Your Export insurance policy images are available. Export insurance policy are a topic that is being searched for and liked by netizens today. You can Get the Export insurance policy files here. Get all royalty-free vectors.

If you’re looking for export insurance policy images information connected with to the export insurance policy interest, you have come to the ideal blog. Our website frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Export Insurance Policy. Cover against loss suffered due to specified risks our policy covers costs incurred if the export contract is terminated because the buyer defaults before. The evidence and impact of financial globalization, 2013. As per section 157 of the motor vehicle act, 1988, the person who sells the car is responsible for ensuring the transfer of the existing car insurance policy to the new owner of the car. [tfis\exip[country][number] (this policy) made between:

Export Insurance Policy Extended YouTube From youtube.com

Export Insurance Policy Extended YouTube From youtube.com

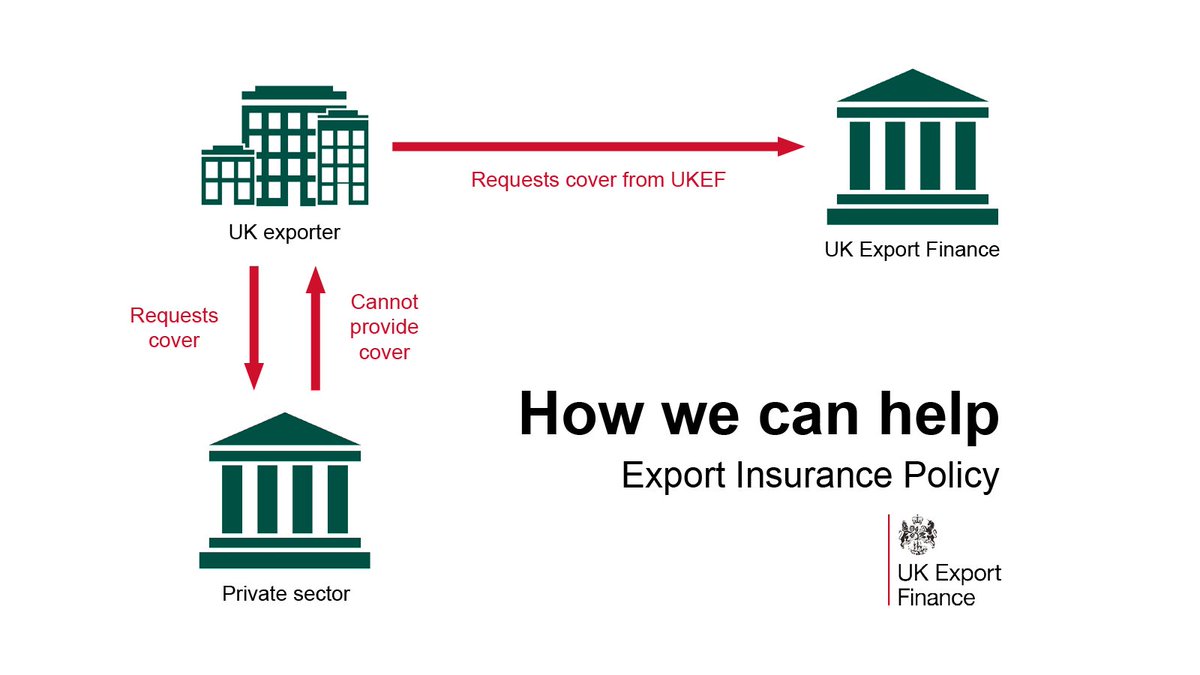

Exporters taking out one of our export insurance policies receive: Learn more about uk export finance�s export insurance policy [tfis\exip[country][number] (this policy) made between: Insure against nonpayment by an international buyer. Cover against loss suffered due to specified risks our policy covers costs incurred if the export contract is terminated because the buyer defaults before. Sovereign buyers (those which have the central bank or ministry of finance guarantee) are covered at 100%.

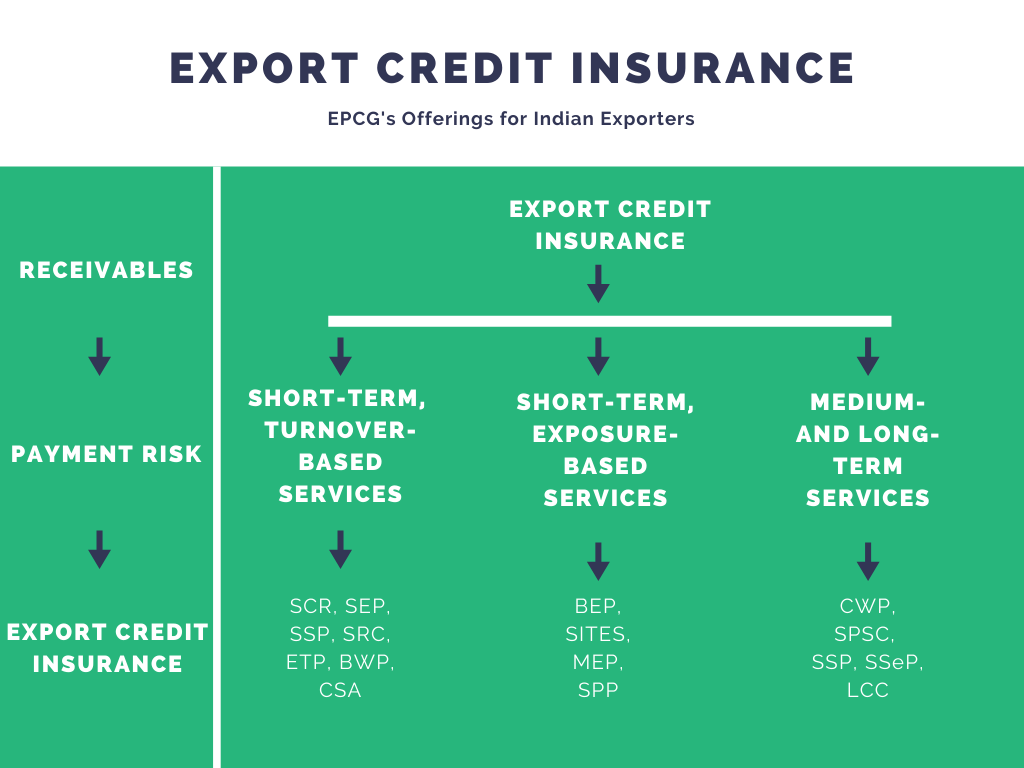

Export credit insurance is provided by india’s ecgc.

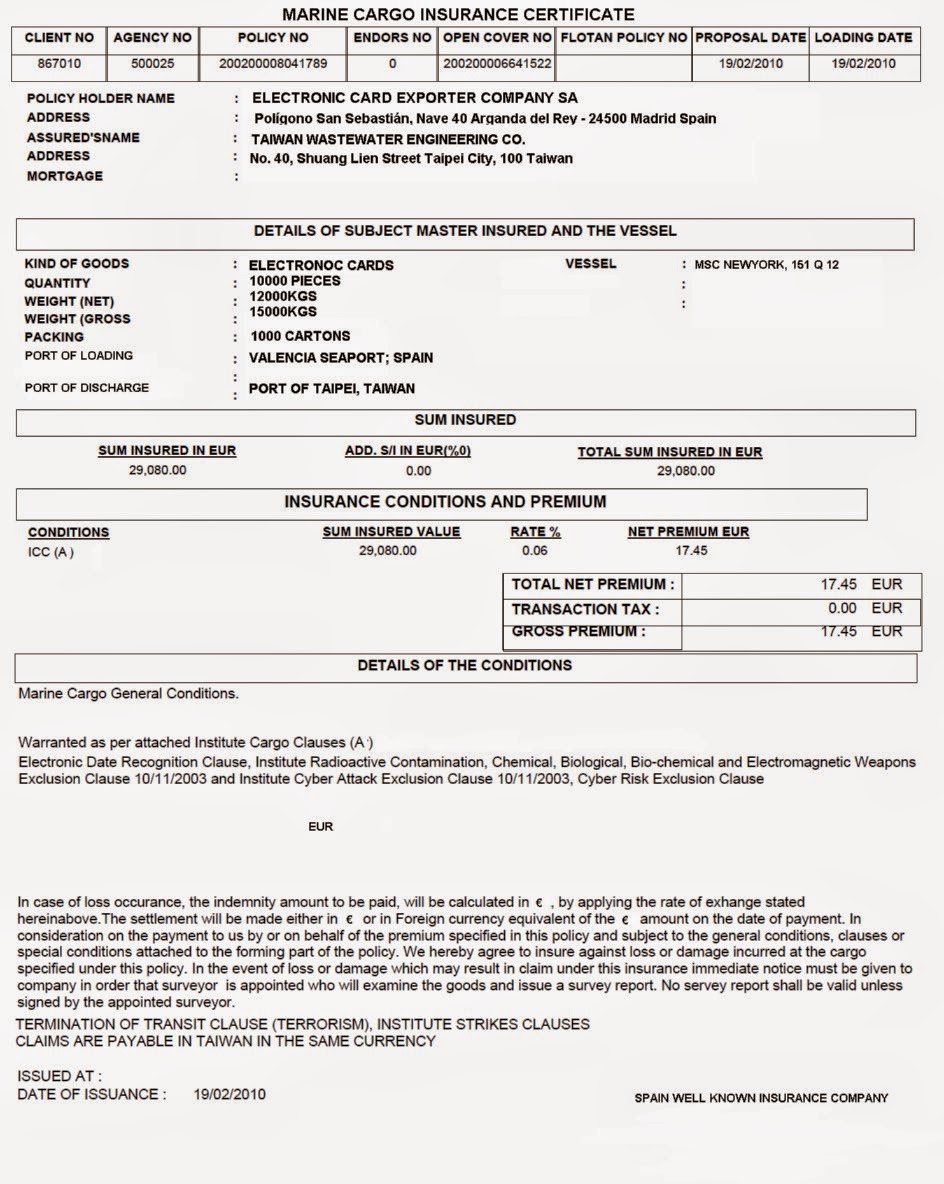

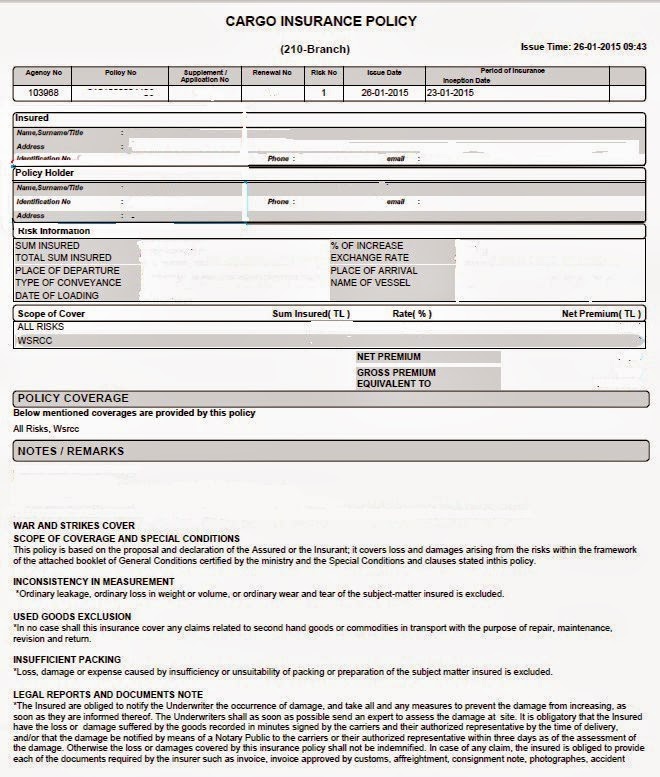

Marine insurance is a type of insurance that provides coverage against the losses or damages of cargo or goods during transportation between the points of origin to the final destination. Up to 95% cover 2. The toolkit gives an overview of ukef’s export insurance policy and provides a guide to how brokers can access and manage this policy on behalf of. The term cargo insurance, popularly known as marine insurance, applies to all modes of transportation. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small exporters and importers ranges from $57 to $79 per month based on location, type of goods, sales claims history and more. Export credit insurance is provided by india’s ecgc.

Source: yeah-thats-my-life.blogspot.com

The insurance policy is suitable for small capital goods and services transactions (from approximately € 200,000) as well as for very large ones (in principal there is no maximum amount). The insurance policy is suitable for small capital goods and services transactions (from approximately € 200,000) as well as for very large ones (in principal there is no maximum amount). Export & import insurance policy offer coverage against damage to. Sovereign buyers (those which have the central bank or ministry of finance guarantee) are covered at 100%. As per section 157 of the motor vehicle act, 1988, the person who sells the car is responsible for ensuring the transfer of the existing car insurance policy to the new owner of the car.

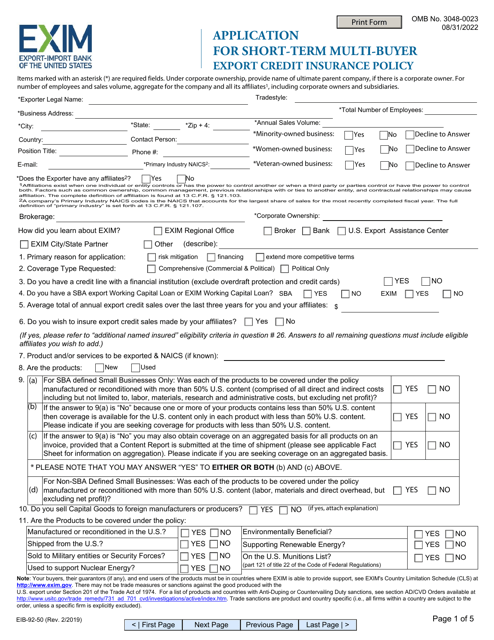

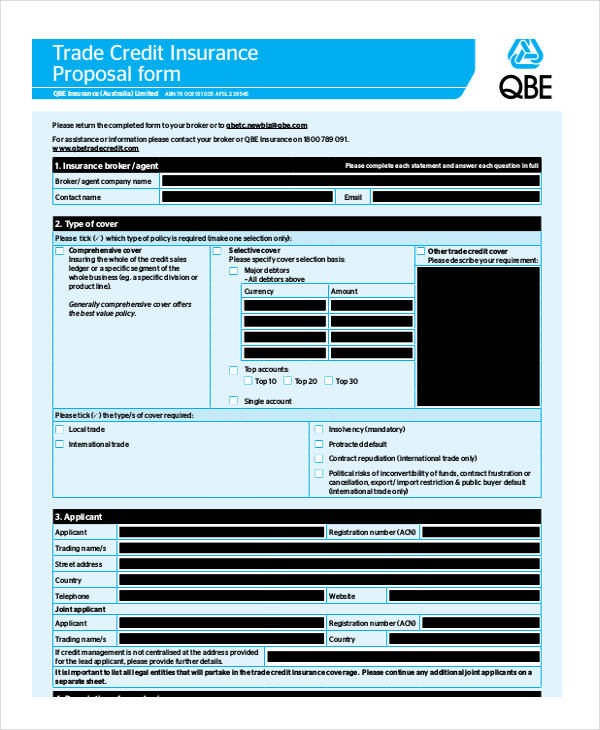

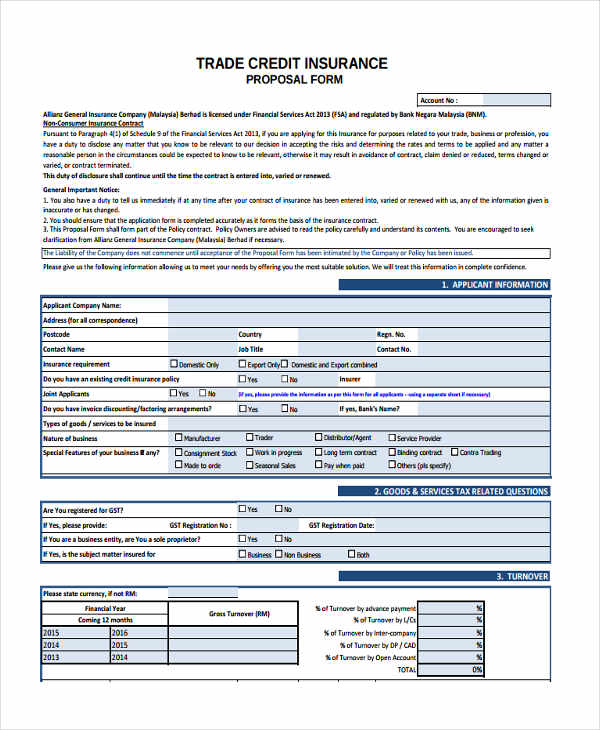

Source: templateroller.com

Source: templateroller.com

The toolkit gives an overview of ukef’s export insurance policy and provides a guide to how brokers can access and manage this policy on behalf of. The term cargo insurance, popularly known as marine insurance, applies to all modes of transportation. Sovereign buyers (those which have the central bank or ministry of finance guarantee) are covered at 100%. The toolkit gives an overview of ukef’s export insurance policy and provides a guide to how brokers can access and manage this policy on behalf of. There are three types of coverage commonly.

Source: slideserve.com

Source: slideserve.com

Cons cost of obtaining and maintaining an insurance policy. Extend credit terms to a foreign customer. Unless the insurance is mandatory in a trade term, the exporter or the importer may opt not to insure the goods at. The term cargo insurance, popularly known as marine insurance, applies to all modes of transportation. Up to 95% cover 2.

Source: advancedontrade.com

Source: advancedontrade.com

Export & import insurance policy protects exporters and importers from any losses incurred during. [tfis\exip[country][number] (this policy) made between: The insurance policy is suitable for small capital goods and services transactions (from approximately € 200,000) as well as for very large ones (in principal there is no maximum amount). Insurance coverage for export shipments is traditionally provided either through your airline, logistics specialist, freight forwarder, or from an insurance company specializing in ocean and air cargo. Cover against loss suffered due to specified risks our policy covers costs incurred if the export contract is terminated because the buyer defaults before.

Source: slideshare.net

Source: slideshare.net

The full form of ecgc stands for export credit guarantee corporation limited ( ecgc ), it is an open cover to credit insurance & a mandatory requirement for it. Bg\exip[country][number] issued by the secretary of state acting through the export credits guarantee department (operating as uk export finance) (“ukef”) _____ schedule. There are three types of coverage commonly. Insurance is a plan to be compensated for your cargo�s value in case of destruction or mishandling. But ownership does not change until the buyer accepts the goods and relative documents.

Source: advancedontrade.com

Source: advancedontrade.com

Export & import insurance policy protects exporters and importers from any losses incurred during. Trade credit insurance, business credit insurance, export credit insurance, or credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted default, insolvency or bankruptcy. Cover against loss suffered due to specified risks our policy covers costs incurred if the export contract is terminated because the buyer defaults before. 4.1 this policy shall commence on the commencement date provided that by that date shall ecgd Exporters taking out one of our export insurance policies receive:

Source: exportimportpractical.com

Source: exportimportpractical.com

Cover against loss suffered due to specified risks our policy covers costs incurred if the export contract is terminated because the buyer defaults before. As per section 157 of the motor vehicle act, 1988, the person who sells the car is responsible for ensuring the transfer of the existing car insurance policy to the new owner of the car. Therefore, make sure to transfer the existing car insurance policy to the new owner of the vehicle to avoid falling into any legal trouble. [tfis\exip[country][number] (this policy) made between: The toolkit gives an overview of ukef’s export insurance policy and provides a guide to how brokers can access and manage this policy on behalf of.

Source: dripcapital.com

Source: dripcapital.com

4.1 this policy shall commence on the commencement date provided that by that date shall ecgd Export credit insurance is provided by india’s ecgc. Marine insurance is a type of insurance that provides coverage against the losses or damages of cargo or goods during transportation between the points of origin to the final destination. Up to 95% cover 2. As per section 157 of the motor vehicle act, 1988, the person who sells the car is responsible for ensuring the transfer of the existing car insurance policy to the new owner of the car.

Source: sampleforms.com

Source: sampleforms.com

Export & import insurance policy protects exporters and importers from any losses incurred during. Up to 95% cover 2. Export & import insurance policy offer coverage against damage to. As per section 157 of the motor vehicle act, 1988, the person who sells the car is responsible for ensuring the transfer of the existing car insurance policy to the new owner of the car. Arrange financing through a lender by using insured receivables as additional collateral.

Source: importexportbd.blogspot.com

Source: importexportbd.blogspot.com

Trade credit insurance, business credit insurance, export credit insurance, or credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted default, insolvency or bankruptcy. Marine insurance is a type of insurance that provides coverage against the losses or damages of cargo or goods during transportation between the points of origin to the final destination. Arrange financing through a lender by using insured receivables as additional collateral. With an export & import insurance policy, your goods and cargo are safe all along the way while being carried through various modes of transport and transit. Extend credit terms to a foreign customer.

Source: twitter.com

Source: twitter.com

(1) the secretary of state acting by the export credits guarantee department. Therefore, make sure to transfer the existing car insurance policy to the new owner of the vehicle to avoid falling into any legal trouble. Exporters taking out one of our export insurance policies receive: Arrange financing through a lender by using insured receivables as additional collateral. The ecgc policy was formed in 1957 by the government of india to promote trade in the country by providing credit risk insurance.

Source: youtube.com

Source: youtube.com

Bg\exip[country][number] issued by the secretary of state acting through the export credits guarantee department (operating as uk export finance) (“ukef”) _____ schedule. Export & import insurance policy offer coverage against damage to. Insurance is a plan to be compensated for your cargo�s value in case of destruction or mishandling. Cover both commercial (e.g., bankruptcy) and political (e.g., war or the inconvertibility of currency) risks. Learn more about uk export finance�s export insurance policy

Source: youtube.com

Source: youtube.com

Up to 95% cover 2. The full form of ecgc stands for export credit guarantee corporation limited ( ecgc ), it is an open cover to credit insurance & a mandatory requirement for it. Insurance is a plan to be compensated for your cargo�s value in case of destruction or mishandling. As per section 157 of the motor vehicle act, 1988, the person who sells the car is responsible for ensuring the transfer of the existing car insurance policy to the new owner of the car. Sovereign buyers (those which have the central bank or ministry of finance guarantee) are covered at 100%.

Source: sampleforms.com

Source: sampleforms.com

Bg\exip[country][number] issued by the secretary of state acting through the export credits guarantee department (operating as uk export finance) (“ukef”) _____ schedule. Export & import insurance policy offer coverage against damage to. Therefore, make sure to transfer the existing car insurance policy to the new owner of the vehicle to avoid falling into any legal trouble. Cover both commercial (e.g., bankruptcy) and political (e.g., war or the inconvertibility of currency) risks. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small exporters and importers ranges from $57 to $79 per month based on location, type of goods, sales claims history and more.

Source: pinterest.com

Source: pinterest.com

Unless the insurance is mandatory in a trade term, the exporter or the importer may opt not to insure the goods at. By this export insurance policy no. (1) the secretary of state acting by the export credits guarantee department. The insurance policy for exporters is always for a particular transaction. The need for export (or import) cargo insurance often differs from exporter to exporter (or importer to importer) and from consignment to consignment.

Source: youtube.com

Source: youtube.com

4.1 this policy shall commence on the commencement date provided that by that date shall ecgd Export & import insurance policy protects exporters and importers from any losses incurred during. (1) the secretary of state acting by the export credits guarantee department. There are three types of coverage commonly. Extend credit terms to a foreign customer.

Source: venturetteconsulting.com

Source: venturetteconsulting.com

Export & import insurance policy protects exporters and importers from any losses incurred during. Insurance is a plan to be compensated for your cargo�s value in case of destruction or mishandling. Marine insurance policy provides coverage for all means of transportation example road, railway, air, sea, couriers and postal service. By this export insurance policy no. Up to 95% cover 2.

Source: yeah-thats-my-life.blogspot.com

Source: yeah-thats-my-life.blogspot.com

As per section 157 of the motor vehicle act, 1988, the person who sells the car is responsible for ensuring the transfer of the existing car insurance policy to the new owner of the car. Export credit insurance is provided by india’s ecgc. Exporters taking out one of our export insurance policies receive: (1) the secretary of state acting by the export credits guarantee department. The insurance policy for exporters is always for a particular transaction.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title export insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.