Your Factors affecting home insurance premiums images are available. Factors affecting home insurance premiums are a topic that is being searched for and liked by netizens now. You can Get the Factors affecting home insurance premiums files here. Download all royalty-free images.

If you’re searching for factors affecting home insurance premiums pictures information linked to the factors affecting home insurance premiums topic, you have pay a visit to the ideal blog. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

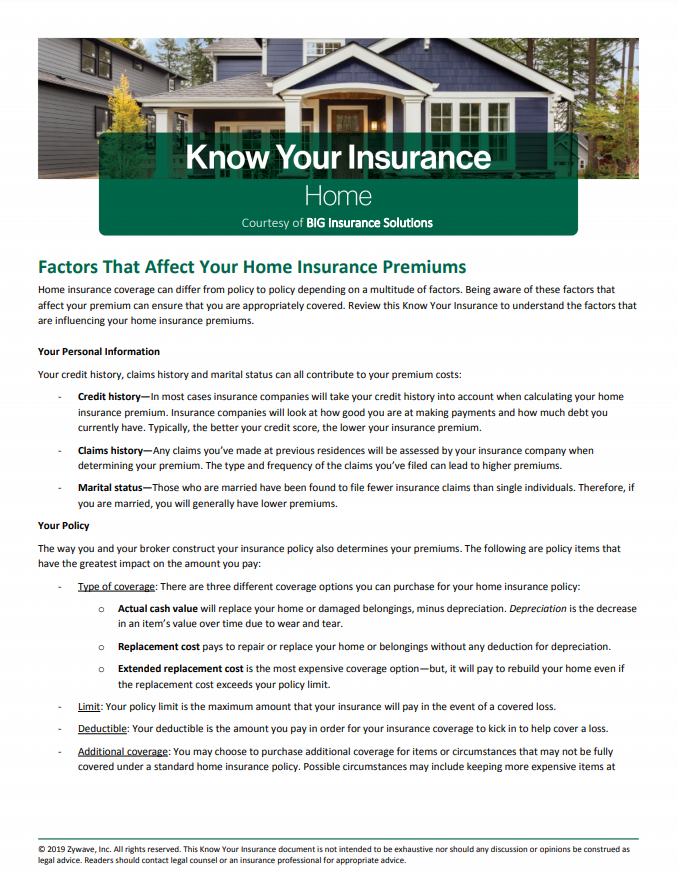

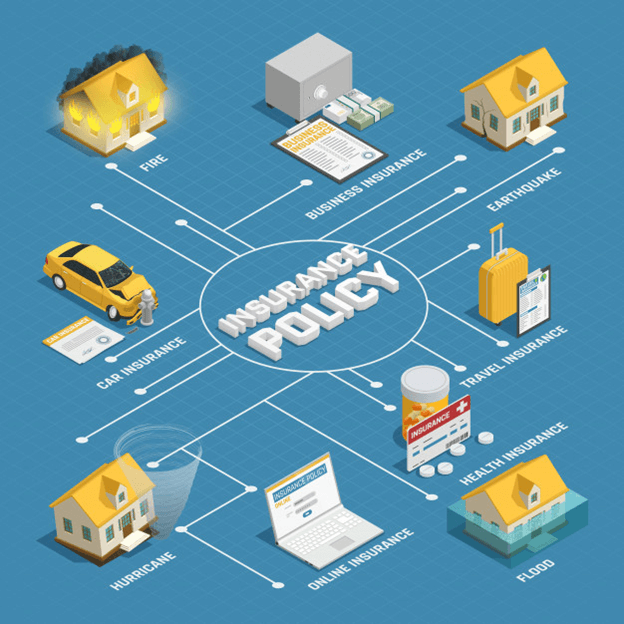

Factors Affecting Home Insurance Premiums. The age of your house and of its roof are common factors affecting home insurance premiums. 16 factors that affect home insurance rates (1). First, highly populated areas like cities tend to have higher construction costs. Where you live has a significant impact on the cost of your homeowners insurance.

10 Factors Which Determine Car Insurance Premium? From acko.com

10 Factors Which Determine Car Insurance Premium? From acko.com

These are those external factors that change premium rates for the entire market. The value of your home is calculated based on its current condition. Determining the level of your home or property insurance premium is determined through an underwriting process. 16 factors that affect homeowners insurance premiums replacement cost. Home insurance policies, for instance, see increased premiums when severe weather patterns occur with more frequency. Similarly, the age of your roof will influence your premiums.

The age of your house and of its roof are common factors affecting home insurance premiums.

The condition of your roof. Factors affecting home insurance premiums. Premium rate you must know that the financial services authority of indonesia (ojk) has set a lower and upper limit for the percentage of the level of property insurance premiums that are considered reasonable and feasible. Factors affecting premiums the following is a review of some of the main factors that influence the amount of your property insurance premium. It is so because the other factors such as location and the coverage also influence the. Swimming pool or hot tub.

Source: teamayao.com

Source: teamayao.com

Home insurance premiums are calculated based on several factors, each of which rates your risk of having an insured loss. Home insurance policies, for instance, see increased premiums when severe weather patterns occur with more frequency. First, highly populated areas like cities tend to have higher construction costs. Home insurance premiums are calculated based on several factors, each of which rates your risk of having an insured loss. Factors affecting premiums the following is a review of some of the main factors that influence the amount of your property insurance premium.

Source: todaytechhelp.com

Source: todaytechhelp.com

Here are 10 factors that could be affecting your home insurance costs. Swimming pool or hot tub. Home insurance policies, for instance, see increased premiums when severe weather patterns occur with more frequency. The condition of your home this contributes a great deal towards the total cost. Other factors that affect your home insurance.

Source: insurify.com

Source: insurify.com

Top 5 factors affecting home insurance premiums. Age and construction of home. The condition of your home this contributes a great deal towards the total cost. Your location the geographic location of your home or property determines the likelihood of loss. What affects homeowners insurance premiums state.

Source: biginsurancesolutions.com

Source: biginsurancesolutions.com

Your home insurance premiums will be affected by the level of cover you choose. 10 factors that affect your home insurance premiums. 16 factors that affect homeowners insurance premiums replacement cost. Generally, home insurance premiums increase as a home ages. Continuous property insurance the amount of time a person has continuous home insurance without any claims can lower their home insurance premium.

Source: acko.com

Source: acko.com

Continuous property insurance the amount of time a person has continuous home insurance without any claims can lower their home insurance premium. This is going to be factored into the premiums. The location of your home. Here are 10 factors that could be affecting your home insurance costs. 16 factors that affect home insurance rates (1).

Source: insubuy.com

Source: insubuy.com

The value of your home is calculated based on its current condition. Thus, one of the important tasks for health insurance companies is to determine the policy premiums. The condition of your roof. 1 day ago — factors that impact your home insurance rate · replacement cost · credit history · claims history · marital status · age of home · deductible (2). It is so because the other factors such as location and the coverage also influence the.

Source: weaverinsurance.com

Source: weaverinsurance.com

While many factors potentially increase the cost of premiums, there are some that will lower it. While many factors potentially increase the cost of premiums, there are some that will lower it. 10 factors that affect your home insurance premiums. The value of your home is calculated based on its current condition. By using predictive modelling, the insurers can determine the policy premium for the insured based on their behaviors which are indicated by attributes such as age, bmi (body mass index), smoking habits, number of children etcetera.

Source: bandingin.com

Source: bandingin.com

By using predictive modelling, the insurers can determine the policy premium for the insured based on their behaviors which are indicated by attributes such as age, bmi (body mass index), smoking habits, number of children etcetera. The condition of your roof. Sep 21, 2020 — state · credit score · claims history · coverage amount · condition of the home. Here are some of the primary factors that determine personal auto and commercial property insurance costs: You need to know and understand in advance what factors are used as the basis for determining the insurance to determine the amount of your property insurance premiums.

Source: slideshare.net

Source: slideshare.net

That includes past suspensions and dui/dwi charges. Property area while the area of your house is an important factor that determines the premium of your home insurance policy, it is possible that two houses having similar area might have different insurance rates. You need to know and understand in advance what factors are used as the basis for determining the insurance to determine the amount of your property insurance premiums. Your credit score is another big factor that can impact your home insurance premium. 5 factors affecting your health insurance premium ;

Source: issuu.com

Source: issuu.com

These are those external factors that change premium rates for the entire market. Accidents, theft, vandalism, and severe weather such as flooding or hail are more common in some areas than others. These can be based on risk factors that are considered that have been eliminated. Living in a densely populated area can affect insurance premiums for two reasons. First, highly populated areas like cities tend to have higher construction costs.

Source: firstcitizens.com

Source: firstcitizens.com

16 factors that affect homeowners insurance premiums replacement cost. Age and construction of home. Multiple moving violations, higher risk auto accidents, and suspensions are also factors that affect your life insurance premiums. What affects homeowners insurance premiums state. The condition of your roof.

Source: bobatoo.co.uk

Source: bobatoo.co.uk

Accidents, theft, vandalism, and severe weather such as flooding or hail are more common in some areas than others. Multiple moving violations, higher risk auto accidents, and suspensions are also factors that affect your life insurance premiums. Here are some of the primary factors that determine personal auto and commercial property insurance costs: Other factors that affect your home insurance. The condition of your home this contributes a great deal towards the total cost.

Source: allaroundmoving.com

Source: allaroundmoving.com

Renovations increase the value of the home. The cost of the insurance cover is dependent on several factors. Other factors that affect your home insurance. Your location the geographic location of your home or property determines the likelihood of loss. With that said, let’s see some of the factors that affects average home insurance costs.

Source: covernest.com

Source: covernest.com

Top 5 factors affecting home insurance premiums. While many factors potentially increase the cost of premiums, there are some that will lower it. The condition of your home this contributes a great deal towards the total cost. 10 factors that affect your home insurance premiums. First, highly populated areas like cities tend to have higher construction costs.

Source: bajajallianz.com

Source: bajajallianz.com

The cost of the insurance cover is dependent on several factors. 16 factors that affect homeowners insurance premiums replacement cost. Similarly, the age of your roof will influence your premiums. Below we have outlined 15 key factors that could affect your home insurance premium. The replacement cost cost of your home.

Source: slideshare.net

Source: slideshare.net

Age and construction of home. The value of your home is calculated based on its current condition. Here are some of the primary factors that determine personal auto and commercial property insurance costs: Your location the geographic location of your home or property determines the likelihood of loss. Where you live has a significant impact on the cost of your homeowners insurance.

Source: slideshare.net

Source: slideshare.net

Factors affecting home insurance premiums. Factors affecting premiums the following is a review of some of the main factors that influence the amount of your property insurance premium. If your home is old, your insurer will consider it as being more risky to insure than a brand new construction. With that said, let’s see some of the factors that affects average home insurance costs. Other factors that affect your home insurance.

Source: petleyhare.com

Source: petleyhare.com

While many factors potentially increase the cost of premiums, there are some that will lower it. Living in a densely populated area can affect insurance premiums for two reasons. What affects homeowners insurance premiums state. The age of your house and of its roof are common factors affecting home insurance premiums. This is going to be factored into the premiums.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title factors affecting home insurance premiums by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.