Your Extended replacement cost homeowners insurance images are ready in this website. Extended replacement cost homeowners insurance are a topic that is being searched for and liked by netizens now. You can Download the Extended replacement cost homeowners insurance files here. Find and Download all free photos and vectors.

If you’re looking for extended replacement cost homeowners insurance images information connected with to the extended replacement cost homeowners insurance interest, you have come to the right blog. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

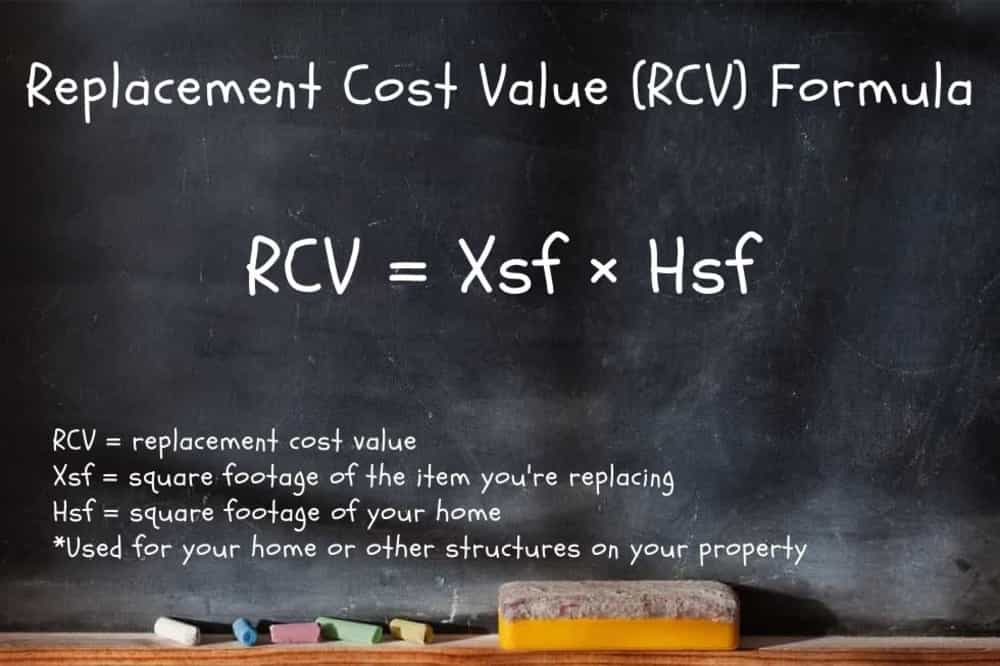

Extended Replacement Cost Homeowners Insurance. This percentage is often shown as 120 to 125 percent of the stated limit of coverage. When you are shopping for homeowners insurance one of the items you can select if called extended replacement cost, extra replacement cost, or cost plus coverage. Guaranteed or extended replacement cost coverage pays the full replacement cost if your home is destroyed. The home insurance policy endorsement insures your home beyond the replacement cost.

Why You Want Home Insurance With Extended Or Guaranteed From pinterest.com

Why You Want Home Insurance With Extended Or Guaranteed From pinterest.com

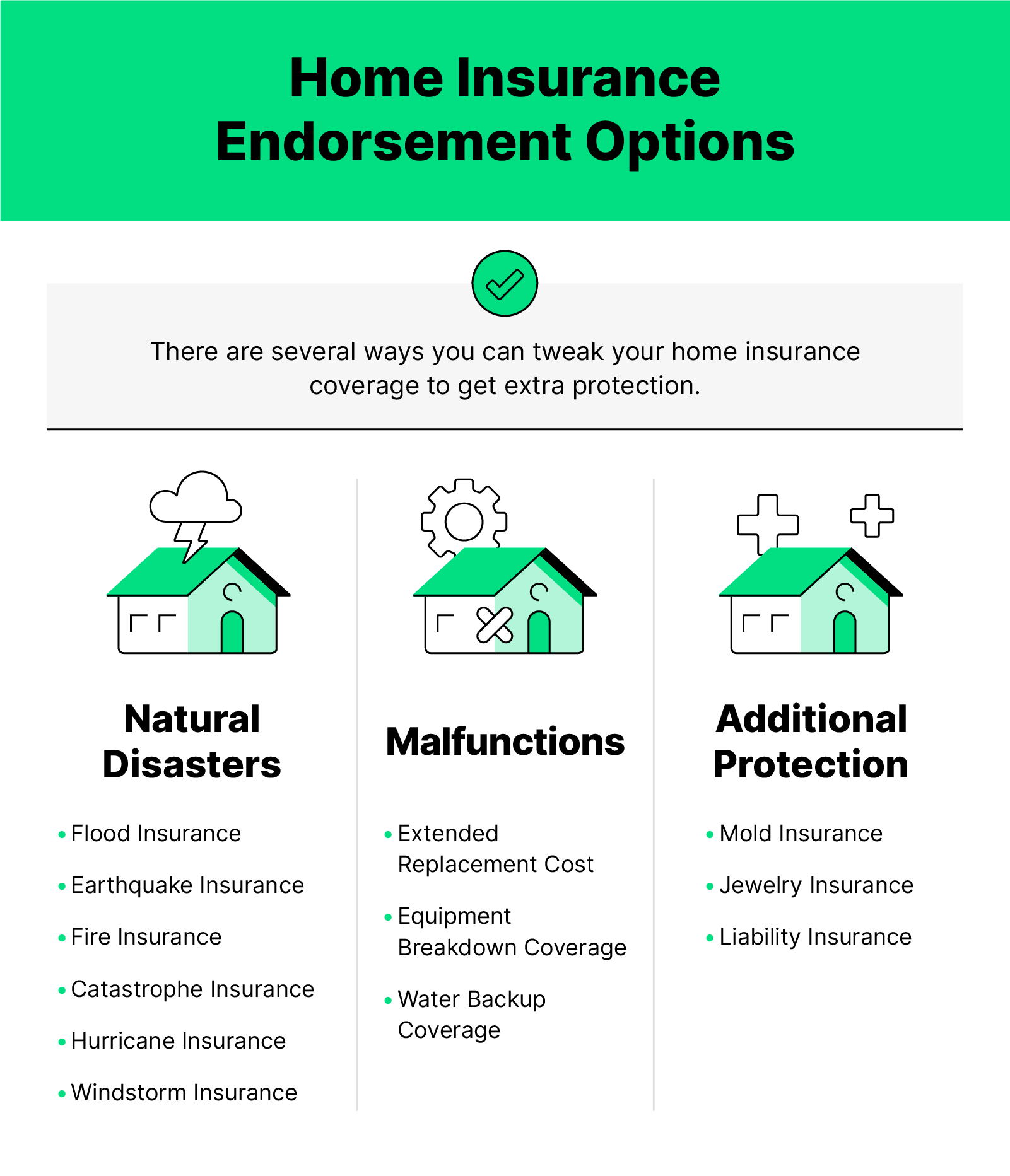

There are several coverages included in typical home insurance, such as personal. This is something you can easily overlook or avoid purchasing because it can add some dollars to your annual insurance premium. Also known as extended dwelling coverage or increased replacement cost, extended replacement cost may help repair or rebuild your home after a covered loss when the cost of materials and labor. Extended replacement cost is an endorsement on your home insurance policy that extends your dwelling coverage by 10% to 50% of the cost to rebuild your home. If a peril destroys your house, the rebuilding costs may exceed your dwelling coverage limit. Extended replacement cost coverage (dwelling):

Extended replacement cost is an endorsement on your home insurance policy that extends your dwelling coverage by 10% to 50% of the cost to rebuild your home.

Extended replacement cost adds onto your insurance coverage limits. Extended replacement cost is an insurance endorsement that you can buy and add to your homeowners insurance coverage. Find the formats you�re looking for homeowners insurance extended replacement cost here. An extended replacement cost (erc) can give you a little extra insurance coverage. An extended replacement cost policy will cover you up to a certain percentage above your dwelling limit. Guaranteed replacement coverage is the premier choice of coverage for homeowners.

Source: news.leavitt.com

Source: news.leavitt.com

Extended replacement cost refers to an insurance policy that usually provides a benefit over and above the limits specified by the policy for replacing a damaged house. Instead, it provides 125% to 150% of the home�s replacement cost. Guaranteed replacement coverage is the premier choice of coverage for homeowners. Purchasing extended replacement cost would allow your coverage a to increase, which helps. You can also add extended replacement cost coverage to your dwelling coverage.

Source: jorbear1.blogspot.com

Source: jorbear1.blogspot.com

Most companies offer a special home coverage endorsement called extended replacement coverage, which generally pays an additional 25 or 50 percent over the amount for which the home was insured. Why would want an extended replacement cost policy? Conventional homeowners� policies often do not track (or do so on a limited basis) the inflation in building. There are several coverages included in typical home insurance, such as personal. If you had $300,000 in coverage a, then:

Source: forbes.com

Source: forbes.com

Extended replacement cost is an insurance endorsement that you can buy and add to your homeowners insurance coverage. Buying extended replacement cost coverage ensures that you have enough protection in case of increased costs. When you are shopping for homeowners insurance one of the items you can select if called extended replacement cost, extra replacement cost, or cost plus coverage. Conventional homeowners� policies often do not track (or do so on a limited basis) the inflation in building. That’s where extended replacement value comes in.

Source: pinterest.com

Source: pinterest.com

When insurance companies determine the replacement cost of your home, which is used to determine coverage a, they are using the best available information they have at the time. Conventional homeowners� policies often do not track (or do so on a limited basis) the inflation in building. A wide range of choices for you to choose from. Depending on the percentage you chose, your new coverage amount could be anywhere from $275,000 to $375,000. If your house is badly damaged by a wildfire or severe storm and the cost to repair or rebuild it exceeds your policy’s dwelling coverage limit, extended replacement cost can increase your limit an extra.

Source: hippo.com

Source: hippo.com

Extended replacement cost adds onto your insurance coverage limits. An extended replacement cost policy will pay up to a specified percentage over an insured’s policy limit in order to fully replace a damaged home. American family connect american modern property and casualty berkley insurance chubb commerce insurance the cincinnati country financial erie insurance farmers foremost insurance grange. Conventional homeowners� policies often do not track (or do so on a limited basis) the inflation in building. The home insurance policy endorsement insures your home beyond the replacement cost.

Source: aesthetecurator.com

Source: aesthetecurator.com

The home insurance policy endorsement insures your home beyond the replacement cost. There are other levels of extended replacement cost as well. That means that they would have an. However, depending on the type and value of the items, even full replacement coverage might not be enough. Guaranteed replacement coverage is the premier choice of coverage for homeowners.

Source: hippo.com

Source: hippo.com

Buying extended replacement cost coverage ensures that you have enough protection in case of increased costs. Extended replacement cost coverage (dwelling): Extended replacement cost is an endorsement on your home insurance policy that extends your dwelling coverage by 10% to 50% of the cost to rebuild your home. Buying extended replacement cost coverage ensures that you have enough protection in case of increased costs. In the unfortunate case your $270,000 home catches fire and burns to the ground, and is estimated to cost $300,000 to replace, extended replacement coverage will kick in and and pay the additional $30,000 to make you whole again.

Source: pinterest.com.mx

Source: pinterest.com.mx

Extended replacement cost is an endorsement on your home insurance policy that extends your dwelling coverage by 10% to 50% of the cost to rebuild your home. Why would want an extended replacement cost policy? Find the formats you�re looking for homeowners insurance extended replacement cost here. Extended replacement cost refers to an insurance policy that usually provides a benefit over and above the limits specified by the policy for replacing a damaged house. When you are shopping for homeowners insurance one of the items you can select if called extended replacement cost, extra replacement cost, or cost plus coverage.

Source: pahvantpost.com

Source: pahvantpost.com

It doesn’t take into account depreciation or dwelling coverage limits. Purchasing extended replacement cost would allow your coverage a to increase, which helps. Extended replacement cost coverage (dwelling): Instead, it provides 125% to 150% of the home�s replacement cost. Guaranteed replacement cost homeowners insurance insurance options for homeowners.

Source: insurify.com

Source: insurify.com

Out of the four dwelling coverage options, acv is the. Find the formats you�re looking for homeowners insurance extended replacement cost here. The home insurance policy endorsement insures your home beyond the replacement cost. If your house is badly damaged by a wildfire or severe storm and the cost to repair or rebuild it exceeds your policy’s dwelling coverage limit, extended replacement cost can increase your limit an extra. That’s where extended replacement value comes in.

Source: revisi.net

Source: revisi.net

This coverage enhancement can become very important when there is a sudden spike in construction costs that. Not all insurers offer an extended replacement cost option with homeowners insurance, but these companies do: You can also add extended replacement cost coverage to your dwelling coverage. If your house is badly damaged by a wildfire or severe storm and the cost to repair or rebuild it exceeds your policy’s dwelling coverage limit, extended replacement cost can increase your limit an extra. Extended replacement cost coverage (dwelling):

Source: tmib.com

Source: tmib.com

If your home is damaged, extended replacement cost provides coverage for your home to be rebuilt or repaired to its condition before the damage, even if if the cost to replace the house itself is more. You can also add extended replacement cost coverage to your dwelling coverage. Most companies offer extended replacement in increments of 25% and 50% of your home’s dwelling coverage limit, meaning if your home is insured for $300,000 and you have 25% extended replacement cost, then your home is essentially insured for $375,000. There are other levels of extended replacement cost as well. Extended replacement cost is an endorsement on your home insurance policy that extends your dwelling coverage by 10% to 50% of the cost to rebuild your home.

Source: jorbear1.blogspot.com

Source: jorbear1.blogspot.com

If you had $300,000 in coverage a, then: We will even pay for upgrades made necessary by the loss due to modern building codes. Most extended replacement cost riders allow homeowners to extend their coverage by 10% to 50%. In most cases, adding the extended replacement cost to your policy isn�t too expensive. It doesn’t take into account depreciation or dwelling coverage limits.

Guaranteed replacement cost is the gold plan. Find the formats you�re looking for homeowners insurance extended replacement cost here. That’s where extended replacement value comes in. Extended replacement cost is an insurance endorsement that you can buy and add to your homeowners insurance coverage. Most extended replacement cost riders allow homeowners to extend their coverage by 10% to 50%.

Source: jorbear1.blogspot.com

Source: jorbear1.blogspot.com

Extended replacement cost adds onto your insurance coverage limits. For example, if you have a 25% extended replacement cost policy with $200,000 in dwelling coverage, your insurer will cover you for rebuilding costs up to $250,000, or 25% more than $200,000. So if that $170,000 home burns down and now is going to cost $200,000 to rebuild, extended replacement coverage will pay the extra $30,000 to rebuild. Not all insurers offer an extended replacement cost option with homeowners insurance, but these companies do: However, depending on the type and value of the items, even full replacement coverage might not be enough.

Source: jorbear1.blogspot.com

Source: jorbear1.blogspot.com

When you are shopping for homeowners insurance one of the items you can select if called extended replacement cost, extra replacement cost, or cost plus coverage. If you had $300,000 in coverage a, then: Extended replacement cost is a homeowners insurance endorsement that provides an added layer of coverage for your home in the event of an expensive disaster. There are several coverages included in typical home insurance, such as personal. This percentage is often shown as 120 to 125 percent of the stated limit of coverage.

Source: foagency.com

Source: foagency.com

If you had $300,000 in coverage a, then: Instead, it provides 125% to 150% of the home�s replacement cost. If your home is damaged, extended replacement cost provides coverage for your home to be rebuilt or repaired to its condition before the damage, even if if the cost to replace the house itself is more. You can also add extended replacement cost coverage to your dwelling coverage. Extended replacement cost is a homeowners insurance endorsement that provides an added layer of coverage for your home in the event of an expensive disaster.

Source: jorbear1.blogspot.com

When insurance companies determine the replacement cost of your home, which is used to determine coverage a, they are using the best available information they have at the time. That means that they would have an. If you had $300,000 in coverage a, then: A wide range of choices for you to choose from. If your house is badly damaged by a wildfire or severe storm and the cost to repair or rebuild it exceeds your policy’s dwelling coverage limit, extended replacement cost can increase your limit an extra.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title extended replacement cost homeowners insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.