Your Factors that affect homeowners insurance premiums images are available in this site. Factors that affect homeowners insurance premiums are a topic that is being searched for and liked by netizens today. You can Download the Factors that affect homeowners insurance premiums files here. Find and Download all free vectors.

If you’re looking for factors that affect homeowners insurance premiums images information related to the factors that affect homeowners insurance premiums keyword, you have pay a visit to the right site. Our website always provides you with hints for viewing the highest quality video and image content, please kindly search and find more informative video content and graphics that match your interests.

Factors That Affect Homeowners Insurance Premiums. The exact location of your home can greatly affect your homeowners insurance premium. Personal factors — what you do personally can affect your homeowners insurance premium, too. Here are the most common factors that impact your home insurance costs. Some people are mistaken about the flat rate of home insurance.

5 Little Known Factors That Could Affect Your Home From ihryins.com

5 Little Known Factors That Could Affect Your Home From ihryins.com

Your home, your financial history and your policy choices are all factors that affect homeowners insurance premiums. A good credit history also can lower what you pay for home insurance. There are so many things that can affect insurance premiums. Here are 16 key factors that influence your home�s insurance rates. In this article, we will go over the factors that affect the price of homeowners insurance premium. For instance, your premium may be impacted by the home’s:

The factors that affect homeowners insurance homeowner’s insurance is designed to restore your home and personal possessions in the event of an unexpected loss.

Below are some of the factors that can influence homeowners’ insurance rates. This vulnerability drives up premiums, before we get to factors that homeowners can control. Since obesity, for instance, can cause health problems and a shorter lifespan, this could affect your premium. The insurance company itself determines how much you are going to pay as the premiums as you apply for your home. The exact location of your home can greatly affect your homeowners insurance premium. In reality, the opposite is the case:

Source: firstcitizens.com

Source: firstcitizens.com

Finally, the insurance company will need to know about any custom features to your home, flooring type, and the type of cabinetry. For instance, smokers may pay more for home insurance than nonsmokers. This vulnerability drives up premiums, before we get to factors that homeowners can control. In reality, the opposite is the case: Living in a densely populated area can affect insurance premiums for two reasons.

Source: slideshare.net

Source: slideshare.net

The type and frequency of the claims you’ve filed can lead to higher premiums. Home location is perhaps the biggest factor that insurers use to determine homeowners insurance premiums. If you have expensive features on the interior of your home, your insurance premiums will reflect those features. Since obesity, for instance, can cause health problems and a shorter lifespan, this could affect your premium. When you ask your insurance agent for a quote, they will take into consideration certain factors that may affect your.

Source: slideshare.net

Source: slideshare.net

For instance, your premium may be impacted by the home’s: Another thing insurance companies look for is if you hold a dangerous job, such as a coal miner, race car driver, or you work in any profession that can cause accidents. Here are 16 key factors that influence your home�s insurance rates. Similar to how banks use various elements to determine credit worthiness of a borrower and interest rate of a loan, insurance companies utilize several factors to determine insurance premium for a customer’s policy. It should not have so many unpaid claims.

Source: jgsinsurance.com

Source: jgsinsurance.com

Personal factors — what you do personally can affect your homeowners insurance premium, too. Your home, your financial history and your policy choices are all factors that affect homeowners insurance premiums. Lowering the amount of coverage within your policy is one of the factors that affect home insurance costs. Below are some of the factors that can influence homeowners’ insurance rates. If you have expensive features on the interior of your home, your insurance premiums will reflect those features.

Source: bailyagency.com

Source: bailyagency.com

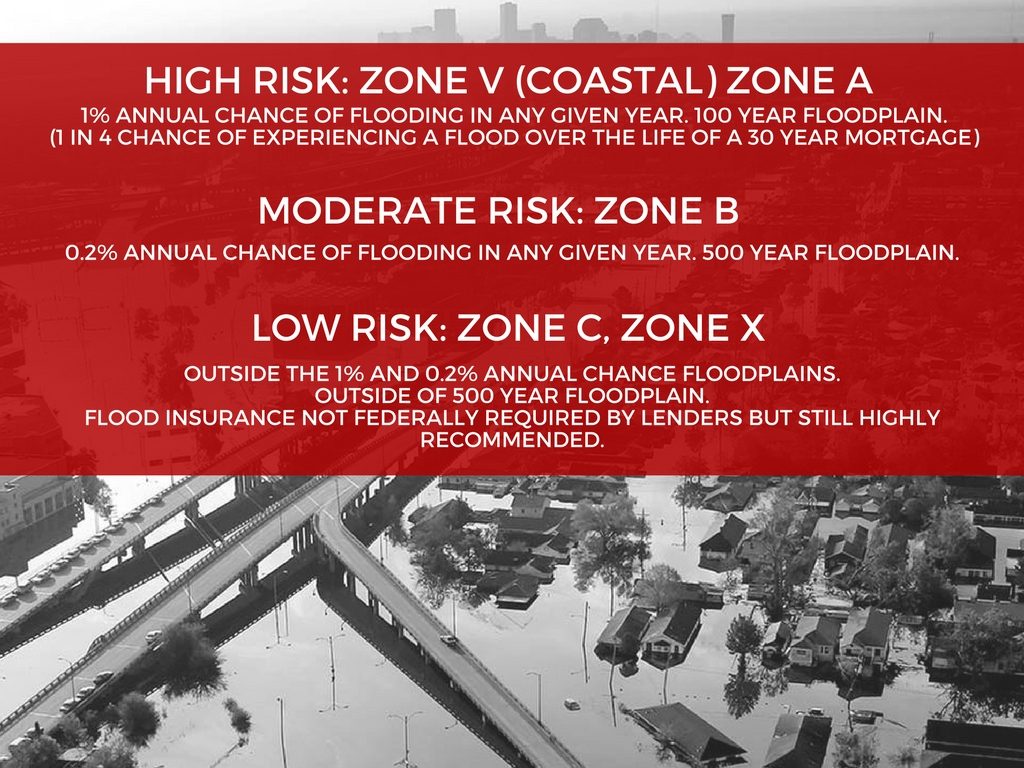

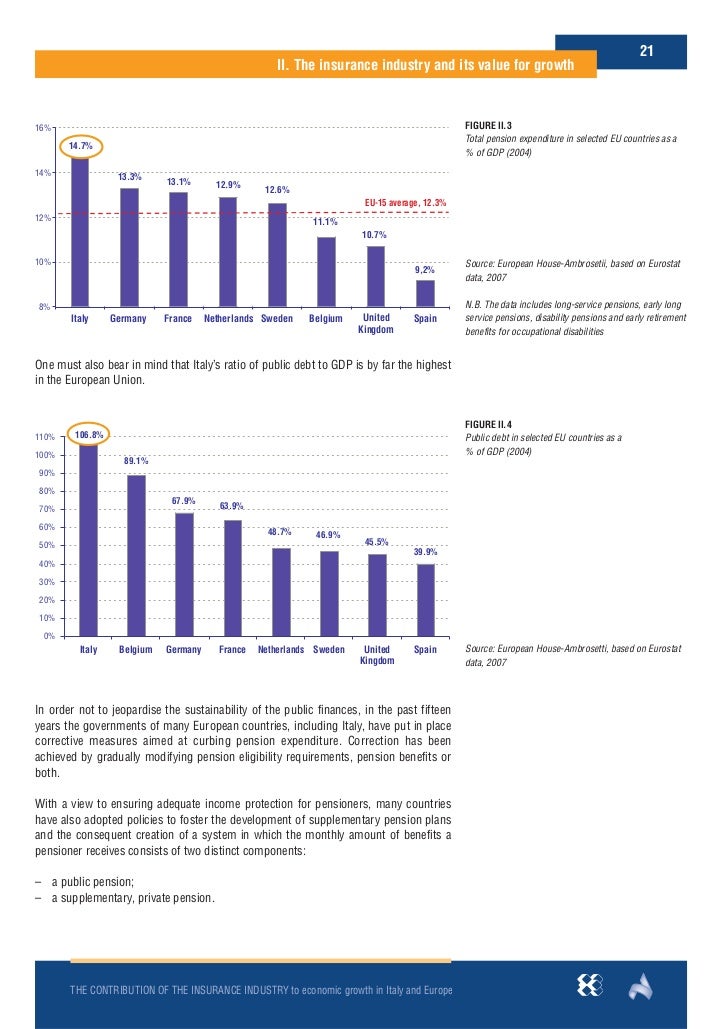

Similar to how banks use various elements to determine credit worthiness of a borrower and interest rate of a loan, insurance companies utilize several factors to determine insurance premium for a customer’s policy. Living in a densely populated area can affect insurance premiums for two reasons. Factors that affect homeowners insurance premiums. Main factors that affect your home insurance premiums. Generally speaking, if you live in an area that is prone to natural disasters like hurricanes, tornadoes, or wildfires, you’ll pay more for homeowners insurance since the risk of insuring your home is higher.

Source: phocusinsurance.com

Source: phocusinsurance.com

Main factors that affect your home insurance premiums. Older homes can often cost more to insure, and those costs can differ depending on whether your home is brick, frame, masonry. There are so many things that can affect insurance premiums. This is also a factor. Generally speaking, if you live in an area that is prone to natural disasters like hurricanes, tornadoes, or wildfires, you’ll pay more for homeowners insurance since the risk of insuring your home is higher.

Source: teamayao.com

Source: teamayao.com

In all states except california, maryland and massachusetts, insurance companies can use your credit history when determining home insurance rates. Generally speaking, if you live in an area that is prone to natural disasters like hurricanes, tornadoes, or wildfires, you’ll pay more for homeowners insurance since the risk of insuring your home is higher. Personal factors — what you do personally can affect your homeowners insurance premium, too. Another thing insurance companies look for is if you hold a dangerous job, such as a coal miner, race car driver, or you work in any profession that can cause accidents. Finally, the insurance company will need to know about any custom features to your home, flooring type, and the type of cabinetry.

Source: connect2local.com

Source: connect2local.com

When you ask your insurance agent for a quote, they will take into consideration certain factors that may affect your. Your home, your financial history and your policy choices are all factors that affect homeowners insurance premiums. There are so many things that can affect insurance premiums. Some people are mistaken about the flat rate of home insurance. While your rates could be lower, it.

Source: weaverinsurance.com

Source: weaverinsurance.com

Lowering the amount of coverage within your policy is one of the factors that affect home insurance costs. While your rates could be lower, it. When you ask your insurance agent for a quote, they will take into consideration certain factors that may affect your. Below are some of the factors that can influence homeowners’ insurance rates. Personal factors — what you do personally can affect your homeowners insurance premium, too.

Source: todaytechhelp.com

Source: todaytechhelp.com

The insurance company must also be reliable; The insurance company itself determines how much you are going to pay as the premiums as you apply for your home. Older homes can often cost more to insure, and those costs can differ depending on whether your home is brick, frame, masonry. Home location is perhaps the biggest factor that insurers use to determine homeowners insurance premiums. Another thing insurance companies look for is if you hold a dangerous job, such as a coal miner, race car driver, or you work in any profession that can cause accidents.

Source: insurify.com

Source: insurify.com

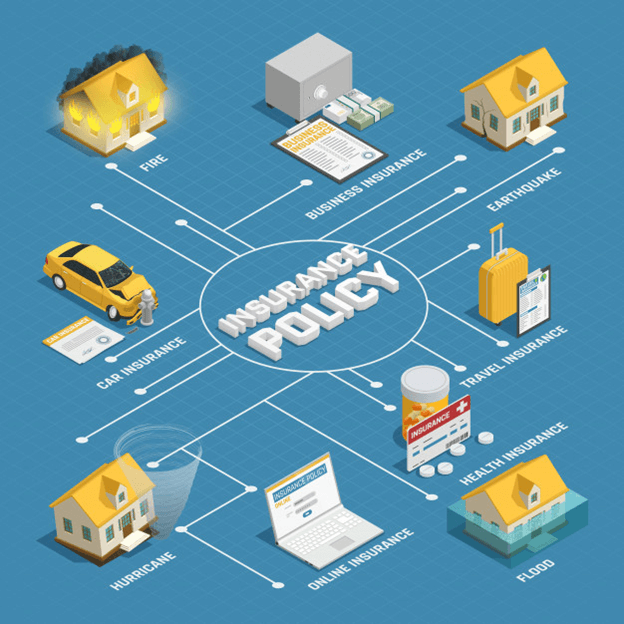

There are so many things that can affect insurance premiums. The type and frequency of the claims you’ve filed can lead to higher premiums. Finally, the insurance company will need to know about any custom features to your home, flooring type, and the type of cabinetry. The insurance company must also be reliable; There are several types of insurance policies offered by different companies, but not all coverage is.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

Below are some of the factors that can influence homeowners’ insurance rates. Your credit score is another big factor that can impact your home insurance premium. The type and frequency of the claims you’ve filed can lead to higher premiums. Your insurance premium is the price of your home insurance policy. For instance, your premium may be impacted by the home’s:

Source: ihryins.com

Source: ihryins.com

There are several types of insurance policies offered by different companies, but not all coverage is. The factors that affect homeowners insurance homeowner’s insurance is designed to restore your home and personal possessions in the event of an unexpected loss. Home insurance rates for every householder are tailored. Finally, the insurance company will need to know about any custom features to your home, flooring type, and the type of cabinetry. Personal factors — what you do personally can affect your homeowners insurance premium, too.

Source: allaroundmoving.com

Source: allaroundmoving.com

Factors that affect homeowners insurance premiums. The factors that affect homeowners insurance homeowner’s insurance is designed to restore your home and personal possessions in the event of an unexpected loss. You�re probably curious how the insurance provider decides the price when shopping for homeowners� insurance. Home features and characteristics — your home�s age, type of structure, wiring, roof, garage, etc., can affect your homeowners insurance premium. In all states except california, maryland and massachusetts, insurance companies can use your credit history when determining home insurance rates.

Source: oyerinsurance.com

Source: oyerinsurance.com

Lowering the amount of coverage within your policy is one of the factors that affect home insurance costs. Main factors that affect your home insurance premiums. In reality, the opposite is the case: In this article, we will go over the factors that affect the price of homeowners insurance premium. A good credit history also can lower what you pay for home insurance.

Source: bajajallianz.com

Source: bajajallianz.com

Generally speaking, if you live in an area that is prone to natural disasters like hurricanes, tornadoes, or wildfires, you’ll pay more for homeowners insurance since the risk of insuring your home is higher. Another thing insurance companies look for is if you hold a dangerous job, such as a coal miner, race car driver, or you work in any profession that can cause accidents. First, highly populated areas like cities tend to have higher construction costs. For instance, your premium may be impacted by the home’s: Since obesity, for instance, can cause health problems and a shorter lifespan, this could affect your premium.

Source: bandingin.com

Source: bandingin.com

It should not have so many unpaid claims. Generally speaking, if you live in an area that is prone to natural disasters like hurricanes, tornadoes, or wildfires, you’ll pay more for homeowners insurance since the risk of insuring your home is higher. In reality, the opposite is the case: In all states except california, maryland and massachusetts, insurance companies can use your credit history when determining home insurance rates. Read more about this on our blog about how credit score affects insurance premiums.

Source: risethestudio.com

Source: risethestudio.com

It should not have so many unpaid claims. For instance, your premium may be impacted by the home’s: Here are the most common factors that impact your home insurance costs. In all states except california, maryland and massachusetts, insurance companies can use your credit history when determining home insurance rates. It should not have so many unpaid claims.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title factors that affect homeowners insurance premiums by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.