Your Farmers insurance agent commission rates images are ready. Farmers insurance agent commission rates are a topic that is being searched for and liked by netizens now. You can Find and Download the Farmers insurance agent commission rates files here. Find and Download all royalty-free images.

If you’re searching for farmers insurance agent commission rates images information linked to the farmers insurance agent commission rates topic, you have come to the right blog. Our website always provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Farmers Insurance Agent Commission Rates. Farmers is so expensive because of agent commissions and rising costs overall for insurance companies. At $1,073 per year, the average farmers car insurance policy is a lot more expensive than the national average of $720 for a policy with minimum coverage. Farmers insurance group of companies farmers financial solutions, llc tel: If you�re interested in being a commercial producer, please email me.

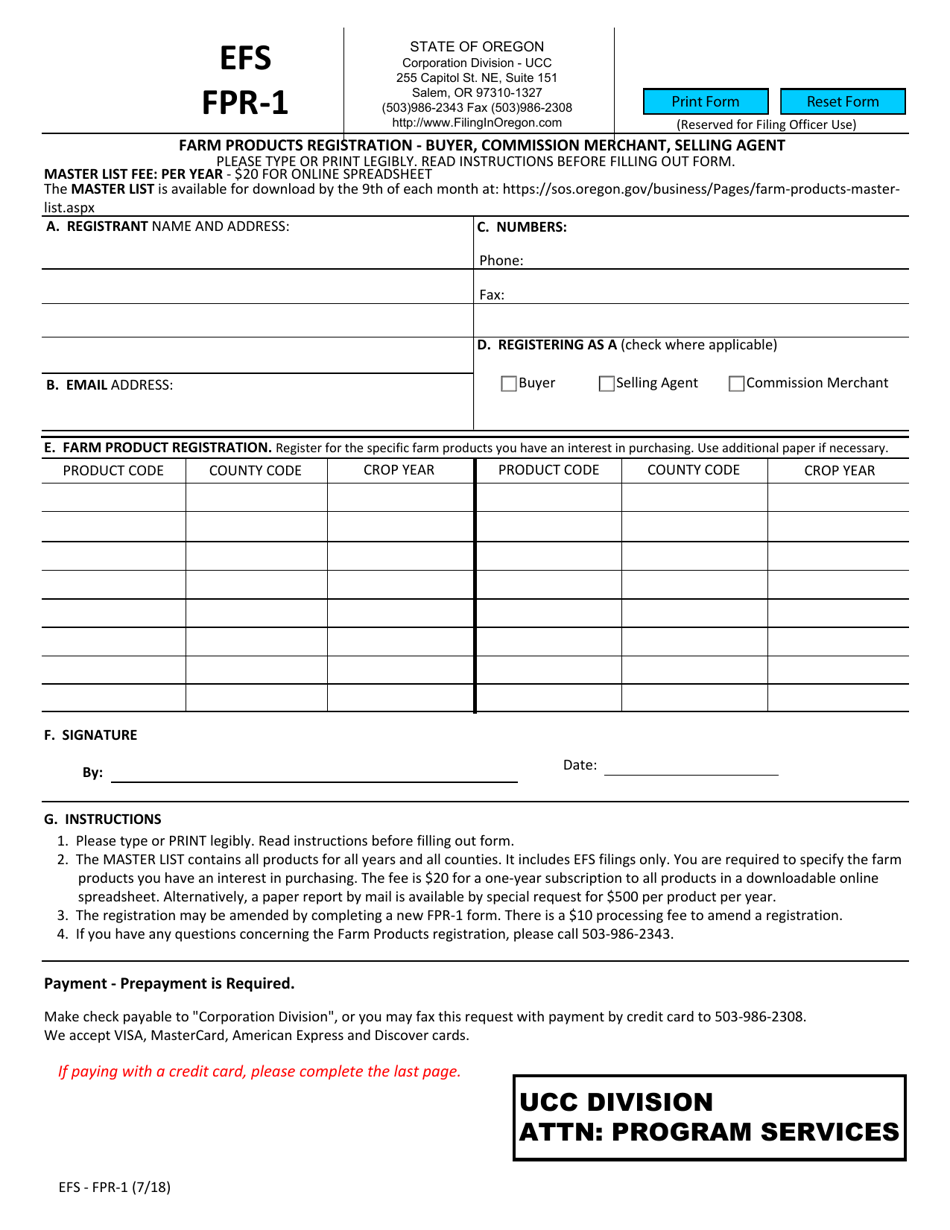

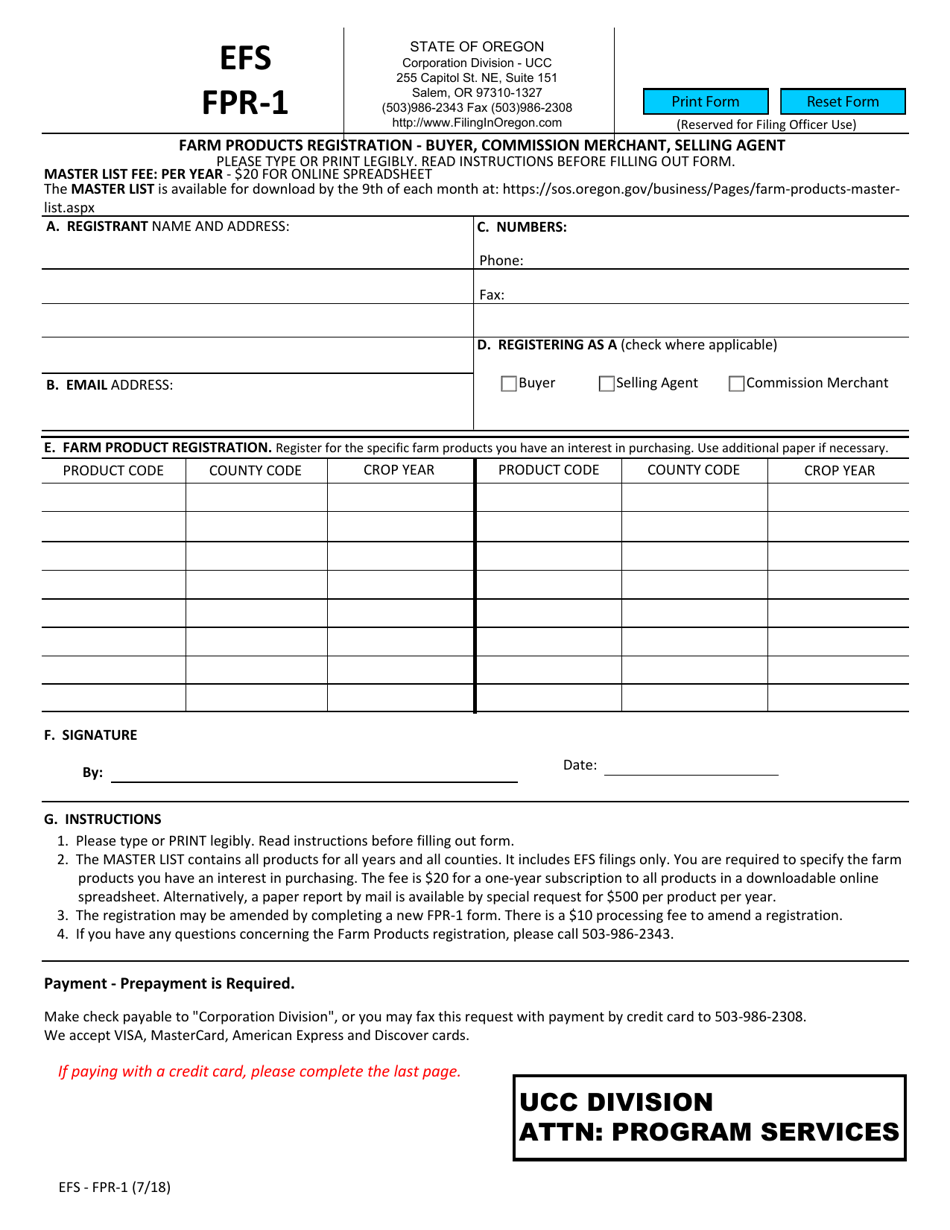

Form EFSFPR1 Download Fillable PDF or Fill Online Farm From templateroller.com

Form EFSFPR1 Download Fillable PDF or Fill Online Farm From templateroller.com

Your agent�s commissions can vary based on the type of life insurance you choose. For four years, the defendant in this case, farmers insurance exchange (`farmers insurance’), had fought its employees claims for denied overtime pay, despite minnesota labor laws that entitle workers with their job responsibilities to overtime pay. So many happy farmers agents! Ranges for standard commission paid by chubb to brokers and independent agents for particular types of insurance products are set forth below. Life insurance agents make typically 1 to 2% for renewals — or nothing after three years. Property and casualty (auto, home and business) insurance agents typically earn anywhere between 7% and 20% commission on each policy sold.

If you�re interested in being a commercial producer, please email me.

For four years, the defendant in this case, farmers insurance exchange (`farmers insurance’), had fought its employees claims for denied overtime pay, despite minnesota labor laws that entitle workers with their job responsibilities to overtime pay. Your agent�s commissions can vary based on the type of life insurance you choose. If maximized, the opportunity to create a generous income is possible. Property and casualty (auto, home and business) insurance agents typically earn anywhere between 7%. I get told that none of us are getting raises. Well 2 weeks before my exam.

Source: studenomics.com

Source: studenomics.com

The standard commission data reflects the premiums and standard commissions on policies booked by chubb in 2020. Les kimble, jr., lutcf district manager & registered principal. Your agent�s commissions can vary based on the type of life insurance you choose. So many happy farmers agents! Commissions vary by policy and company, but life insurance agents often receive 80% to 100% of the first year’s policy premium as commission.

Source: slideshare.net

Source: slideshare.net

Ranges for standard commission paid by chubb to brokers and independent agents for particular types of insurance products are set forth below. Farmers insurance agent commission rates. The farmers insurance agency owner program. Your agent�s commissions can vary based on the type of life insurance you choose. Ranges for standard commission paid by chubb to brokers and independent agents for particular types of insurance products are set forth below.

Source: wildwestweldinghorseshoedesign.blogspot.com

When i was hired at farmers insurance, i was told after i got my license, i’d be making $15/hr. Why are farmers insurance rates so high? Commissions vary by policy and company, but life insurance agents often receive 80% to 100% of the first year’s policy premium as commission. Every company differs, but for term insurance policies, agents may make 40% to 90% of the first year premium as a commission. So many happy farmers agents!

Source: toptenreviews.com

Source: toptenreviews.com

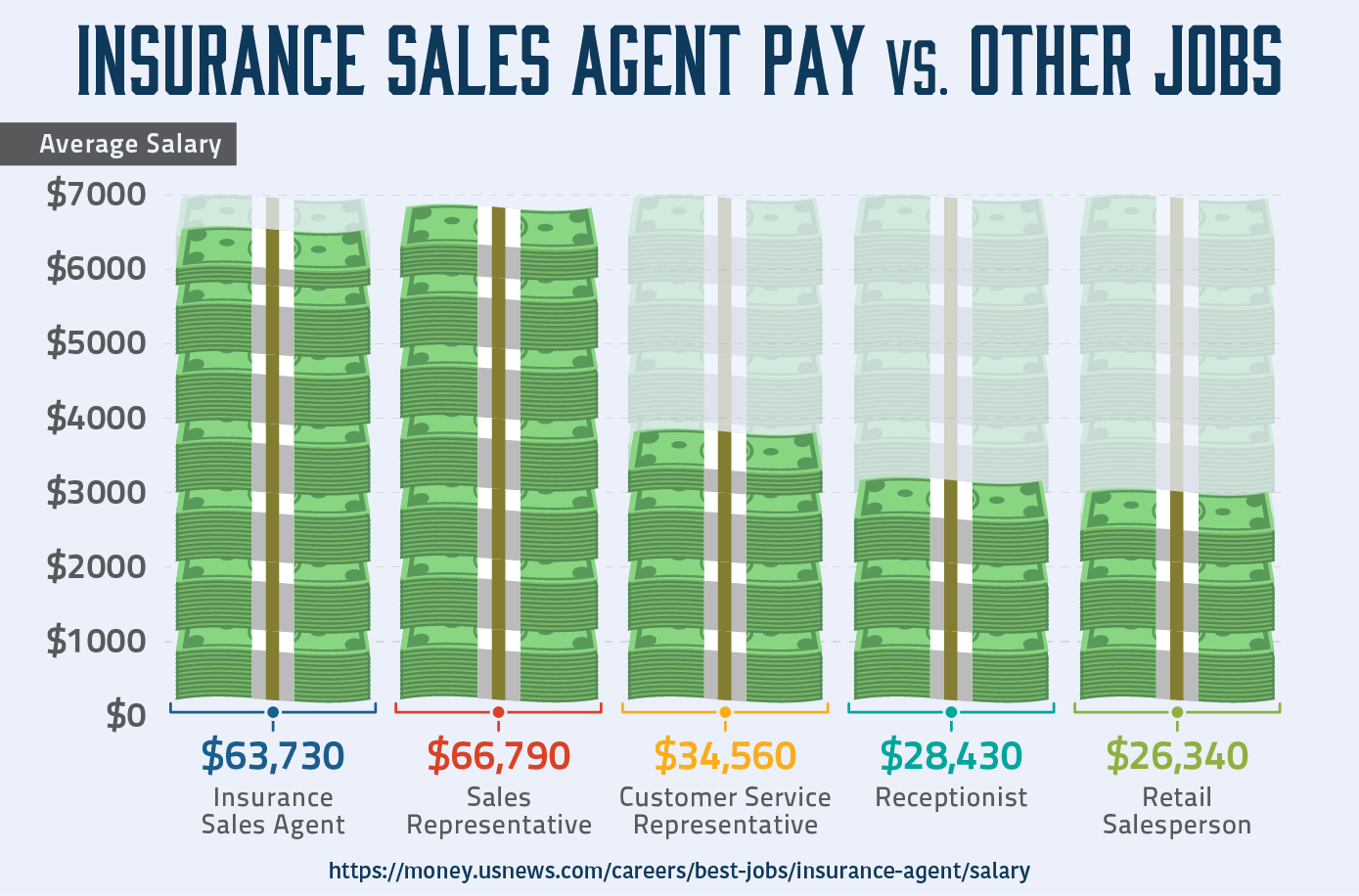

According to indeed, insurance agents earn an average of around $57,600 a year, while agency owners make an average of $100,800 annually. For auto and home insurance renewals, an insurance agent makes a 2 to 15% commission (most are in the 2 to 5% range). Property and casualty (auto, home and business) insurance agents typically earn anywhere between 7% and 20% commission on each policy sold. Property and casualty (auto, home and business) insurance agents typically earn anywhere between 7% and 20% commission on each policy sold. Commissions vary by policy and company, but life insurance agents often receive 80% to 100% of the first year’s policy premium as commission.

Source: 4kwallpaperforcars5306.blogspot.com

Source: 4kwallpaperforcars5306.blogspot.com

Farmers insurance exchange must pay overtime in minnesota: Property and casualty (auto, home and business) insurance agents typically earn anywhere between 7%. Property and casualty (auto, home and business) insurance agents typically earn anywhere between 7%. The owner operator program provides special access to an expanded portfolio of benefits including: The base salary for insurance agent in companies like farmers insurance group range from $49,706 to $61,393 with the average base salary of $54,424.

Source: templateroller.com

Source: templateroller.com

I felt there was dishonesty about their commission plan, i didn�t feel like i got the support that an insurance agent should get that is new, the benefits are non existent for an insurance company you would think you would get good health insurance it costs about 1700 per month for a family which is horrible. The agent was retiring, had about 1,274 farmers policies in force, and was asking $205k for the agency. Until then it’s just $10. If maximized, the opportunity to create a generous income is possible. The base salary for insurance agent in companies like farmers insurance group range from $49,706 to $61,393 with the average base salary of $54,424.

Source: listing.tworldminnesota.com

Life insurance agents make typically 1 to 2% for renewals — or nothing after three years. Farmers is so expensive because of agent commissions and rising costs overall for insurance companies. The agent was retiring, had about 1,274 farmers policies in force, and was asking $205k for the agency. Property and casualty (auto, home and business) insurance agents typically earn anywhere between 7% and 20% commission on each policy sold. If maximized, the opportunity to create a generous income is possible.

Source: eventsured.com

Source: eventsured.com

Typically, an insurance agent is paid a commission, or percentage, of the total insurance premium the insurer charges for a given policy. Farmers insurance is one of the only careers where age, disability, of lifestyle has no effect on your success or income. Les kimble, jr., lutcf district manager & registered principal. Renewal rates vary by insurance type: If you�re interested in being a commercial producer, please email me.

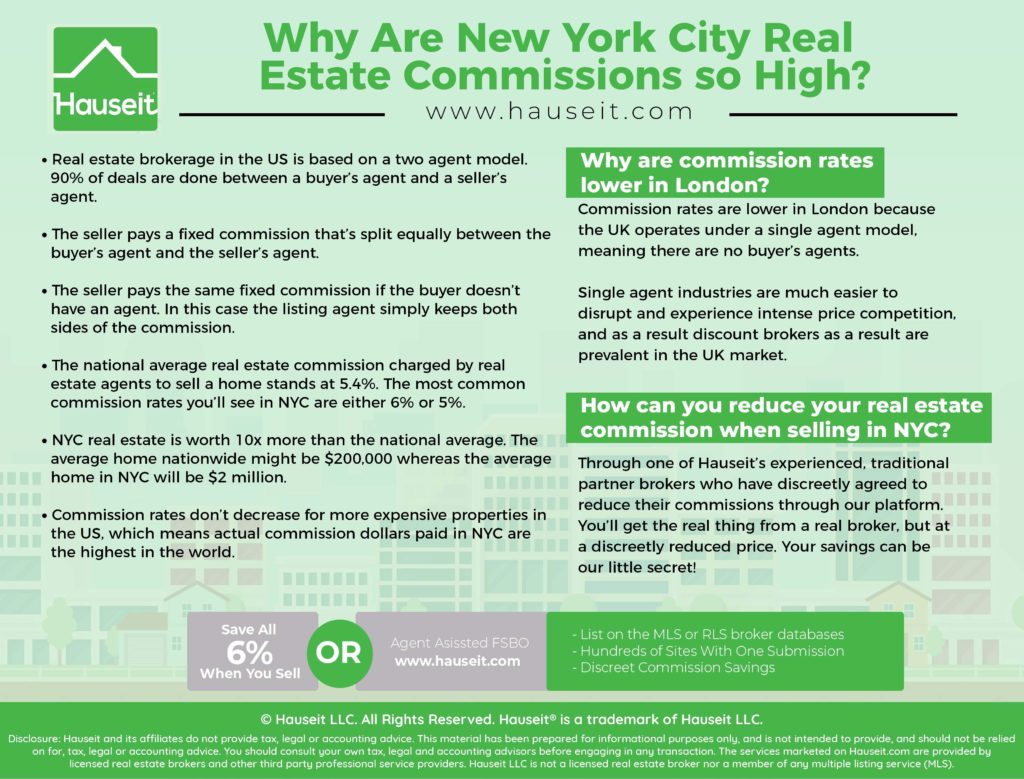

Source: hauseit.com

Source: hauseit.com

According to indeed, insurance agents earn an average of around $57,600 a year, while agency owners make an average of $100,800 annually. At $1,073 per year, the average farmers car insurance policy is a lot more expensive than the national average of $720 for a policy with minimum coverage. Well 2 weeks before my exam. Typically, an insurance agent is paid a commission, or percentage, of the total insurance premium the insurer charges for a given policy. For four years, the defendant in this case, farmers insurance exchange (`farmers insurance’), had fought its employees claims for denied overtime pay, despite minnesota labor laws that entitle workers with their job responsibilities to overtime pay.

Source: iae.news

Source: iae.news

I became a reserve agent after i obtained my property and casualty license, and i spent around $300 to reach this point, training materials, cost of the license, etc. Farmers insurance allows agents to own their books of business insofar that they can generally, under favorable circumstances, sell and leverage their books. The total cash compensation, which includes bonus, and annual incentives, can vary anywhere from $56,875 to $68,165 with the average total cash compensation of $57,248. If you�re interested in being a commercial producer, please email me. Life insurance agents make typically 1 to 2% for renewals — or nothing after three years.

Source: wildwestweldinghorseshoedesign.blogspot.com

Source: wildwestweldinghorseshoedesign.blogspot.com

When i was hired at farmers insurance, i was told after i got my license, i’d be making $15/hr. Property and casualty (auto, home and business) insurance agents typically earn anywhere between 7% and 20% commission on each policy sold. Farmers insurance is one of the only careers where age, disability, of lifestyle has no effect on your success or income. If you�re interested in being a commercial producer, please email me. Farmers insurance exchange must pay overtime in minnesota:

Source: eventsured.com

Source: eventsured.com

The base salary for insurance agent in companies like farmers insurance group range from $49,706 to $61,393 with the average base salary of $54,424. “in fact, most of the time companies are in the. Farmers is so expensive because of agent commissions and rising costs overall for insurance companies. The agent was retiring, had about 1,274 farmers policies in force, and was asking $205k for the agency. Like many insurance marketing organizations, farmers does not explicitly list the commissions that you earn as an agent anywhere.

Source: ouealth.com

Source: ouealth.com

Property and casualty (auto, home and business) insurance agents typically earn anywhere between 7%. I felt there was dishonesty about their commission plan, i didn�t feel like i got the support that an insurance agent should get that is new, the benefits are non existent for an insurance company you would think you would get good health insurance it costs about 1700 per month for a family which is horrible. The standard commission data reflects the premiums and standard commissions on policies booked by chubb in 2020. We pay 50% commission and 50% broker fees. I became a reserve agent after i obtained my property and casualty license, and i spent around $300 to reach this point, training materials, cost of the license, etc.

Source: usnews.com

Source: usnews.com

Farmers insurance group farmers insurance agent reviews. I felt there was dishonesty about their commission plan, i didn�t feel like i got the support that an insurance agent should get that is new, the benefits are non existent for an insurance company you would think you would get good health insurance it costs about 1700 per month for a family which is horrible. Farmers insurance is one of the only careers where age, disability, of lifestyle has no effect on your success or income. If you�re interested in being a commercial producer, please email me. The owner operator program provides special access to an expanded portfolio of benefits including:

Source: landthink.com

Source: landthink.com

Your agent�s commissions can vary based on the type of life insurance you choose. Instead we’re getting partial commissions on the policies we sell. If you�re interested in being a commercial producer, please email me. Farmers insurance allows agents to own their books of business insofar that they can generally, under favorable circumstances, sell and leverage their books. Property and casualty (auto, home and business) insurance agents typically earn anywhere between 7% and 20% commission on each policy sold.

Source: sec.gov

Source: sec.gov

The farmers insurance agency owner program. The agent was retiring, had about 1,274 farmers policies in force, and was asking $205k for the agency. Farmers insurance agent commission rates. Farmers is so expensive because of agent commissions and rising costs overall for insurance companies. Your agent�s commissions can vary based on the type of life insurance you choose.

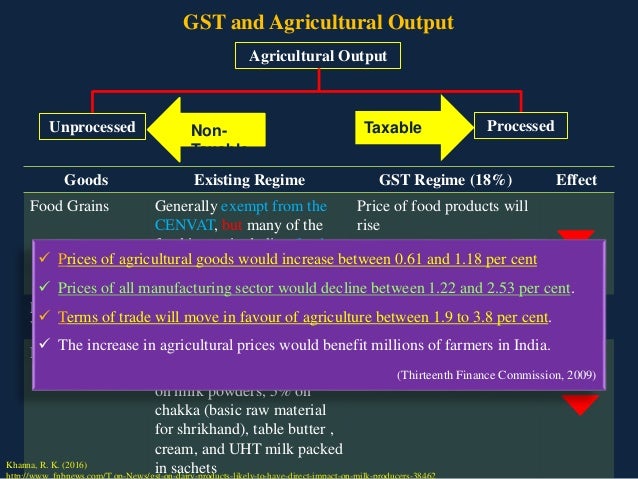

Source: taxguru.in

Source: taxguru.in

Your agent�s commissions can vary based on the type of life insurance you choose. Ranges for standard commission paid by chubb to brokers and independent agents for particular types of insurance products are set forth below. The owner operator program provides special access to an expanded portfolio of benefits including: Farmers is so expensive because of agent commissions and rising costs overall for insurance companies. Your agent�s commissions can vary based on the type of life insurance you choose.

Source: blog.goway.com

Source: blog.goway.com

We pay 50% commission and 50% broker fees. Farmers is so expensive because of agent commissions and rising costs overall for insurance companies. So many happy farmers agents! Until then it’s just $10. Which is just $25 extra in our paycheck.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title farmers insurance agent commission rates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.