Your Face value life insurance meaning images are ready in this website. Face value life insurance meaning are a topic that is being searched for and liked by netizens today. You can Get the Face value life insurance meaning files here. Get all royalty-free photos.

If you’re looking for face value life insurance meaning images information related to the face value life insurance meaning topic, you have come to the right blog. Our website always provides you with hints for seeking the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that fit your interests.

Face Value Life Insurance Meaning. In term insurance, the face value is usually the same as what is. Face value can also be used synonymously with “face amount” or “coverage amount.”. For term life insurance, only the face value is paid out upon death, because term life insurance does not build up any cash value. Cash value life insurance is a type of permanent policy.

Life Insurance Face Value Meaning What Is The Face Value From erroresseguramente.blogspot.com

Life Insurance Face Value Meaning What Is The Face Value From erroresseguramente.blogspot.com

Cash value life insurance is a type of life insurance policy that’s in place for your whole life and comes with a sort of savings account built into it. The face value of property, casualty or health insurance policies is the maximum amount payable, as stated on the policy�s face or declarations page. In term insurance, the face value is usually the same as what is. The face value definition in life insurance refers to the death benefit that is paid to beneficiaries upon the death of the insured. Depending on the type of insurance policy, the death benefit may decrease over time, such as with credit life insurance purchased to cover a home mortgage that decreases as the mortgage is paid off. When a life insurance policy is identified by a dollar amount, this amount is the face value.

This event also cancels the life insurance policy.

Only permanent life insurance policies, such as whole life and universal life, have a cash value account. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. So, you’re paying for two things here—the life insurance part (the bit that covers your family if you die) and the cash value part (the savings account that supposedly grows your money over time). Cash value is the amount of money inside a permanent life insurance policy. In other words, it amounts to the total value paid once the policy matures, the policyholder passes on, or if the holder. This policy can only be cash in upon full maturity at the time of death of the insured.

Source: inthebox.buzz

Source: inthebox.buzz

It’s the amount of death benefit purchased, which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. It is used for life insurance policies. Frequently asked and often misunderstood, the face amount of life insurance is the initial amount of financial protection listed on a life insurance policy. That is the amount the issuer has borrowed, usually the amount you pay to buy the bond at the time it is issued, and the amount you are repaid at maturity, provided the issuer doesn�t default. When this happens most policy�s “endow” and the policy owner receives the cash benefit.

Source: rumahhijabaqila.com

Source: rumahhijabaqila.com

It’s the amount of death benefit purchased, which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. On the other hand a face amount life insurance policy doesn�t have that option. In addition to the face value of the life insurance (the amount the policyholder is. In the case of a typical level term life insurance the face amount is the amount of insurance for the guaranteed length of time. Face value can be used to refer to the apparent value of something other than a financial instrument, such as a concept or plan.

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

This event also cancels the life insurance policy. Face value is calculated by adding the death benefit with any rider benefits, and subtracting any loans you’ve taken on the policy. This is the dollar amount that the policy owner�s beneficiaries will receive upon the death of the insured. For term life insurance, only the face value is paid out upon death, because term life insurance does not build up any cash value. Simply put a cash value insurance policy allows the policy holder to cash in on the policy up to the equity that has been paid in on the policy.

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

The face value of life insurance is the original amount of coverage purchased, minus any loans, or adding cash value that accumulates beyond the original face amount. First lets discuss cash value. When this happens most policy�s “endow” and the policy owner receives the cash benefit. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. Endowment is a taxable event.

Source: alqurumresort.com

Source: alqurumresort.com

The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to. First lets discuss cash value. For term life insurance, only the face value is paid out upon death, because term life insurance does not build up any cash value. In other words, it amounts to the total value paid once the policy matures, the policyholder passes on, or if the holder. You choose the life insurance face amount when you buy a policy, and the amount is stated in your contract.

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

Face value can be used to refer to the apparent value of something other than a financial instrument, such as a concept or plan. Depending on the type of insurance policy, the death benefit may decrease over time, such as with credit life insurance purchased to cover a home mortgage that decreases as the mortgage is paid off. The face value is the death benefit. Face value is calculated by adding the death benefit with any rider benefits, and subtracting any loans you’ve taken on the policy. That is the amount the issuer has borrowed, usually the amount you pay to buy the bond at the time it is issued, and the amount you are repaid at maturity, provided the issuer doesn�t default.

Source: youtube.com

Source: youtube.com

First lets discuss cash value. Both the cash value and face value are different in terms of how their monetary amounts are determined. In short, your face value is the amount of money your beneficiaries will receive from your insurance company at the time of your death. Face value is different from cash value, which is the amount you receive when you surrender your policy, if you have a permanent type of life insurance. The face value of a life insurance policy is the death benefit.

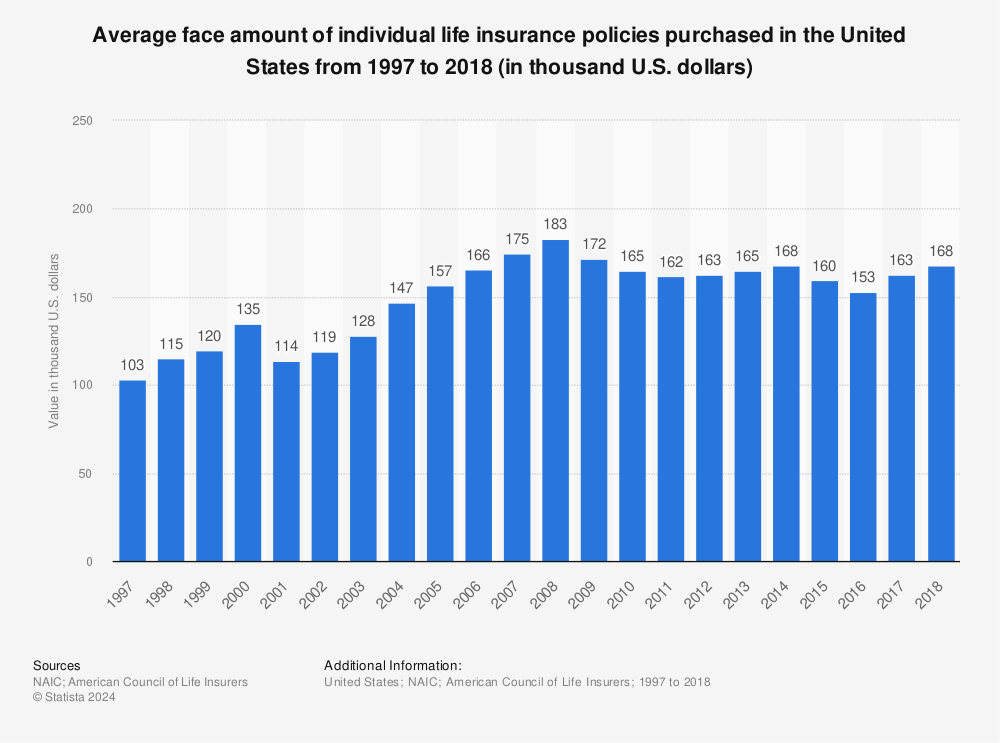

Source: statista.com

Source: statista.com

In short, your face value is the amount of money your beneficiaries will receive from your insurance company at the time of your death. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. When this happens most policy�s “endow” and the policy owner receives the cash benefit. Face value is different from cash value, which is the amount you receive when you surrender your policy, if you have a permanent type of life insurance. Two of the major types of permanent life policy are universal life and whole life policies.

Source: sappscarpetcare.com

Source: sappscarpetcare.com

Within your policy, it is officially denoted as the death benefit. On the other hand a face amount life insurance policy doesn�t have that option. Endowment is a taxable event. Within your policy, it is officially denoted as the death benefit. This is the dollar amount that the policy owner�s beneficiaries will receive upon the death of the insured.

Source: fishbowlapp.com

Source: fishbowlapp.com

When a life insurance policy is identified by a dollar amount, this amount is the face value. Both the cash value and face value are different in terms of how their monetary amounts are determined. When a life insurance policy is identified by a dollar amount, this amount is the face value. For term life insurance, only the face value is paid out upon death, because term life insurance does not build up any cash value. It’s the amount of death benefit purchased, which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies.

Source: researchgate.net

Source: researchgate.net

On the other hand a face amount life insurance policy doesn�t have that option. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. You might hear it called your death benefit, coverage amount. In the case of a typical level term life insurance the face amount is the amount of insurance for the guaranteed length of time. Simply put a cash value insurance policy allows the policy holder to cash in on the policy up to the equity that has been paid in on the policy.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

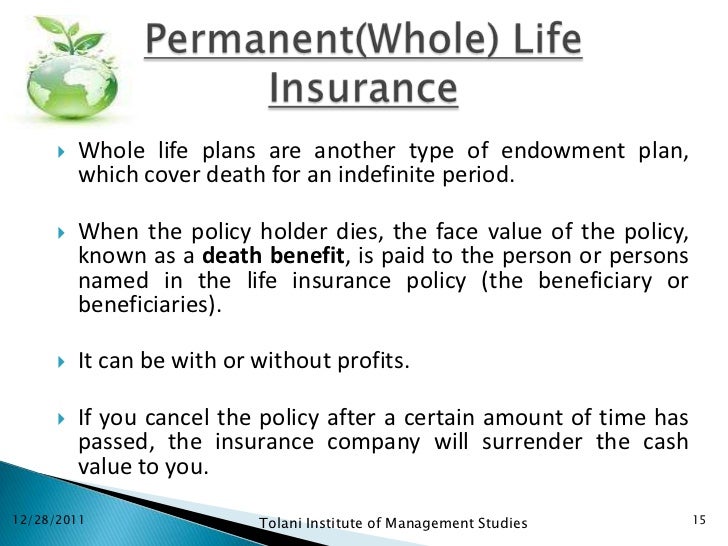

The face value of property, casualty or health insurance policies is the maximum amount payable, as stated on the policy�s face or declarations page. When this happens most policy�s “endow” and the policy owner receives the cash benefit. Whole life and universal life policies are considered permanent life insurance because they will provide coverage for the lifetime of the insured. Depending on the type of insurance policy, the death benefit may decrease over time, such as with credit life insurance purchased to cover a home mortgage that decreases as the mortgage is paid off. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. In addition to the face value of the life insurance (the amount the policyholder is. Cash value and face value are two elements that make up a permanent life policy. Two of the major types of permanent life policy are universal life and whole life policies. In term insurance, the face value is usually the same as what is.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

The face value, or face amount, of a life insurance policy is established when the policy is issued. The cash value is often stated on the top sheet of the policy, hence the name face amount. The face value of life insurance is the original amount of coverage purchased, minus any loans, or adding cash value that accumulates beyond the original face amount. In addition to the face value of the life insurance (the amount the policyholder is. In other words, it amounts to the total value paid once the policy matures, the policyholder passes on, or if the holder.

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

The face value of a life insurance policy is the amount of insurance that is purchased. You choose the life insurance face amount when you buy a policy, and the amount is stated in your contract. Face value is different from cash value, which is the amount you receive when you surrender your policy, if you have a permanent type of life insurance. It’s the amount of death benefit purchased, which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. In short, your face value is the amount of money your beneficiaries will receive from your insurance company at the time of your death.

Source: slideshare.net

Source: slideshare.net

Face value is different from cash value, which is the amount you receive when you surrender your policy, if you have a permanent type of life insurance. Increases in the cash value over time can help offset increased insurance costs as the insured person gets older. Frequently asked and often misunderstood, the face amount of life insurance is the initial amount of financial protection listed on a life insurance policy. It is the accumulation of funds that remains after your premiums pay for policy fees and expenses, including the cost of insurance. Face amount is the gross total amount of cash quantified in an agreement or insurance policy.

Source: revisi.net

Source: revisi.net

The death benefit is the amount of money that is paid to the beneficiary upon death. Face value is defined as the value printed on money or on a bill or bond or on a ticket, or the amount of the death benefits of an insurance policy, or. The cash value is often stated on the top sheet of the policy, hence the name face amount. In term insurance, the face value is usually the same as what is. In short, your face value is the amount of money your beneficiaries will receive from your insurance company at the time of your death.

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

In the case of whole life insurance the face amount is the. When a life insurance policy is identified by a dollar amount, this amount is the face value. When this happens most policy�s “endow” and the policy owner receives the cash benefit. Face value is defined as the value printed on money or on a bill or bond or on a ticket, or the amount of the death benefits of an insurance policy, or. The death benefit is the amount of money that is paid to the beneficiary upon death.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title face value life insurance meaning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.