Your Experience rating insurance images are ready in this website. Experience rating insurance are a topic that is being searched for and liked by netizens today. You can Get the Experience rating insurance files here. Get all free images.

If you’re looking for experience rating insurance pictures information related to the experience rating insurance interest, you have visit the ideal site. Our site frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

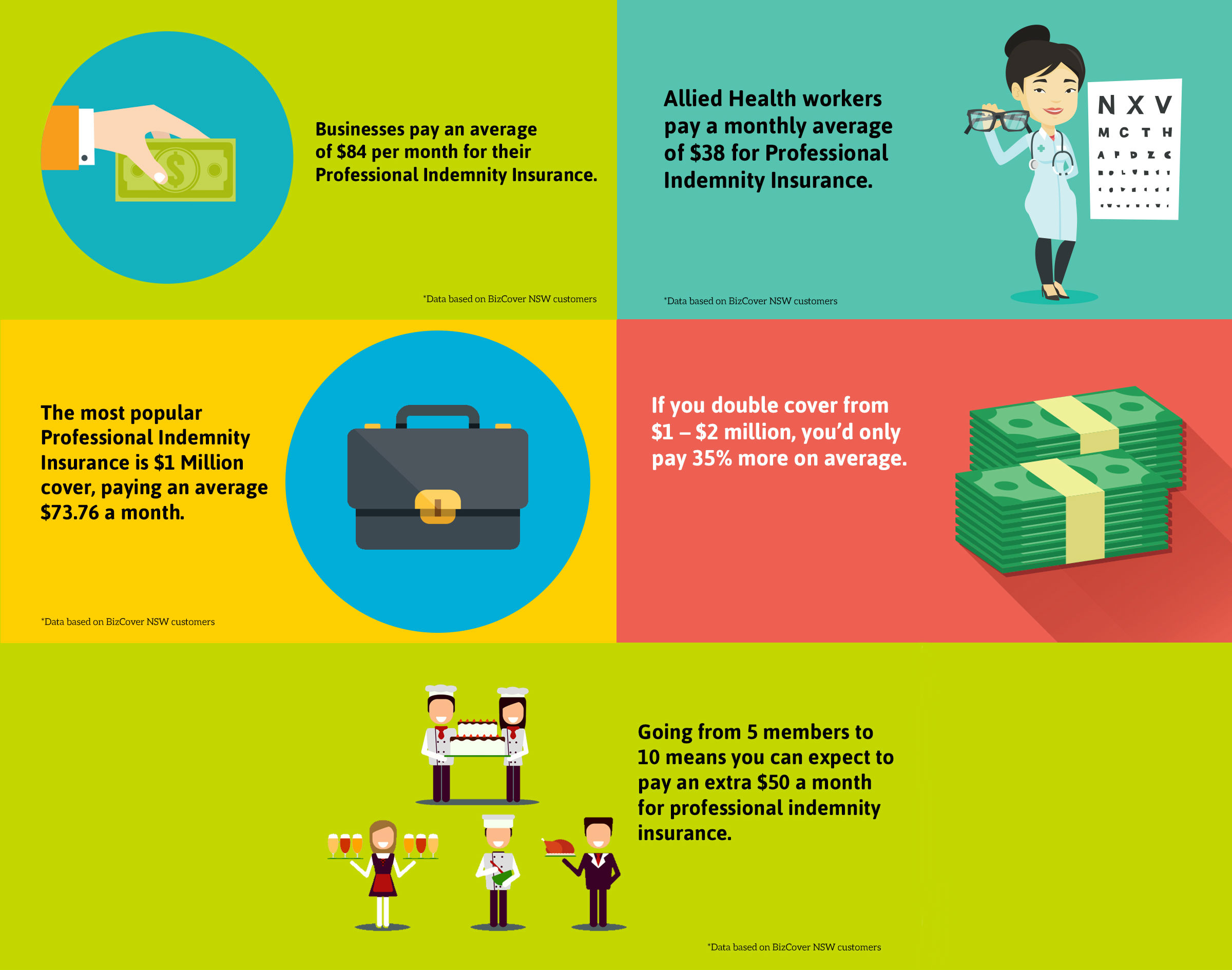

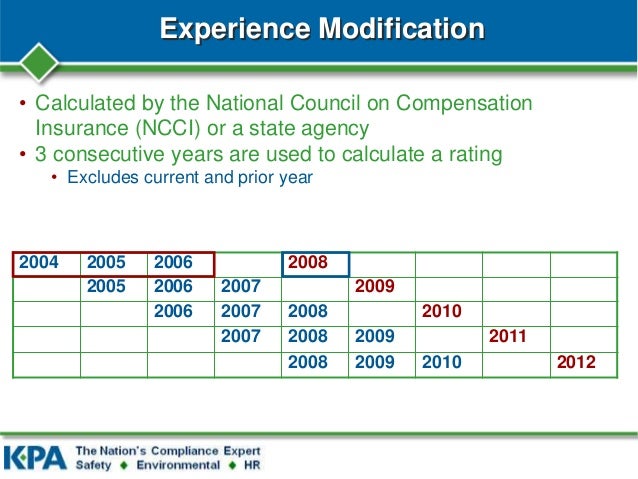

Experience Rating Insurance. For example, workers’ compensation premiums are calculated using an experience rating, based on the employer’s claim history and industry. (1) an analysis of the portfolio in each policy year, assuming that each )�ear. This can also be applied to specific groups and the premium of the group would be based on the health risks faced by that particular group (e.g. Experience rating is not the only pricing tool available to insurance providers to determine the cost of workers compensation coverage.

Experience Rating Health Insurance Week 3 Health From entreduasaspas.blogspot.com

Experience Rating Health Insurance Week 3 Health From entreduasaspas.blogspot.com

With experience rated standards, premiums are adjusted based on the health history of those covered. Sapna isotupa lazaridis school of business & economics, wilfrid laurier university, waterloo, ontario, canada , mary kelly lazaridis school of business & economics, wilfrid laurier university, waterloo, ontario, canada correspondence. Experience rating is based on the premise that the expected loss ratio. Experience rating in medical professional liability insurance 151 experience information on a centralized basis as a measure critical to the long run health of the medical malpractice insurance industry. We assume that an insured has a loss ratio distribution, d, which is selected at random from a class of distributions, d. In the ui literature experience rating is usually taken to mean full liability for benefit payments at the margin.

The rating reflects a variety lagging indicators, such as injury costs or claim history, and offers a prediction of future risk.

Experience rating under this system of rating, the individual has their premiums determined based on their present health condition and other risks associated with that person. Experience rating, in the context of insurance, is a rating method that takes into account the amount of loss experienced by an insured party as compared to the amount of loss experienced by other insured parties with similar characteristics. Insurance companies use it to adjust premium rates typically for workers� compensation and liability. Experience rating — as respects workers compensation, the method in which the actual loss experience of the insured is compared to the loss experience that is normally expected by other risks in the insured�s rating class. Experience rating under this system of rating, the individual has their premiums determined based on their present health condition and other risks associated with that person. Experience rating is a mathematical tool used by insurance providers that considers your previous loss experience in calculating your current premium.

Source: pinterest.com

Source: pinterest.com

However, even the limited experience information that does exist is not typically utilized in rate setting despite the fact that it has been shown to be Experience rating is based on the premise that the expected loss ratio. Experience rating under this system of rating, the individual has their premiums determined based on their present health condition and other risks associated with that person. Experience rating — as respects workers compensation, the method in which the actual loss experience of the insured is compared to the loss experience that is normally expected by other risks in the insured�s rating class. Experience rating tailors policies to the specific group or individual.

Source: insurancejournal.com

Source: insurancejournal.com

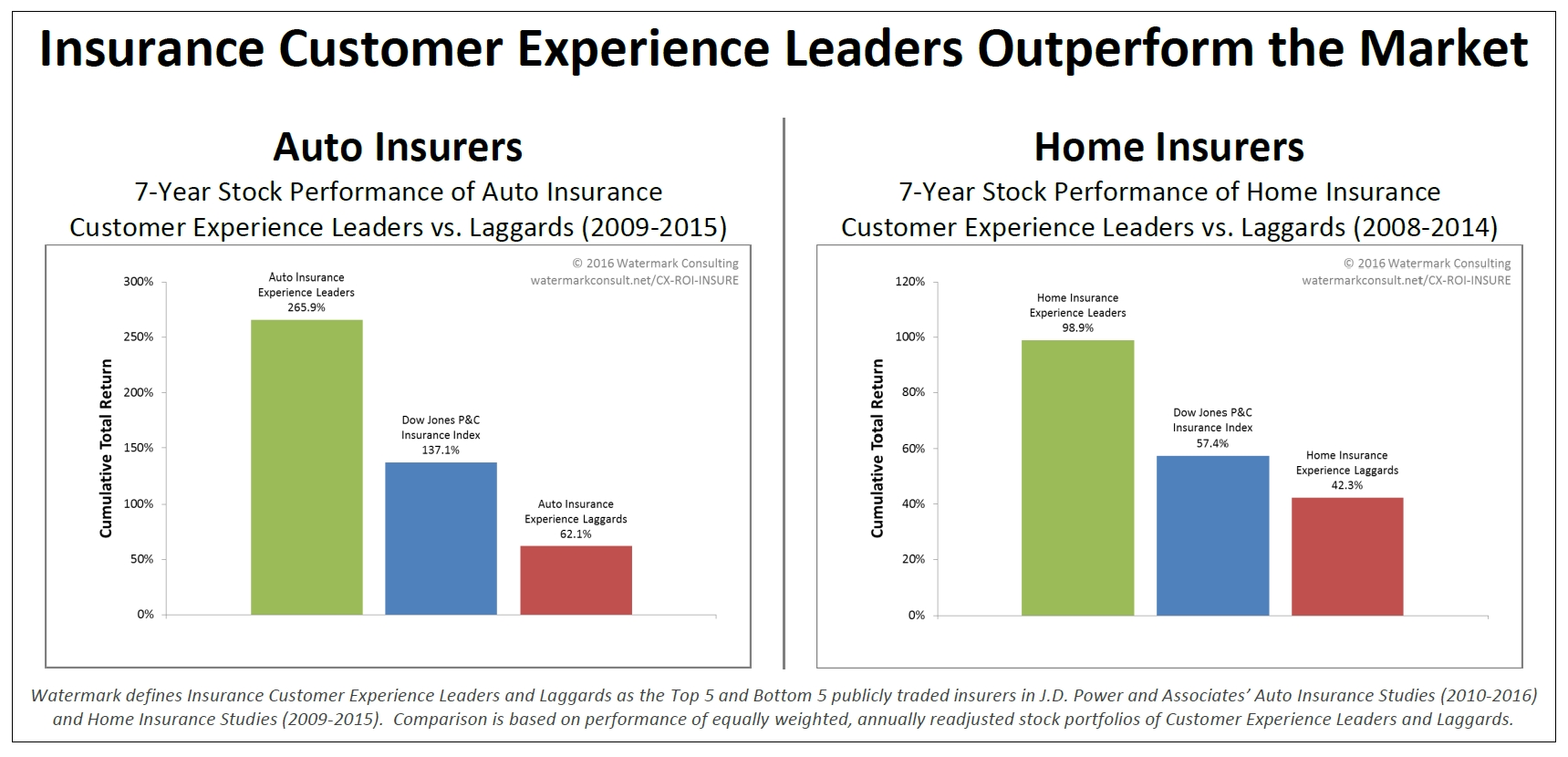

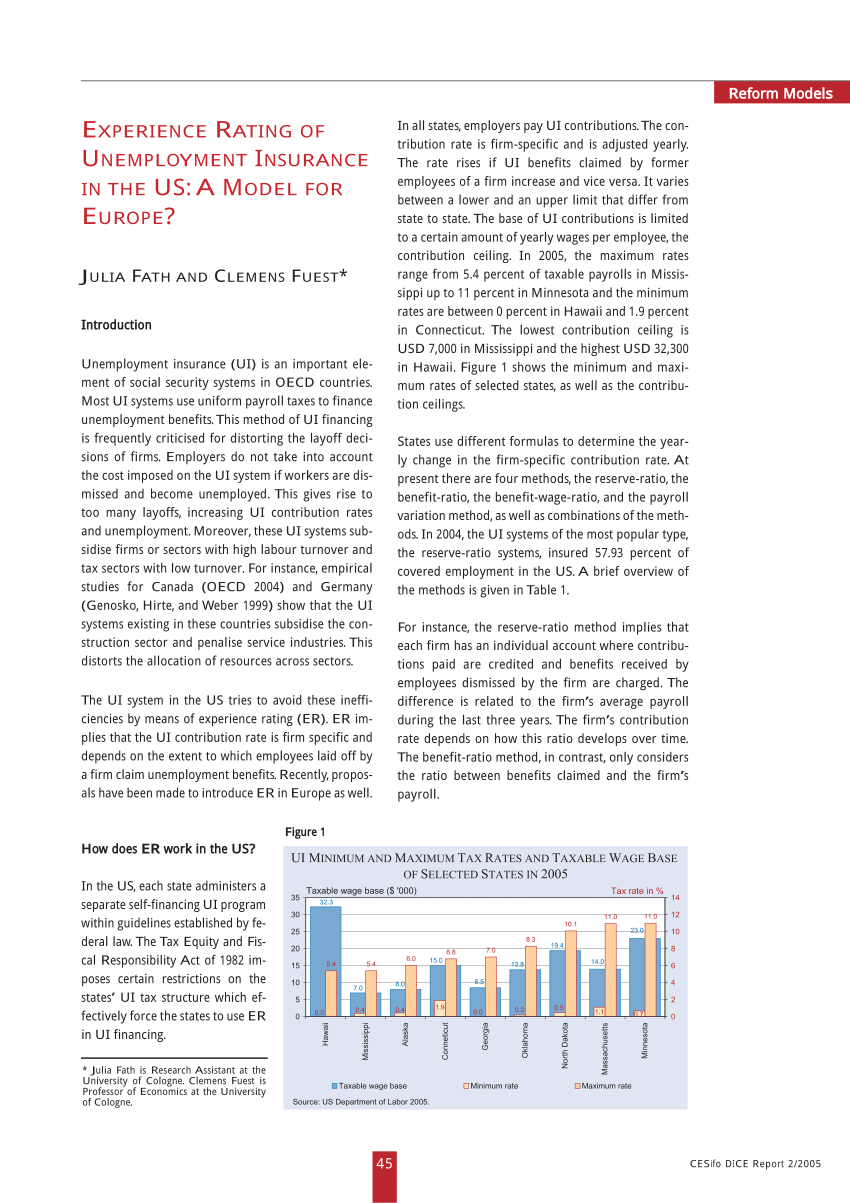

Experience rating is a term that many consumers are unaware of when it comes to how their auto insurance premiums are calculated. It is not something that companies advertise or typically mention on a website or during a phone consultation, but it is a quantitative formula that is used to determine what category of payment a client will fall into. Experience rating is a measurement the insurance industry uses to evaluate the insurance risk of an employer based on their experience. In the ui literature experience rating is usually taken to mean full liability for benefit payments at the margin. Emr, or experience modification rating is a calculation used by insurance firms to price the cost of workers’ compensation premiums.

Source: aiamga.com

Source: aiamga.com

Underwriting) experience rating is a method of adjusting the premium for a risk based on past loss experience for that risk compared to loss experience for an average risk. With experience rating, the insurer evaluates the claims history of a particular group in order to set. Premiums based on a community rating allocate risks evenly across a community. Experience rating is a mathematical tool used by insurance providers that considers your previous loss experience in calculating your current premium. Experience rating — as respects workers compensation, the method in which the actual loss experience of the insured is compared to the loss experience that is normally expected by other risks in the insured�s rating class.

Source: entreduasaspas.blogspot.com

Source: entreduasaspas.blogspot.com

Experience rating is not the only pricing tool available to insurance providers to determine the cost of workers compensation coverage. Experience rating — as respects workers compensation, the method in which the actual loss experience of the insured is compared to the loss experience that is normally expected by other risks in the insured�s rating class. Experience rating in the insurance literature means that premiums are actuarially fair, given a best predictor of the insured�s expected loss. Sapna isotupa lazaridis school of business & economics, wilfrid laurier university, waterloo, ontario, canada , mary kelly lazaridis school of business & economics, wilfrid laurier university, waterloo, ontario, canada correspondence. Experience rating is a mathematical tool used by insurance providers that considers your previous loss experience in calculating your current premium.

Source: entreduasaspas.blogspot.com

Source: entreduasaspas.blogspot.com

In the ui literature experience rating is usually taken to mean full liability for benefit payments at the margin. Premiums are typically lower for healthier groups and individuals. An experience rating system is used to estimate how much a specific individual or group will have to spend on medical care. Experience rating is based on the premise that the expected loss ratio. The rating reflects a variety lagging indicators, such as injury costs or claim history, and offers a prediction of future risk.

Source: slideserve.com

Source: slideserve.com

An unemployment insurance experience rating, or experience rating, is a term that refers to a tax evaluation tool used by state unemployment insurance programs that allows states to collect unemployment taxes from employers according to the amount of unemployment insurance benefits drawn by their former employees. Experience rating is a measurement the insurance industry uses to evaluate the insurance risk of an employer based on their experience. When the era applies, only 30% of the claim amount is used for experience rating. Experience rating in medical professional liability insurance 151 experience information on a centralized basis as a measure critical to the long run health of the medical malpractice insurance industry. However, even the limited experience information that does exist is not typically utilized in rate setting despite the fact that it has been shown to be

Source: insurancenewsletters.com

Source: insurancenewsletters.com

It is not something that companies advertise or typically mention on a website or during a phone consultation, but it is a quantitative formula that is used to determine what category of payment a client will fall into. This means that everyone pays the same, regardless of age, gender or health and wellness. Insurance companies use it to adjust premium rates typically for workers� compensation and liability. Though these concepts are related, they are not identical. The era does not apply to claims that result in disability payments.

Source: slideshare.net

Source: slideshare.net

In comparison, an insurer uses “experience rating” when it predicts a group � s future medical costs based on its past experience (i.e., the actual cost of providing health care coverage to the group during a given period of time; Rating experience — computing a premium based on the loss experience of the risk itself. For example, workers’ compensation premiums are calculated using an experience rating, based on the employer’s claim history and industry. In the ui literature experience rating is usually taken to mean full liability for benefit payments at the margin. Sapna isotupa lazaridis school of business & economics, wilfrid laurier university, waterloo, ontario, canada , mary kelly lazaridis school of business & economics, wilfrid laurier university, waterloo, ontario, canada correspondence.

Source: researchgate.net

Source: researchgate.net

Experience rating is based on the premise that the expected loss ratio. The experience rating is the proportion of an insured party’s loss experience to that of a comparison group. When the era applies, only 30% of the claim amount is used for experience rating. Experience rating — as respects workers compensation, the method in which the actual loss experience of the insured is compared to the loss experience that is normally expected by other risks in the insured�s rating class. Experience rating is a mathematical tool used by insurance providers that considers your previous loss experience in calculating your current premium.

Source: researchgate.net

Source: researchgate.net

For example, workers’ compensation premiums are calculated using an experience rating, based on the employer’s claim history and industry. Though these concepts are related, they are not identical. We assume that an insured has a loss ratio distribution, d, which is selected at random from a class of distributions, d. It is not something that companies advertise or typically mention on a website or during a phone consultation, but it is a quantitative formula that is used to determine what category of payment a client will fall into. Experience rating is a mathematical tool used by insurance providers that considers your previous loss experience in calculating your current premium.

Source: blog.idrenvironmental.com

Source: blog.idrenvironmental.com

Emr, or experience modification rating is a calculation used by insurance firms to price the cost of workers’ compensation premiums. Experience rating is a term that many consumers are unaware of when it comes to how their auto insurance premiums are calculated. P, is different for each insured in a given classification. This means that everyone pays the same, regardless of age, gender or health and wellness. This rating is based on how much the person has already spent, what conditions are already present and what risks a person has.

Source: researchgate.net

Source: researchgate.net

The rating reflects a variety lagging indicators, such as injury costs or claim history, and offers a prediction of future risk. In the ui literature experience rating is usually taken to mean full liability for benefit payments at the margin. ( ɪkspɪəriəns reɪtɪŋ ) noun. Experience rating tailors policies to the specific group or individual. Sapna isotupa lazaridis school of business & economics, wilfrid laurier university, waterloo, ontario, canada , mary kelly lazaridis school of business & economics, wilfrid laurier university, waterloo, ontario, canada correspondence.

Source: researchgate.net

Source: researchgate.net

The resulting experience modification factor is then applied to the premium of the insured. Experience rating is a measurement the insurance industry uses to evaluate the insurance risk of an employer based on their experience. In comparison, an insurer uses “experience rating” when it predicts a group � s future medical costs based on its past experience (i.e., the actual cost of providing health care coverage to the group during a given period of time; For example, workers’ compensation premiums are calculated using an experience rating, based on the employer’s claim history and industry. Experience rating under this system of rating, the individual has their premiums determined based on their present health condition and other risks associated with that person.

Source: ebay.com

Source: ebay.com

With experience rating, the insurer evaluates the claims history of a particular group in order to set. Though these concepts are related, they are not identical. Essentially a comparison of actual losses with expected losses. (1) an analysis of the portfolio in each policy year, assuming that each )�ear. With experience rating, the insurer evaluates the claims history of a particular group in order to set.

Source: slideshare.net

Source: slideshare.net

Premiums based on a community rating allocate risks evenly across a community. Though these concepts are related, they are not identical. Experience rating is a measurement the insurance industry uses to evaluate the insurance risk of an employer based on their experience. It is most commonly associated with workers’ compensation insurance , where it is used to develop the experience modification factor. This means that everyone pays the same, regardless of age, gender or health and wellness.

Source: researchgate.net

Source: researchgate.net

Experience rating, in the context of insurance, is a rating method that takes into account the amount of loss experienced by an insured party as compared to the amount of loss experienced by other insured parties with similar characteristics. The remaining 70% is ignored. Experience rating is a mathematical tool used by insurance providers that considers your previous loss experience in calculating your current premium. It is not something that companies advertise or typically mention on a website or during a phone consultation, but it is a quantitative formula that is used to determine what category of payment a client will fall into. With experience rated standards, premiums are adjusted based on the health history of those covered.

Source: researchgate.net

Source: researchgate.net

The rating reflects a variety lagging indicators, such as injury costs or claim history, and offers a prediction of future risk. With experience rating, the insurer evaluates the claims history of a particular group in order to set. Experience rating is a mathematical tool used by insurance providers that considers your previous loss experience in calculating your current premium. ( ɪkspɪəriəns reɪtɪŋ ) noun. In comparison, an insurer uses “experience rating” when it predicts a group � s future medical costs based on its past experience (i.e., the actual cost of providing health care coverage to the group during a given period of time;

Source: taxpolicycenter.org

Source: taxpolicycenter.org

However, even the limited experience information that does exist is not typically utilized in rate setting despite the fact that it has been shown to be With experience rating, the insurer evaluates the claims history of a particular group in order to set. Experience rating is not the only pricing tool available to insurance providers to determine the cost of workers compensation coverage. The group � s claim history). This means that everyone pays the same, regardless of age, gender or health and wellness.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title experience rating insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.