Your Export credit insurance images are available. Export credit insurance are a topic that is being searched for and liked by netizens now. You can Get the Export credit insurance files here. Find and Download all royalty-free images.

If you’re searching for export credit insurance images information related to the export credit insurance topic, you have visit the ideal site. Our site frequently gives you hints for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

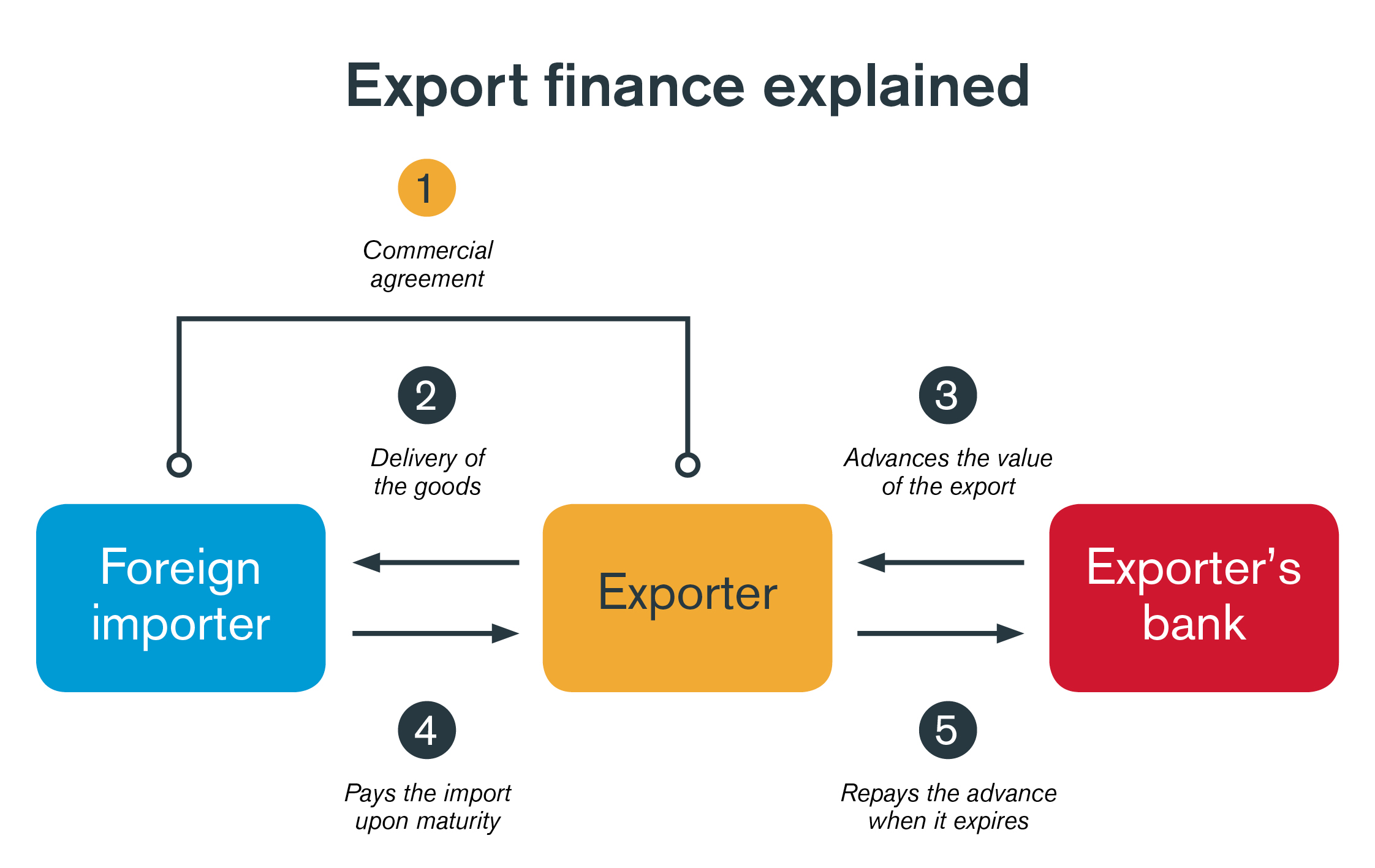

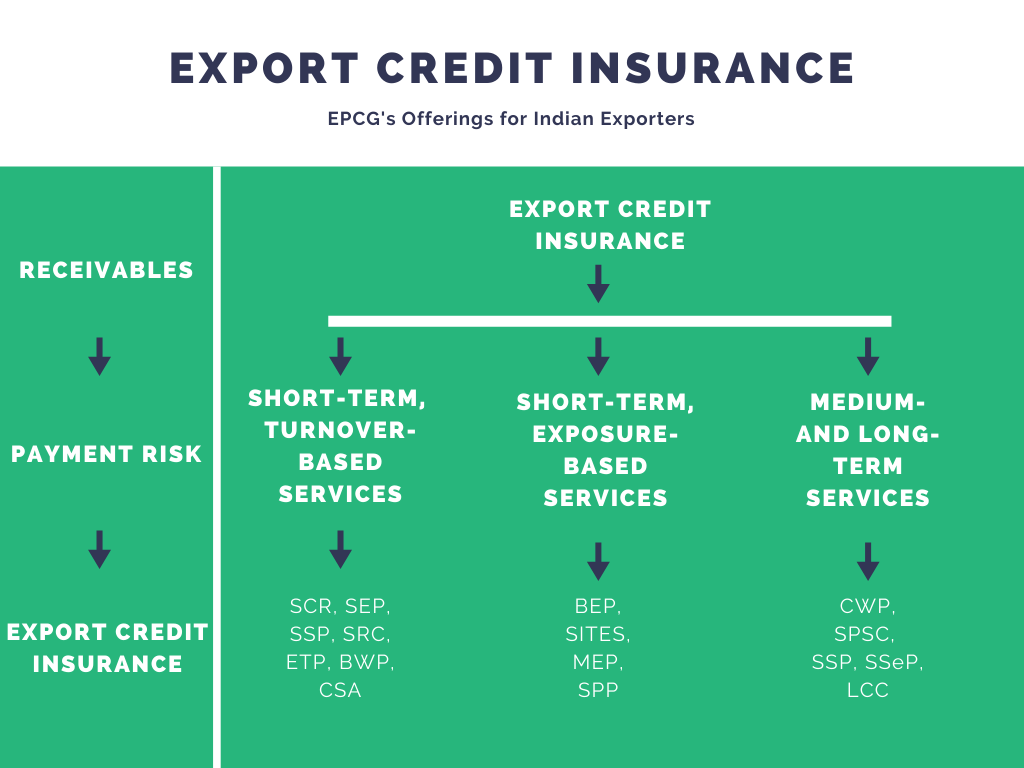

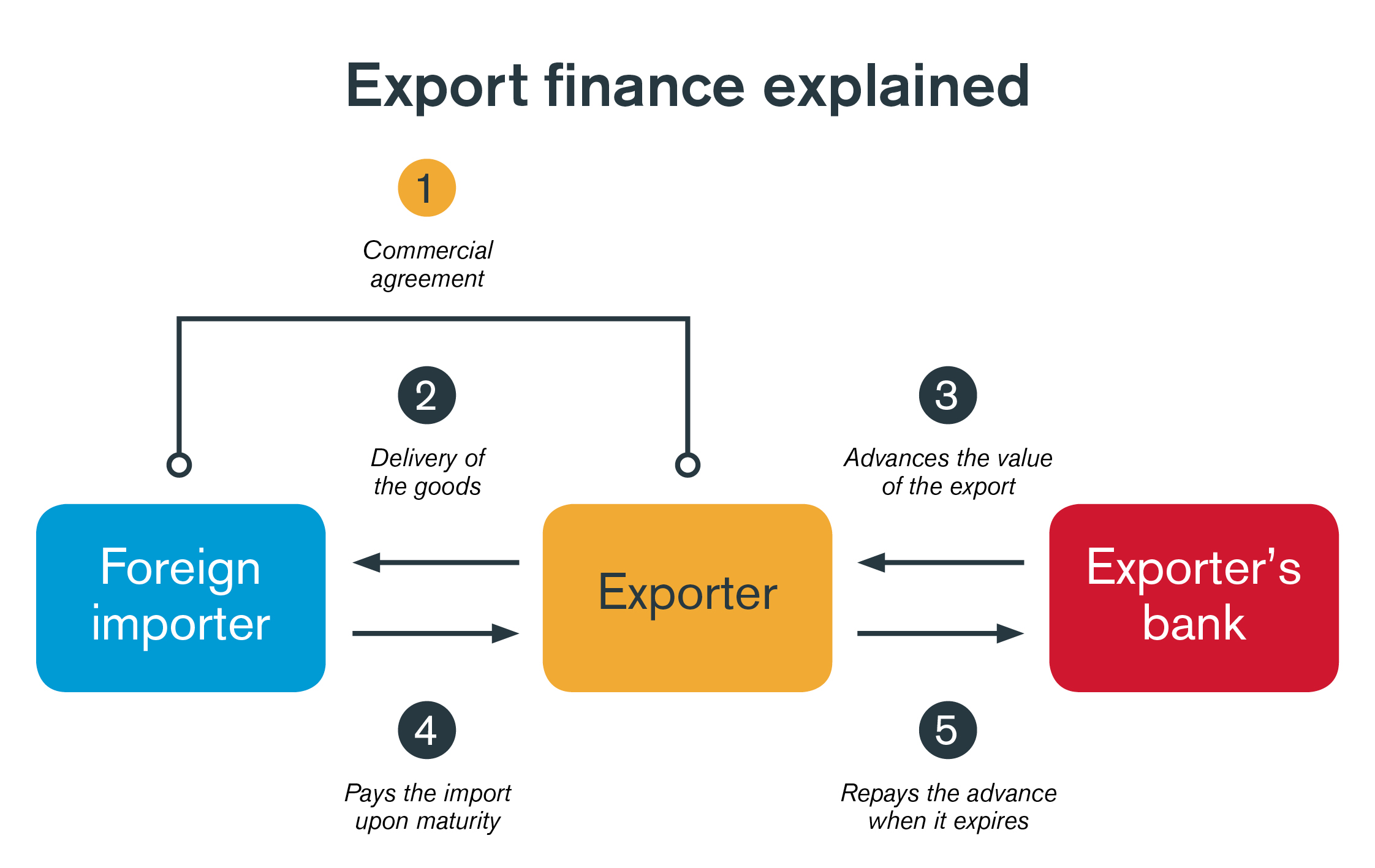

Export Credit Insurance. Export credit insurance has three key benefits. The insurance pays a portion of the assured value in case the customer or the foreign bank is not able to pay it due to political. Export credit insurance helps companies remain competitive by offering open terms when letters of credit or prepayment may have previously been the only safe way to do business. Ecas can be government agencies or.

Export and agency finance Global Trade Review (GTR) From gtreview.com

Export and agency finance Global Trade Review (GTR) From gtreview.com

Political causes of loss can be, besides lack of hard currency in the buyer`s country, wars, civil unrest or a payment moratorium imposed by a government. Export credit insurance is an insurance policy that. You can enhance your borrowing capacity and obtain more favorable financing by including your insured foreign receivables in your collateral base. When it comes to export trade credit insurance, the advantages of having a policy far outweigh the disadvantages. In other words, eci significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay. In fact, it could be argued that the only disadvantage of a trade credit insurance policy is its cost.

Four good reasons to take out credit insurance.

Ecas can be government agencies or. Export credit insurance mitigates your nonpayment risk while empowering you. Ecas can be government agencies or. In other words, eci significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay. Export credit insurance cover is provided for transactions involving capital goods and/or services outside south africa. To meet, or beat, your competitors by offering attractive credit terms.

Source: dripcapital.com

Source: dripcapital.com

Presently sinosure has formed a nationwide service network. Export credit insurance is an insurance policy that. The insurance pays a portion of the assured value in case the customer or the foreign bank is not able to pay it due to political. Commercial causes of loss are payment default by the customer or e.g. The financing can take the form of credits (financial support) or credit insurance and guarantees.

Source: gtreview.com

Source: gtreview.com

Advantages & disadvantages of export credit insurance. The exporter must demonstrate an inability to obtain credit insurance from the commercial market all transactions supported by ukef must satisfy: Credit insurance policy proceeds are assignable to the lender of your choice. Presently sinosure has formed a nationwide service network. Advantages & disadvantages of export credit insurance.

Source: cashflowsignals.com

Source: cashflowsignals.com

Advantages & disadvantages of export credit insurance. In fact, foreign companies buy an average of 40 percent more when they are offered open terms, according to the world trade organization. Presently sinosure has formed a nationwide service network. In fact, it could be argued that the only disadvantage of a trade credit insurance policy is its cost. Export credit insurance cover is provided for transactions involving capital goods and/or services outside south africa.

Source: studylib.net

Source: studylib.net

You can enhance your borrowing capacity and obtain more favorable financing by including your insured foreign receivables in your collateral base. Export credit insurance mitigates your nonpayment risk while empowering you. In fact, foreign companies buy an average of 40 percent more when they are offered open terms, according to the world trade organization. Export credit insurance cover is provided for transactions involving capital goods and/or services outside south africa. Export credit insurance helps companies remain competitive by offering open terms when letters of credit or prepayment may have previously been the only safe way to do business.

Source: tldallas.com

Source: tldallas.com

Companies that are new to exporting may find some benefits from taking out an. In fact, foreign companies buy an average of 40 percent more when they are offered open terms, according to the world trade organization. The policy protects the exporter from an overseas importer�s default, insolvency or its refusal to pay for the exporter�s shipments. Export credit insurance in india is designed to protect the receivables of an exporter. Commercial causes of loss are payment default by the customer or e.g.

Source: insure24-7.co.uk

Source: insure24-7.co.uk

Export credit insurance mitigates your nonpayment risk while empowering you. To meet, or beat, your competitors by offering attractive credit terms. Credit insurance policy proceeds are assignable to the lender of your choice. Second, export credit insurance allows exporters to provide qualifying international buyers with advantageous terms of credit. Advantages & disadvantages of export credit insurance.

Source: eventpop.me

Source: eventpop.me

Second, export credit insurance allows exporters to provide qualifying international buyers with advantageous terms of credit. To meet, or beat, your competitors by offering attractive credit terms. The financing can take the form of credits (financial support) or credit insurance and guarantees. Export credit insurance has three key benefits. When it comes to export trade credit insurance, the advantages of having a policy far outweigh the disadvantages.

Source: drakefinance.com

Source: drakefinance.com

However, with premiums typically costing around £3,500 for a turnover of. Export credit insurance in india is designed to protect the receivables of an exporter. Companies that are new to exporting may find some benefits from taking out an. To encourage and support hk export trading, the hkecic provides credit and receivables management, and shared market information to help exporters manage credit risks and grasp business opportunities. Political causes of loss can be, besides lack of hard currency in the buyer`s country, wars, civil unrest or a payment moratorium imposed by a government.

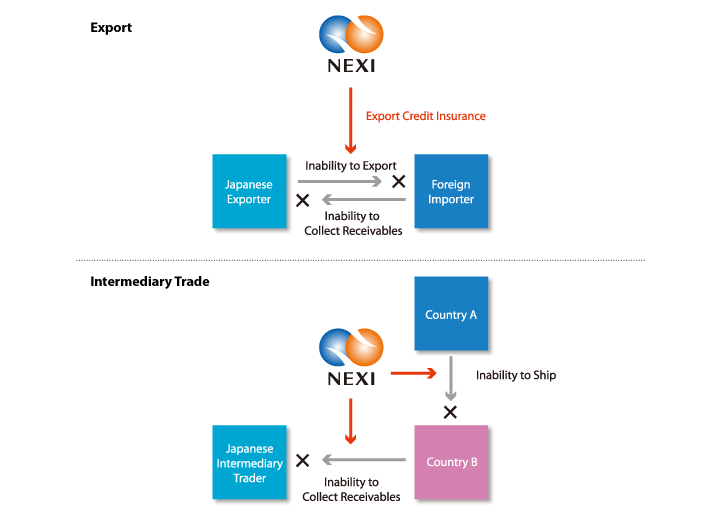

Source: nexi.go.jp

Source: nexi.go.jp

However, with premiums typically costing around £3,500 for a turnover of. Credit insurance policy proceeds are assignable to the lender of your choice. You can enhance your borrowing capacity and obtain more favorable financing by including your insured foreign receivables in your collateral base. Many times an exporter just wants to get cash in advance, or arrange for a costly letter of credit, but these are not very. Four good reasons to take out credit insurance.

Source: ravenhallgroup.co.uk

Source: ravenhallgroup.co.uk

The exporter must demonstrate an inability to obtain credit insurance from the commercial market all transactions supported by ukef must satisfy: You can enhance your borrowing capacity and obtain more favorable financing by including your insured foreign receivables in your collateral base. Export credit insurance has three key benefits. Presently sinosure has formed a nationwide service network. Four good reasons to take out credit insurance.

Export credit insurance is an insurance policy that. Export credit agencies offer loans, loan guarantees and insurance to help domestic companies limit the risk of selling goods and services in overseas markets. Credit insurance policy proceeds are assignable to the lender of your choice. The financing can take the form of credits (financial support) or credit insurance and guarantees. In fact, foreign companies buy an average of 40 percent more when they are offered open terms, according to the world trade organization.

Source: youtube.com

Source: youtube.com

The financing can take the form of credits (financial support) or credit insurance and guarantees. Second, export credit insurance allows exporters to provide qualifying international buyers with advantageous terms of credit. When it comes to export trade credit insurance, the advantages of having a policy far outweigh the disadvantages. Export credit insurance has three key benefits. Presently sinosure has formed a nationwide service network.

Source: snapdeal.com

Source: snapdeal.com

Ecas can be government agencies or. When it comes to export trade credit insurance, the advantages of having a policy far outweigh the disadvantages. Commercial causes of loss are payment default by the customer or e.g. The policy protects the exporter from an overseas importer�s default, insolvency or its refusal to pay for the exporter�s shipments. Second, export credit insurance allows exporters to provide qualifying international buyers with advantageous terms of credit.

Source: tabinsurancebrokers.com

Source: tabinsurancebrokers.com

It means that the insurance tool provides an assurance to the exporter about receiving the amount due from the foreign customer. The financing can take the form of credits (financial support) or credit insurance and guarantees. It means that the insurance tool provides an assurance to the exporter about receiving the amount due from the foreign customer. Export credit insurance cover is provided for transactions involving capital goods and/or services outside south africa. The exporter must demonstrate an inability to obtain credit insurance from the commercial market all transactions supported by ukef must satisfy:

Source: hectorbonilla.com

Source: hectorbonilla.com

Credit insurance policy proceeds are assignable to the lender of your choice. Export credit insurance cover is provided for transactions involving capital goods and/or services outside south africa. Business can use open account credit terms to win new customers and increase. In other words, eci significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay. The insurance pays a portion of the assured value in case the customer or the foreign bank is not able to pay it due to political.

Source: invoisec.com

Hong kong export credit insurance corporation provides export credit insurance protection against buyer & country risks, with percentage of indemnity up to 90%. Ecas can be government agencies or. Presently sinosure has formed a nationwide service network. Hong kong export credit insurance corporation provides export credit insurance protection against buyer & country risks, with percentage of indemnity up to 90%. The policy protects the exporter from an overseas importer�s default, insolvency or its refusal to pay for the exporter�s shipments.

Source: astreos-credit.com

Source: astreos-credit.com

Commercial causes of loss are payment default by the customer or e.g. Export credit insurance mitigates your nonpayment risk while empowering you. Political causes of loss can be, besides lack of hard currency in the buyer`s country, wars, civil unrest or a payment moratorium imposed by a government. It means that the insurance tool provides an assurance to the exporter about receiving the amount due from the foreign customer. Presently sinosure has formed a nationwide service network.

Source: securitasglobal.com

Source: securitasglobal.com

Hong kong export credit insurance corporation provides export credit insurance protection against buyer & country risks, with percentage of indemnity up to 90%. Four good reasons to take out credit insurance. In other words, eci significantly reduces the payment risks associated with doing business internationally by giving the exporter conditional assurance that payment will be made if the foreign buyer is unable to pay. Companies that are new to exporting may find some benefits from taking out an. You can enhance your borrowing capacity and obtain more favorable financing by including your insured foreign receivables in your collateral base.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title export credit insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.