Your Fdi allowed in insurance sector in india images are available in this site. Fdi allowed in insurance sector in india are a topic that is being searched for and liked by netizens now. You can Download the Fdi allowed in insurance sector in india files here. Find and Download all royalty-free photos and vectors.

If you’re looking for fdi allowed in insurance sector in india images information related to the fdi allowed in insurance sector in india interest, you have come to the right site. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

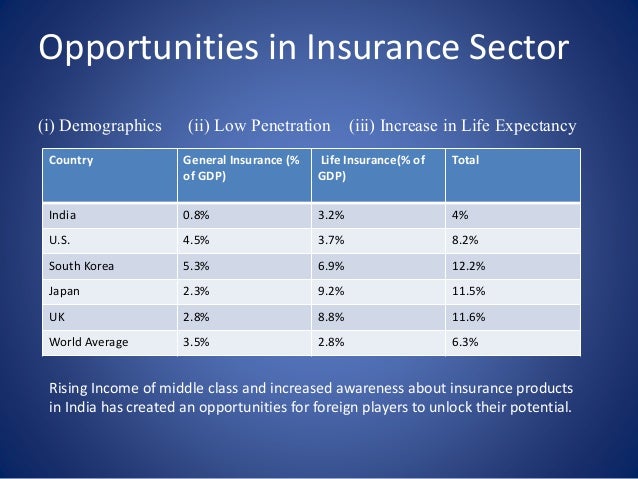

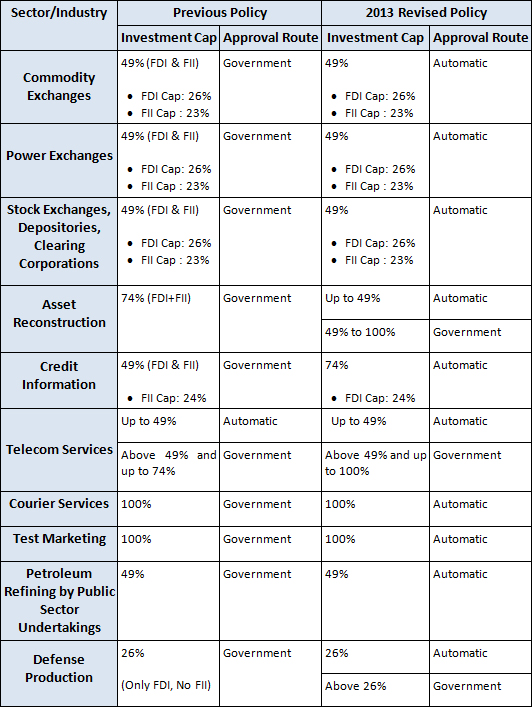

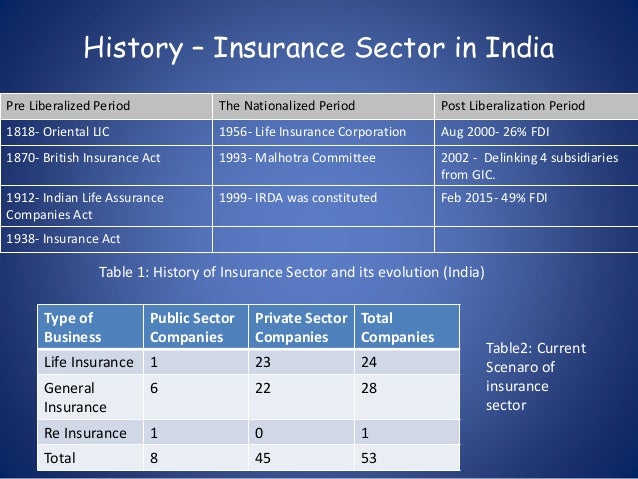

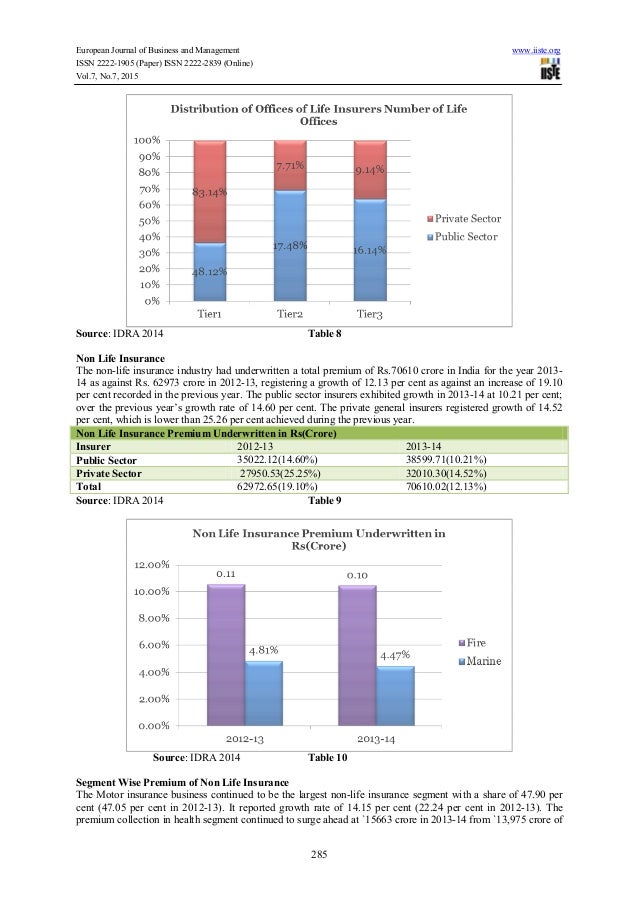

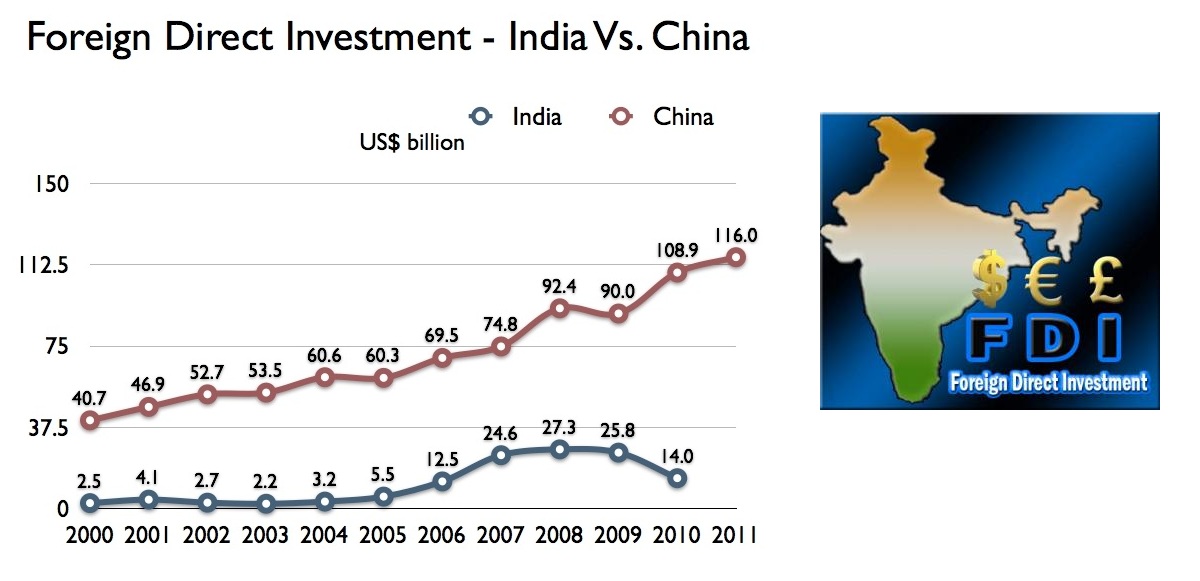

Fdi Allowed In Insurance Sector In India. Life insurance premium as a percentage of gdp is 3.6 per cent in the country, almost half of. Fdi in the telecom sector. Service sector includes banking, insurance, outsourcing, research & development, courier and technology testing. Fdi limit in insurance sector was raised from 26% to 49% in 2014.

Historical Trend of India�s FDI Inflows Yadnya From blog.investyadnya.in

Historical Trend of India�s FDI Inflows Yadnya From blog.investyadnya.in

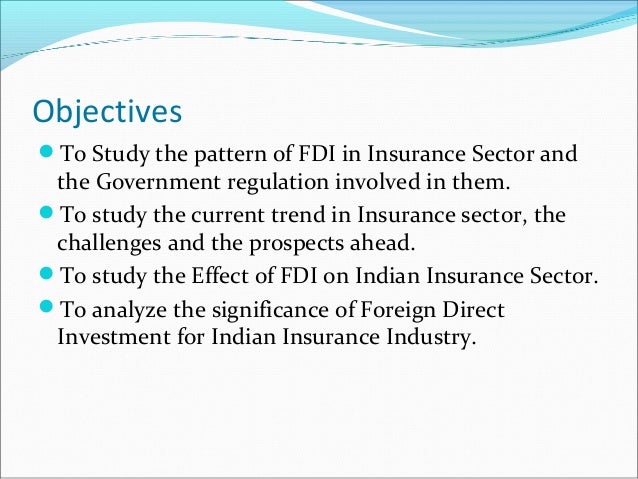

Fdi limits in different sectors in india 2020. The present paper focuses on the overview of the indian insurance sector along with the opportunities due to expansion of fdi in insurance in india and the major challenges that it faces. Recently, india has allowed foreign direct investment up to 100% in many manufacturing industries which were designated as small. Allowing higher fdi in insurance sector is expected to increase insurance penetration in the country. The impacts of fdi in the growth of the indian economy are phenomenal. This is primarily attributed to ease in fdi rules in india.

There are too many states and sectors to study and make an informed decision.

To receive our efficient and expert legal service for making fdi in the indian insurance sector, please contact at: Moreover, total fdi inflow grew by 65.3%, i.e. Fdi limit in insurance sector was raised from 26% to 49% in 2014. After that, for a long time, there were demands from the industry to further increase this cap to 49 per cent. India allowed private companies in insurance sector in 2000, setting a limit on fdi to 26%, which was increased to 49% in 2014. It was in 2015 when the government hiked the fdi cap in the insurance sector from 26 per cent to 49 per cent.

Source: slideshare.net

Source: slideshare.net

India allows foreign direct investment (fdi) up to 74% in the insurance sector, but this does not apply to lic, which is governed by the lic act. Moreover, total fdi inflow grew by 65.3%, i.e. • insurance company • insurance brokers • third party administrators • surveyors and loss assessors • other insurance intermediaries. Fdi can meet india’s long term capital requirements to fund the building of infrastructures. Recently, india has allowed foreign direct investment up to 100% in many manufacturing industries which were designated as small.

Source: slideshare.net

Source: slideshare.net

Fdi limit in insurance sector was raised from 26% to 49% in 2014. Allowing higher fdi in insurance sector is expected to increase insurance penetration in the country. It is us $1.88 billion in 2017. Service sector includes banking, insurance, outsourcing, research & development, courier and technology testing. Find out in which sectors fdi in india is permitted under the two routes of approval.

Source: slideshare.net

Source: slideshare.net

Fdi up to 26% was also allowed. Fdi up to 26% in the insurance sector is allowed on the automatic route subject to obtaining licence from insurance regulatory & development authority (irda). Fdi under automatic route up to 49%; India raises fdi cap for insurance sector to 74%, ownership restrictions eased. In the last few years, the government has made many changes in fdi policies and allowed fdi in the banking sector (public and private) and the insurance sector (49% through automatic route).

Source: slideshare.net

Source: slideshare.net

There is no fdi allowed in insurance sector in india. In the automatic route, the foreign entities are not require to obtain an approval before proceeding further. India allows foreign direct investment (fdi) up to 74% in the insurance sector, but this does not apply to lic, which is governed by the lic act. Fdi can meet india’s long term capital requirements to fund the building of infrastructures. As per current fdi norms the current fdi limit for insurance sector is 49%.

Source: bizindia.net

Source: bizindia.net

After that, for a long time, there were demands from the industry to further increase this cap to 49 per cent. Fdi in telecom services is allowed up to 49 percent under the automatic route and up to 100 percent with the prior approval of the fipb. It was in 2015 when the government hiked the fdi cap in the insurance sector from 26 per cent to 49 per cent. There is no fdi allowed in insurance sector in india. It is us $1.88 billion in 2017.

Source: slideshare.net

Source: slideshare.net

India allows foreign direct investment (fdi) up to 74% in the insurance sector, but this does not apply to lic, which is governed by the lic act. There is no fdi allowed in insurance sector in india. Above 49% and up to 100% through government route. Evolution of fdi policy in defence. Find out in which sectors fdi in india is permitted under the two routes of approval.

Source: indiatoday.in

Source: indiatoday.in

As per current fdi norms the current fdi limit for insurance sector is 49%. By way of the amendment rules, the government of india allowed insurance intermediaries to be 100% foreign owned. Fdi in telecom services is allowed up to 49 percent under the automatic route and up to 100 percent with the prior approval of the fipb. India allowed private companies in insurance sector in 2000, setting a limit on fdi to 26%, which was increased to 49% in 2014. Further, fdi is also allowed to get into different routes, automatic and the government route.

Source: india-briefing.com

Source: india-briefing.com

In the automatic route, the foreign entities are not require to obtain an approval before proceeding further. It is us $1.88 billion in 2017. The impacts of fdi in the growth of the indian economy are phenomenal. Fdi under automatic route up to 49%; Fdi limits in different sectors in india 2020.

Source: slideshare.net

Source: slideshare.net

India allowed private companies in insurance sector in 2000, setting a limit on fdi to 26%, which was increased to 49% in 2014. Recently, india has allowed foreign direct investment up to 100% in many manufacturing industries which were designated as small. As an fdi agency, or more fittingly one of the best fdi facilitators in india, we make the entire process of overseas investment easy, which can otherwise be overwhelming. The impacts of fdi in the growth of the indian economy are phenomenal. India first opened up the insurance sector in the year 2000 under the atal bihari vajpayee government when it allowed private sector firms to set up insurance companies and allowed fdi of 26 per cent.

Source: slideshare.net

Source: slideshare.net

• insurance company • insurance brokers • third party administrators • surveyors and loss assessors • other insurance intermediaries. Fdi in the telecom sector. The impacts of fdi in the growth of the indian economy are phenomenal. India first opened up the insurance sector in the year 2000 under the atal bihari vajpayee government when it allowed private sector firms to set up insurance companies and allowed fdi of 26 per cent. • insurance company • insurance brokers • third party administrators • surveyors and loss assessors • other insurance intermediaries.

Source: slideshare.net

Source: slideshare.net

Moreover, total fdi inflow grew by 65.3%, i.e. Service sector includes banking, insurance, outsourcing, research & development, courier and technology testing. Fdi limit in insurance sector was raised from 26% to 49% in 2014. There is no fdi allowed in insurance sector in india. Find out in which sectors fdi in india is permitted under the two routes of approval.

Source: meghainvestments.blogspot.com

Source: meghainvestments.blogspot.com

After that, for a long time, there were demands from the industry to further increase this cap to 49 per cent. Or mail your curiosities and queries to: By way of the amendment rules, the government of india allowed insurance intermediaries to be 100% foreign owned. Fdi in the telecom sector. Life insurance penetration in the country is 3.6 per cent of the gdp, way below the global average of 7.13 per cent, and in case of general insurance, it is even worse at 0.94 per cent of gdp, as against the world average of 2.88 per cent.

Source: slideshare.net

Source: slideshare.net

By way of the amendment rules, the government of india allowed insurance intermediaries to be 100% foreign owned. Further, fdi is also allowed to get into different routes, automatic and the government route. Evolution of fdi policy in defence. Service sector includes banking, insurance, outsourcing, research & development, courier and technology testing. As per current fdi norms the current fdi limit for insurance sector is 49%.

Source: slideshare.net

Source: slideshare.net

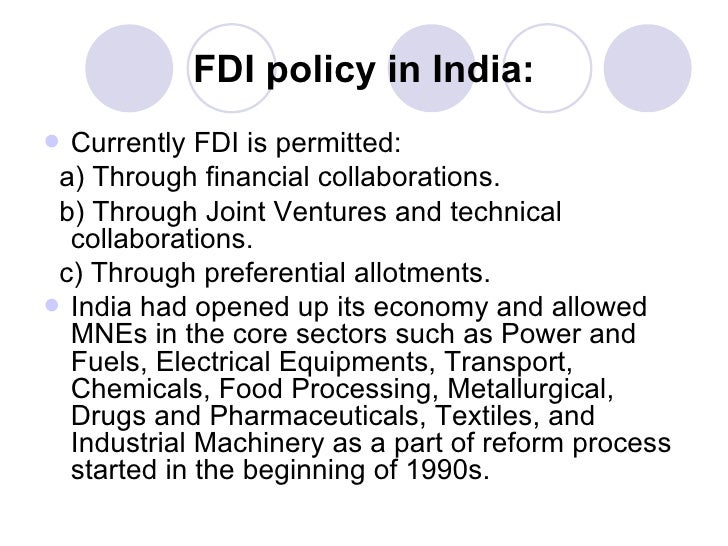

There are too many states and sectors to study and make an informed decision. Allowing higher fdi in insurance sector is expected to increase insurance penetration in the country. It was in 2015 when the government hiked the fdi cap in the insurance sector from 26 per cent to 49 per cent. Further, fdi is also allowed to get into different routes, automatic and the government route. The fdi policy in india has witnessed tons of changes and alterations in the past few years.

Source: slideshare.net

Source: slideshare.net

In the automatic route, the foreign entities are not require to obtain an approval before proceeding further. India first opened up the insurance sector in the year 2000 under the atal bihari vajpayee government when it allowed private sector firms to set up insurance companies and allowed fdi of 26 per cent. Fdi in insurance sector in india. Or mail your curiosities and queries to: • insurance company • insurance brokers • third party administrators • surveyors and loss assessors • other insurance intermediaries.

Source: slideshare.net

Source: slideshare.net

Fdi can meet india’s long term capital requirements to fund the building of infrastructures. The government may now allow up to 20% foreign investment in the insurer that plans to list by the end of this fiscal year. By way of the amendment rules, the government of india allowed insurance intermediaries to be 100% foreign owned. India allowed private companies in insurance sector in 2000, setting a limit on fdi to 26%, which was increased to 49% in 2014. Service sector includes banking, insurance, outsourcing, research & development, courier and technology testing.

Source: medhin1.blogspot.com

Source: medhin1.blogspot.com

There are too many states and sectors to study and make an informed decision. Above 49% and up to 100% through government route. India first opened up the insurance sector in the year 2000 under the atal bihari vajpayee government when it allowed private sector firms to set up insurance companies and allowed fdi of 26 per cent. Further, fdi is also allowed to get into different routes, automatic and the government route. Fdi in insurance sector in india.

Source: blog.investyadnya.in

Source: blog.investyadnya.in

Penetration of insurance in india; 100% foreign investment permitted in insurance intermediaries. Or mail your curiosities and queries to: There is no fdi allowed in insurance sector in india. Fdi under automatic route up to 49%;

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fdi allowed in insurance sector in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.