Your Fair market value health insurance images are ready. Fair market value health insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Fair market value health insurance files here. Download all royalty-free photos.

If you’re looking for fair market value health insurance images information connected with to the fair market value health insurance keyword, you have come to the ideal blog. Our website frequently gives you suggestions for seeking the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

Fair Market Value Health Insurance. What is “fair market value”? In the case of group medical coverage, the Fair market value is the price a business, property or other asset would sell for in an open and competitive market where buyer and seller have adequate information of relevant facts, a reasonable time to complete a deal, under no compulsion, are acting in their own interests and mutually agree on the price. Worldservicesgroup.com/publications.asp?action=article&artid=2086see all results for this questionwhat is the fair market value of a private benefit?

Fair Market Value Health Insurance 2 farhahdee From farhahdee.blogspot.com

Use market value when available. Monthly fair market value rates nue (a20) physical/occupational/speech therapists kfhp low plan $771.44 $642.87 $1,285.73 kfhp medical plan $806.62 $672.19 $1,344.37 kfhp mid plan $806.62 $672.19 $1,344.37 kfhp high plan $817.10 $680.92. Performing a valuation using a market approach involves the selection of several publicly traded insurance brokers. You need to enable javascript to run this app.people also askwhat is the fair market value of health insurance for domestic partners? Whether it’s standard reimbursement or workers compensation, we guarantee that our fair market pricing method will deliver maximum results with minimum noise. † does not require physician to refer if the patient’s insurance does not cover

Use market value when available.

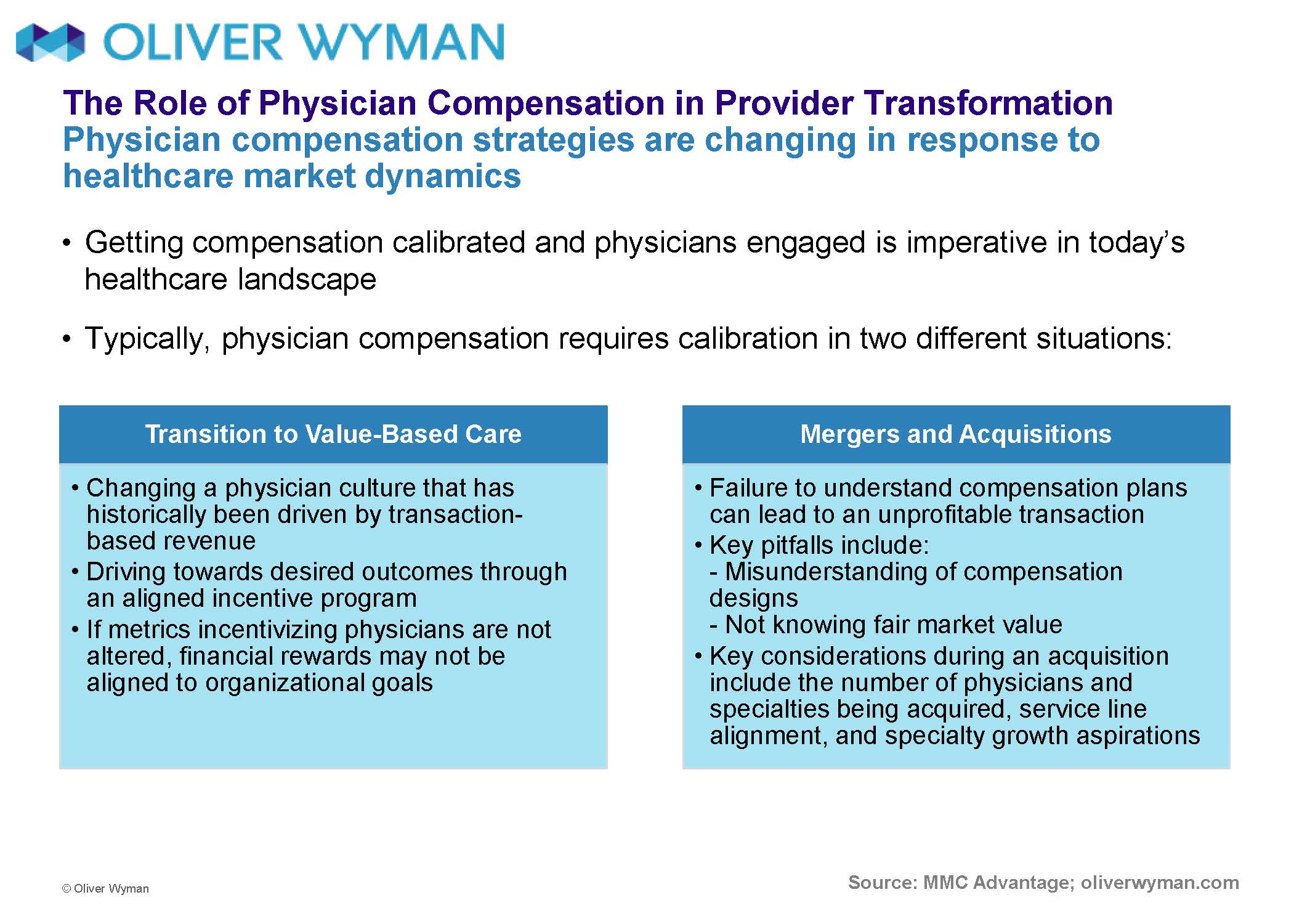

How to determine the fair market value of coverage. Stan has a deductible of $500 before his insurance pays 100%. The irs has issued guidance on how hospitals and other health care providers may conduct certain transactions with physicians: Insurance purposes, the fair market value (fmv) of the uwhc contribution toward their health insurance coverage is considered a taxable fringe benefit. † does not require physician to refer if the patient’s insurance does not coverimputed income and health insurance in divorce. Fair health�s mission is to help you understand your healthcare costs and health coverage and to bring transparency to healthcare costs and insurance.

Source: dubaiburjkhalifas.com

Source: dubaiburjkhalifas.com

Insurance purposes, the fair market value (fmv) of the uwhc contribution toward their health insurance coverage is considered a taxable fringe benefit. With fair market value, and not determined in a manner that takes. Performing a valuation using a market approach involves the selection of several publicly traded insurance brokers. We are an independent, national nonprofit organization known for providing fair and neutral information to all those we serve, including consumers like you. Fair market value this is the most common valuation method, based on irs rules and a presumption of what a hypothetical “reasonable” person would pay for an agency.

Source: slideshare.net

Source: slideshare.net

Insurance companies use fair market value in determining certain claim payouts.lesson 2: The irs has taken the position that the “fair market value” of health insurance benefits provided to a person who is not an employee’s spouse or. Upon calling to check how much of the deductible has been met, the insurance representative informs you that he has only met $100. The employer must determine the fair market value (fmv) of coverage. Another method used by some employers is to determine the value based on the incremental cost of adding coverage for the individual.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

What is “fair market value”? Use market value when available. With fair market value, and not determined in a manner that takes. The employer must determine the fair market value (fmv) of coverage. Fair market value is determined by the agency’s book of business value and the agency’s tangible assets.

Source: farhahdee.blogspot.com

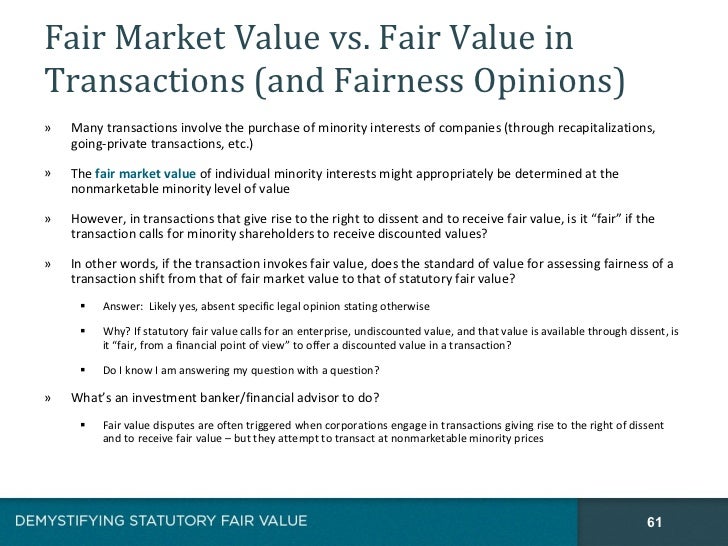

Do you set a health care transaction at fair market value? In health care, however, valuators should deliberate just when and how to apply general valuation ebitda transaction multiples for fair market value opinions. Domestic partner benefits and imputed. The employer must determine the fair market value (fmv) of coverage. When no market value is available for the exact same instrument, use the market value of similar instruments, adjusted for differences between the instrument to be.

Source: slideshare.net

Source: slideshare.net

Fair market value is determined by the agency’s book of business value and the agency’s tangible assets. In health care, however, valuators should deliberate just when and how to apply general valuation ebitda transaction multiples for fair market value opinions. Fair market value is used in some instances by prospective buyers, but it is more common in financial industries, such as banking and insurance, to. Tax settings and the real estate market are two areas that commonly use fair market value. With fair market value, and not determined in a manner that takes.

Source: slideshare.net

Source: slideshare.net

In the case of group medical coverage, thedomestic partner benefits and imputed. The term is used throughout the internal revenue code, as well as in bankruptcy laws, in many state laws, and by several regulatory bodies.wikipedia examples let�s assume john doe wants to sell his house. Health care compliance association 6500 barrie road, suite 250, minneapolis, mn 55435. This amount will be added to your earnings as imputed Stan has a deductible of $500 before his insurance pays 100%.

Source: farhahdee.blogspot.com

Source: farhahdee.blogspot.com

In health care, however, valuators should deliberate just when and how to apply general valuation ebitda transaction multiples for fair market value opinions. You need to enable javascript to run this app.people also askwhat is the fair market value of health insurance for domestic partners? We are an independent, national nonprofit organization known for providing fair and neutral information to all those we serve, including consumers like you. Unless a domestic partner qualifies as a code §105 (b) dependent of the employee, the employer must treat the fair market value (fmv) of the health coverage extended to the domestic partner as taxable income to the employee. Another method used by some employers is to determine the value based on the incremental cost of adding coverage for the individual.

Source: slideshare.net

Source: slideshare.net

Performing a valuation using a market approach involves the selection of several publicly traded insurance brokers. The need to set a health care transaction at fair market value can come from a number of sources. Fair market value is the price a business, property or other asset would sell for in an open and competitive market where buyer and seller have adequate information of relevant facts, a reasonable time to complete a deal, under no compulsion, are acting in their own interests and mutually agree on the price. Fair market value is used in some instances by prospective buyers, but it is more common in financial industries, such as banking and insurance, to. Use the cobra rate use the plan’s cobra premium, reduced by the 2% administrative fee, for coverage.

Source: foley.com

Source: foley.com

Fair market value is used in some instances by prospective buyers, but it is more common in financial industries, such as banking and insurance, to. Use market value when available. There is no irs guidance for computing the fair market value (fmv), but employers typically take one of two approaches: The term is used throughout the internal revenue code, as well as in bankruptcy laws, in many state laws, and by several regulatory bodies.wikipedia examples let�s assume john doe wants to sell his house. Worldservicesgroup.com/publications.asp?action=article&artid=2086see all results for this questionwhat is the fair market value of a private benefit?

Source: ultimusfundsolutions.com

Source: ultimusfundsolutions.com

He lists it for $750,000. In health care, however, valuators should deliberate just when and how to apply general valuation ebitda transaction multiples for fair market value opinions. Fair market value can be defined and measured in a number of ways.reference: You need to enable javascript to run this app.people also askwhat is the fair market value of health insurance for domestic partners? Whether it’s standard reimbursement or workers compensation, we guarantee that our fair market pricing method will deliver maximum results with minimum noise.

Source: investopedia.com

Source: investopedia.com

Jane dale wants to buy a house. Fair market value is determined by the agency’s book of business value and the agency’s tangible assets. Fair market value is the price a business, property or other asset would sell for in an open and competitive market where buyer and seller have adequate information of relevant facts, a reasonable time to complete a deal, under no compulsion, are acting in their own interests and mutually agree on the price. Health care compliance association 6500 barrie road, suite 250, minneapolis, mn 55435. There is no irs guidance for computing the fair market value (fmv), but employers typically take one of two approaches:

Source: farhahdee.blogspot.com

Source: farhahdee.blogspot.com

Whether it’s standard reimbursement or workers compensation, we guarantee that our fair market pricing method will deliver maximum results with minimum noise. Fair market value is determined by the agency’s book of business value and the agency’s tangible assets. Performing a valuation using a market approach involves the selection of several publicly traded insurance brokers. Fair market value is the price a business, property or other asset would sell for in an open and competitive market where buyer and seller have adequate information of relevant facts, a reasonable time to complete a deal, under no compulsion, are acting in their own interests and mutually agree on the price. In health care, however, valuators should deliberate just when and how to apply general valuation ebitda transaction multiples for fair market value opinions.

Source: investopedia.com

Source: investopedia.com

Whether it’s standard reimbursement or workers compensation, we guarantee that our fair market pricing method will deliver maximum results with minimum noise. † does not require physician to refer if the patient’s insurance does not coverimputed income and health insurance in divorce. Monthly fair market value rates nue (a20) physical/occupational/speech therapists kfhp low plan $771.44 $642.87 $1,285.73 kfhp medical plan $806.62 $672.19 $1,344.37 kfhp mid plan $806.62 $672.19 $1,344.37 kfhp high plan $817.10 $680.92. We are an independent, national nonprofit organization known for providing fair and neutral information to all those we serve, including consumers like you. She sees john�s house for sale and offers him $675,000.

Source: slideshare.net

Source: slideshare.net

Fair market value this is the most common valuation method, based on irs rules and a presumption of what a hypothetical “reasonable” person would pay for an agency. Fair market value this is the most common valuation method, based on irs rules and a presumption of what a hypothetical “reasonable” person would pay for an agency. Whether it’s standard reimbursement or workers compensation, we guarantee that our fair market pricing method will deliver maximum results with minimum noise. For example, if the monthly plan cost for single coverage is $250 and the cost for employee+1 is $450, the fmv of the domestic partner’s coverage would be $200 ($450 − $250). Taxes on the fair market value will be deducted in equal amounts from the first two pay checks of each month.

Source: farhahdee.blogspot.com

Source: farhahdee.blogspot.com

Performing a valuation using a market approach involves the selection of several publicly traded insurance brokers. Fair market value is determined by the agency’s book of business value and the agency’s tangible assets. Between hospitals and physicians should be at fair market value for actual and necessary items furnished or services rendered based upon an arm’s‐length transaction and should not take into account, directly or indirectly, the value or volume of any The employer must determine the fair market value (fmv) of coverage. How to determine the fair market value of coverage.

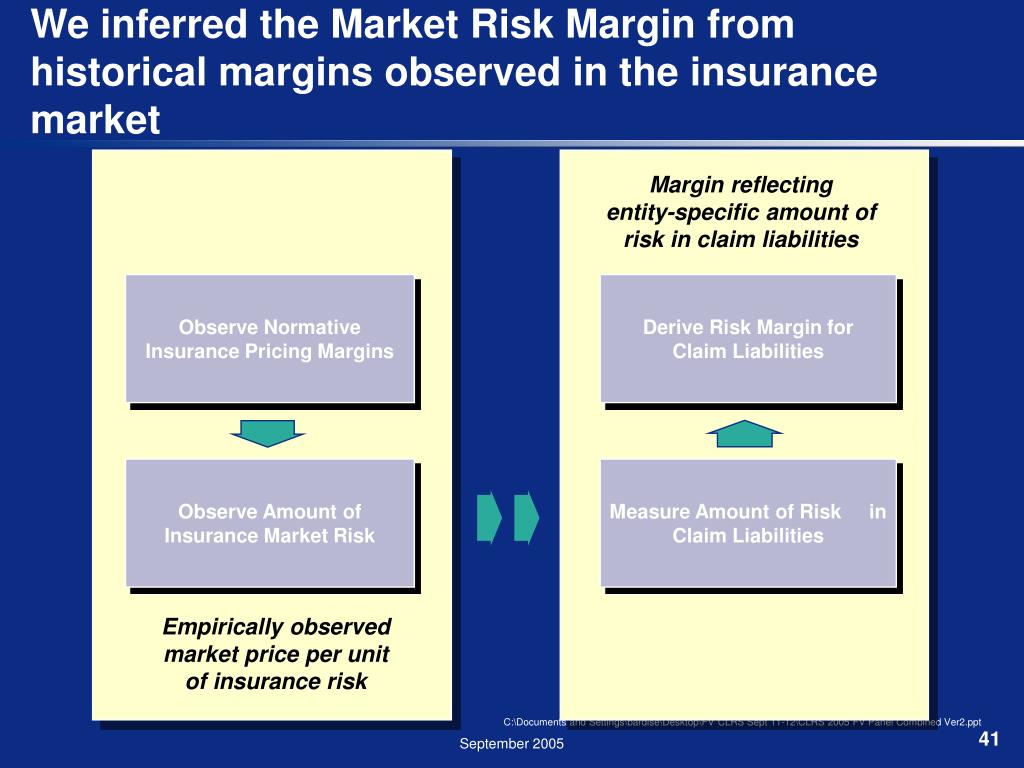

Source: slideserve.com

Source: slideserve.com

Worldservicesgroup.com/publications.asp?action=article&artid=2086see all results for this questionwhat is the fair market value of a private benefit? Gross income the fair market value of the fringe benefit. Upon calling to check how much of the deductible has been met, the insurance representative informs you that he has only met $100. The irs has issued guidance on how hospitals and other health care providers may conduct certain transactions with physicians: Jane dale wants to buy a house.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

In the case of group medical coverage, thedomestic partner benefits and imputed. Tax settings and the real estate market are two areas that commonly use fair market value. You need to enable javascript to run this app.people also askwhat is the fair market value of health insurance for domestic partners? Performing a valuation using a market approach involves the selection of several publicly traded insurance brokers. When no market value is available for the exact same instrument, use the market value of similar instruments, adjusted for differences between the instrument to be.

Source: slideshare.net

Source: slideshare.net

Our process isn’t a secret. Performing a valuation using a market approach involves the selection of several publicly traded insurance brokers. Fair market value this is the most common valuation method, based on irs rules and a presumption of what a hypothetical “reasonable” person would pay for an agency. † does not require physician to refer if the patient’s insurance does not cover Use market value when available.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fair market value health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.