Your Fannie mae hazard insurance coverage minimum images are available. Fannie mae hazard insurance coverage minimum are a topic that is being searched for and liked by netizens now. You can Get the Fannie mae hazard insurance coverage minimum files here. Get all free photos.

If you’re searching for fannie mae hazard insurance coverage minimum images information related to the fannie mae hazard insurance coverage minimum interest, you have visit the right site. Our site frequently provides you with hints for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video content and images that fit your interests.

Fannie Mae Hazard Insurance Coverage Minimum. The unpaid principal balance of the mortgage, as long as it at least equals the minimum amount—80% of the insurable value of the improvements—required to compensate for damage or loss on a replacement cost basis. Refer to the selling guide and other resources for complete requirements and more information. Contractor general liability insurance with minimum of $500,000 coverage. Insurance requirements for the grrhp program.

You may want to read this about Fema Flood Insurance From finance-review.com

You may want to read this about Fema Flood Insurance From finance-review.com

Your lender will likely have “scope of coverage” requirements that detail what must be covered by the policy. Failure to ensure that proper insurance is maintained on the property may result in denial of the guarantee payment by the agency. Requirements and terms and conditions meet fannie mae�s requirements. What is the fannie mae hazard insurance coverage minimum? Fannie mae has released a calculator tool for lenders to use in determining the minimum amount of flood insurance coverage requires by fannie mae. 13 firsttime homebuyer tips for 2021 lendingtree from www.lendingtree.com

• va should follow fannie mae/freddie mac guidelines.

Private flood insurers must meet the minimum standards for insurance underwriters as outlined in the hazard insurance guidelines. Insurance requirements for the grrhp program. Your policy will also need to contain a high enough coverage limit to fully replace your home in the event it’s destroyed in a fire or other disaster. What is the fannie mae hazard insurance coverage minimum? Insurance companies underwriting the master or blanket insurance coverage must meet fannie mae’s insurance ratings requirements; Your lender will likely have “scope of coverage” requirements that detail what must be covered by the policy.

Source: gustancho.com

Source: gustancho.com

Failure to ensure that proper insurance is maintained on the property may result in denial of the guarantee payment by the agency. What is the fannie mae hazard insurance coverage minimum? The unpaid principal balance of the mortgage, as long as it at least equals the minimum amount—80% of the insurable value of the improvements—required to compensate for damage or loss on a replacement cost basis. Failure to ensure that proper insurance is maintained on the property may result in denial of the guarantee payment by the agency. • va should follow fannie mae/freddie mac guidelines.

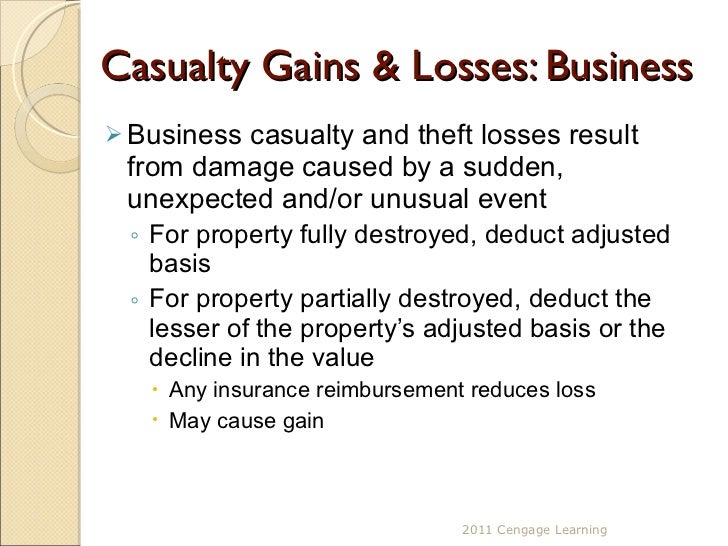

Source: casualtyinsuranceashitaga.blogspot.com

Source: casualtyinsuranceashitaga.blogspot.com

The requirements of a property insurance policy for the insurable improvements of the property securing a mortgage loan are as follows: Insurance companies underwriting the master or blanket insurance coverage must meet fannie mae’s insurance ratings requirements; The coverage must protect against loss or damage from fire, windstorm, hurricane, hail, and other hazards covered by the standard extended coverage endorsement. Extended coverage must include, at a minimum, wind, hurricane, civil commotion (including riots), smoke, hail, and damages caused by aircraft, vehicle, or explosion. The policy clearly states that each condominium, residential, or substantially residential project is a named insured, or.

Source: mortgage.info

Source: mortgage.info

Coverage must be at least fire and extended coverage with a special form coverage endorsement, i.e.: The unpaid principal balance of the mortgage, as long as it at least equals the minimum amount—80% of the insurable value of the improvements—required to compensate for damage or loss on a replacement cost basis. July 28, 2015 caresaprelichplc what is. The program does allow structural related items in the scope of work being performed as well as landscaping and site amenity work. The unpaid principal balance of the mortgage, as long as it at least equals the minimum amount—80% of the insurable value of the improvements—required to compensate for damage or loss on a replacement cost basis.

Source: gustancho.com

Source: gustancho.com

100% of the insurable value of the improvements, as established by the property insurer; Contractor general liability insurance with minimum of $500,000 coverage. The fannie mae homestyle product enables homebuyers to finance the costs of renovations through a single mortgage. For this reason, governement sponsored enterprises (gses) like freddie mac and fannie mae and many private investors require hazard and wind insurance on all outstanding properties and that the servicer monitors to ensure such coverage remains in place. The requirements of a property insurance policy for the insurable improvements of the property securing a mortgage loan are as follows:

Source: quickenloans.com

Source: quickenloans.com

Fannie mae has updated the existing minimum flood insurance coverage requirements to?be the lowest of 100% of the property?dwelling replacement cost, the maximum insurance available from the?nfip, or the unpaid principle?balance of the mortgage.?? Insurance requirements for the grrhp program. The coverage must protect against loss or damage from fire, windstorm, hurricane, hail, and other hazards covered by the standard extended coverage endorsement. Typhoon coverage is required for security properties located in guam. The policy clearly states that each condominium, residential, or substantially residential project is a named insured, or.

Source: gustancho.com

Source: gustancho.com

Insurance requirements for the grrhp program. What is the fannie mae hazard insurance coverage minimum? 13 firsttime homebuyer tips for 2021 lendingtree from www.lendingtree.com Fannie mae hazard insurance coverage minimum. Insurance requirements for the grrhp program.

Source: gustancho.com

Source: gustancho.com

Insurance requirements for the grrhp program. Your lender and fha/va have basic, minimum hazard insurance requirements related to your home mortgage, which are described below: Insurance requirements for the grrhp program. Insurance companies underwriting the master or blanket insurance coverage must meet fannie mae’s insurance ratings requirements; Extended coverage must include, at a minimum, wind, hurricane, civil commotion (including riots), smoke, hail, and damages caused by aircraft, vehicle, or explosion.

Source: pacificcoastfin.com

Source: pacificcoastfin.com

Insurance companies underwriting the master or blanket insurance coverage must meet fannie mae’s insurance ratings requirements; Contractor general liability insurance with minimum of $500,000 coverage. Extended coverage must include, at a minimum, wind, hurricane, civil commotion (including riots), smoke, hail, and damages caused by aircraft, vehicle, or explosion. The requirements of a property insurance policy for the insurable improvements of the property securing a mortgage loan are as follows: Requirements and terms and conditions meet fannie mae�s requirements.

Source: peterperfectsports.blogspot.com

Source: peterperfectsports.blogspot.com

The requirements of a property insurance policy for the insurable improvements of the property securing a mortgage loan are as follows: Maximum allowable deductible requirements the maximum allowable deductible is 5%. Coverage must be at least fire and extended coverage with a special form coverage endorsement, i.e.: The coverage must provide for claims to be settled on a replacement cost basis. The policy clearly states that each condominium, residential, or substantially residential project is a named insured, or.

Source: ratemarketplace.com

Source: ratemarketplace.com

Insurance requirements for the grrhp program. Contractor general liability insurance with minimum of $500,000 coverage. Your policy will also need to contain a high enough coverage limit to fully replace your home in the event it’s destroyed in a fire or other disaster. What is the fannie mae hazard insurance coverage minimum? For this reason, governement sponsored enterprises (gses) like freddie mac and fannie mae and many private investors require hazard and wind insurance on all outstanding properties and that the servicer monitors to ensure such coverage remains in place.

Source: americanbanker.com

Source: americanbanker.com

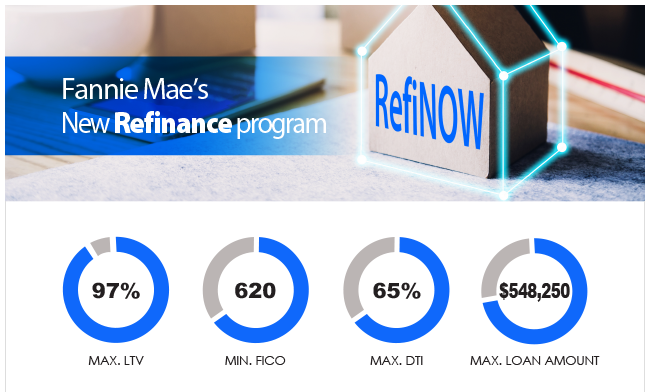

Assessments, and insurance for detailed steps to determine the amount of insurance fannie mae requires. Your lender and fha/va have basic, minimum hazard insurance requirements related to your home mortgage, which are described below: Assessments, and insurance for detailed steps to determine the amount of insurance fannie mae requires. What is the fannie mae hazard insurance coverage minimum? Fannie mae has released a calculator tool for lenders to use in determining the minimum amount of flood insurance coverage requires by fannie mae.

Source: gustancho.com

Source: gustancho.com

The unpaid principal balance of the mortgage, as long as it at least equals the minimum amount—80% of the insurable value of the improvements—required to compensate for damage or loss on a replacement cost basis. Contractor general liability insurance with minimum of $500,000 coverage. Requirements and terms and conditions meet fannie mae�s requirements. What is the fannie mae hazard insurance coverage minimum? Fannie mae hazard insurance coverage minimum.

Source: gustancho.com

Source: gustancho.com

If it does not, then coverage that does provide the minimum required amount must be obtained. The fannie mae homestyle product enables homebuyers to finance the costs of renovations through a single mortgage. Insurance companies underwriting the master or blanket insurance coverage must meet fannie mae’s insurance ratings requirements; If it does not, then coverage that does provide the minimum required amount must be obtained. At a minimum, lenders must establish insurance standards for grrhp loans that meet or exceed the insurance requirements of fannie mae, freddie mac, or ginnie mae.

Source: 21931-2287.my220.com

Source: 21931-2287.my220.com

If it does not, then coverage that does provide the minimum required amount must be obtained. Fannie mae has updated the existing minimum flood insurance coverage requirements to?be the lowest of 100% of the property?dwelling replacement cost, the maximum insurance available from the?nfip, or the unpaid principle?balance of the mortgage.?? July 28, 2015 caresaprelichplc what is. The maximum deductible amount is based on the total insurable values of the property insurance policy. At a minimum, lenders must establish insurance standards for grrhp loans that meet or exceed the insurance requirements of fannie mae, freddie mac, or ginnie mae.

Source: peterperfectsports.blogspot.com

Source: peterperfectsports.blogspot.com

The maximum deductible amount is based on the total insurable values of the property insurance policy. Contractor general liability insurance with minimum of $500,000 coverage. What is the fannie mae hazard insurance coverage minimum? Fannie mae flood coverage calculator. What is the fannie mae hazard insurance coverage minimum?

Source: bostonreb.com

Source: bostonreb.com

The coverage must protect against loss or damage from fire, windstorm, hurricane, hail, and other hazards covered by the standard extended coverage endorsement. July 28, 2015 caresaprelichplc what is. 13 firsttime homebuyer tips for 2021 lendingtree from www.lendingtree.com The unpaid principal balance of the mortgage, as long as it at least equals the minimum amount—80% of the insurable value of the improvements—required to compensate for damage or loss on a replacement cost basis. At a minimum, lenders must establish insurance standards for grrhp loans that meet or exceed the insurance requirements of fannie mae, freddie mac, or ginnie mae.

Source: finance-review.com

Source: finance-review.com

What is the fannie mae hazard insurance coverage minimum? What is the fannie mae hazard insurance coverage minimum? If it does not, then coverage that does provide the minimum required amount must be obtained. The fannie mae homestyle product enables homebuyers to finance the costs of renovations through a single mortgage. Coverage must be at least fire and extended coverage with a special form coverage endorsement, i.e.:

Source: finance-review.com

Source: finance-review.com

The requirements of a property insurance policy for the insurable improvements of the property securing a mortgage loan are as follows: If it does not, then coverage that does provide the minimum required amount must be obtained. Your lender and fha/va have basic, minimum hazard insurance requirements related to your home mortgage, which are described below: The unpaid principal balance of the mortgage, as long as it at least equals the minimum amount—80% of the insurable value of the improvements—required to compensate for damage or loss on a replacement cost basis. The coverage must protect against loss or damage from fire, windstorm, hurricane, hail, and other hazards covered by the standard extended coverage endorsement.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fannie mae hazard insurance coverage minimum by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.