Your Face value insurance images are available. Face value insurance are a topic that is being searched for and liked by netizens today. You can Download the Face value insurance files here. Find and Download all free images.

If you’re searching for face value insurance images information connected with to the face value insurance interest, you have come to the right site. Our website always provides you with suggestions for refferencing the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that match your interests.

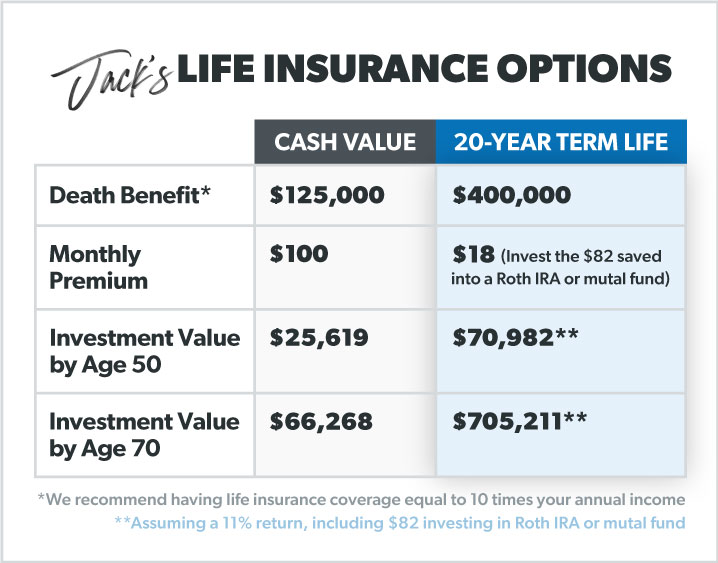

Face Value Insurance. The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your beneficiaries when you pass away. What happens when you pass away? The face value of life insurance is the dollar amount equated to the worth of your policy.it can also be referred to as the death benefit or the face amount of life insurance. What is the face worth of a life insurance policy.

Life Insurance Selecting the Right Face Value Demont From demontinsurance.com

Life Insurance Selecting the Right Face Value Demont From demontinsurance.com

If it says $500,000 in life insurance coverage, your policy’s face value is $500,000. You might hear it called your death benefit, coverage amount. It’s the amount of death benefit purchased, which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. Face value is the nominal value or dollar value of a security stated by the issuer, also known as par value or simply par. According to statista, the average face amount of life insurance purchased in the united states in 2015 was about $160,000. Face value is sometimes referred to as “face amount’ or “coverage amount.”

According to statista, the average face amount of life insurance purchased in the united states in 2015 was about $160,000.

Also referred to as a life insurance death benefit, the face value is the amount of money your beneficiaries will receive after you pass away. Within your policy, it is officially denoted as the death benefit. Face value is the amount that the insured’s family or beneficiaries receive upon death of the policy owner. The face value of property, casualty or health insurance policies is the maximum amount payable, as stated on the policy�s face or declarations page. The policy owner’s beneficiaries will receive this amount when he or she dies. Average life insurance face amounts have come down from a high point of $175,000 in the mid 2000s.

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

The face value is the death benefit. You might hear it called your death benefit, coverage amount. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. It’s the amount of death benefit purchased, which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. Your face value, or the money that your beneficiaries will receive from you insurance company upon your death, is shorthand for your financial worth.

Source: demontinsurance.com

Source: demontinsurance.com

The face value, or face amount, of a life insurance policy is established when the policy is issued. The face value of property, casualty or health insurance policies is the maximum amount payable, as stated on the policy�s face or declarations page. Within your policy, it is officially denoted as the death benefit. The face value of a life insurance policy is the death benefit. The face value of a life insurance policy is regarded as the percentage of death benefit purchased when adjusting with the procedure.

Source: insuranceinforme.blogspot.com

Source: insuranceinforme.blogspot.com

In all cases, life insurance face value is the amount of money given to. The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your beneficiaries when you pass away. The face value is the amount that the beneficiary of the policy or life insurance receives when the insured dies. Average life insurance face amounts have come down from a high point of $175,000 in the mid 2000s. Also referred to as a life insurance death benefit, the face value is the amount of money your beneficiaries will receive after you pass away.

Face value is a factor in determining the monthly insurance premiums and shows how much your policy is worth. It is also the chief determinant in analyzing and evaluating the amount of premium required to pay. The face value of a life insurance policy is regarded as the percentage of death benefit purchased when adjusting with the procedure. The cash value, or surrender value, is a savings component included in some life insurance policies that can accumulate cash value from premium payments. Face value is calculated by adding the death benefit with any rider benefits, and subtracting any loans you’ve taken on the.

Source: inthebox.buzz

Source: inthebox.buzz

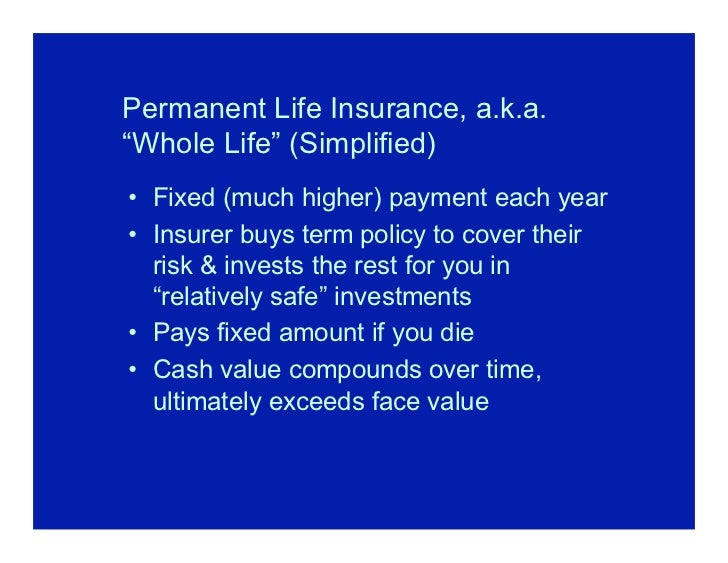

The face value of life insurance is the dollar amount equated to the worth of your policy.it can also be referred to as the death benefit or the face amount of life insurance. The face value of property, casualty or health insurance policies is the maximum amount payable, as stated on the policy�s face or declarations page. What is the face worth of a life insurance policy. A permanent life insurance policy including whole life insurance and universal life insurance has a face value and a cash value, which are two distinct values. The face value is the amount that the beneficiary of the policy or life insurance receives when the insured dies.

Source: howtoshopforlifeinsurancenensan.blogspot.com

Source: howtoshopforlifeinsurancenensan.blogspot.com

Your face value, or the money that your beneficiaries will receive from you insurance company upon your death, is shorthand for your financial worth. A permanent life insurance policy including whole life insurance and universal life insurance has a face value and a cash value, which are two distinct values. It is also the chief determinant in analyzing and evaluating the amount of premium required to pay. This is why you pay for life insurance. The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early.

Source: researchgate.net

Source: researchgate.net

Face value of variable life insurance. The face value, or face amount, of a life insurance policy is established when the policy is issued. Face value is sometimes referred to as “face amount’ or “coverage amount.” You might hear it called your death benefit, coverage amount. Face value is a factor in determining the monthly insurance premiums and shows how much your policy is worth.

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

Face value of variable life insurance. Average life insurance face amounts have come down from a high point of $175,000 in the mid 2000s. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. Face value is the nominal value or dollar value of a security stated by the issuer, also known as par value or simply par. The policy owner’s beneficiaries will receive this amount when he or she dies.

Source: youtube.com

Source: youtube.com

The cash value of variable life insurance policies can grow at a much faster rate and in certain cases can be used to pay premiums. In all cases, life insurance face value is the amount of money given to. You might hear it called your death benefit, coverage amount. The cash value, or surrender value, is a savings component included in some life insurance policies that can accumulate cash value from premium payments. The policy owner’s beneficiaries will receive this amount when he or she dies.

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

A permanent life insurance policy including whole life insurance and universal life insurance has a face value and a cash value, which are two distinct values. You might hear it called your death benefit, coverage amount. According to statista, the average face amount of life insurance purchased in the united states in 2015 was about $160,000. It’s the amount of death benefit purchased, which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. The face value of life insurance is the dollar amount equated to the worth of your policy.it can also be referred to as the death benefit or the face amount of life insurance.

Source: revisi.net

Source: revisi.net

The face value of a life insurance policy is regarded as the percentage of death benefit purchased when adjusting with the procedure. The face value is the amount that the beneficiary of the policy or life insurance receives when the insured dies. The face value of life insurance policy is the dollar amount that defines the actual worth of your policy. Face value is the nominal value or dollar value of a security stated by the issuer, also known as par value or simply par. Face value is sometimes referred to as “face amount’ or “coverage amount.”

Source: insuranceinforme.blogspot.com

Source: insuranceinforme.blogspot.com

The face value of life insurance is the dollar amount equated to the worth of your policy.it can also be referred to as the death benefit or the face amount of life insurance. What is the face worth of a life insurance policy. The face value, or face amount, of a life insurance policy is established when the policy is issued. The face value of a life insurance policy is the death benefit. The face value of a life insurance policy is the death benefit.

Source: coverage.com

Source: coverage.com

The face value, or face amount, of a life insurance policy is established when the policy is issued. The face value of a life insurance policy is the death benefit. Face value can also be used synonymously with “face amount” or “coverage amount.” The cash value, or surrender value, is a savings component included in some life insurance policies that can accumulate cash value from premium payments. Face value can be used to refer to the apparent value of something other than a financial instrument, such as a concept or plan.

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

Average life insurance face amounts have come down from a high point of $175,000 in the mid 2000s. The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early. Face value is sometimes referred to as “face amount’ or “coverage amount.” The face value, or face amount, of a life insurance policy is established when the policy is issued. According to statista, the average face amount of life insurance purchased in the united states in 2015 was about $160,000.

Source: insureguardian.com

Source: insureguardian.com

The face value of a life insurance policy is the death benefit. The face value is the death benefit. Face value is the amount that the insured’s family or beneficiaries receive upon death of the policy owner. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. The face value of life insurance is the dollar amount equated to the worth of your policy.it can also be referred to as the death benefit or the face amount of life insurance.

Source: alqurumresort.com

Source: alqurumresort.com

It’s the amount of death benefit purchased, which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. Face value is sometimes referred to as “face amount’ or “coverage amount.” The face value is the amount that the beneficiary of the policy or life insurance receives when the insured dies. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. Your face value, or the money that your beneficiaries will receive from you insurance company upon your death, is shorthand for your financial worth.

Source: fishbowlapp.com

Source: fishbowlapp.com

The face value of your life insurance policy is printed on the first page of the policy itself. In all cases, life insurance face value is the amount of money given to. The policy owner’s beneficiaries will receive this amount when he or she dies. The face value of life insurance is how much your policy is worth, and more importantly, how much life insurance money is paid out when the policyholder dies. Face value is different from cash value.

Face value is the nominal value or dollar value of a security stated by the issuer, also known as par value or simply par. A permanent life insurance policy including whole life insurance and universal life insurance has a face value and a cash value, which are two distinct values. The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early. Within your policy, it is officially denoted as the death benefit. Face value is sometimes referred to as “face amount’ or “coverage amount.”

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title face value insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.