Your Farmers market insurance images are available. Farmers market insurance are a topic that is being searched for and liked by netizens now. You can Get the Farmers market insurance files here. Download all royalty-free vectors.

If you’re looking for farmers market insurance images information linked to the farmers market insurance interest, you have come to the ideal site. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

Farmers Market Insurance. The average farmers market insurance cost is about $35 per month or $420 per year for a $1 million dollar general liability insurance for farmers market vendors. Vendors click here to get a live quote and get started. Damage to the rented premises such as a vendor painting his booth with permanent paint. Flip offers farmers market insurance starting at only $299 per year.

Farmers Insurance Exterior Signs and Indoor Graphics From cityscoop.us

Farmers Insurance Exterior Signs and Indoor Graphics From cityscoop.us

If you are a farmers market owner, organizer or manager and are needing the insurance the farmers market itself, campbell risk management understands your unique general liability exposures, coverage needs and personal concerns. With flip, you�ll receive general and product liability coverage. The average farmers market insurance cost is about $35 per month or $420 per year for a $1 million dollar general liability insurance for farmers market vendors. Damage to other people’s property. Buy farmers market insurance online in minutes. We’ll even send a copy of your proof of insurance directly to the event organizer!

What does farmers’ market insurance cover?

Covered claims may include slip and fall accidents, illnesses caused by food products, or equipment loss. Our farmers market insurance provides coverage for. If your product is in transit to a farmers market, you�ll need insurance on it in case there is a loss due to an accident, or temperature control goes out and the like. What does farmers’ market insurance cover? There are several types of farmers market insurance coverage that proprietors and vendors should carry, including: Most event organizers will require an exhibitor to purchase vendor insurance for their farmers’ market before the big day.

Source: nextinsurance.com

Source: nextinsurance.com

Product & public liability included in all policies. The average cost of a $1,000,000/$2,000,000 general liability insurance policy for farmers market vendors is approximately $35 per month, or $420 per. Flip offers farmers market insurance starting at only $299 per year. If you’re running a farmers market, your business property most likely consists of the booths that you rent out and perhaps a computer system. Covered claims may include slip and fall accidents, illnesses caused by food products, or equipment loss.

Source: thezebra.com

Source: thezebra.com

Protect your business with the food liability insurance program (flip). Damage to other people’s property. We’ll even send a copy of your proof of insurance directly to the event organizer! Insurance for the market / venue owner. Having a conversation with your independent insurance agent regarding the different stages of coverage and how they will apply will give you useful information.

Source: investopedia.com

Source: investopedia.com

It also provides investigation services and defense against claims, including those that may be false or fraudulent. Apply and purchase online many farmers markets require vendors to add the event or farmers market manager as an. What does farmers’ market insurance cover? An attorney in the event the market is sued, so that the farmers market has access to the expertise necessary to defend against the lawsuit; The average farmers market insurance cost is about $35 per month or $420 per year for a $1 million dollar general liability insurance for farmers market vendors.

![]() Source: purepng.com

Source: purepng.com

Farmers markets’ insurance limits vary with the amount of risk they are exposed and should consider the number of vendors, shoppers, market days, and other factors. Our policy protects organisers and attendees from public liability claims and more. Insurance for the market / venue owner. The minnesota farmers’ market association offers a group insurance policy exclusively for mfma member markets and mfma member vendors through advantage 1 insurance agency. Product & public liability included in all policies.

Source: npa1.org

Source: npa1.org

If you’re running a farmers market, your business property most likely consists of the booths that you rent out and perhaps a computer system. Farmers’ market insurance can also provide coverage for. Instant coverage for farmers markets and vendors starting at only. We’ll even send a copy of your proof of insurance directly to the event organizer! In 2010 the farmers market coalition worked with campbell risk management (crm) to create an affordable farmers market liability policy to support our members.

Source: cityscoop.us

Source: cityscoop.us

Complete public liability protection for farmers markets & other events from just £40. Good insurance provides farmers markets with: If your product is in transit to a farmers market, you�ll need insurance on it in case there is a loss due to an accident, or temperature control goes out and the like. Market managers click to get a quote to insure your market. With flip, you�ll receive general and product liability coverage.

Source: ocnjdaily.com

Source: ocnjdaily.com

Farmers market insurance is an incredibly valuable tool to manage these risks. Farmers markets’ insurance limits vary with the amount of risk they are exposed and should consider the number of vendors, shoppers, market days, and other factors. Flip offers farmers market insurance starting at only $299 per year. Our farmers market insurance provides coverage for. Annual cover $149 for $10 million or $200 for $20 million.

Source: npa1.org

Source: npa1.org

Farmers markets’ insurance limits vary with the amount of risk they are exposed and should consider the number of vendors, shoppers, market days, and other factors. With flip, you�ll receive general and product liability coverage. The average farmers market insurance cost is about $35 per month or $420 per year for a $1 million dollar general liability insurance for farmers market vendors. Insurance for the market / venue owner. If you are a farmers market owner, organizer or manager and are needing the insurance the farmers market itself, campbell risk management understands your unique general liability exposures, coverage needs and personal concerns.

Source: insurancefraudgeorgiatekagoro.blogspot.com

Source: insurancefraudgeorgiatekagoro.blogspot.com

Buy farmers market insurance online in minutes. 3 month pop up retail shop cover (same rates as annual cover) * see “faq” for more details. Insurance for the market / venue owner. Farmers market insurance is an incredibly valuable tool to manage these risks. Rates for farmers market insurance can vary based on a number of different factors, including:

Source: tripsavvy.com

Source: tripsavvy.com

That said, here are some average farmers market vendor insurance quotes from some of the best farmers market insurance companies in america: Having a conversation with your independent insurance agent regarding the different stages of coverage and how they will apply will give you useful information. Flip offers farmers market insurance starting at only $299 per year. Additional cover for home & internet sales. Damage to the rented premises such as a vendor painting his booth with permanent paint.

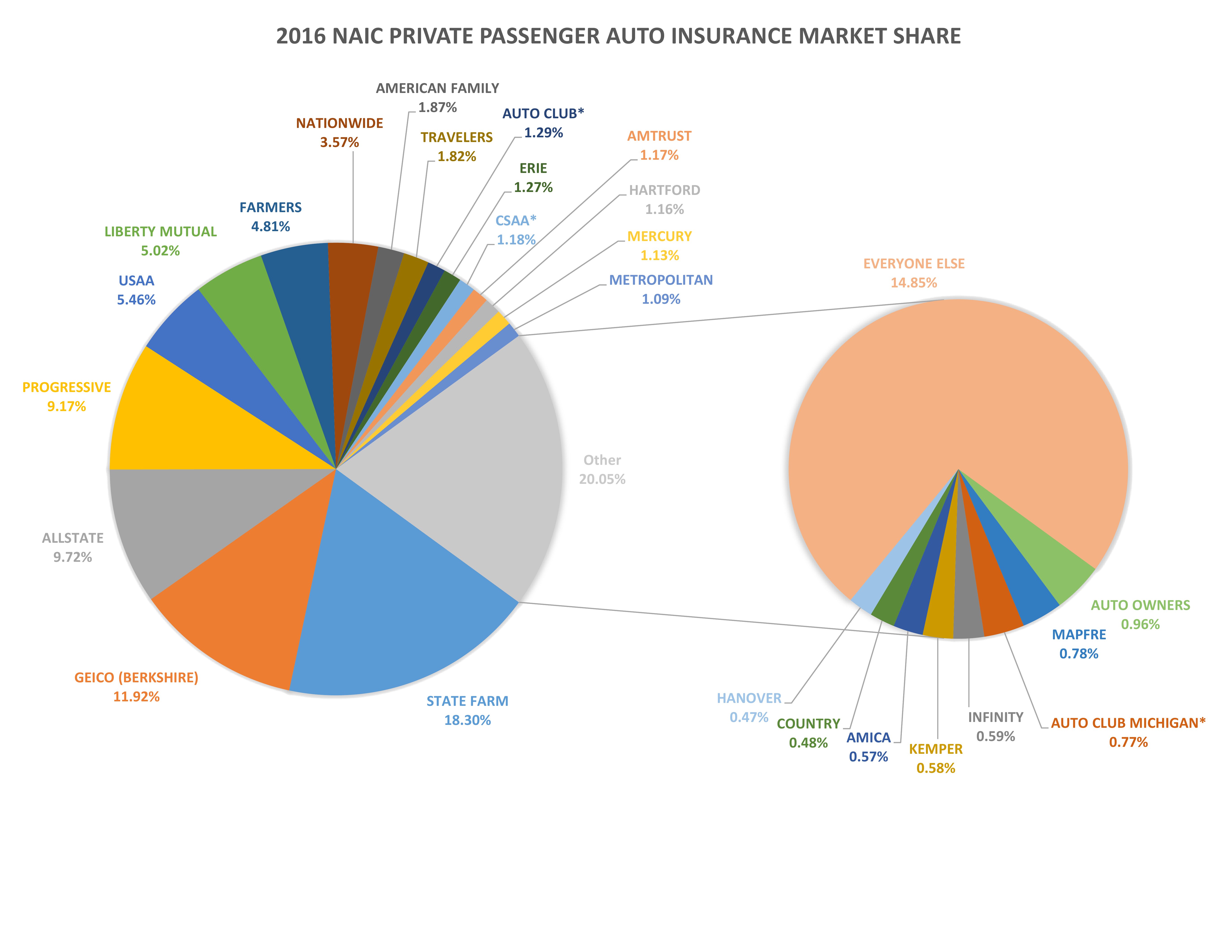

Source: repairerdrivennews.com

Source: repairerdrivennews.com

It also provides investigation services and defense against claims, including those that may be false or fraudulent. If, in addition to your arts and crafts, you sell food products, you should consider our food liability insurance program (flip). Instant coverage for farmers markets and vendors starting at only. Farmers market insurance is an incredibly valuable tool to manage these risks. Insurance for the market / venue owner.

Source: prnewswire.com

Source: prnewswire.com

First off, you should know that farmers’ market insurance is a kind of special event coverage that protects policyholders from the financial consequences associated with organizing farmers’ markets. Market managers click to get a quote to insure your market. Farmers’ market insurance 1) farmers’ market commercial general liability insurance as a farmers’ market member of the bcafm your market may be eligible to access a group rate on farmers’ market insurance starting at $350 per annum for. We understand the insurance that land owners and municipalities are requiring you. Protect your business with the food liability insurance program (flip).

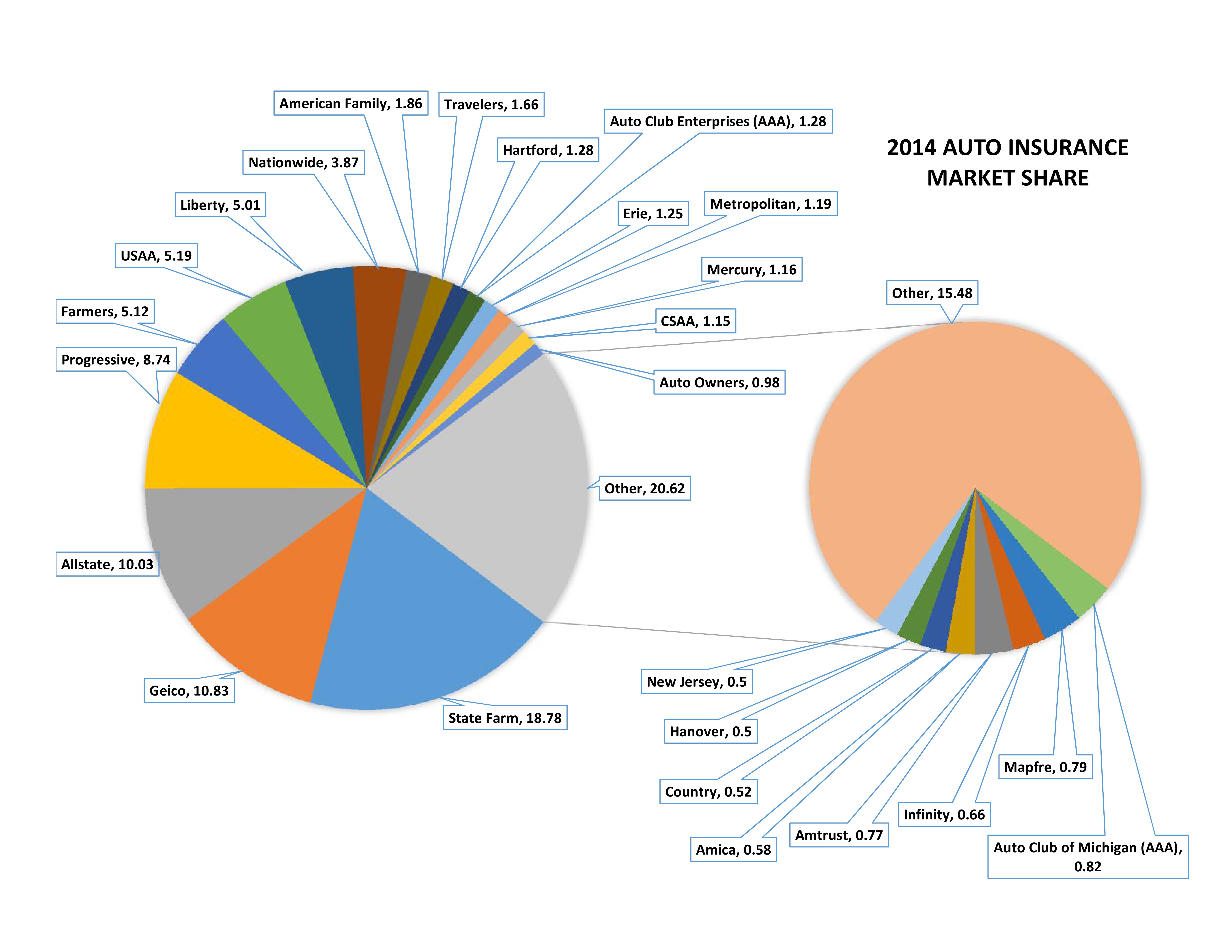

Source: repairerdrivennews.com

Source: repairerdrivennews.com

The average farmers market insurance cost is about $35 per month or $420 per year for a $1 million dollar general liability insurance for farmers market vendors. Farmers’ market insurance can also provide coverage for. Complete public liability protection for farmers markets & other events from just £40. The average cost of a $1,000,000/$2,000,000 general liability insurance policy for farmers market vendors is approximately $35 per month, or $420 per. There are several types of farmers market insurance coverage that proprietors and vendors should carry, including:

Source: weeksinsurance.com

Source: weeksinsurance.com

Most event organizers will require an exhibitor to purchase vendor insurance for their farmers’ market before the big day. We’ll even send a copy of your proof of insurance directly to the event organizer! Good insurance provides farmers markets with: Flip offers farmers market insurance starting at only $299 per year. Covered claims may include slip and fall accidents, illnesses caused by food products, or equipment loss.

Source: tripsavvy.com

Source: tripsavvy.com

With flip, you�ll receive general and product liability coverage. Vendors click here to get a live quote and get started. Our policy protects organisers and attendees from public liability claims and more. Farmers market insurance is an incredibly valuable tool to manage these risks. Apply and purchase online many farmers markets require vendors to add the event or farmers market manager as an.

Source: secura.net

Source: secura.net

Farmers’ market insurance is a type of event insurance covering liability claims that can occur from organizing the event. Good insurance provides farmers markets with: Having a conversation with your independent insurance agent regarding the different stages of coverage and how they will apply will give you useful information. Insurance for the market / venue owner. Apply and purchase online many farmers markets require vendors to add the event or farmers market manager as an.

Source: meheartpilipinas.blogspot.com

Source: meheartpilipinas.blogspot.com

Damage to the rented premises such as a vendor painting his booth with permanent paint. Vendors click here to get a live quote and get started. Damage to the rented premises such as a vendor painting his booth with permanent paint. As an artist or crafter, you may be missing out on potential sales by not attending certain events that are growing in popularity. Our insurance packages typically include:

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title farmers market insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.