Your Family floater health insurance policy india images are ready in this website. Family floater health insurance policy india are a topic that is being searched for and liked by netizens today. You can Get the Family floater health insurance policy india files here. Find and Download all free images.

If you’re looking for family floater health insurance policy india images information connected with to the family floater health insurance policy india keyword, you have pay a visit to the right site. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more informative video content and images that fit your interests.

Family Floater Health Insurance Policy India. It’s quite easy to manage. For example, if a family has purchased a family floater plan of rs. 6 rows a family floater health insurance plan covers a maximum of 4 or 6 family members depending on. You may contact me on pritul@anakinindia.com for more information.

Best Family Floater Health Insurance Plans In India 2018 From gujunews.in

Best Family Floater Health Insurance Plans In India 2018 From gujunews.in

The premium to be paid is dependent on the age of the family members. One of the most beneficial features of family health insurance policies is that if two members in family fall sick, then funds will not be in short supply. Most health insurance companies in india offer family floater policies. Care advantage 1 crore health insurance plan care health insurance was earlier known as religare health insurance. What is family floater insurance? A few insurers provide 100 percent redemption of the amount insured if the sum.

A family floater health insurance, also called family health insurance plan, is one in which one or more members of the family are covered under one plan.

Iifl insurance will help you cover your expenses, charges & more. A family floater plan�s amount insured is higher to protect the whole family. Available for a term of 1 year, the policy comes with several benefits, including extensive coverage, remote medical second opinion, no claim bonus, cashless treatment, tax benefits and so on. One of the most beneficial features of family health insurance policies is that if two members in family fall sick, then funds will not be in short supply. What is family floater health insurance policy? Now, you don’t need to maintain separate policies and tracking renewals.

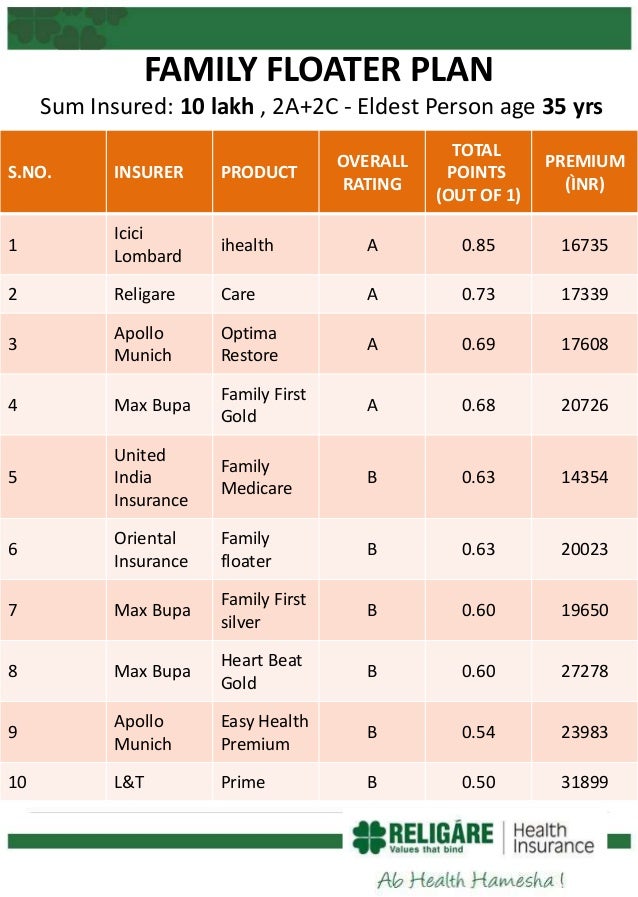

Source: slideshare.net

Source: slideshare.net

Most health insurance companies in india offer family floater policies. Long term cover you can keep your family safely protected under a good medical insurance cover for as long as 3 years when you buy a family floater health insurance policy. It will have a single annual premium and a fixed sum insured. A family floater plan�s amount insured is higher to protect the whole family. Hassle free a family floater plan requires you to pay for a single plan.

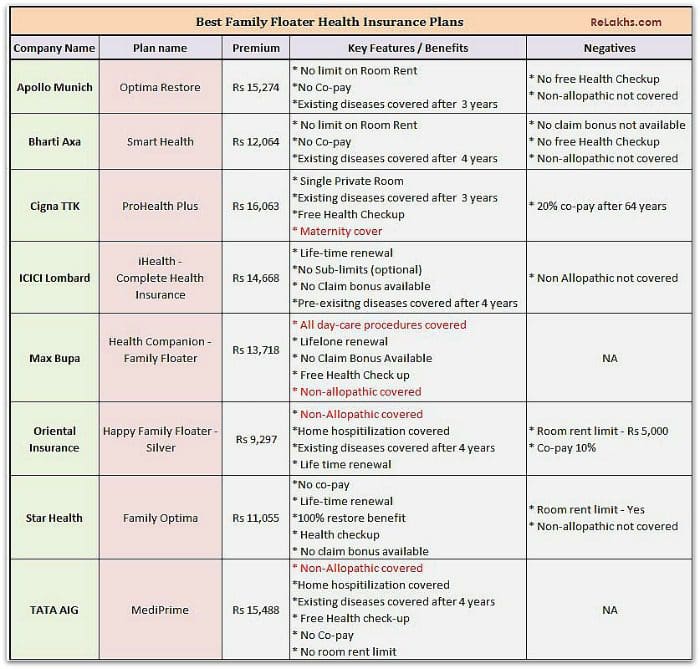

Source: relakhs.com

Source: relakhs.com

A waiting period of 1 or 2 years for specific diseases or procedures. For example, if a family has purchased a family floater plan of rs. Most health insurance companies in india offer family floater policies. You may contact me on pritul@anakinindia.com for more information. Most health insurance companies in india offer family floater policies.

Source: standardwealthonline.com

Source: standardwealthonline.com

Most health insurance companies in india offer family floater policies. A waiting period of 1 or 2 years for specific diseases or procedures. Most of the health insurance companies in india offer family health plans at a discounted rate when the sum insured is high for a large number of people in a family. Such a policy provides assured coverage to all proposed members of a family at the same time, in case they get hospitalized following a sickness/ailment or accident. Take a look at them below:

Source: gujunews.in

Source: gujunews.in

For example, if a family has purchased a family floater plan of rs. A family floater is a health insurance plan that extends the coverage to the entire family rather read more get ₹5 lac health insurance starts @ ₹200/month* tax benefit up to rs.75,000 save up to 12.5%* on 2 year payment plans 7 lakh+ happy customers *all savings are provided by the insurer as per the irdai approved insurance plan. Get oriental happy family floater policy health insurance online in india for interesting benefits that closely meets your needs. Family medicare policy by united india is a type of health policy that covers all family members under a single sum insured. You may contact me on pritul@anakinindia.com for more information.

Source: gujunews.in

Source: gujunews.in

One of the key features of a family floater health insurance is that the sum assured can be extended to cover several members of the same family if the need arises. Family floater is a policy that covers more than one family member for a fixed cover. A family floater plan�s amount insured is higher to protect the whole family. One of the most beneficial features of family health insurance policies is that if two members in family fall sick, then funds will not be in short supply. Best family floater health insurance plans in india 2022 #1.

Source: slideserve.com

Source: slideserve.com

A family floater plan provides you an easy option to add members in the health policy in case you get married, the birth of a child, or can add parents in this policy too. A family floater plan provides you an easy option to add members in the health policy in case you get married, the birth of a child, or can add parents in this policy too. Long term cover you can keep your family safely protected under a good medical insurance cover for as long as 3 years when you buy a family floater health insurance policy. Such a policy provides assured coverage to all proposed members of a family at the same time, in case they get hospitalized following a sickness/ailment or accident. One of the most beneficial features of family health insurance policies is that if two members in family fall sick, then funds will not be in short supply.

Source: advisorkhoj.com

Source: advisorkhoj.com

For example, if a family has purchased a family floater plan of rs. Care advantage health insurance is one of the best family floater plans in india. The sum assured can be used multiple times if required. A family health insurance policy may come with several waiting periods depending on the plan. One of the key features of a family floater health insurance is that the sum assured can be extended to cover several members of the same family if the need arises.

Source: slideshare.net

Source: slideshare.net

You may contact me on pritul@anakinindia.com for more information. Now, you don’t need to maintain separate policies and tracking renewals. The sum assured can be used multiple times if required. One of the most beneficial features of family health insurance policies is that if two members in family fall sick, then funds will not be in short supply. Get oriental happy family floater policy health insurance online in india for interesting benefits that closely meets your needs.

Source: youtube.com

Source: youtube.com

Most family floater health insurance policies offer coverage for self, spouse, children and parents. An initial waiting period of 30 days. A family health plan is generally recommended for a younger family coupled with a good medical history. Family medicare policy by united india is a type of health policy that covers all family members under a single sum insured. A family floater plan provides you an easy option to add members in the health policy in case you get married, the birth of a child, or can add parents in this policy too.

Source: tflguide.com

Source: tflguide.com

For example, if a family has purchased a family floater plan of rs. Family floater is a policy that covers more than one family member for a fixed cover. Now, you don’t need to maintain separate policies and tracking renewals. A family health plan is generally recommended for a younger family coupled with a good medical history. One of the most beneficial features of family health insurance policies is that if two members in family fall sick, then funds will not be in short supply.

Source: gujunews.in

Source: gujunews.in

A few insurers provide 100 percent redemption of the amount insured if the sum. Such a policy provides assured coverage to all proposed members of a family at the same time, in case they get hospitalized following a sickness/ailment or accident. The maximum number of members that can be included may vary from one insurer to another. A family health plan is generally recommended for a younger family coupled with a good medical history. A family health insurance policy may come with several waiting periods depending on the plan.

Source: gujunews.in

Source: gujunews.in

Key features cashless treatment in network hospitals anywhere in india hospital cash benefits, 0.1% of the sum insured lifelong policy renewal facility sum insured ranging from rs. Hassle free a family floater plan requires you to pay for a single plan. One of the key features of a family floater health insurance is that the sum assured can be extended to cover several members of the same family if the need arises. Many of family floater health insurance plans india can cover newborn babies almost immediately. For instance, suppose you purchase a family floater plan with a sum assured of rs 5 lakhs for four members of your family.

Source: healthinsurance.manipalcigna.com

Source: healthinsurance.manipalcigna.com

For example, if a family has purchased a family floater plan of rs. Now, you don’t need to maintain separate policies and tracking renewals. Available for a term of 1 year, the policy comes with several benefits, including extensive coverage, remote medical second opinion, no claim bonus, cashless treatment, tax benefits and so on. The premium to be paid is dependent on the age of the family members. Key features cashless treatment in network hospitals anywhere in india hospital cash benefits, 0.1% of the sum insured lifelong policy renewal facility sum insured ranging from rs.

Source: slideshare.net

Source: slideshare.net

For example, if a family has purchased a family floater plan of rs. Premium paid by you for medical insurance for your family, the available tax deduction is rs 25,000 when the eldest member’s age is below 60 years. A family floater plan provides you an easy option to add members in the health policy in case you get married, the birth of a child, or can add parents in this policy too. Best family floater health insurance plans in india 2022 #1. What is family floater insurance?

Source: iiflinsurance.com

Source: iiflinsurance.com

You may contact me on pritul@anakinindia.com for more information. By obtaining this policy, an individual can do away with the hassle of maintaining multiple health insurance policies. Maternity cover waiting period of 9 months to 2 years What is family floater insurance? The maximum number of members that can be included may vary from one insurer to another.

Source: mutualfunday.com

Source: mutualfunday.com

Care advantage 1 crore health insurance plan care health insurance was earlier known as religare health insurance. One of the key features of a family floater health insurance is that the sum assured can be extended to cover several members of the same family if the need arises. A waiting period of 1 or 2 years for specific diseases or procedures. Get oriental happy family floater policy health insurance online in india for interesting benefits that closely meets your needs. Key features cashless treatment in network hospitals anywhere in india hospital cash benefits, 0.1% of the sum insured lifelong policy renewal facility sum insured ranging from rs.

Source: relakhs.com

Source: relakhs.com

A family floater mediclaim policy provides a range of incentives to meet the healthcare needs of all family members, regardless of age. 10 lakh the policy is available for one year Most health insurance companies in india offer family floater policies. This is the best advantage of having a family floater plan. Many of family floater health insurance plans india can cover newborn babies almost immediately.

Source: mintwise.com

Source: mintwise.com

A few insurers provide 100 percent redemption of the amount insured if the sum. A family floater health insurance policy offers the tax benefit under section 80d of the income tax act towards the premium amount paid in a set financial year. A family health plan is generally recommended for a younger family coupled with a good medical history. Long term cover you can keep your family safely protected under a good medical insurance cover for as long as 3 years when you buy a family floater health insurance policy. A family floater health insurance policy enjoys a higher tax deduction than the individual policy under section 80d if you have included your parents in the policy too.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title family floater health insurance policy india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.