Your Exposure insurance definition images are available. Exposure insurance definition are a topic that is being searched for and liked by netizens today. You can Find and Download the Exposure insurance definition files here. Get all free photos and vectors.

If you’re looking for exposure insurance definition images information linked to the exposure insurance definition keyword, you have pay a visit to the right blog. Our website frequently provides you with hints for seeing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Exposure Insurance Definition. An insurance company may utilize internal criteria to determine whether an event is a catastrophe as it relates to its specific book of business even if the event Exposure in insurance refers to the risk associated with a particular action or entity. Exposure units are used to measure the degree of this risk. Its ability to support effective exposure management across a range of business classes, systems and cultures, puts it at the leading edge of a rapidly changing industry.

Exposure Rating Definition From investopedia.com

Exposure Rating Definition From investopedia.com

Insurance companies use exposure to measure the risks of taking on certain policies and to help determine premiums. Where exposure risk management will be in another 5 years time is uncertain but there is no doubt that it is currently adding real value across the market. An insurance company may utilize internal criteria to determine whether an event is a catastrophe as it relates to its specific book of business even if the event Cope allows the insurer to. Exposure in insurance refers to the risk associated with a particular action or entity. It is the responsibility of the middle manager to monitor the exposures and to follow the policies and procedures should the probability of a loss increase.

Risk exposure is a measure of possible future loss (or losses) which may result from an activity or occurrence.

Exposure in insurance refers to the risk associated with a particular action or entity. Your potential for accidents and other losses is called exposure. A loss, of course, is something that causes damage to property or costs you money through liability. Increasing exposure means that aggregate losses from severe weather events is likely to increase and modelling the risk is becoming more important main insurance classes affected are property, motor and agriculture Living in the city instead of a rural community is seen as a larger. Can policy holders have multiple e insurance accounts if they have multiple insurance policies issued by various insurance companies?

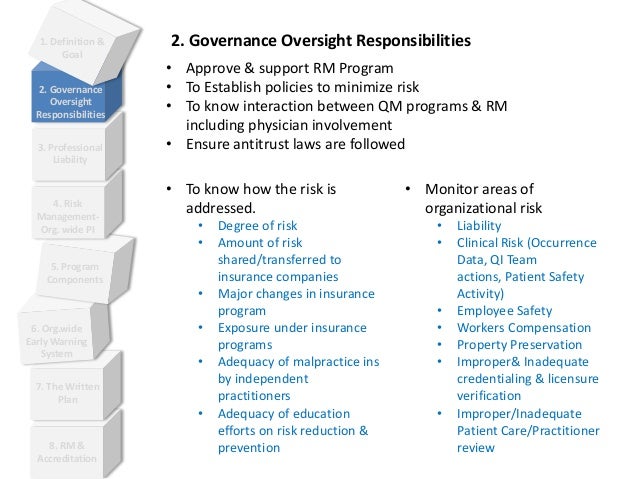

Source: ppt-online.org

Source: ppt-online.org

Insurance companies use exposure to measure the risks of taking on certain policies and to help determine premiums. Exposure, and evaluating ability to pay catastrophe losses.! It is a calculation of the pure cost of property or liability insurance protection without loadings for the insurance company�s expenses, premium. In insurance terms, exposure refers to an individual, business, or entity’s susceptibility to various losses or risks they might encounter in life or in the ordinary course of business. Construction occupancy protection exposure (cope) is a set of risks that property insurance underwriters review when determining whether to offer an insurance policy.

Source: slideshare.net

Source: slideshare.net

That’s better, but still of limited utility. Exposure in insurance refers to the risk associated with a particular action or entity. For example, the more a person drives their car, the higher their exposure to an accident. Exposure rating is a procedure used to calculate risk exposure in a reinsurance treaty. Term definition exposure rating (manual rating, tariff rating) a system for premium development and risk classification where filed rates, rules and classifications are applied against premium exposures, as determined by the manuals of insurance developed independently by insurance companies or by independent rating organizations,.

Source: canonprintermx410.blogspot.com

Source: canonprintermx410.blogspot.com

Exposure is an individual’s inclination to risk in their daily life. Insurance the transfer of risk from one party to another party, in which the insurer promises to pay the insured an amount of money for economic losses sustained from an unexpected event, during a period of time for which the insured makes a premium payment to the insurer. Exposure is an individual’s inclination to risk in their daily life. It’s measured by insurance companies in determining premiums and whether or not they will offer insurance. Risk exposure refers to the level of loss that an employer may potentially incur by engaging in a particular activity combined with the probability that he or she will incur that loss.

Source: slideserve.com

Source: slideserve.com

What are apartment insurance exposures? A loss, of course, is something that causes damage to property or costs you money through liability. This can be potential for accidents or other types of loss due to events like crime, fire or natural disasters. It is a calculation of the pure cost of property or liability insurance protection without loadings for the insurance company�s expenses, premium. Also used as a measure of the rating units or the premium base of a risk.

Source: baltimorelatest.blogspot.com

Source: baltimorelatest.blogspot.com

Exposure base — the basis to which rates are applied to determine premium. Insurance companies want to calculate this exposure to be able to access their overall risk. Exposure base — the basis to which rates are applied to determine premium. It’s measured by insurance companies in determining premiums and whether or not they will offer insurance. Can policy holders have multiple e insurance accounts if they have multiple insurance policies issued by various insurance companies?

Source: hwaoconsulting.com

Source: hwaoconsulting.com

Its ability to support effective exposure management across a range of business classes, systems and cultures, puts it at the leading edge of a rapidly changing industry. Where exposure risk management will be in another 5 years time is uncertain but there is no doubt that it is currently adding real value across the market. The more you drive, the more exposure you have to accidents and other potential problems. Exposure, and evaluating ability to pay catastrophe losses.! Basically, it refers to their potential for accidents or other types of losses like crime, fire, earthquake, etc.

Insurance companies use exposure to measure the risks of taking on certain policies and to help determine premiums. It is a calculation of the pure cost of property or liability insurance protection without loadings for the insurance company�s expenses, premium. Throughout our lives, we are all under some amount of risk, whether we�re driving a car or simply walking from the. Also used as a measure of the rating units or the premium base of a risk. An insurance company may utilize internal criteria to determine whether an event is a catastrophe as it relates to its specific book of business even if the event

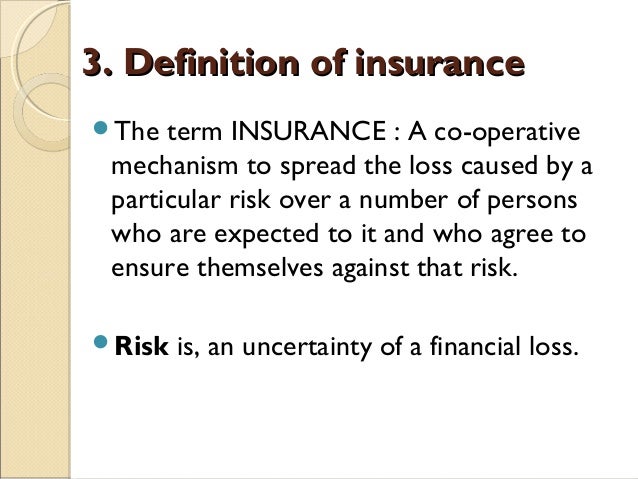

Source: iedunote.com

Source: iedunote.com

This can be potential for accidents or other types of loss due to events like crime, fire or natural disasters. What are apartment insurance exposures? Risk exposure is a measure of possible future loss (or losses) which may result from an activity or occurrence. Exposure is an individual’s inclination to risk in their daily life. Also used as a measure of the rating units or the premium base of a risk.

Source: canonprintermx410.blogspot.com

Source: canonprintermx410.blogspot.com

Your potential for accidents and other losses is called exposure. Risk exposure refers to the level of loss that an employer may potentially incur by engaging in a particular activity combined with the probability that he or she will incur that loss. A better phrased definition of “exposure” might read, “being subject to loss because of a specific thing that increases risk.”. The middle manager should have intimate knowledge of the exposures that could potentially lead to a loss. Can anyone become or set up an insurance.

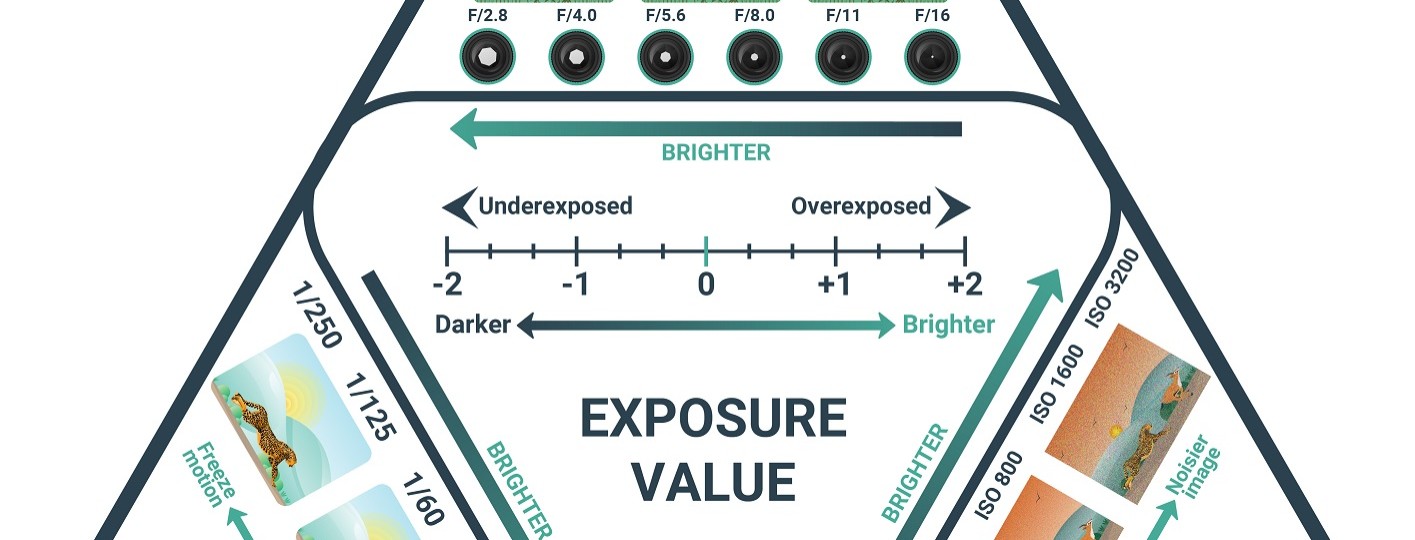

Source: capturetheatlas.com

Source: capturetheatlas.com

Insurance companies use exposure to measure the risks of taking on certain policies and to help determine premiums. What are apartment insurance exposures? Can policy holders have multiple e insurance accounts if they have multiple insurance policies issued by various insurance companies? Definition exposure — the state of being subject to loss because of some hazard or contingency. Cope allows the insurer to.

Source: investopedia.com

Source: investopedia.com

Living in the city instead of a rural community is seen as a larger. The loss experience of a portfolio of similar, but. A better phrased definition of “exposure” might read, “being subject to loss because of a specific thing that increases risk.”. A loss, of course, is something that causes damage to property or costs you money through liability. Risk exposure is a measure of possible future loss (or losses) which may result from an activity or occurrence.

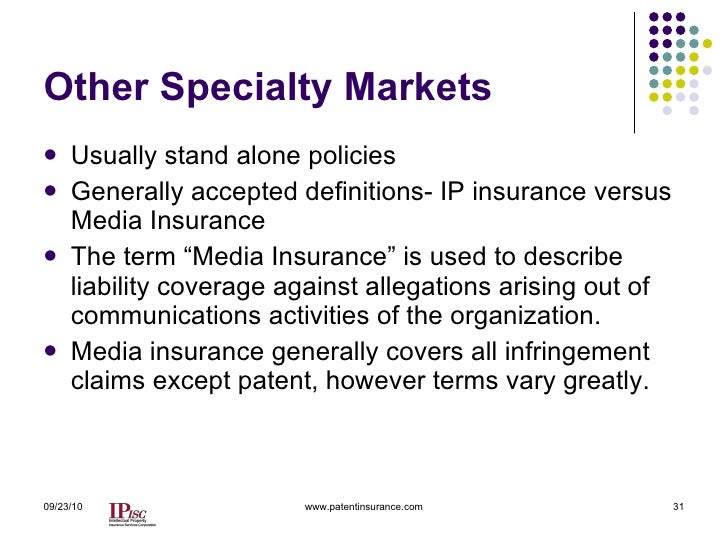

Source: slideshare.net

Source: slideshare.net

Risk exposure is a measure of possible future loss (or losses) which may result from an activity or occurrence. Its ability to support effective exposure management across a range of business classes, systems and cultures, puts it at the leading edge of a rapidly changing industry. Exposure is used by insurance companies to calculate our premiums and, simply put, it measures our level of risk. Exposure, and evaluating ability to pay catastrophe losses.! Insurance companies want to calculate this exposure to be able to access their overall risk.

Source: slideserve.com

Source: slideserve.com

In insurance terms, exposure refers to an individual, business, or entity’s susceptibility to various losses or risks they might encounter in life or in the ordinary course of business. This exposure is the number of units that are exposed to loss at a specific time across all policies. Term definition exposure rating (manual rating, tariff rating) a system for premium development and risk classification where filed rates, rules and classifications are applied against premium exposures, as determined by the manuals of insurance developed independently by insurance companies or by independent rating organizations,. That’s better, but still of limited utility. Can anyone become or set up an insurance.

Definition exposure — the state of being subject to loss because of some hazard or contingency. This exposure helps determine if the insurance companies have taken on too much risk or if they have room to take on more. A better phrased definition of “exposure” might read, “being subject to loss because of a specific thing that increases risk.”. It’s measured by insurance companies in determining premiums and whether or not they will offer insurance. This can be potential for accidents or other types of loss due to events like crime, fire or natural disasters.

Source: info.corvusinsurance.com

Source: info.corvusinsurance.com

Exposure in insurance refers to the risk associated with a particular action or entity. Living in the city instead of a rural community is seen as a larger. This exposure helps determine if the insurance companies have taken on too much risk or if they have room to take on more. Insurance the transfer of risk from one party to another party, in which the insurer promises to pay the insured an amount of money for economic losses sustained from an unexpected event, during a period of time for which the insured makes a premium payment to the insurer. Basically, it refers to their potential for accidents or other types of losses like crime, fire, earthquake, etc.

Source: frasesbonitas-parati.blogspot.com

Source: frasesbonitas-parati.blogspot.com

Also used as a measure of the rating units or the premium base of a risk. Insurance the transfer of risk from one party to another party, in which the insurer promises to pay the insured an amount of money for economic losses sustained from an unexpected event, during a period of time for which the insured makes a premium payment to the insurer. Risk exposure is a measure of possible future loss (or losses) which may result from an activity or occurrence. A loss, of course, is something that causes damage to property or costs you money through liability. A better phrased definition of “exposure” might read, “being subject to loss because of a specific thing that increases risk.”.

It’s measured by insurance companies in determining premiums and whether or not they will offer insurance. Risk exposure is a measure of possible future loss (or losses) which may result from an activity or occurrence. For example, the more a person drives their car, the higher their exposure to an accident. It is a calculation of the pure cost of property or liability insurance protection without loadings for the insurance company�s expenses, premium. The loss experience of a portfolio of similar, but.

Source: slideshare.net

Source: slideshare.net

Can the eia be operated by the policy holder only? Insurance companies want to calculate this exposure to be able to access their overall risk. Its ability to support effective exposure management across a range of business classes, systems and cultures, puts it at the leading edge of a rapidly changing industry. Construction occupancy protection exposure (cope) is a set of risks that property insurance underwriters review when determining whether to offer an insurance policy. It’s measured by insurance companies in determining premiums and whether or not they will offer insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title exposure insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.