Your Factoring insurance receivables images are available in this site. Factoring insurance receivables are a topic that is being searched for and liked by netizens today. You can Download the Factoring insurance receivables files here. Get all free photos and vectors.

If you’re searching for factoring insurance receivables pictures information linked to the factoring insurance receivables keyword, you have pay a visit to the ideal blog. Our site frequently gives you hints for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

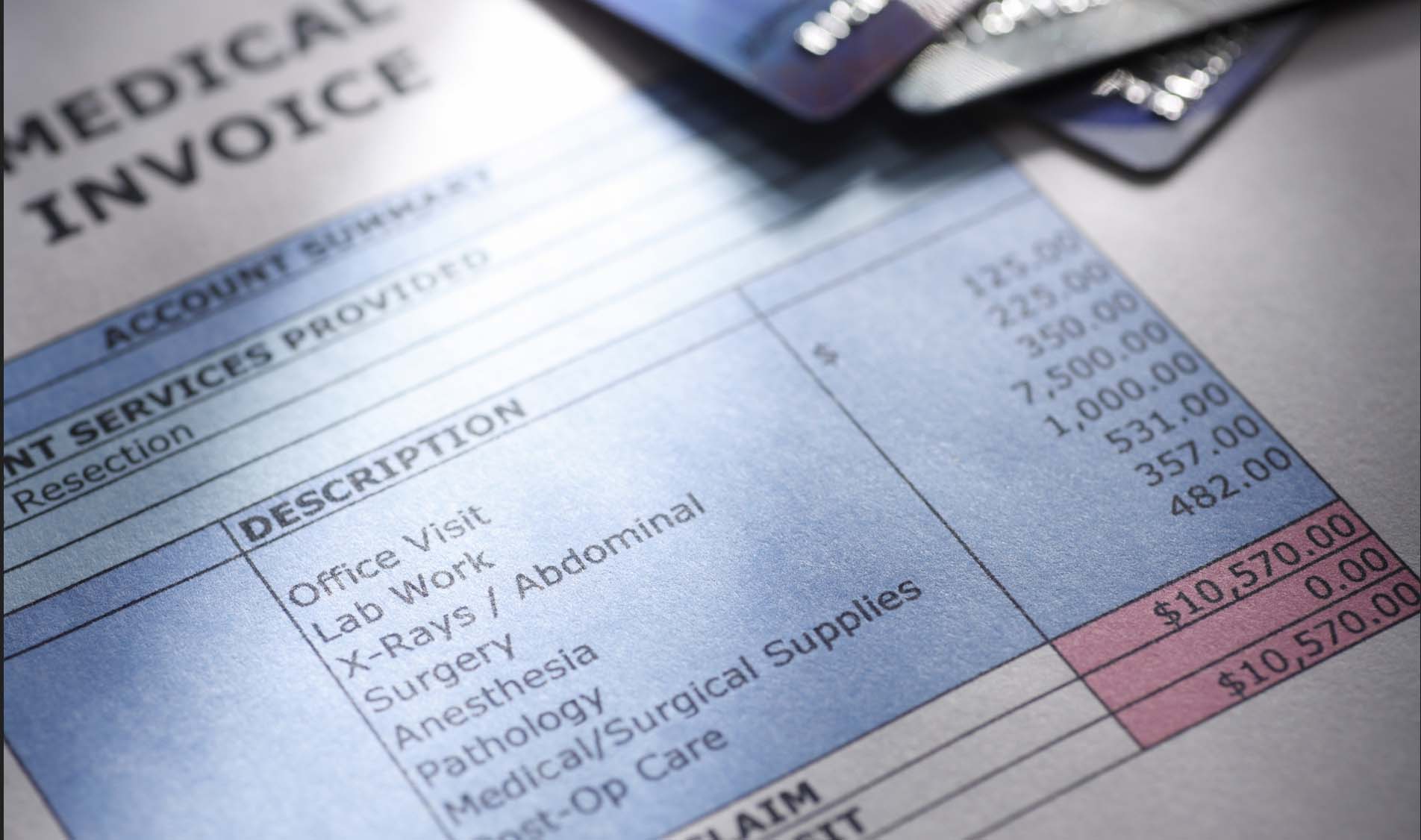

Factoring Insurance Receivables. Average rates, benefits, and qualifications. This enables you to stay focused and gives you the ability to better align revenues with expenses, such as payroll and hiring costs. Payment is then owed to the factoring company. The cost of factoring your medical receivables varies based on the size of the financing facility, the creditworthiness of your insurance providers, and other criteria.

Factoring Insurance Receivables Corsa Finance 8558826772 From corsafinance.com

Factoring Insurance Receivables Corsa Finance 8558826772 From corsafinance.com

On average, it takes anywhere from 30 to 120 days to receive payment on medical insurance claims. Factoring isn�t just a way of improving your cash flow and eliminating the need for collections, it also acts as a form of insurance for your receivables. Fueling business growth when new opportunities arise Average rates, benefits, and qualifications. You, the exporter, sign a contract to sell your export receivables to a factor (financial institution). By factoring insurance receivables, practices can skip the long wait.

We offer immediate payment for your receivables and that money is yours.

How does factoring insure my receivables? Factoring is a financial transaction in which a company sells its receivables to a financial company (called a factor). For an instant quote, fill out this form. It agrees to pay the invoice, less a discount for commission and fees. Medical factoring for healthcare receivables: This enables you to stay focused and gives you the ability to better align revenues with expenses, such as payroll and hiring costs.

Source: capflowfunding.com

Source: capflowfunding.com

We offer immediate payment for your receivables and that money is yours. By factoring insurance receivables, you can eliminate the wait on payment from insurers. To do this, they can factor their receivables. Healthcare & medical receivables factoring. When factoring receivables, the business will receive an advance that’s typically 80% of the invoice amount at the point of purchase.

Source: capflowfunding.com

Source: capflowfunding.com

Providing cash liquidity without taking on debt; By factoring insurance receivables, you can eliminate the wait on payment from insurers. The healthcare sector is stressed with cash flow issues due to outstanding. Medical factoring for healthcare receivables: Receivables or invoice discounting will conversely mean that individual invoices are discounted and this may be selective invoices or customers of a company;

Source: corsafinance.com

Source: corsafinance.com

To do this, they can factor their receivables. Payment is then owed to the factoring company. Generally, costs range from 2% to 3.5% per 30 days. For an instant quote, fill out this form. Healthcare & medical receivables factoring.

Source: financeandloans.org

Source: financeandloans.org

You export $100,000 worth of goods or services and allow your foreign buyer 90 days to pay the invoice. Medical factoring for healthcare receivables: Payment is then owed to the factoring company. Fueling business growth when new opportunities arise Generally, costs range from 2% to 3.5% per 30 days.

Source: corsafinance.com

Source: corsafinance.com

Once the claims have been approved by the provider, the practice would receive a percentage of the net value of the claim, typically 70 to 80 percent. Factoring receivables involves a different process than taking out a bank loan, but the general goal for both is often the same: Providing cash liquidity without taking on debt; You export $100,000 worth of goods or services and allow your foreign buyer 90 days to pay the invoice. By factoring insurance receivables, you can eliminate the wait on payment from insurers.

Source: corsafinance.com

Source: corsafinance.com

Receivables or invoice discounting will conversely mean that individual invoices are discounted and this may be selective invoices or customers of a company; Providing cash liquidity without taking on debt; Receivables or invoice discounting will conversely mean that individual invoices are discounted and this may be selective invoices or customers of a company; Fueling business growth when new opportunities arise The factor collects payment on the receivables from the company’s customers.

Source: corsafinance.com

Source: corsafinance.com

A factor is a financial intermediary that purchases receivables from a company. Payment is then owed to the factoring company. Receivables or invoice discounting will conversely mean that individual invoices are discounted and this may be selective invoices or customers of a company; Accounts receivable factoring, also known as invoice factoring or business receivable factoring, is a method of business financing that companies sometimes use to help manage cash flow and meet expenses. When factoring receivables, the business will receive an advance that’s typically 80% of the invoice amount at the point of purchase.

Source: capflowfunding.com

Source: capflowfunding.com

Healthcare & medical receivables factoring. Healthcare providers face significant challenges when it comes to receiving payment for medical services in a timely manner. Prn funding works with factor finders, llc, a leading factoring broker that pairs healthcare providers with the leading medical factoring companies. Ultimately, credit insurance improves both the level of security of your trade receivables portfolio and the terms of your factoring contract. Factoring is a financial transaction in which a company sells its receivables to a financial company (called a factor).

Source: capflowfunding.com

Source: capflowfunding.com

Providing cash liquidity without taking on debt; The factor collects payment on the receivables from the company’s customers. For an instant quote, fill out this form. This combination also secures the unfinanced portion of the receivables, which varies in line with the available financial resources. Healthcare providers face significant challenges when it comes to receiving payment for medical services in a timely manner.

Source: wikibanks.cz

Source: wikibanks.cz

It agrees to pay the invoice, less a discount for commission and fees. Factoring isn�t just a way of improving your cash flow and eliminating the need for collections, it also acts as a form of insurance for your receivables. Providing cash liquidity without taking on debt; Companies choose factoring if they want to receive cash quickly rather than waiting for the duration of the credit terms. The factor collects payment on the receivables from the company’s customers.

Source: capitalforbusiness.net

Source: capitalforbusiness.net

Prn funding works with factor finders, llc, a leading factoring broker that pairs healthcare providers with the leading medical factoring companies. Factoring is a financial transaction in which a company sells its receivables to a financial company (called a factor). In effect, it is when the whole ledger of invoices or debts are factored. Factoring receivables is the selling of accounts receivables to free up cash flow. One type provides services or sells goods to the medical industry, such as nurse staffing or medical billing services.

Source: usmedcapital.com

Source: usmedcapital.com

Receivables factoring for healthcare is the selling of outstanding accounts receivables from a healthcare provider to a lender. We offer immediate payment for your receivables and that money is yours. You, the exporter, sign a contract to sell your export receivables to a factor (financial institution). Factoring receivables is the selling of accounts receivables to free up cash flow. Factoring isn�t just a way of improving your cash flow and eliminating the need for collections, it also acts as a form of insurance for your receivables.

Source: ar-factoring.com

Source: ar-factoring.com

Receivables factoring is a term used interchangeably with invoice factoring. To do this, they can factor their receivables. A factor is a financial intermediary that purchases receivables from a company. Ultimately, credit insurance improves both the level of security of your trade receivables portfolio and the terms of your factoring contract. How does factoring insure my receivables?

Source: capflowfunding.com

Source: capflowfunding.com

Once the receivables are paid, factor funding will send the remaining value minus a small factoring fee. A factor is a financial intermediary that purchases receivables from a company. Companies choose factoring if they want to receive cash quickly rather than waiting for the duration of the credit terms. Providing cash liquidity without taking on debt; One type provides services or sells goods to the medical industry, such as nurse staffing or medical billing services.

Source: pinterest.com

Source: pinterest.com

Average rates, benefits, and qualifications. Once the receivables are paid, factor funding will send the remaining value minus a small factoring fee. The healthcare industry has two different types of companies that can benefit from medical factoring. For an instant quote, fill out this form. This enables you to stay focused and gives you the ability to better align revenues with expenses, such as payroll and hiring costs.

Source: factorfunding.com

Source: factorfunding.com

Once the claims have been approved by the provider, the practice would receive a percentage of the net value of the claim, typically 70 to 80 percent. Providing cash liquidity without taking on debt; Factoring is a financial transaction in which a company sells its receivables to a financial company (called a factor). We offer immediate payment for your receivables and that money is yours. The healthcare sector is stressed with cash flow issues due to outstanding.

Source: capflowfunding.com

Source: capflowfunding.com

You export $100,000 worth of goods or services and allow your foreign buyer 90 days to pay the invoice. Companies choose factoring if they want to receive cash quickly rather than waiting for the duration of the credit terms. Accounts receivable factoring, also known as invoice factoring or business receivable factoring, is a method of business financing that companies sometimes use to help manage cash flow and meet expenses. The factor collects payment on the receivables from the company’s customers. Prn funding works with factor finders, llc, a leading factoring broker that pairs healthcare providers with the leading medical factoring companies.

Source: corsafinance.com

Source: corsafinance.com

You export $100,000 worth of goods or services and allow your foreign buyer 90 days to pay the invoice. You export goods or services to a foreign buyer on mutually decided terms e.g. Receivables factoring is a term used interchangeably with invoice factoring. Healthcare providers face significant challenges when it comes to receiving payment for medical services in a timely manner. Factoring is a financial transaction in which a company sells its receivables to a financial company (called a factor).

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title factoring insurance receivables by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.