Your Farmers market liability insurance images are ready in this website. Farmers market liability insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Farmers market liability insurance files here. Download all free photos.

If you’re searching for farmers market liability insurance images information connected with to the farmers market liability insurance interest, you have come to the ideal blog. Our site always provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

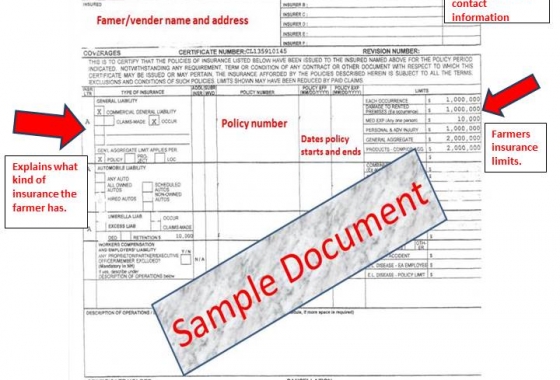

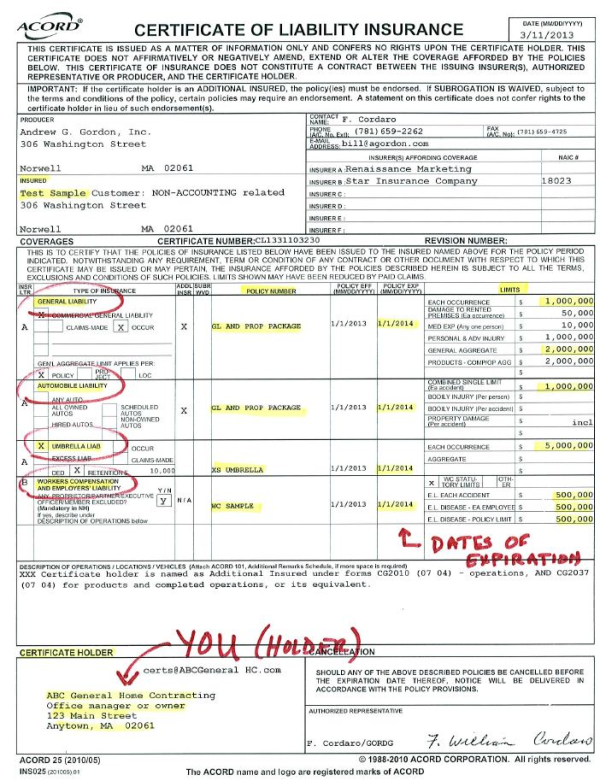

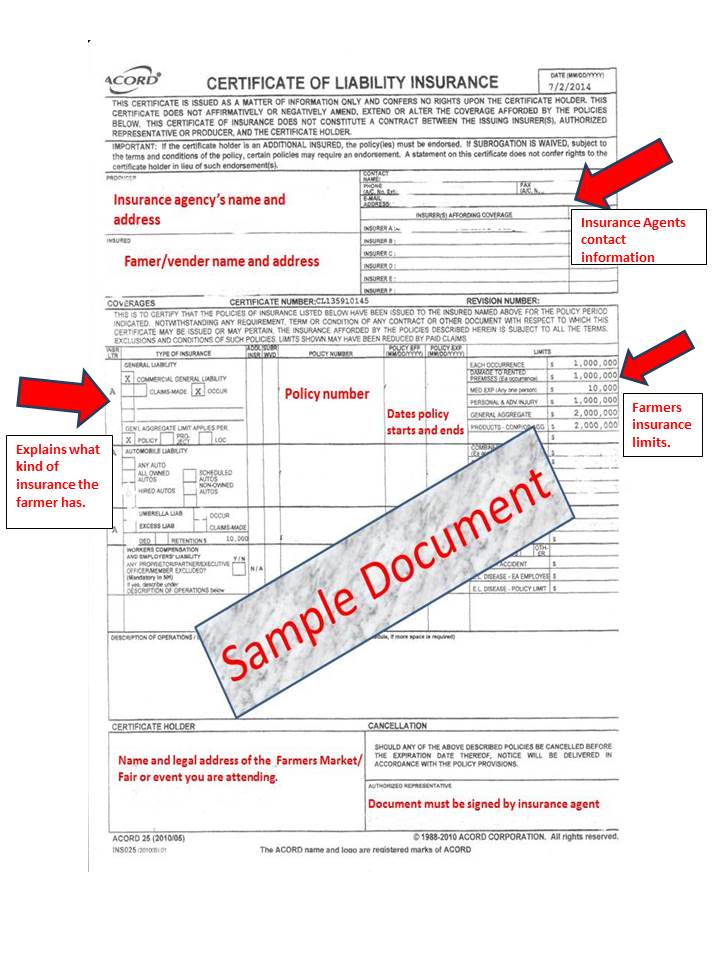

Farmers Market Liability Insurance. That said, here are some average farmers market vendor insurance quotes from some of the best farmers market insurance companies in america: For more detailed information on. Insurance is a cost of doing business in today’s marketplace. If someone purchases produce or baked goods from you, develops a food borne illness, and files a lawsuit against you, claiming that the food you sold him or her was the cause of illness, product liability insurance would protect you.

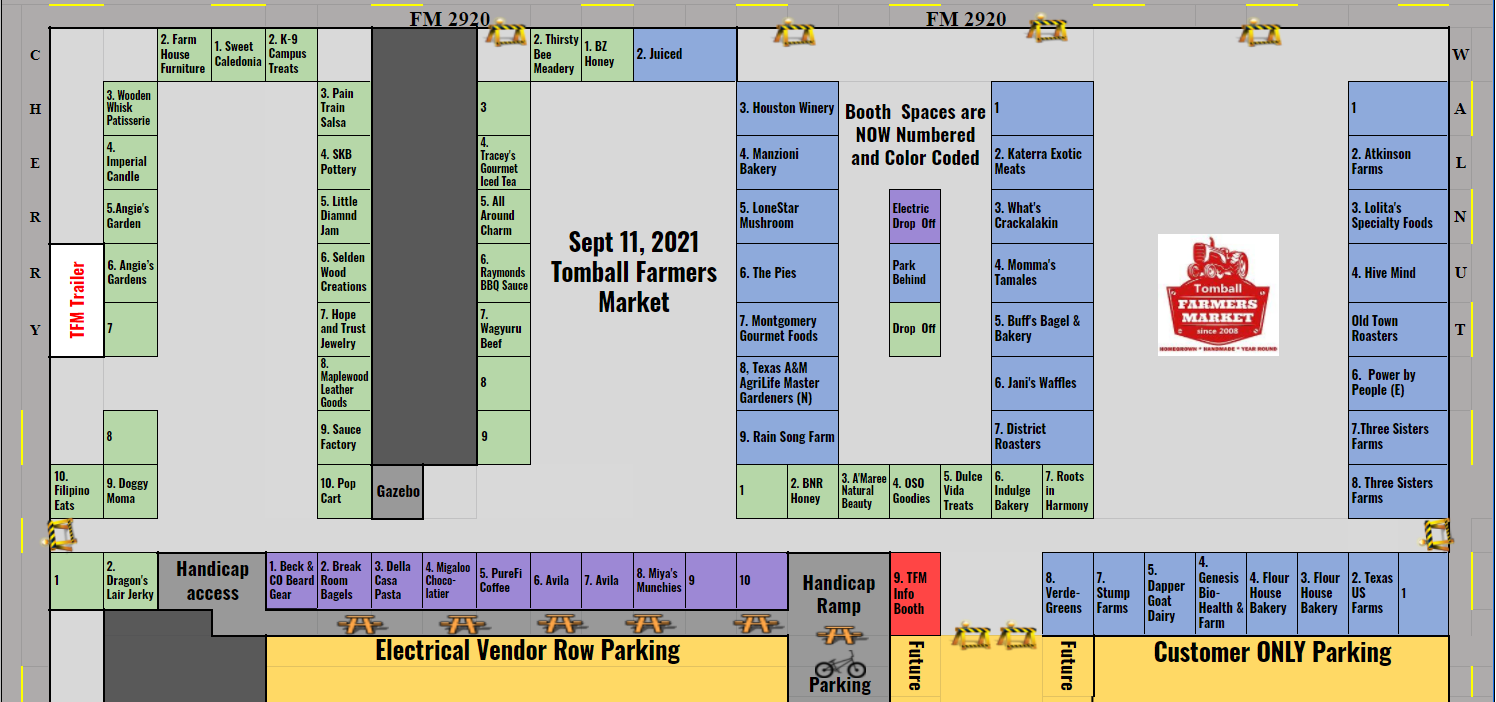

Farmers Market Vendor Booth Guide Farmers Market Coalition From farmersmarketcoalition.org

Farmers Market Vendor Booth Guide Farmers Market Coalition From farmersmarketcoalition.org

If you are a farmers market owner, organizer or manager and are needing the insurance the farmers market itself, campbell risk management understands your unique general liability exposures, coverage needs and personal concerns. Farmers should contact the department of agriculture in their own state to confirm the specific minimum liability insurance requirements for farmers markets. Our vendor insurance for farmers’ markets policy covers the following: Damage to the rented premises such as a vendor painting his booth with permanent paint. This means you will able to provide value and nourishment to your community for years to come. Insurance is a cost of doing business in today’s marketplace.

Our farmers market is requiring 1,000,000 liability insurance this year because of all the food claims that have been made regarding vegetables/produce.

Liability insurance for artists and crafters who sell at farmers’ markets. Damage to the rented premises such as a vendor painting his booth with permanent paint. If someone purchases produce or baked goods from you, develops a food borne illness, and files a lawsuit against you, claiming that the food you sold him or her was the cause of illness, product liability insurance would protect you. As an artist or crafter, you may be missing out on potential sales by not attending certain events that are growing in popularity. Commercial general liability insurance for businesses. We understand the insurance that land owners and municipalities are requiring you.

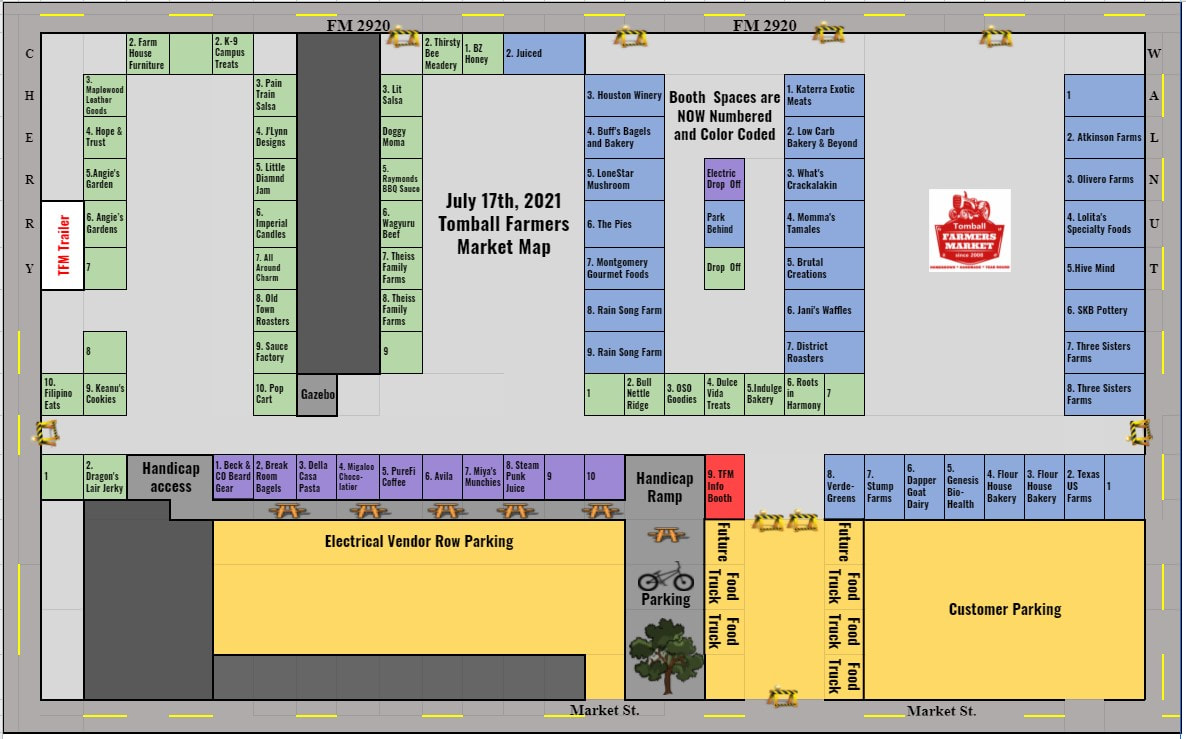

Source: tomballfarmersmarket.org

Source: tomballfarmersmarket.org

This means you will able to provide value and nourishment to your community for years to come. Because every farmers agent is also a small business owner, each. This means you will able to provide value and nourishment to your community for years to come. Damage to other people’s property. All approved farmers’ markets, regardless of size, must obtain liability insurance.

Source: tomballfarmersmarket.org

Source: tomballfarmersmarket.org

A farmers market that handles food products extensively itself (that is, the market itself sells a considerable amount of food, rather than or in addition to vendors) might consider product liability insurance to cover its own products as well. The average farmers market insurance cost is about $35 per month or $420 per year for a $1 million dollar general liability insurance for farmers market vendors. To manage this risk, wsfma member farmers markets are required to have general commercial liability insurance so that you are protected against physical injury to people or damage to property arising from your daily operation. Market organizers can download and fill out the below application, then submit it to dyer insurance group, and expect a quote back in a couple of days. Farmers markets are usually held, with permission, in the parking lots of established businesses.

Source: tomballfarmersmarket.org

Source: tomballfarmersmarket.org

Farmers’ market insurance is a type of event insurance covering liability claims that can occur from organizing the event. What is public liability insurance for farmers market? Liability insurance for artists and crafters who sell at farmers’ markets. Farmers should contact the department of agriculture in their own state to confirm the specific minimum liability insurance requirements for farmers markets. Farmers markets are usually held, with permission, in the parking lots of established businesses.

Source: tomballfarmersmarket.org

Source: tomballfarmersmarket.org

Failure to obtain insurance will lead to the market approval status being revoked. I did find a business liability policy through a local independent insurance agent that costs $333 a year. All approved farmers’ markets, regardless of size, must obtain liability insurance. For more detailed information on. Download the farmers market insurance application.

Source: backyardriches.com

Source: backyardriches.com

While these businesses are likely to carry premises liability insurance, they frequently require those running the farmers market to purchase premises liability insurance as well. So you might want to check with an independent insurance agent. When you operate at a farmers market, you are liable if injuries, illnesses, or damages happen due to your business operations. Because every farmers agent is also a small business owner, each. Farmers’ market insurance 1) farmers’ market commercial general liability insurance as a farmers’ market member of the bcafm your market may be eligible to access a group rate on farmers’ market insurance starting at $350 per annum for up.

Source: hilofarmersmarket.com

Source: hilofarmersmarket.com

A farmers market that handles food products extensively itself (that is, the market itself sells a considerable amount of food, rather than or in addition to vendors) might consider product liability insurance to cover its own products as well. Liability insurance should be a part of every direct market business to help reduce any possible legal and financial burdens that may arise from an injury or other claim brought against your business. I did find a business liability policy through a local independent insurance agent that costs $333 a year. This means you will able to provide value and nourishment to your community for years to come. Liability insurance for farmers markets and for vendors is important because it:

Source: tomballfarmersmarket.org

Source: tomballfarmersmarket.org

Does a market engaging directly in the aggregation and handling of food for The average farmers market insurance cost is about $35 per month or $420 per year for a $1 million dollar general liability insurance for farmers market vendors. The insurance provides markets with $1,000,000 in general liability per occurrence with a $2,000,000 annual aggregate limit for market location(s). If someone purchases produce or baked goods from you, develops a food borne illness, and files a lawsuit against you, claiming that the food you sold him or her was the cause of illness, product liability insurance would protect you. A farmers market that handles food products extensively itself (that is, the market itself sells a considerable amount of food, rather than or in addition to vendors) might consider product liability insurance to cover its own products as well.

Source: fliprogram.tumblr.com

Source: fliprogram.tumblr.com

Failure to obtain insurance will lead to the market approval status being revoked. We understand the insurance that land owners and municipalities are requiring you. That’s why farmers® offers small business general liability insurance, which can help with challenging situations and the associated costs of legal defense and legal damages, up to policy limits selected for covered claims. Insurance is a cost of doing business in today’s marketplace. Farmers’ market insurance 1) farmers’ market commercial general liability insurance as a farmers’ market member of the bcafm your market may be eligible to access a group rate on farmers’ market insurance starting at $350 per annum for up.

Source: swautoinsurancequotae.blogspot.fr

Source: swautoinsurancequotae.blogspot.fr

I did find a business liability policy through a local independent insurance agent that costs $333 a year. What is public liability insurance for farmers market? Damage to the rented premises such as a vendor painting his booth with permanent paint. Our vendor insurance for farmers’ markets policy covers the following: The farmers market public liability insurance policy protects you against claims in respect of your legal liability for personal injury or property damage sustained by third parties arising during the course of your business.

Source: fliprogram.tumblr.com

Source: fliprogram.tumblr.com

In 2010 the farmers market coalition worked with campbell risk management (crm) to create an affordable farmers market liability policy to support our members. The farmers market public liability insurance policy protects you against claims in respect of your legal liability for personal injury or property damage sustained by third parties arising during the course of your business. Damage to other people’s property. General liability insurance protects businesses from property owners, customers or other potential claimants, and helps businesses focus on risk assessment, food safety, and good operating practices. The insurance provides markets with $1,000,000 in general liability per occurrence with a $2,000,000 annual aggregate limit for market location(s).

Source: campbellriskmanagement.com

Source: campbellriskmanagement.com

Unfortunately, regular farmers markets activities include risks to customers and property. Should an accident happen, the whole program could be at risk. General liability insurance protects businesses from property owners, customers or other potential claimants, and helps businesses focus on risk assessment, food safety, and good operating practices. In 2010 the farmers market coalition worked with campbell risk management (crm) to create an affordable farmers market liability policy to support our members. That said, here are some average farmers market vendor insurance quotes from some of the best farmers market insurance companies in america:

Source: farmersmarketcoalition.org

Source: farmersmarketcoalition.org

If, in addition to your arts and crafts, you sell food products, you should consider our food liability insurance program (flip). Private markets on private property may not necessarily require that farmers / vendors carry liability insurance although it’s still a good idea to do so. Liability insurance for farmers markets protects your market from liability. A farmers market that handles food products extensively itself (that is, the market itself sells a considerable amount of food, rather than or in addition to vendors) might consider product liability insurance to cover its own products as well. That said, here are some average farmers market vendor insurance quotes from some of the best farmers market insurance companies in america:

Source: backyardriches.com

Source: backyardriches.com

Liability insurance for farmers markets protects your market from liability. Our farmers market is requiring 1,000,000 liability insurance this year because of all the food claims that have been made regarding vegetables/produce. So you might want to check with an independent insurance agent. Download the farmers market insurance application. Damage to the rented premises such as a vendor painting his booth with permanent paint.

Source: tomballfarmersmarket.org

Source: tomballfarmersmarket.org

Event liability (bodily injury & property damage) tenants’ legal liability; Liability issues resulting in lawsuits are becoming more common. Liability insurance should be a part of every direct market business to help reduce any possible legal and financial burdens that may arise from an injury or other claim brought against your business. All approved farmers’ markets, regardless of size, must obtain liability insurance. So you might want to check with an independent insurance agent.

Source: mycentraljersey.com

Source: mycentraljersey.com

A few types of insurance are discussed below. As an artist or crafter, you may be missing out on potential sales by not attending certain events that are growing in popularity. That’s why farmers® offers small business general liability insurance, which can help with challenging situations and the associated costs of legal defense and legal damages, up to policy limits selected for covered claims. All approved farmers’ markets, regardless of size, must obtain liability insurance. When you operate at a farmers market, you are liable if injuries, illnesses, or damages happen due to your business operations.

Source: tomballfarmersmarket.org

Source: tomballfarmersmarket.org

That said, here are some average farmers market vendor insurance quotes from some of the best farmers market insurance companies in america: Because every farmers agent is also a small business owner, each. That said, here are some average farmers market vendor insurance quotes from some of the best farmers market insurance companies in america: Our farmers market is requiring 1,000,000 liability insurance this year because of all the food claims that have been made regarding vegetables/produce. When you operate at a farmers market, you are liable if injuries, illnesses, or damages happen due to your business operations.

Source: weeksinsurance.com

Source: weeksinsurance.com

The insurance provides markets with $1,000,000 in general liability per occurrence with a $2,000,000 annual aggregate limit for market location(s). This insurance protects vendors and owners from liabilities arising from illnesses or injuries caused due to the products sold in the market. In 2010 the farmers market coalition worked with campbell risk management (crm) to create an affordable farmers market liability policy to support our members. Should an accident happen, the whole program could be at risk. Damage to the rented premises such as a vendor painting his booth with permanent paint.

Source: secura.net

Source: secura.net

If someone purchases produce or baked goods from you, develops a food borne illness, and files a lawsuit against you, claiming that the food you sold him or her was the cause of illness, product liability insurance would protect you. Medical payments* *we offer limited coverage for medical expenses incurred. A farmers market that handles food products extensively itself (that is, the market itself sells a considerable amount of food, rather than or in addition to vendors) might consider product liability insurance to cover its own products as well. Farmers markets are usually held, with permission, in the parking lots of established businesses. Unfortunately, regular farmers markets activities include risks to customers and property.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title farmers market liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.