Your Fbar insurance policy images are available. Fbar insurance policy are a topic that is being searched for and liked by netizens today. You can Download the Fbar insurance policy files here. Get all royalty-free photos and vectors.

If you’re searching for fbar insurance policy images information related to the fbar insurance policy interest, you have pay a visit to the right blog. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Fbar Insurance Policy. An insurance policy with cash value is a “specified foreign financial account”, which is reported on form 8938. To such diseases, to fund the pure insurance coverage. Since there is some confusion on whether life insurance policies count as financial accounts and the highest value would have to be determined then determine if there is an fbar filing requirement, List the options are substantial.

FBAR Filing for Expats Expat Tax Online From expattaxonline.com

FBAR Filing for Expats Expat Tax Online From expattaxonline.com

Va aid and attendance pension benefit: Person, and the policy has a. Foreign pension accounts would qualify as foreign financial accounts and therefore would be included on the fbar. Generally, a foreign life insurance policy is simply a life insurance policy located overseas. First, a foreign life insurance policy qualifies as a nontaxable life insurance policy for purposes of fbar if it meets the cash value accumulation test. This includes reporting offshore accounts, assets, investments and life insurance.

Foreign life insurance policies are often not what they seem

Person if the person has more than $10,000 in annual aggregate total in their foreign accounts. Person owners of a foreign life insurance policy to report the policy annually, on an fbar. Is a foreign life insurance policy reportable? Posted on mar 29, 2017. The fbar filing now applies to foreign annuity policies and foreign life insurance policies that are owned by u.s. The fbar life insurance policy reporting rules have many components to it — and the reporting revolves around surrender value.

Source: irsstreamlinedprocedures.com

Source: irsstreamlinedprocedures.com

Taxpayers, and to some beneficiaries, along with u.s. Generally, a foreign life insurance policy is simply a life insurance policy located overseas. If the foreign insurance policy does not have a surrender or “cash” value, it may not be reportable. Not all life insurance policies are reported. A foreign life insurance policy is now reportable as a “foreign financial account” if the insurance policy is owned by a u.s.

Source: bfi-consulting.com

Source: bfi-consulting.com

Person if the person has more than $10,000 in annual aggregate total in their foreign accounts. The fbar life insurance policy reporting rules have many components to it — and the reporting revolves around surrender value. It is a form required to be filed annually by any u.s. Person if the person has more than $10,000 in annual aggregate total in their foreign accounts. Person, and the policy has a.

Source: slideshare.net

Source: slideshare.net

A foreign life insurance policy is now reportable as a “foreign financial account” if the insurance policy is owned by a u.s. In order to meet this test, the cash surrender may not exceed the net single premium to fund the future benefits of the life insurance contract. There is one type of policy that is intended to protect the insured for life. Person owners of a foreign life insurance policy to report the policy annually, on an fbar. The reporting requirement applies to the policy owner, if he/she is a u.s.

Source: mondaq.com

Source: mondaq.com

Person, and the policy has a. If you are subject to the fbar filing requirement, the 2010 fbar is due by june 30, 2011. Person, and the policy has a. In other words, if you have the ability to sell the policy now, that means it has a surrender value or value. Person and the policy has a cash surrender value.

Source: youtube.com

Source: youtube.com

The fbar is the report of foreign bank and financial account form. An insurance policy with a cash value (such as a whole life insurance policy), an annuity policy with a cash value, and shares in a mutual fund or similar pooled fund (i.e., a fund that is available to the general public with a regular net asset value. Prudential or icici policy in india; The fbar life insurance policy reporting rules have many components to it — and the reporting revolves around surrender value. Hi, if we have lic ( insurance) policy in india of minimum value, should we file fbar?

Source: formsbirds.com

Source: formsbirds.com

Taxpayers, and to some beneficiaries, along with u.s. The fbar life insurance policy reporting rules have many components to it — and the reporting revolves around surrender value. The fbar is required because foreign financial institutions may not be subject to the same reporting requirements as domestic financial institutions. In recent years, the internal revenue service has taken an aggressive approach to foreign accounts compliance. Is a foreign life insurance policy reportable?

Source: bfi-consulting.com

Source: bfi-consulting.com

The fbar is also a tool used by the united states government to identify persons who may be using foreign financial accounts to circumvent united states law. Is a foreign life insurance policy reportable? It is a form required to be filed annually by any u.s. Person if the person has more than $10,000 in annual aggregate total in their foreign accounts. Since there is some confusion on whether life insurance policies count as financial accounts and the highest value would have to be determined then determine if there is an fbar filing requirement,

Source: formsbirds.com

Source: formsbirds.com

Taxpayers, and to some beneficiaries of foreign trusts. Va aid and attendance pension benefit: Foreign life insurance policies are often not what they seem Taxpayers, and to some beneficiaries, along with u.s. Foreign pension accounts would qualify as foreign financial accounts and therefore would be included on the fbar.

Source: taxdefensenetwork.com

Source: taxdefensenetwork.com

Most of the united states tax payers are not aware of fbar filing, which is very much mandatory to report.since april 2013 fincen(financial crimes enforcement network) which is a bureau of department of treasury entitled to keenly analyse the foreign bank account transitions in order to contain. The fbar is the report of foreign bank and financial account form. What is a foreign life insurance policy? The thresholds are the following: The fbar life insurance policy reporting rules have many components to it — and the reporting revolves around surrender value.

Source: mondaq.com

Source: mondaq.com

For fbar reporting purposes, the cash surrender value of the policy is the value of the account. Prudential or icici policy in india; In other words, if you have the ability to sell the policy now, that means it has a surrender value or value. Fatca form 8938 fatca is the foreign account tax compliance act. Taxpayers, and to some beneficiaries, along with u.s.

Source: slideshare.net

Source: slideshare.net

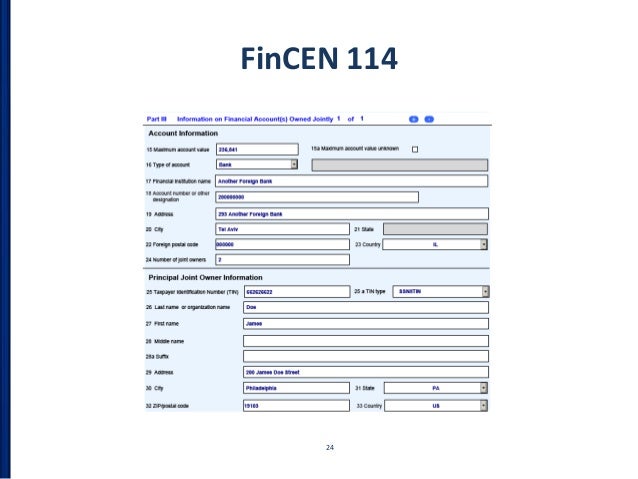

Fincen form 114 (fbar) you must include the life insurance in your fincen 114, also known as fbar, to report your foreign financial accounts. That is a very interesting question. And part of your australian superannuation. A foreign life insurance policy is reportable when it has a surrender value or cash value. An insurance policy with a cash value (such as a whole life insurance policy), an annuity policy with a cash value, and shares in a mutual fund or similar pooled fund (i.e., a fund that is available to the general public with a regular net asset value.

Source: bfi-consulting.com

Source: bfi-consulting.com

Foreign pension accounts would qualify as foreign financial accounts and therefore would be included on the fbar. Not all life insurance policies are reported. Do i report the insurance policy on an fbar or 8938. First, a foreign life insurance policy qualifies as a nontaxable life insurance policy for purposes of fbar if it meets the cash value accumulation test. A foreign life insurance policy is now reportable as a “foreign financial account” if the insurance policy is owned by a u.s.

Source: irsmedic.com

Source: irsmedic.com

If the foreign life insurance policy has a surrender or cash value, then the current year surrender or cash value (not the future payout value) is generally required to be included on the fbar. A foreign life insurance policy is reportable when it has a surrender value or cash value. List the options are substantial. Prudential or icici policy in india; Person, and the policy has a.

Source: alfredjordan.com

Source: alfredjordan.com

The fbar is required because foreign financial institutions may not be subject to the same reporting requirements as domestic financial institutions. An insurance policy with a cash value (such as a whole life insurance policy), an annuity policy with a cash value, and shares in a mutual fund or similar pooled fund (i.e., a fund that is available to the general public with a regular net asset value. In other words, if you have the ability to sell the policy now, that means it has a surrender value or value. Not all life insurance policies are reported. Since there is some confusion on whether life insurance policies count as financial accounts and the highest value would have to be determined then determine if there is an fbar filing requirement,

Source: 1040abroad.com

Source: 1040abroad.com

There is one type of policy that is intended to protect the insured for life. The fbar rules for reporting life insurance for foreign policies are very complex. If you are subject to the fbar filing requirement, the 2010 fbar is due by june 30, 2011. Fbar is the foreign bank and financial account form, otherwise known as fincen form 114. Generally, a foreign life insurance policy is simply a life insurance policy located overseas.

Source: crescenttaxfiling.com

Source: crescenttaxfiling.com

If the foreign life insurance policy has a surrender or cash value, then the current year surrender or cash value (not the future payout value) is generally required to be included on the fbar. Fatca form 8938 fatca is the foreign account tax compliance act. Posted on mar 29, 2017. The reporting requirement applies to the policy owner, if he/she is a u.s. Foreign pension accounts would qualify as foreign financial accounts and therefore would be included on the fbar.

Source: slideshare.net

Source: slideshare.net

It is a form required to be filed annually by any u.s. Va aid and attendance pension benefit: What amount to report in fbar about the foreign life insurance policy, is it the face value of the policy or cash surrender value if any? Fbar is the foreign bank and financial account form, otherwise known as fincen form 114. The fbar is the report of foreign bank and financial account form.

Source: expattaxonline.com

Source: expattaxonline.com

Fbar stands for “foreign bank account reporting”. The downside for those who have foreign life insurance policies, is that there may be punitive fbar tax penalties imposed by the irs for not reporting the life insurance policies correctly. Person, and the policy has a. The fbar filing now applies to foreign annuity policies and foreign life insurance policies that are owned by u.s. Fatca form 8938 fatca is the foreign account tax compliance act.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fbar insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.