Your Farmers term life insurance images are ready. Farmers term life insurance are a topic that is being searched for and liked by netizens today. You can Get the Farmers term life insurance files here. Get all free images.

If you’re searching for farmers term life insurance images information related to the farmers term life insurance interest, you have pay a visit to the right site. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly surf and locate more informative video content and images that fit your interests.

Farmers Term Life Insurance. The value term plan offers a level, guaranteed death benefit amount, as well as a premium that is locked in and cannot increase the duration of the policy. Protective life insurance gives consumers the choice of both level term and decreasing term life insurance, with options for 10, 15, 20, 25, or 30 years. Farmers new world life is not licensed and does not solicit or sell in the state of new york. Term life insurance term life is a type of life insurance policy where premiums remain level for a specified period of time — generally for 10, 20 or 30 years.

Farmers Insurance Reviews Real Customer Reviews From bestcompany.com

Farmers Insurance Reviews Real Customer Reviews From bestcompany.com

The term length of the policy varies depending on the policy you choose. Life insurance issued by farmers new world life insurance company, a washington domestic company: Life insurance issued by farmers new world life insurance company, a washington domestic company: Protective life insurance gives consumers the choice of both level term and decreasing term life insurance, with options for 10, 15, 20, 25, or 30 years. Its life insurance products are all listed on the website of its parent company farmers insurance. Because term life insurance is designed to be kept for a shorter amount of time compared to permanent life insurance plans, term.

Farmers life insurance reviews and complaints.

Rates current as of 2/1/2022. Get your term life insurance quote, or contact an agent. State farm select term life insurance product. Term life insurance plans do not build cash value but pay a guaranteed death benefit. Its customer review section has 106 reviews, but the average rating is a low 1.5 out of 5 stars. Ad affordable, flexible term life insurance at your pace.

Source: pinterest.com

Source: pinterest.com

State farm select term life insurance product. Its life insurance products are all listed on the website of its parent company farmers insurance. Term life insurance plans do not build cash value but pay a guaranteed death benefit. Conversion option may be available for carriers that offer and. Protective life insurance gives consumers the choice of both level term and decreasing term life insurance, with options for 10, 15, 20, 25, or 30 years.

Source: writeopinions.com

Source: writeopinions.com

Rates current as of 2/1/2022. Its life insurance products are all listed on the website of its parent company farmers insurance. Farmers new world life is not licensed and does not solicit or sell in the state of new york. Term life insurance provides death protection for a stated time period, or term. Life insurance coverage at a glance.

Source: ancsakonyhaja.blogspot.com

Source: ancsakonyhaja.blogspot.com

New york life term life insurance rates and ratings comparison chart vs competitors for: Perhaps this is an option you may want to consider. Life insurance issued by farmers new world life insurance company, a washington domestic company: Ad affordable, flexible term life insurance at your pace. $100k, $250k, $500k, $1 million, monthly premiums.

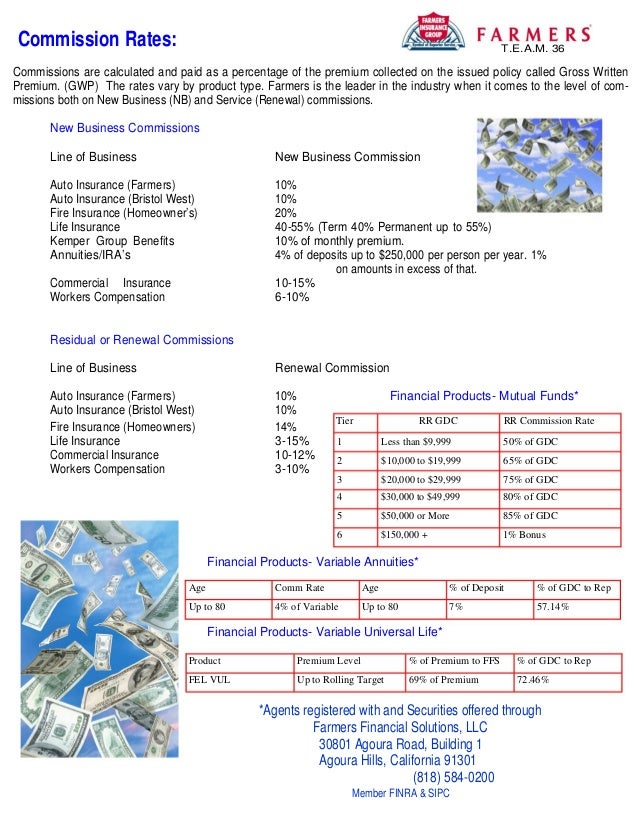

Source: slideshare.net

Source: slideshare.net

Rates current as of 2/1/2022. Term life insurance provides death protection for a stated time period, or term. At farmers insurance, there are various term life insurance options from which to choose. Rates current as of 2/1/2022. $100k, $250k, $500k, $1 million, monthly premiums.

Source: pinterest.com

Source: pinterest.com

Because term life insurance is designed to be kept for a shorter amount of time compared to permanent life insurance plans, term. 6’0’’ 170 lbs excellent health, no tobacco use. Coverage amounts start at $75,000,. Term life insurance provides a sum (also called death benefit) if you, the insured, die during a predetermined period of time (the “term”). The value term plan offers a level, guaranteed death benefit amount, as well as a premium that is locked in and cannot increase the duration of the policy.

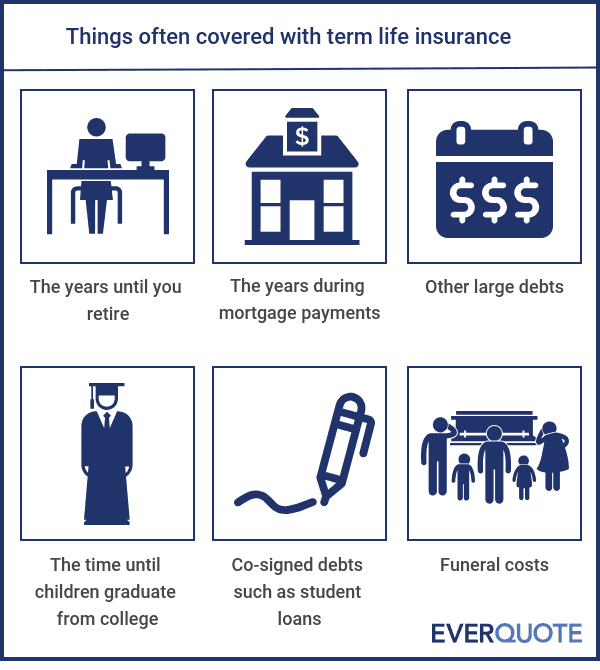

Source: investopedia.com

Source: investopedia.com

The term length of the policy varies depending on the policy you choose. Coverage amounts start at $75,000,. Rates current as of 2/1/2022. Whether you�re looking for the affordability of term insurance, the lifelong protection and cash value of permanent insurance, or a combination of both, we have options to fit your needs and budget. State farm select term life insurance product.

Source: quote.com

Source: quote.com

6’0’’ 170 lbs excellent health, no tobacco use. $100k, $250k, $500k, $1 million, monthly premiums. 300 bellevue, wa 98005 (ca#: Its life insurance products are all listed on the website of its parent company farmers insurance. Get your term life insurance quote, or contact an agent.

Source: youtube.com

Source: youtube.com

Farmers new world life is not licensed and does not solicit or sell in the state of new york. Farmers life insurance reviews and complaints. Life insurance coverage at a glance. Enter your zip code below to view companies that have cheap insurance rates. Farmers new world life insurance company offers three types of life insurance — and each has unique characteristics:

Source: besttravelassistance.net

Source: besttravelassistance.net

Term life insurance provides a sum (also called death benefit) if you, the insured, die during a predetermined period of time (the “term”). Life insurance issued by farmers new world life insurance company, a washington domestic company: Whether you�re looking for the affordability of term insurance, the lifelong protection and cash value of permanent insurance, or a combination of both, we have options to fit your needs and budget. Enter your zip code below to view companies that have cheap insurance rates. Its life insurance products are all listed on the website of its parent company farmers insurance.

![Famers Whole Life Insurance Review [Not Your Best Bet] Famers Whole Life Insurance Review [Not Your Best Bet]](https://2l27cd2bdspu43ihba1hjyq4-wpengine.netdna-ssl.com/wp-content/uploads/2017/05/Farmers_WL_Review_1.jpg) Source: topwholelife.com

Source: topwholelife.com

Life insurance coverage at a glance. On average, most people purchase term life insurance plans that run between 10 and 30 years, at prices of around $30 a month. Coverage continues as long as the premiums are paid. The company earns an a+ rating with the better business bureau (bbb) as of october 2020 and is accredited by the agency. State farm select term life insurance product.

![Farmers Life Insurance Review [Solid Financial Ratings] Farmers Life Insurance Review [Solid Financial Ratings]](https://www.savingfreak.com/wp-content/uploads/farmers-life-insurance-compay-review.jpg) Source: savingfreak.com

Source: savingfreak.com

These include the simple term life and the value term. Life insurance issued by farmers new world life insurance company, a washington domestic company: After the end of the level premium period, premiums will. Protective life insurance gives consumers the choice of both level term and decreasing term life insurance, with options for 10, 15, 20, 25, or 30 years. Conversion option may be available for carriers that offer and.

Source: christiansinbusiness.com

Source: christiansinbusiness.com

Farmers new world life is not licensed and does not solicit or sell in the state of new york. At farmers insurance, there are various term life insurance options from which to choose. After the end of the level premium period, premiums will generally increase. 300 bellevue, wa 98005 (ca#: Get your term life insurance quote, or contact an agent.

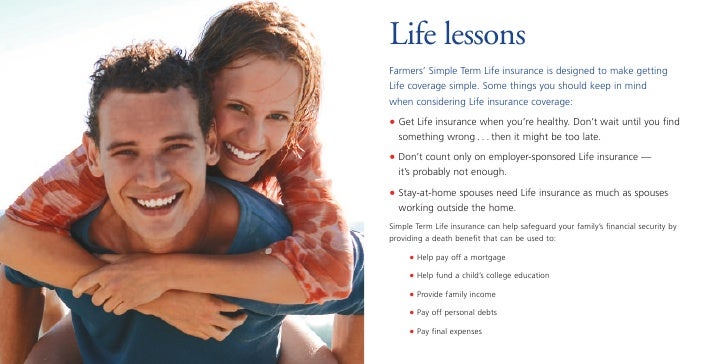

Source: farmers.com

Source: farmers.com

Ad affordable, flexible term life insurance at your pace. New york life term life insurance rates and ratings comparison chart vs competitors for: The value term plan offers a level, guaranteed death benefit amount, as well as a premium that is locked in and cannot increase the duration of the policy. Term life insurance plans do not build cash value but pay a guaranteed death benefit. The company earns an a+ rating with the better business bureau (bbb) as of october 2020 and is accredited by the agency.

Source: farmers.com

Source: farmers.com

Farmers new world life is not licensed and does not solicit or sell in the state of new york. Whether you�re looking for the affordability of term insurance, the lifelong protection and cash value of permanent insurance, or a combination of both, we have options to fit your needs and budget. After the end of the level premium period, premiums will. Life insurance issued by farmers new world life insurance company, a washington domestic company: After the end of the level premium period, premiums will generally increase.

Source: archstoneinsurance.com

Source: archstoneinsurance.com

Term life insurance provides death protection for a stated time period, or term. Term life insurance provides death protection for a stated time period, or term. Rates current as of 2/1/2022. Enter your zip code below to view companies that have cheap insurance rates. Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years.

Source: slideshare.net

Source: slideshare.net

After the end of the level premium period, premiums will generally increase. Term life is a type of life insurance policy where premiums remain level for a specified period of time —generally for 10, 20 or 30 years. 300 bellevue, wa 98005 (ca#: Life insurance issued by farmers new world life insurance company, a washington domestic company: Life insurance issued by farmers new world life insurance company, a washington domestic company:

Source: pinterest.com

Source: pinterest.com

300 bellevue, wa 98005 (ca#: Term life insurance plans do not build cash value but pay a guaranteed death benefit. Term life insurance provides a sum (also called death benefit) if you, the insured, die during a predetermined period of time (the “term”). Rates current as of 2/1/2022. Decide which coverage is right for you before getting a life insurance quote.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title farmers term life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.