Your Explain the function of insurance images are ready. Explain the function of insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Explain the function of insurance files here. Get all royalty-free photos and vectors.

If you’re looking for explain the function of insurance pictures information related to the explain the function of insurance topic, you have come to the right blog. Our site always provides you with hints for seeking the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that fit your interests.

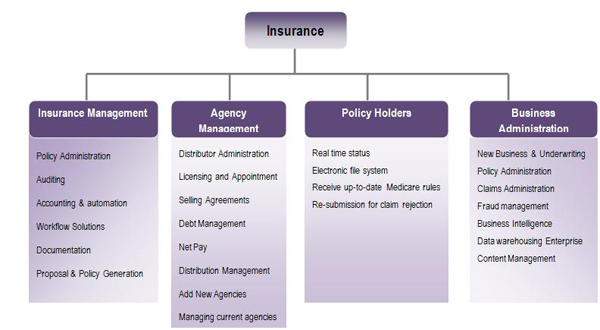

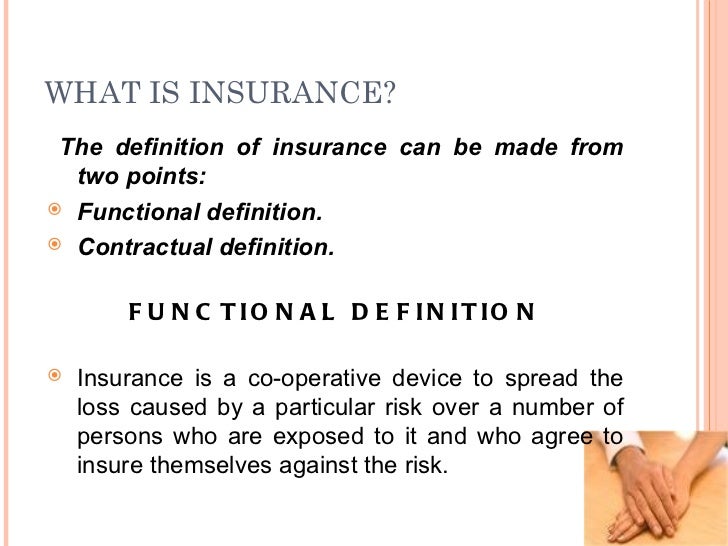

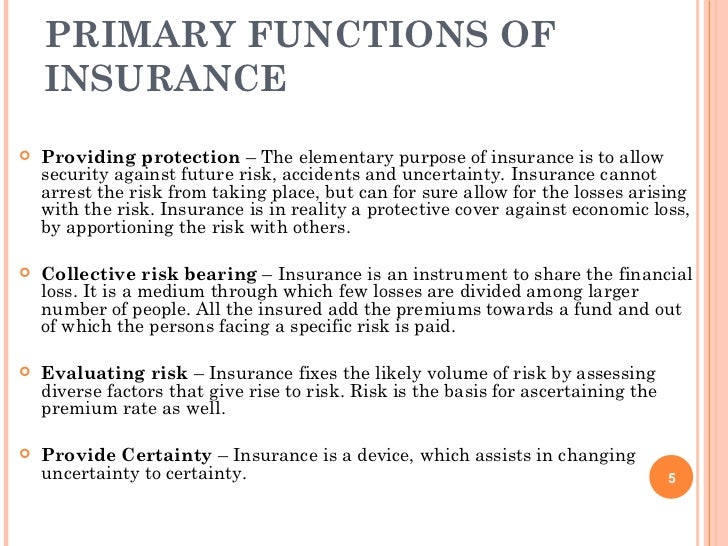

Explain The Function Of Insurance. Explain the function of insurance. To bring about speedy and orderly growth of the insurance industry (including annuity and superannuation payments), for the benefit of the common man, and to provide long term funds for accelerating growth of the economy; Insurance is a device which helps to change from uncertainty to certainty. Insurance is a means of.

Functions of Insurance.What is insurance? Functional From youtube.com

Functions of Insurance.What is insurance? Functional From youtube.com

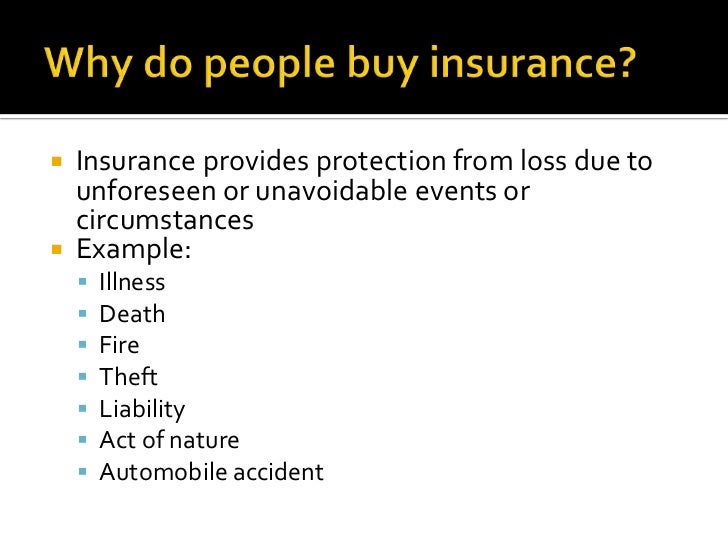

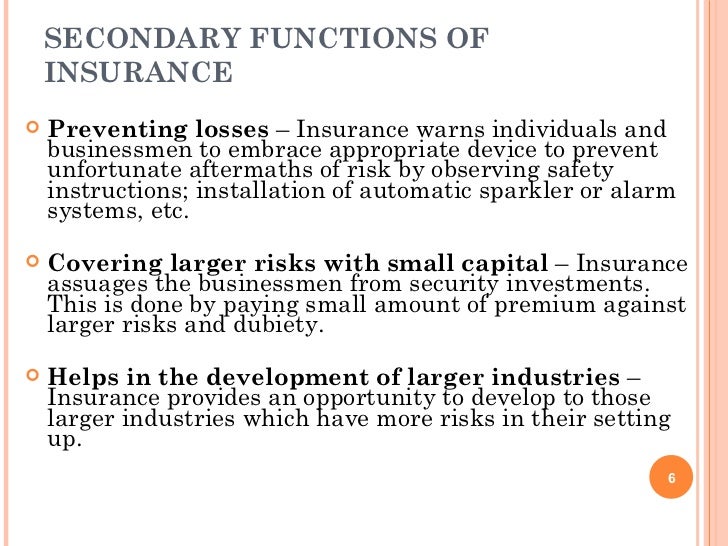

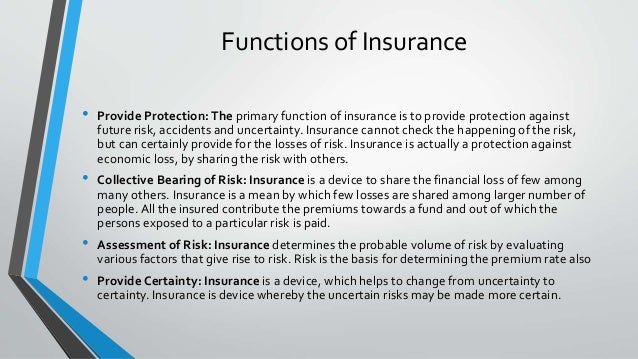

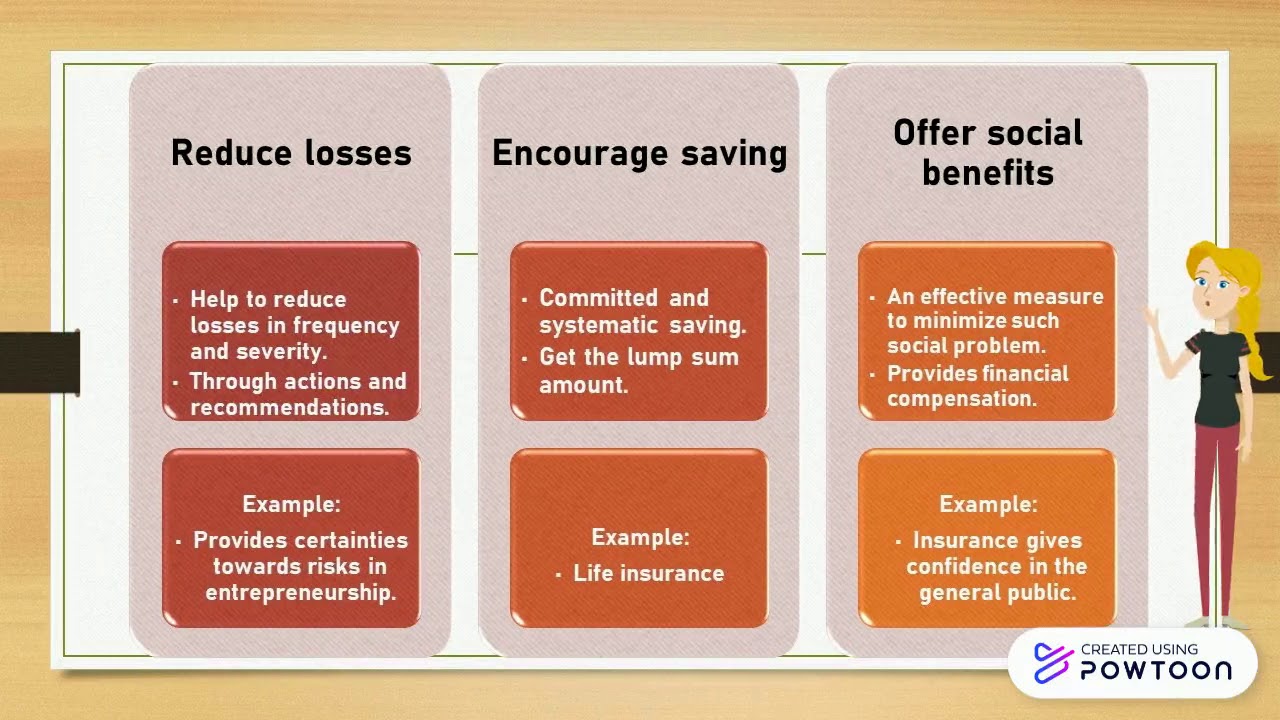

Secondary function of insurance insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for payment. Get the facts and learn the key differences before choosing a policy. Insurance does not reduce the risk of loss or damage that a company may suffer. (i) primary functions (ii) secondary functions. This may the reason that john magee writes that the function of insurance is to provide certainty. Some of the benefits are discussed below:

Read on to find out what insurance is, how it works and.

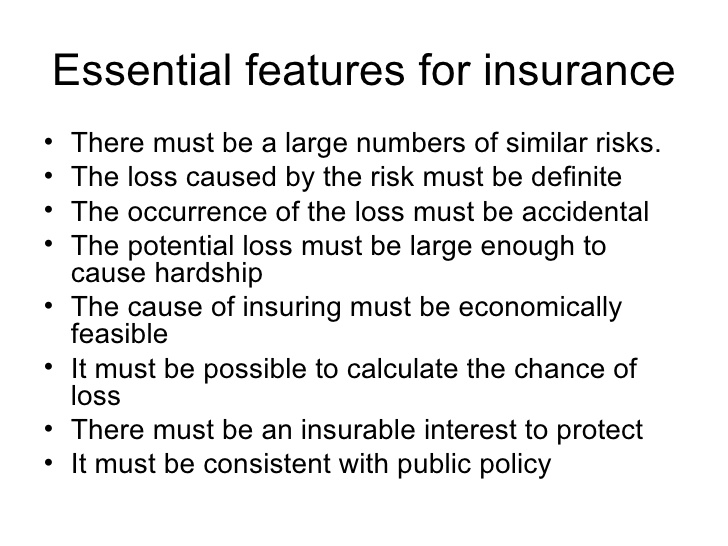

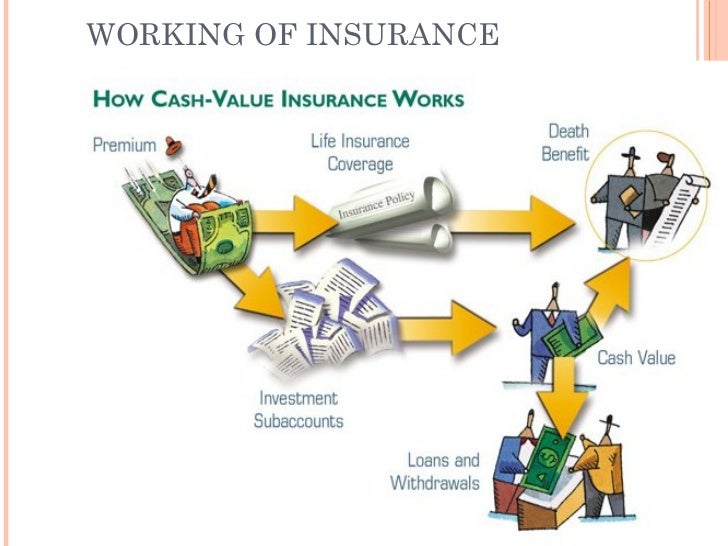

The insurer should provide all the details regarding the insurance contract. This may the reason that john magee writes that the function of insurance is to provide certainty. New questions in business studies. To bring about speedy and orderly growth of the insurance industry (including annuity and superannuation payments), for the benefit of the common man, and to provide long term funds for accelerating growth of the economy; The most important function of insurance is to spread the risk over a number of persons who are insured against the risk, share the loss of each member of the society on the basis of the probability of loss to their risk and provide security against losses to the insured. Families purchase life insurance primarily as a hedge against future loss, although some buy whole life plans that accumulate cash value that can be used.

Source: slideshare.net

Source: slideshare.net

The main function of insurcen is to provides protection against the risk of loss. Advertisement remove all ads solution 1. Some of the benefits are discussed below: Manages cash flow uncertainty when paying capacity at the time of losses is reduced significantly. Life insurance has important functions in business and in family and personal life.

Source: slideshare.net

Source: slideshare.net

The obvious benefit of insurance is the payment of losses. Insurance means the insurance company provides an assurance of compensation to the insured person in case of loss or damage or death or any other disastrous event happening with the insured person & against such assurance, the insured persons pays the premium. Insurance does not reduce the risk of loss or damage that a company may suffer. The concept of insurance developed from the need to minimize the adverse effects of risk associated with the probability of financial loss. In, simple words the meaning of insurance is to keep a person fearless and unworried about the future happenings which always remain uncertain.

Source: youtube.com

Source: youtube.com

The obvious benefit of insurance is the payment of losses. Insurance does not reduce the risk of loss or damage that a company may suffer. Manages cash flow uncertainty when paying capacity at the time of losses is reduced significantly. The insurer should provide all the details regarding the insurance contract. The main function of insurcen is to provides protection against the risk of loss.

Source: banktheories.com

Source: banktheories.com

The most important function of insurance is to spread the risk over a number of persons who are insured against the risk, share the loss of each member of the society on the basis of the probability of loss to their risk and provide security against losses to the insured. Advertisement remove all ads solution 1. The principle to share the los… Marine insurance is used to protect businesses from losses that occur while transporting goods by ship. The insurer should provide all the details regarding the insurance contract.

Source: commercemates.com

Source: commercemates.com

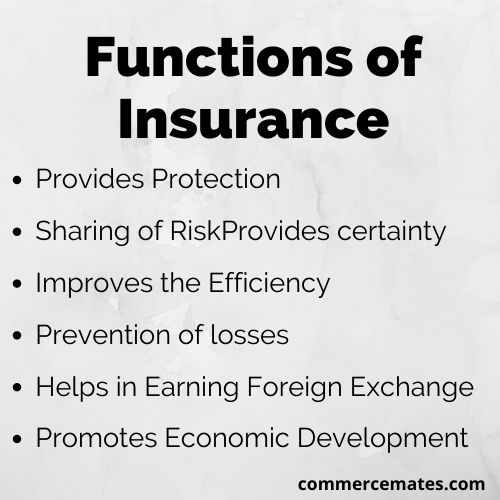

Provide certainty against risk : Insurance agents specialise in providing their clients with insurance policies that protect them against uncertain events such as illness, damage, theft, or death. The insurance gives benefits to individuals and organisations in many ways. The most important function of insurance is to spread the risk over a number of persons who are insured against the risk, share the loss of each member of the society on the basis of the probability of loss to their risk and provide security against losses to the insured. Explain the function of insurance.

Source: slideshare.net

Source: slideshare.net

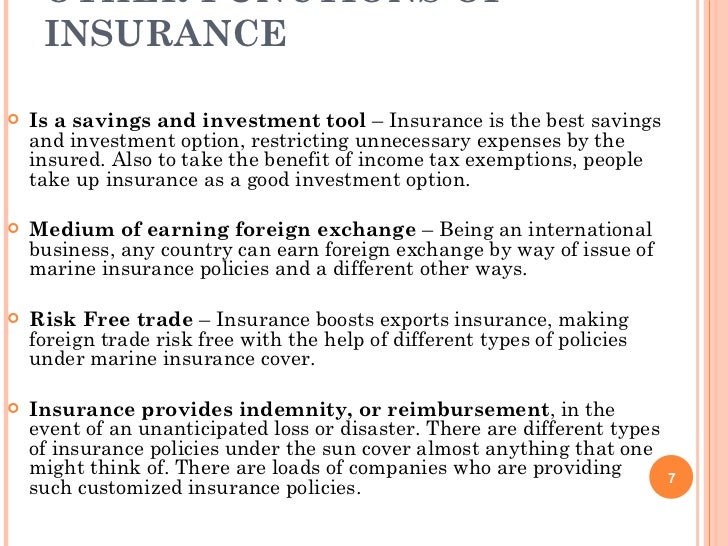

The principle to share the los… Such damage apart from causing financial loss to the owners dislocates the economic activity of the community. (i) primary functions (ii) secondary functions. Get the facts and learn the key differences before choosing a policy. Also to take the benefit of income tax exemptions, people take up insurance as a good investment option.

Source: canonprintermx410.blogspot.com

Source: canonprintermx410.blogspot.com

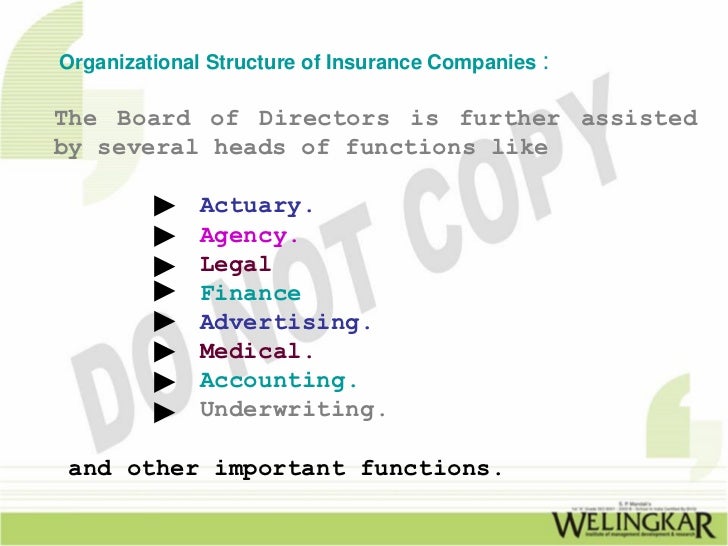

(i) primary functions (ii) secondary functions. To bring about speedy and orderly growth of the insurance industry (including annuity and superannuation payments), for the benefit of the common man, and to provide long term funds for accelerating growth of the economy; 14a evaluate insurance as a risk management strategy 14b distinguish among the types, costs and benefits of insurance coverage, including automobile, life, property, health, and professional liability 14c explain the role of insurance in financial planning. The concept of insurance developed from the need to minimize the adverse effects of risk associated with the probability of financial loss. Such damage apart from causing financial loss to the owners dislocates the economic activity of the community.

Source: slideshare.net

Source: slideshare.net

Marine insurance is used to protect businesses from losses that occur while transporting goods by ship. This may the reason that john magee writes that the function of insurance is to provide certainty. The time and amount of loss are uncertain and at the happening of risk, the person will suffer loss in absence of insurance. The obvious benefit of insurance is the payment of losses. Provide certainty against risk :

Source: canonprintermx410.blogspot.com

Source: canonprintermx410.blogspot.com

The primary objective of an insurance agent is to sell insurance policies that will meet the requirements of the client. The main function of insurance is that eliminates the uncertainty of an unexpected and sudden. The insurance gives benefits to individuals and organisations in many ways. Some of the benefits are discussed below: Manages cash flow uncertainty when paying capacity at the time of losses is reduced significantly.

Source: learnpick.in

Source: learnpick.in

Also to take the benefit of income tax exemptions, people take up insurance as a good investment option. Get the facts and learn the key differences before choosing a policy. Insurance is a device which helps to change from uncertainty to certainty. Also to take the benefit of income tax exemptions, people take up insurance as a good investment option. The most important function of insurance is to spread the risk over a number of persons who are insured against the risk, share the loss of each member of the society on the basis of the probability of loss to their risk and provide security against losses to the insured.

Source: slideserve.com

Source: slideserve.com

The time and amount of loss are uncertain and at the happening of risk, the person will suffer loss in absence of insurance. Such damage apart from causing financial loss to the owners dislocates the economic activity of the community. To bring about speedy and orderly growth of the insurance industry (including annuity and superannuation payments), for the benefit of the common man, and to provide long term funds for accelerating growth of the economy; The main function of the insurance is to provide protection against the probable chances of loss. The most important function of insurance is to spread the risk over a number of persons who are insured against the risk, share the loss of each member of the society on the basis of the probability of loss to their risk and provide security against losses to the insured.

Source: slideshare.net

Source: slideshare.net

Insurance is a means of. Similarly, riegel and miller observe, “the function of insurance is primarily to decrease the uncertainty of events.” 5. Get the facts and learn the key differences before choosing a policy. Advertisement remove all ads solution 1. The principle to share the loss of each member of the society based on the probability of loss to their risk;

Source: slideshare.net

Source: slideshare.net

It is not the function of fire insurance to replace the economic loss termed the ‘fire waste’. The main function of the insurance is to provide protection against the probable chances of loss. The insurance gives benefits to individuals and organisations in many ways. The insurance guarantees the payment of loss and thus protects the assured from sufferings. The function of insurance is to safeguard against financial loss by having the losses of few paid by the contributions of many who are exposed to.

Source: slideshare.net

Source: slideshare.net

Secondary function of insurance insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for payment. In, simple words the meaning of insurance is to keep a person fearless and unworried about the future happenings which always remain uncertain. The obvious benefit of insurance is the payment of losses. The main function of insurcen is to provides protection against the risk of loss. According to this principle, both insurer and insured should enter into a contract in good faith.

Source: youtube.com

Source: youtube.com

Similarly, riegel and miller observe, “the function of insurance is primarily to decrease the uncertainty of events.” 5. It absolve the risk of uncertainty and provides a piece of mind because the insurance facilitates reimbursement during crises situations and compensate for any potential future losses. In business, it plays a major role in strategic planning for future operations. Secondary function of insurance insurance is defined as the equitable transfer of the risk of a loss, from one entity to another, in exchange for payment. The function of fire insurance is to make good the financial loss suffered as a result of the fire.

Source: slideshare.net

Source: slideshare.net

In spite of sustained efforts made. Insurance does not reduce the risk of loss or damage that a company may suffer. The main function of insurcen is to provides protection against the risk of loss. According to this principle, both insurer and insured should enter into a contract in good faith. The concept of insurance developed from the need to minimize the adverse effects of risk associated with the probability of financial loss.

Source: slideshare.net

Source: slideshare.net

Explain the principles of insurance. The main function of insurance is that eliminates the uncertainty of an unexpected and sudden. Explain the function of insurance. Such damage apart from causing financial loss to the owners dislocates the economic activity of the community. Also to take the benefit of income tax exemptions, people take up insurance as a good investment option.

Source: slideshare.net

Source: slideshare.net

Families purchase life insurance primarily as a hedge against future loss, although some buy whole life plans that accumulate cash value that can be used. 14a evaluate insurance as a risk management strategy 14b distinguish among the types, costs and benefits of insurance coverage, including automobile, life, property, health, and professional liability 14c explain the role of insurance in financial planning. The insurance guarantees the payment of loss and thus protects the assured from sufferings. Marine insurance is used to protect businesses from losses that occur while transporting goods by ship. Explore the types and functions of marine insurance and discover marine property coverages.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title explain the function of insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.