small scale organizations may fear that they might not be able to compete with the multi national. If insurance sector is opened up to an extent of 49% for fdis, it is expected that fdi’s contribution to insurance business would touch nearly us$ 2 billion. Insurance business that are emerging in a changing dynamic environment, which also includes private participation.

Impact analysis of fdi on insurance sector in india From slideshare.net

Impact analysis of fdi on insurance sector in india From slideshare.net

A bill to increase foreign direct investment (fdi) in the insurance sector from 49 per cent to 74 per cent was approved by parliament with the lok sabha giving green signal to the legislation by a. The huge amount of capital, which comes through fdi not only enables insurance companies to improve their basic insurance infrastructure (manpower and business operation) but also allows them to develop innovative insurance. The government may now allow up to 20% foreign investment in the insurer that plans to list. After announcing an increase in the fdi threshold in insurance companies to 74% in the union budget this year, the government seems to be moving swiftly towards implementation, signalling optimism in the sector. Paving the way for higher foreign direct investment (fdi) in the insurance industry, the rajya sabha thursday passed the insurance amendment bill to permit 74 per cent fdi in insurance companies as against the existing cap of 49 per cent. Fdi limit rise to 74% in insurance sector 15 january , 2021 fdiindia fdi limit rise to 74% in insurance sector the government is setting higher limits on the foreign investment in the insurance and pension domain, certainly raised at 49%, the proposal is to raise it.

Insurance business that are emerging in a changing dynamic environment, which also includes private participation.

If insurance sector is opened up to an extent of 49% for fdis, it is expected that fdi’s contribution to insurance business would touch nearly us$ 2 billion. The amendment bill seeks to increase the foreign direct investment (fdi) limit in insurance sector by up to 49 percent. Investment through the fdi can be a maximum of 26%. Back in february, when the government announced in the. 18) with many of them choosing to enter with a foreign joint venture partner. Our country’s parliament passed the insurance amendment bill 2021 to increase the foreign direct investment (fdi) limit in the insurance sector to.

Source: slideshare.net

Source: slideshare.net

Since then the sector has grown at 20% annually and have seen entry of 41 private insurance companies (life: Parliament on 22 march 2021 passed the insurance amendment bill 2021 to increase the foreign direct investment (fdi) limit in the insurance sector to 74% from 49% in an attempt to attract more overseas insurance players to india. Paving the way for higher foreign direct investment (fdi) in the insurance industry, the rajya sabha thursday passed the insurance amendment bill to permit 74 per cent fdi in insurance companies as against the existing cap of 49 per cent. If insurance sector is opened up to an extent of 49% for fdis, it is expected that fdi’s contribution to insurance business would touch nearly us$ 2 billion. The huge amount of capital, which comes through fdi not only enables insurance companies to improve their basic insurance infrastructure (manpower and business operation) but also allows them to develop innovative insurance.

Source: timesofindia.indiatimes.com

Source: timesofindia.indiatimes.com

The insurance sector was opened up for private sector in 2000 after the enactment of the insurance regulatory and development authority act, 1999. As a rule fdi alludes to capital inflows from abroad that put sources into the era limit of the economic system and are normally favoured over other sort of outer fund due to the fact they�re. 18) with many of them choosing to enter with a foreign joint venture partner. Insurance business that are emerging in a changing dynamic environment, which also includes private participation. Our country’s parliament passed the insurance amendment bill 2021 to increase the foreign direct investment (fdi) limit in the insurance sector to.

Source: slideshare.net

Source: slideshare.net

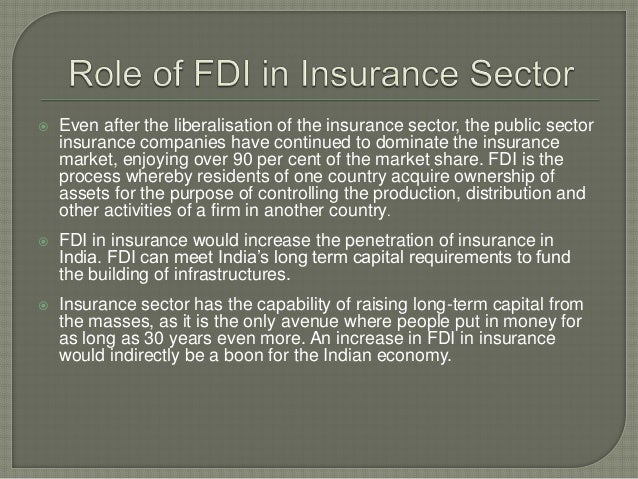

Fdi in insurance would increase the penetration of insurance in india; If insurance sector is opened up to an extent of 49% for fdis, it is expected that fdi’s contribution to insurance business would touch nearly us$ 2 billion. Small scale organizations may fear that they might not be able to compete with the multi national. Our country’s parliament passed the insurance amendment bill 2021 to increase the foreign direct investment (fdi) limit in the insurance sector to. Fdi can meet india’s long term capital requirements to fund the building of infrastructures.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

Our country’s parliament passed the insurance amendment bill 2021 to increase the foreign direct investment (fdi) limit in the insurance sector to. The huge amount of capital, which comes through fdi not only enables insurance companies to improve their basic insurance infrastructure (manpower and business operation) but also allows them to develop innovative insurance. The amendment bill hikes foreign direct investment (fdi) cap in the insurance sector to 49 percent from present 26 percent. The total insurance business would touch us$ 60 billion size. To ensure the stability and overall better performance of the insurance sector in india, foreign direct investment (fdi) is the most effective step.

Source: es.slideshare.net

Source: es.slideshare.net

Parliament on 22 march 2021 passed the insurance amendment bill 2021 to increase the foreign direct investment (fdi) limit in the insurance sector to 74% from 49% in an attempt to attract more overseas insurance players to india. Understanding nuances of new regime. 18) with many of them choosing to enter with a foreign joint venture partner. India allows foreign direct investment (fdi) up to 74% in the insurance sector, but this does not apply to lic, which is governed by the lic act. The huge amount of capital, which comes through fdi not only enables insurance companies to improve their basic insurance infrastructure (manpower and business operation) but also allows them to develop innovative insurance.

Source: slideshare.net

Source: slideshare.net

Our country’s parliament passed the insurance amendment bill 2021 to increase the foreign direct investment (fdi) limit in the insurance sector to. Fdi in insurance would increase the penetration of insurance in india; A bill to increase foreign direct investment (fdi) in the insurance sector from 49 per cent to 74 per cent was approved by parliament with the lok sabha giving green signal to the legislation by a. Insurance business that are emerging in a changing dynamic environment, which also includes private participation. Paving the way for higher foreign direct investment (fdi) in the insurance industry, the rajya sabha thursday passed the insurance amendment bill to permit 74 per cent fdi in insurance companies as against the existing cap of 49 per cent.

Source: slideshare.net

Source: slideshare.net

Fdi can meet india’s long term capital requirements to fund the building of infrastructures. For several years, stakeholders in the indian insurance sector have wanted the foreign direct investment (fdi) limit for indian insurers to. The amendment bill seeks to increase the foreign direct investment (fdi) limit in insurance sector by up to 49 percent. The government may now allow up to 20% foreign investment in the insurer that plans to list. Investment through the fdi can be a maximum of 26%.

Source: youtube.com

Source: youtube.com

Parliament on 22 march 2021 passed the insurance amendment bill 2021 to increase the foreign direct investment (fdi) limit in the insurance sector to 74% from 49% in an attempt to attract more overseas insurance players to india. Household organizations might expect to get their businesses being taken over by the foreign organizations. To ensure the stability and overall better performance of the insurance sector in india, foreign direct investment (fdi) is the most effective step. Fdi in insurance would increase the penetration of insurance in india; The following are some of the demerits if the fdi gets increased in the insurance sector:

Source: slideshare.net

Source: slideshare.net

74% fdi in indian insurance companies: A bill to increase foreign direct investment (fdi) in the insurance sector from 49 per cent to 74 per cent was approved by parliament with the lok sabha giving green signal to the legislation by a. As a rule fdi alludes to capital inflows from abroad that put sources into the era limit of the economic system and are normally favoured over other sort of outer fund due to the fact they�re. The amendment bill seeks to increase the foreign direct investment (fdi) limit in insurance sector by up to 49 percent. 74% fdi in indian insurance companies:

Source: slideshare.net

Source: slideshare.net

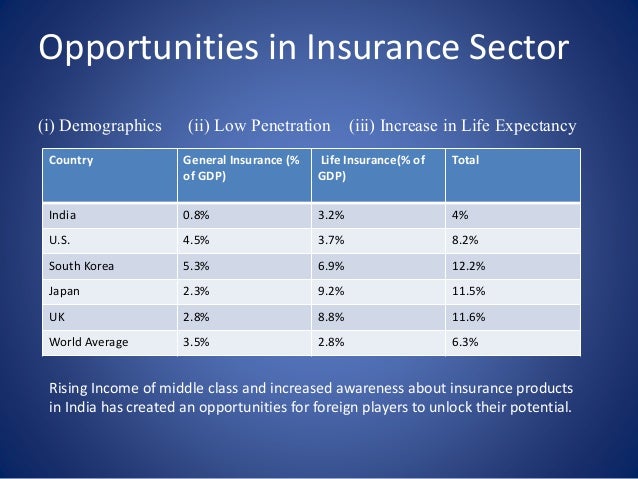

The government may now allow up to 20% foreign investment in the insurer that plans to list. If insurance sector is opened up to an extent of 49% for fdis, it is expected that fdi’s contribution to insurance business would touch nearly us$ 2 billion. Insurance business that are emerging in a changing dynamic environment, which also includes private participation. The government may now allow up to 20% foreign investment in the insurer that plans to list. Fdi importance in insurance sector currently, the insurance penetration in india stands at 3.7% of the gdp compared to the world average of 6.31%.

Source: slideshare.net

Source: slideshare.net

After announcing an increase in the fdi threshold in insurance companies to 74% in the union budget this year, the government seems to be moving swiftly towards implementation, signalling optimism in the sector. The draft rules of the indian insurance companies (foreign investment) amendment 2021 to increase fdi in the insurance space to 74% provide that in any insurance company having foreign investment. Fdi limit rise to 74% in insurance sector 15 january , 2021 fdiindia fdi limit rise to 74% in insurance sector the government is setting higher limits on the foreign investment in the insurance and pension domain, certainly raised at 49%, the proposal is to raise it. Understanding nuances of new regime. Household organizations might expect to get their businesses being taken over by the foreign organizations.

Source: slideshare.net

Source: slideshare.net

The following are some of the demerits if the fdi gets increased in the insurance sector: A bill to increase foreign direct investment (fdi) in the insurance sector from 49 per cent to 74 per cent was approved by parliament with the lok sabha giving green signal to the legislation by a. For several years, stakeholders in the indian insurance sector have wanted the foreign direct investment (fdi) limit for indian insurers to. The government may now allow up to 20% foreign investment in the insurer that plans to list. The total insurance business would touch us$ 60 billion size.

Source: slideshare.net

Source: slideshare.net

Back in february, when the government announced in the. As a rule fdi alludes to capital inflows from abroad that put sources into the era limit of the economic system and are normally favoured over other sort of outer fund due to the fact they�re. Currently, only 26% of fdis is permitted in insurance sector. Paving the way for higher foreign direct investment (fdi) in the insurance industry, the rajya sabha thursday passed the insurance amendment bill to permit 74 per cent fdi in insurance companies as against the existing cap of 49 per cent. Back in february, when the government announced in the.

Source: slideshare.net

Source: slideshare.net

Parliament on 22 march 2021 passed the insurance amendment bill 2021 to increase the foreign direct investment (fdi) limit in the insurance sector to 74% from 49% in an attempt to attract more overseas insurance players to india. For several years, stakeholders in the indian insurance sector have wanted the foreign direct investment (fdi) limit for indian insurers to. The government may now allow up to 20% foreign investment in the insurer that plans to list. The amendment bill seeks to increase the foreign direct investment (fdi) limit in insurance sector by up to 49 percent. The following are some of the demerits if the fdi gets increased in the insurance sector:

Source: slideshare.net

Source: slideshare.net

If insurance sector is opened up to an extent of 49% for fdis, it is expected that fdi’s contribution to insurance business would touch nearly us$ 2 billion. 74% fdi in indian insurance companies: The following are some of the demerits if the fdi gets increased in the insurance sector: If insurance sector is opened up to an extent of 49% for fdis, it is expected that fdi’s contribution to insurance business would touch nearly us$ 2 billion. Back in february, when the government announced in the.

Source: es.slideshare.net

Source: es.slideshare.net

Household organizations might expect to get their businesses being taken over by the foreign organizations. A bill to increase foreign direct investment (fdi) in the insurance sector from 49 per cent to 74 per cent was approved by parliament with the lok sabha giving green signal to the legislation by a. India allows foreign direct investment (fdi) up to 74% in the insurance sector, but this does not apply to lic, which is governed by the lic act. The amendment bill hikes foreign direct investment (fdi) cap in the insurance sector to 49 percent from present 26 percent. The insurance sector was opened up for private sector in 2000 after the enactment of the insurance regulatory and development authority act, 1999.

Source: slideshare.net

Source: slideshare.net

Since then the sector has grown at 20% annually and have seen entry of 41 private insurance companies (life: The following are some of the demerits if the fdi gets increased in the insurance sector: 74% fdi in indian insurance companies: For several years, stakeholders in the indian insurance sector have wanted the foreign direct investment (fdi) limit for indian insurers to. The total insurance business would touch us$ 60 billion size.

Source: medhin1.blogspot.com

Source: medhin1.blogspot.com

Paving the way for higher foreign direct investment (fdi) in the insurance industry, the rajya sabha thursday passed the insurance amendment bill to permit 74 per cent fdi in insurance companies as against the existing cap of 49 per cent. For several years, stakeholders in the indian insurance sector have wanted the foreign direct investment (fdi) limit for indian insurers to. Fdi in insurance sector indian insurance sector got liberalised in 2001. Paving the way for higher foreign direct investment (fdi) in the insurance industry, the rajya sabha thursday passed the insurance amendment bill to permit 74 per cent fdi in insurance companies as against the existing cap of 49 per cent. 18) with many of them choosing to enter with a foreign joint venture partner.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fdi in insurance sector by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.