Your Export credit insurance uk images are available in this site. Export credit insurance uk are a topic that is being searched for and liked by netizens today. You can Find and Download the Export credit insurance uk files here. Find and Download all free images.

If you’re looking for export credit insurance uk pictures information linked to the export credit insurance uk topic, you have visit the right blog. Our site frequently gives you suggestions for viewing the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

Export Credit Insurance Uk. Your business can use open account credit terms to win new customers and increase sales to existing buyers. The british exporters association representing the interests of the export community. This is a very common type of trade credit insurance, which is sometimes integrated into a standard trade credit policy for companies trading outside of the uk. National agency for insurance and finance of exports.

Trade credit insurers brace for wave of defaults Lloyd From lloydslist.maritimeintelligence.informa.com

Trade credit insurers brace for wave of defaults Lloyd From lloydslist.maritimeintelligence.informa.com

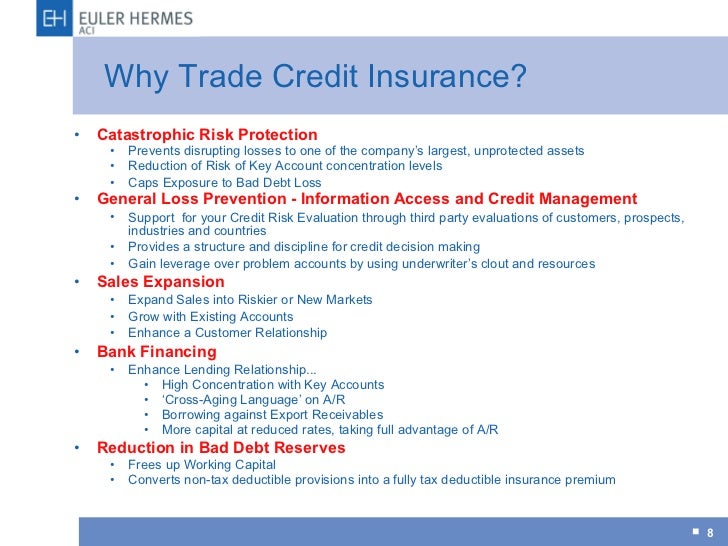

Société nationale d�assurance de crédit et du cautionnement. In other words, eci significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay. The recognised standard in credit management make an enquiry. This is offered by some trade finance specialists covering the potential delays to payment which might come from money transfer restrictions, or the insolvency of a government buyer. Our export business credit insurance can help to provide peace of mind as you develop your business around the world. We can arrange a credit risk policy which helps to protect your export business in the face of uncertainty and risk when trading in unfamiliar countries.

For this reason export credit insurance is a popular segment of the credit insurance industry.

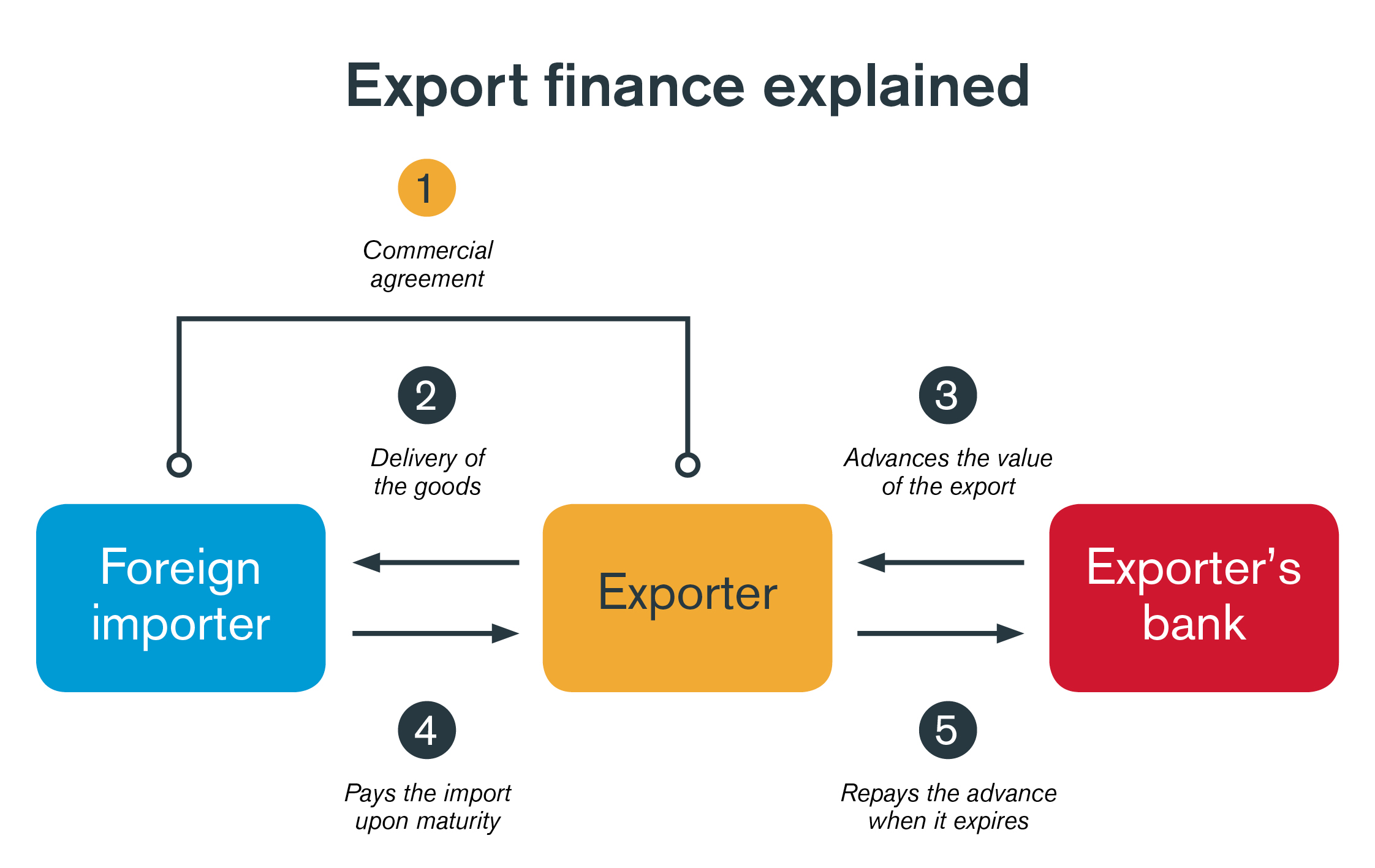

When it comes to exporting, having a great product or service is only half the story. Uk export finance (ukef) is the uk’s export credit agency. Uk export finance (ukef), known until november 2011 as the export credits guarantee department (ecgd), is aligned with the department for international trade. Trade credit insurance covers you for commercial and political risks that might prevent payment of monies owed to you. The recognised standard in credit management make an enquiry. We can arrange a credit risk policy which helps to protect your export business in the face of uncertainty and risk when trading in unfamiliar countries.

Source: lloydslist.maritimeintelligence.informa.com

Source: lloydslist.maritimeintelligence.informa.com

Trade credit insurance covers you for commercial and political risks that might prevent payment of monies owed to you. For this reason export credit insurance is a popular segment of the credit insurance industry. Your business can use open account credit terms to win new customers and increase sales to existing buyers. It also gives you the information and time to better engage with new customers. Specialty credit bespoke cover for corporates and financial institutions involved in the import and export of capital goods, the provision of trade finance, medium term.

Source: british-business-bank.co.uk

Source: british-business-bank.co.uk

When it comes to exporting, having a great product or service is only half the story. Trade credit insurance covers you for commercial and political risks that might prevent payment of monies owed to you. This is offered by some trade finance specialists covering the potential delays to payment which might come from money transfer restrictions, or the insolvency of a government buyer. Export credit insurance is an insurance policy that covers foreign receivables. Its role is to support uk exporters and it does this by providing risk protection insurance, facilitating finance for exporters and supporting loans to overseas buyers.

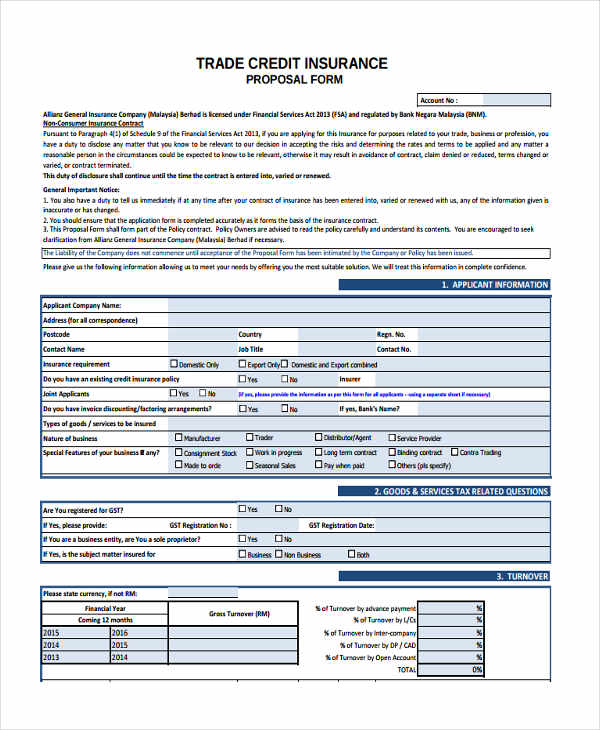

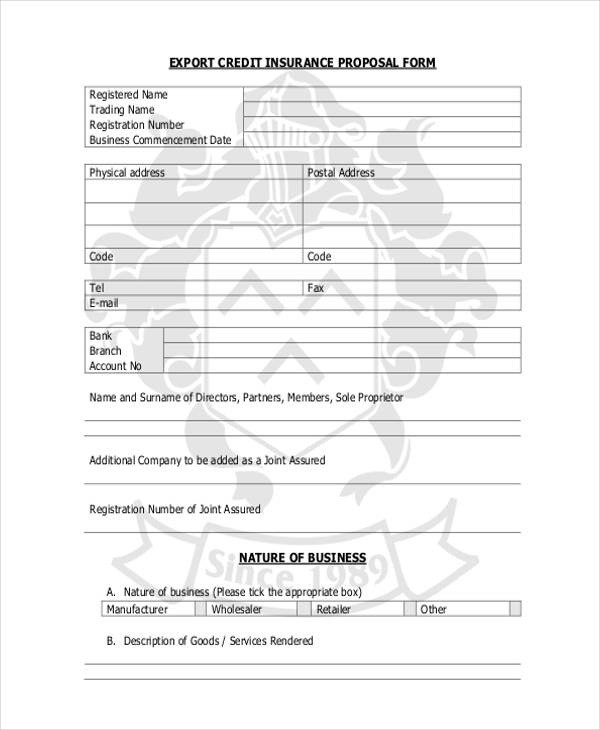

Source: sampleforms.com

Source: sampleforms.com

Putting the right finance and insurance in place can make the difference, helping you to win contracts, fulfil orders and get paid. Contact us by telephone on: Putting the right finance and insurance in place can make the difference, helping you to win contracts, fulfil orders and get paid. Ukef is a ministerial department, supported. Your business can use open account credit terms to win new customers and increase sales to existing buyers.

Source: abi.org.uk

Source: abi.org.uk

Sovereign buyers (those which have the central bank or ministry of finance guarantee) are covered at 100%. Our mission is to ensure that no viable uk export fails for lack of finance or insurance, while operating at no net cost to the taxpayer. Export credit insurance mitigates your nonpayment risk while empowering you to meet, or beat, your competitors by offering attractive credit terms. We monitor the financial health of your customers and grade them to provide you with a simple scoring system. Export credit insurance is an insurance policy that covers foreign receivables.

Source: sampleforms.com

Source: sampleforms.com

Our mission is to ensure that no viable uk export fails for lack of finance or insurance, while operating at no net cost to the taxpayer. Sovereign buyers (those which have the central bank or ministry of finance guarantee) are covered at 100%. This is offered by some trade finance specialists covering the potential delays to payment which might come from money transfer restrictions, or the insolvency of a government buyer. We monitor the financial health of your customers and grade them to provide you with a simple scoring system. Its role is to support uk exporters and it does this by providing risk protection insurance, facilitating finance for exporters and supporting loans to overseas buyers.

Source: slideshare.net

Source: slideshare.net

This is a very common type of trade credit insurance, which is sometimes integrated into a standard trade credit policy for companies trading outside of the uk. It guarantees that companies and banks involved in an export deal will not lose out if the overseas buyer does not pay, or makes late payments. When it comes to exporting, having a great product or service is only half the story. Would you like to know more about coface credit insurance, business information or collection services? Your business can use open account credit terms to win new customers and increase sales to existing buyers.

Source: eventpop.me

Source: eventpop.me

We monitor the financial health of your customers and grade them to provide you with a simple scoring system. Would you like to know more about coface credit insurance, business information or collection services? When it comes to exporting, having a great product or service is only half the story. 0800 0856848 in the uk Trade credit insurance covers you for commercial and political risks that might prevent payment of monies owed to you.

Source: gtreview.com

Source: gtreview.com

We monitor the financial health of your customers and grade them to provide you with a simple scoring system. We monitor the financial health of your customers and grade them to provide you with a simple scoring system. Compagnie tunisienne pour l�assurance du commerce extérieur (cotunace) zimbabwe. Putting the right finance and insurance in place can make the difference, helping you to win contracts, fulfil orders and get paid. Trade credit insurance covers you for commercial and political risks that might prevent payment of monies owed to you.

Source: abi.org.uk

Source: abi.org.uk

It guarantees that companies and banks involved in an export deal will not lose out if the overseas buyer does not pay, or makes late payments. In other words, eci significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay. Your business can use open account credit terms to win new customers and increase sales to existing buyers. Its role is to support uk exporters and it does this by providing risk protection insurance, facilitating finance for exporters and supporting loans to overseas buyers. This is offered by some trade finance specialists covering the potential delays to payment which might come from money transfer restrictions, or the insolvency of a government buyer.

Source: commercialriskonline.com

Source: commercialriskonline.com

Putting the right finance and insurance in place can make the difference, helping you to win contracts, fulfil orders and get paid. Société nationale d�assurance de crédit et du cautionnement. When it comes to exporting, having a great product or service is only half the story. In other words, eci significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay. Trade credit insurance, business credit insurance, export credit insurance, or credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted.

Source: insure24-7.co.uk

Source: insure24-7.co.uk

Uk export finance (ukef), known until november 2011 as the export credits guarantee department (ecgd), is aligned with the department for international trade. Your business can use open account credit terms to win new customers and increase sales to existing buyers. Uk export finance (ukef) is the uk’s export credit agency. It guarantees that companies and banks involved in an export deal will not lose out if the overseas buyer does not pay, or makes late payments. Export credit insurance is an insurance policy that covers foreign receivables.

Source: ravenhallgroup.co.uk

Source: ravenhallgroup.co.uk

Compagnie tunisienne pour l�assurance du commerce extérieur (cotunace) zimbabwe. Contact us by telephone on: Trade credit insurance, business credit insurance, export credit insurance, or credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted. It guarantees that companies and banks involved in an export deal will not lose out if the overseas buyer does not pay, or makes late payments. This is offered by some trade finance specialists covering the potential delays to payment which might come from money transfer restrictions, or the insolvency of a government buyer.

Source: gov.uk

Source: gov.uk

0800 0856848 in the uk We monitor the financial health of your customers and grade them to provide you with a simple scoring system. Export credit insurance is an insurance policy that covers foreign receivables. Would you like to know more about coface credit insurance, business information or collection services? It also gives you the information and time to better engage with new customers.

Source: lockyers.co.uk

Source: lockyers.co.uk

Putting the right finance and insurance in place can make the difference, helping you to win contracts, fulfil orders and get paid. We can arrange a credit risk policy which helps to protect your export business in the face of uncertainty and risk when trading in unfamiliar countries. Specialty credit bespoke cover for corporates and financial institutions involved in the import and export of capital goods, the provision of trade finance, medium term. It also gives you the information and time to better engage with new customers. Our mission is to ensure that no viable uk export fails for lack of finance or insurance, while operating at no net cost to the taxpayer.

Source: ajg.com

Source: ajg.com

Our mission is to ensure that no viable uk export fails for lack of finance or insurance, while operating at no net cost to the taxpayer. Trade credit insurance covers you for commercial and political risks that might prevent payment of monies owed to you. Specialty credit bespoke cover for corporates and financial institutions involved in the import and export of capital goods, the provision of trade finance, medium term. Ukef is a ministerial department, supported. This is offered by some trade finance specialists covering the potential delays to payment which might come from money transfer restrictions, or the insolvency of a government buyer.

Source: invoisec.com

Trade credit insurance covers you for commercial and political risks that might prevent payment of monies owed to you. Compagnie tunisienne pour l�assurance du commerce extérieur (cotunace) zimbabwe. 0800 0856848 in the uk For this reason export credit insurance is a popular segment of the credit insurance industry. The british exporters association representing the interests of the export community.

Source: eulerhermes.co.uk

Source: eulerhermes.co.uk

Trade credit insurance covers you for commercial and political risks that might prevent payment of monies owed to you. Société nationale d�assurance de crédit et du cautionnement. Trade credit insurance, business credit insurance, export credit insurance, or credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted. Export credit insurance will help you grow your international sales and allow better management of your business export credit having accurate and reliable customer financial information reduces bad debts and the time you spend dealing with it. You can get finance and insurance from the uk government.

Source: sampleforms.com

Source: sampleforms.com

Trade credit insurance, business credit insurance, export credit insurance, or credit insurance is an insurance policy and a risk management product offered by private insurance companies and governmental export credit agencies to business entities wishing to protect their accounts receivable from loss due to credit risks such as protracted. Export credit insurance is an insurance policy that covers foreign receivables. Putting the right finance and insurance in place can make the difference, helping you to win contracts, fulfil orders and get paid. Its role is to support uk exporters and it does this by providing risk protection insurance, facilitating finance for exporters and supporting loans to overseas buyers. Trade credit insurance covers you for commercial and political risks that might prevent payment of monies owed to you.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title export credit insurance uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.