Your Fair discrimination in insurance images are ready. Fair discrimination in insurance are a topic that is being searched for and liked by netizens today. You can Get the Fair discrimination in insurance files here. Download all royalty-free photos and vectors.

If you’re looking for fair discrimination in insurance images information related to the fair discrimination in insurance interest, you have pay a visit to the ideal blog. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

Fair Discrimination In Insurance. In insurance, where differences in treatment are reflected by differences in premiums, such a situation would be described as “actuarially” fair, whereas “unfair discrimination” refers to the unequal treatment of individuals with the same risk level (meyer 2004,p.31).unfair, in other words, means for insurers “equal Fairness and discrimination in underwriting. In the case of car insurance, an insurer practicing fair discrimination would take into account the driver’s record of driving violations and what type of car the driver owns. However, there are two types of discrimination:

What Constitutes Landlord Discrimination Against a Tenant From icnj.com

What Constitutes Landlord Discrimination Against a Tenant From icnj.com

Unfair discrimination in insurance broadly speaking, insurance underwriting has been defined as the process by which companies determine whether to accept or to reject an application for insurance coverage.6 the fha seeks to eliminate unfair Using it in that way was not While many forms of direct unfair discrimination have been eliminated, subtle, less obvious forms of discrimination remain in access to insurance and risk classification. And this will not be easy for many insurance people, who see themselves as good people providing an important service. Regulation of big data, consumer education, and increasing. In other words, it is unlawful for both public and private health insurance plans to discriminate on the basis of disability when public accommodations are offered.

Yet every firm will have to evidence the distance between their.

Fairness and discrimination in underwriting. Insurance companies justify such discrimination based on an individual’s area of residency, gender, marital status as “fair” because they are. While many forms of direct unfair discrimination have been eliminated, subtle, less obvious forms of discrimination remain in access to insurance and risk classification. In insurance, where differences in treatment are reflected by differences in premiums, such a situation would be described as “actuarially” fair, whereas “unfair discrimination” refers to the unequal treatment of individuals with the same risk level (meyer 2004,p.31).unfair, in other words, means for insurers “equal All of this information is relevant to the insurer’s decision making process. Fair discrimination is needed to avoid the mechanism of adverse selection, which is the result of rational behaviour by potential insurance policyholders.

Source: glaad.org

Source: glaad.org

However, there are two types of discrimination: Fair discrimination is needed to avoid the mechanism of adverse selection, which is the result of rational behaviour by potential insurance policyholders. Insurance companies must practice fair discrimination. Their evaluation of these risks provides a scientific basis for their pricing decisions. In other words, it is unlawful for both public and private health insurance plans to discriminate on the basis of disability when public accommodations are offered.

Source: blackmeninamerica.com

Source: blackmeninamerica.com

Background to the fha and insurance a. In other words, it is unlawful for both public and private health insurance plans to discriminate on the basis of disability when public accommodations are offered. Lack of minority representation in the insurance sector has alienated minority consumers and exacerbated the problem of discrimination. 2 see infra part ii.c. Using it in that way was not

Source: toronto.redfm.ca

Source: toronto.redfm.ca

The two big ethical issues that firms have to engage with are fairness and discrimination in insurance underwriting. In the case of car insurance, an insurer practicing fair discrimination would take into account the driver’s record of driving violations and what type of car the driver owns. Discrimination refers to making choices and the practice makes sense as long as the choices are not unfair. “fair discrimination.” in that cultural context, property/casualty insurers may soon find themselves forced to defend the fairness of the discrimination they utilize to underwrite and price homeowners insurance. Yet every firm will have to evidence the distance between their.

Source: rpmcentralvalley.com

Source: rpmcentralvalley.com

The two big ethical issues that firms have to engage with are fairness and discrimination in insurance underwriting. Insurers cross the line into unfair discrimination when they. Discrimination refers to making choices and the practice makes sense as long as the choices are not unfair. While many forms of direct unfair discrimination have been eliminated, subtle, less obvious forms of discrimination remain in access to insurance and risk classification. In other words, it is unlawful for both public and private health insurance plans to discriminate on the basis of disability when public accommodations are offered.

Source: tjdlaw.co.uk

Source: tjdlaw.co.uk

However, there are two types of discrimination: Unfair discrimination in insurance broadly speaking, insurance underwriting has been defined as the process by which companies determine whether to accept or to reject an application for insurance coverage.6 the fha seeks to eliminate unfair In insurance, where differences in treatment are reflected by differences in premiums, such a situation would be described as “actuarially” fair, whereas “unfair discrimination” refers to the unequal treatment of individuals with the same risk level (meyer 2004,p.31).unfair, in other words, means for insurers “equal Lack of minority representation in the insurance sector has alienated minority consumers and exacerbated the problem of discrimination. Insurers cross the line into unfair discrimination when they.

Source: youtube.com

Source: youtube.com

What’s fair , 80 c ornell l. Unfair discrimination in insurance broadly speaking, insurance underwriting has been defined as the process by which companies determine whether to accept or to reject an application for insurance coverage.6 the fha seeks to eliminate unfair The two big ethical issues that firms have to engage with are fairness and discrimination in insurance underwriting. Fairness and discrimination in underwriting. Insurers included gender as a risk factor where it was relevant;

Source: tandfonline.com

However, there are two types of discrimination: Their evaluation of these risks provides a scientific basis for their pricing decisions. Insurance companies justify such discrimination based on an individual’s area of residency, gender, marital status as “fair” because they are. Discrimination in insurance recommended citation jill gaulding, race sex and genetic discrimination in insurance: Lack of minority representation in the insurance sector has alienated minority consumers and exacerbated the problem of discrimination.

Source: chronicdiseasecoalition.org

Source: chronicdiseasecoalition.org

While many forms of direct unfair discrimination have been eliminated, subtle, less obvious forms of discrimination remain in access to insurance and risk classification. 2 see infra part ii.c. Insurers included gender as a risk factor where it was relevant; In line with developments in the personalisation of risk, the idea that insurance products should above all be ‘fair’ to the policyholders is increasingly voiced by commentators. Fairness and discrimination in underwriting.

Source: psychiatry.org

This prohibition of discrimination on the basis of disability in the enjoyment of accommodations is the foundation for the ada prohibitions on discrimination in health care. Renewed scrutiny of homeowners insurance practices could arise from enforcement of a new directive from the What’s fair , 80 c ornell l. While many forms of direct unfair discrimination have been eliminated, subtle, less obvious forms of discrimination remain in access to insurance and risk classification. Insurers included gender as a risk factor where it was relevant;

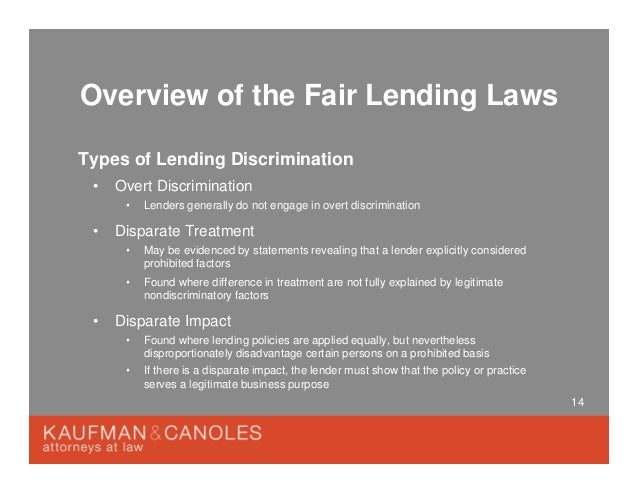

Source: slideshare.net

Source: slideshare.net

In other words, it is unlawful for both public and private health insurance plans to discriminate on the basis of disability when public accommodations are offered. Fair discrimination is needed to avoid the mechanism of adverse selection, which is the result of rational behaviour by potential insurance policyholders. Many examples where insurers, insurance producers, regulators, state legislators and embers of congress m have come together to eliminate these discriminatory practices. Unfair discrimination takes place whenever a choice revolves around a distinction that is irrelevant to offering insurance coverage. Yet every firm will have to evidence the distance between their.

Source: youtube.com

Source: youtube.com

Insurers rely on data and statistics to assess the risk they take on from their customers. “fair discrimination.” in that cultural context, property/casualty insurers may soon find themselves forced to defend the fairness of the discrimination they utilize to underwrite and price homeowners insurance. What’s fair , 80 c ornell l. Insurance companies justify such discrimination based on an individual’s area of residency, gender, marital status as “fair” because they are. Yet every firm will have to evidence the distance between their.

Source: icnj.com

Source: icnj.com

In line with developments in the personalisation of risk, the idea that insurance products should above all be ‘fair’ to the policyholders is increasingly voiced by commentators. And this will not be easy for many insurance people, who see themselves as good people providing an important service. In the case of car insurance, an insurer practicing fair discrimination would take into account the driver’s record of driving violations and what type of car the driver owns. Renewed scrutiny of homeowners insurance practices could arise from enforcement of a new directive from the Insurers cross the line into unfair discrimination when they.

Source: researchgate.net

Source: researchgate.net

Whilst statistical discrimination as such has been clearly identified and widely studied and discussed in scientific writings in economics at least since. Many examples where insurers, insurance producers, regulators, state legislators and embers of congress m have come together to eliminate these discriminatory practices. Whilst statistical discrimination as such has been clearly identified and widely studied and discussed in scientific writings in economics at least since. And this will not be easy for many insurance people, who see themselves as good people providing an important service. The two big ethical issues that firms have to engage with are fairness and discrimination in insurance underwriting.

Source: chronicdiseasecoalition.org

Source: chronicdiseasecoalition.org

Actuarial fairness moves here from being a property of insurance premiums in microeconomics under which homo economicus would obtain full coverage, to a necessary condition for insurance market practices to function. 2 see infra part ii.c. In the case of car insurance, an insurer practicing fair discrimination would take into account the driver’s record of driving violations and what type of car the driver owns. This prohibition of discrimination on the basis of disability in the enjoyment of accommodations is the foundation for the ada prohibitions on discrimination in health care. The insurance industry’s ability to identify, differentiate, and quantify risk is hinged on the concept of fair discrimination, where risks are treated differently based on their expected insurance cost differences.

Source: themedicalcareblog.com

Source: themedicalcareblog.com

“in insurance,” the naic explained to the supreme court, “discrimination is not necessarily a negative term so much as a descriptive one.” courts recognize that “the insurance commissioner is instructed to eliminate unfair discrimination, whereas” general civil rights laws “prohibit all discrimination.” “fair discrimination.” in that cultural context, property/casualty insurers may soon find themselves forced to defend the fairness of the discrimination they utilize to underwrite and price homeowners insurance. Insurers rely on data and statistics to assess the risk they take on from their customers. 2 see infra part ii.c. Fairness and discrimination in underwriting.

Source: youtube.com

Source: youtube.com

This prohibition of discrimination on the basis of disability in the enjoyment of accommodations is the foundation for the ada prohibitions on discrimination in health care. In line with developments in the personalisation of risk, the idea that insurance products should above all be ‘fair’ to the policyholders is increasingly voiced by commentators. Using it in that way was not This prohibition of discrimination on the basis of disability in the enjoyment of accommodations is the foundation for the ada prohibitions on discrimination in health care. Fair discrimination is needed to avoid the mechanism of adverse selection, which is the result of rational behaviour by potential insurance policyholders.

Source: academia.edu

Source: academia.edu

Making or permitting any unfair discrimination between individuals of the same class and of essentially the same hazard in the amount of premium, policy fees, or rates charged for any policy or contract of insurance, other than life insurance, or in the benefits payable thereunder, or in underwriting standards and practices or eligibility requirements, or in any of the terms or. And this will not be easy for many insurance people, who see themselves as good people providing an important service. Yet every firm will have to evidence the distance between their. In insurance, where differences in treatment are reflected by differences in premiums, such a situation would be described as “actuarially” fair, whereas “unfair discrimination” refers to the unequal treatment of individuals with the same risk level (meyer 2004,p.31).unfair, in other words, means for insurers “equal Insurance companies must practice fair discrimination.

Source: peterbethlenfalvympp.ca

Source: peterbethlenfalvympp.ca

In the case of car insurance, an insurer practicing fair discrimination would take into account the driver’s record of driving violations and what type of car the driver owns. Regulation of big data, consumer education, and increasing. Insurance companies must practice fair discrimination. Discrimination in insurance recommended citation jill gaulding, race sex and genetic discrimination in insurance: Whilst statistical discrimination as such has been clearly identified and widely studied and discussed in scientific writings in economics at least since.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fair discrimination in insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.