Your Experience rating health insurance images are available in this site. Experience rating health insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Experience rating health insurance files here. Get all royalty-free vectors.

If you’re looking for experience rating health insurance images information connected with to the experience rating health insurance topic, you have visit the ideal blog. Our site frequently gives you hints for seeking the maximum quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

Experience Rating Health Insurance. An experience rating is the amount of loss that an insured party experiences compared to the amount of loss that similar insured parties have. It means that an applicant or group�s medical history and claims experience is taken into consideration when premiums are determined. Community rated policies are sometimes available under employment benefit plans where a company attains health insurance for all their staff. The system needs to be refined to avoid such a scenario, and experience rating falls under that category.

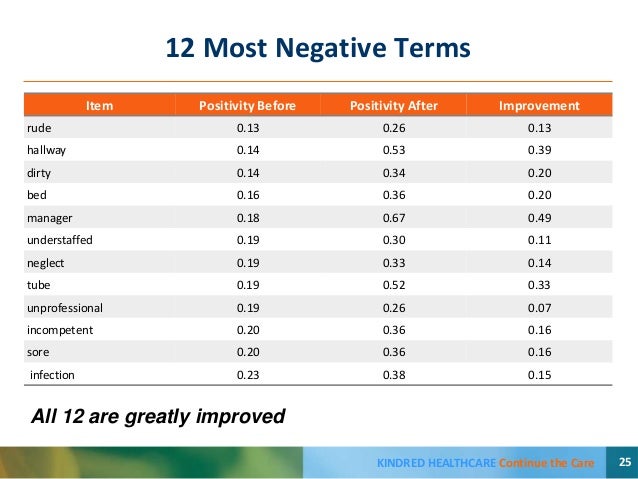

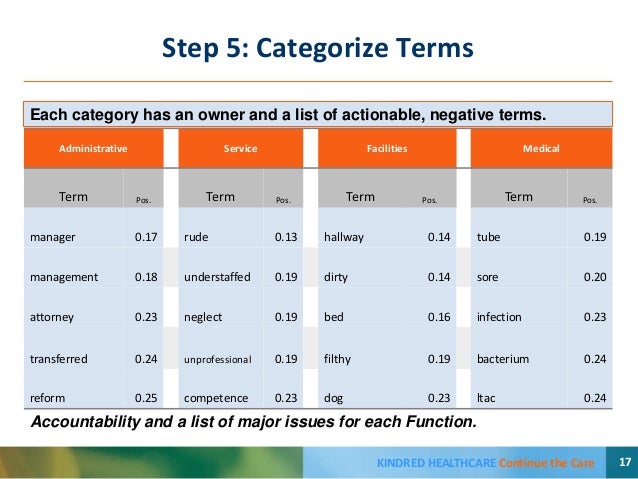

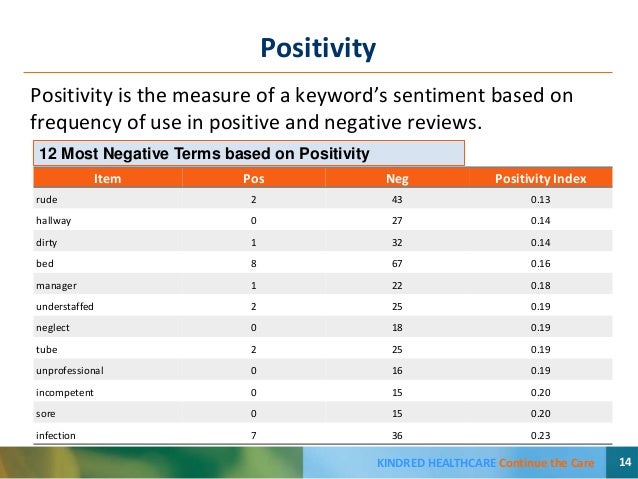

Using data from consumer reviews to change the health care From slideshare.net

Using data from consumer reviews to change the health care From slideshare.net

Experience rating, in the context of insurance, is a rating method that takes into account the amount of loss experienced by an insured party as compared to the amount of loss experienced by other insured parties with similar characteristics. What does experience rating mean? An experience rating system is used to estimate how much a specific individual or group will have to spend on medical care. With experience rating, people pay different premiums based on differences in their demographics, past health care utilization, medical status, and other factors. A plan�s overall rating is based on 3 categories, each with its own star rating:. It is used to calculate the experience modification factor.

Insurers apply experience rating as a means of underwriting heterogeneity among policyholders that may be hard or costly to otherwise observe.

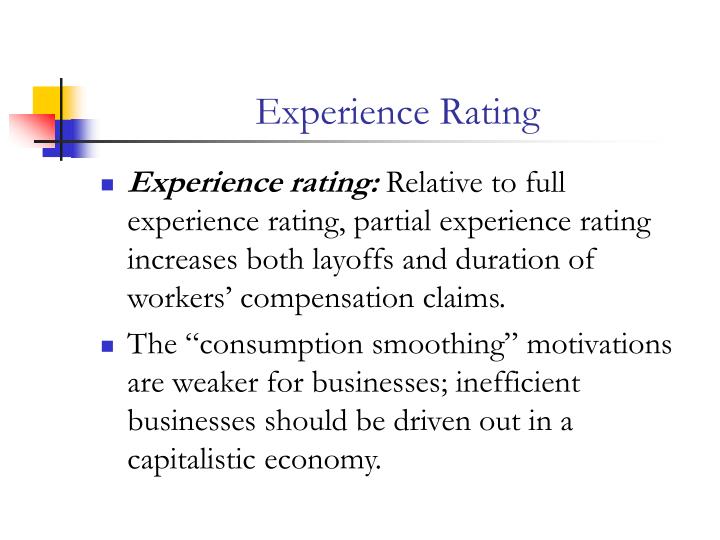

Insurers apply experience rating as a means of underwriting heterogeneity among policyholders that may be hard or costly to otherwise observe. An experience rating system is used to estimate how much a specific individual or group will have to spend on medical care. Experience rating can still be used by large group plans. I the workers’ compensdon experience ruling plum the workers’ compensation experience rating plan [2] has a long and rich history. They also believe experience rating is philosophically correct, given a desire to keep health insurance and the practice of medicine essentially on a private basis. In comparison, an insurer uses “experience rating” when it predicts a group � s future medical costs based on its past experience (i.e., the actual cost of providing health care coverage to the group during a given period of time;

Source: slideshare.net

Source: slideshare.net

The group � s claim history). Premiums are typically lower for healthier groups and individuals. What the health plan star ratings are based on. Experience rating is the opposite of community rating. Experience rated policies do offer lower premiums for healthier individuals, but this also means higher costs for those who are less healthy.

Source: slideshare.net

Source: slideshare.net

What does experience rating mean? Insurers apply experience rating as a means of underwriting heterogeneity among policyholders that may be hard or costly to otherwise observe. Experience ratings are commonly used by insurance companies to determine whether a client’s losses are average, above average or below average, and premiums are charged accordingly. I the workers’ compensdon experience ruling plum the workers’ compensation experience rating plan [2] has a long and rich history. Each rated health plan has an “overall” quality rating of 1 to 5 stars (5 is highest), which accounts for member experience, medical care, and health plan administration.

Source: workerscompensationtodayer.blogspot.com

Source: workerscompensationtodayer.blogspot.com

It is also used, to a lesser extent, in other types of casualty insurance, such as general liability, commercial auto liability and professional liability. This gives you an objective way to quickly compare plans, based on quality, as you shop. Community rated policies are sometimes available under employment benefit plans where a company attains health insurance for all their staff. The system needs to be refined to avoid such a scenario, and experience rating falls under that category. Currently, your small business has the option to choose coverage based on the rating methodology that works best for your circumstances.

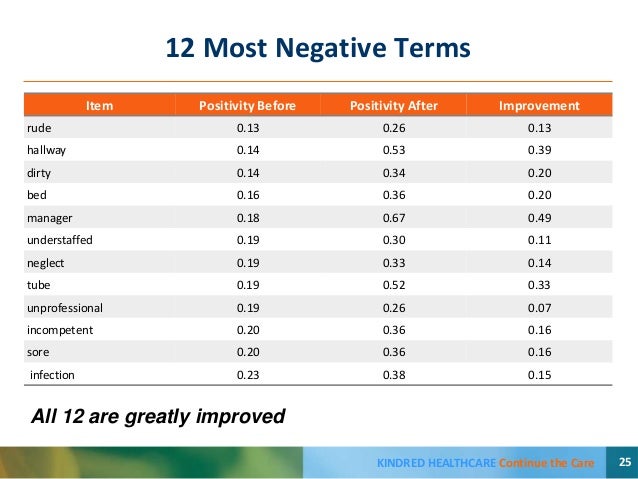

Source: xminstitute.com

Source: xminstitute.com

It is used to calculate the experience modification factor. Experience ratings are commonly used by insurance companies to determine whether a client’s losses are average, above average or below average, and premiums are charged accordingly. The group � s claim history). It is used to calculate the experience modification factor. This rating is based on how much the person has already spent, what conditions are already present and what risks a person has.

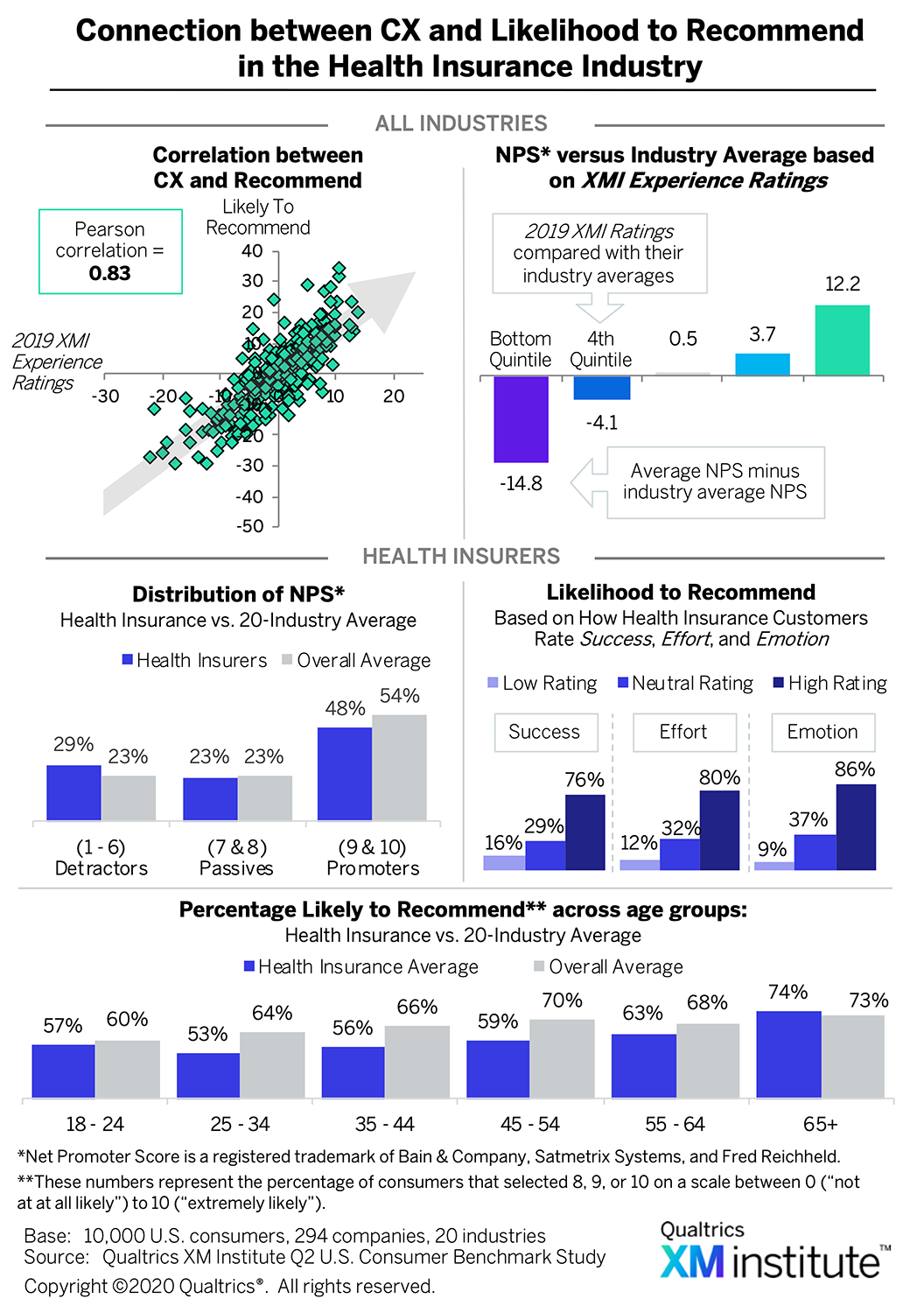

Source: kff.org

Source: kff.org

Premium after experience rating to the premium before experience rating. Experience rating is the opposite of community rating. Experience rating is commonly used in workers compensation insurance. Experience ratings are commonly used by insurance companies to determine whether a client’s losses are average, above average or below average, and premiums are charged accordingly. Experience rated policies do offer lower premiums for healthier individuals, but this also means higher costs for those who are less healthy.

Source: blog.idrenvironmental.com

Source: blog.idrenvironmental.com

The group � s claim history). The group � s claim history). Experience rated policies do offer lower premiums for healthier individuals, but this also means higher costs for those who are less healthy. The system needs to be refined to avoid such a scenario, and experience rating falls under that category. Insurance providers would be able to look for employers with lower costs and avoid ones with higher costs if the rating system were only manual.

Source: marketingcharts.com

Source: marketingcharts.com

Currently, your small business has the option to choose coverage based on the rating methodology that works best for your circumstances. The group � s claim history). Experience rated policies do offer lower premiums for healthier individuals, but this also means higher costs for those who are less healthy. Experience rating an insurance rating method which predicts a group�s future medical costs based on its past experience (i.e., the actual cost of providing healthcare coverage to the group during a given period of time based on the group�s claim history). Experience rating refers to this process of adjusting insurance prices to reflect individual versus group experience.

Source: pinterest.com

Source: pinterest.com

It is used to calculate the experience modification factor. Experience rating is most commonly associated with workers� compensation insurance. The system needs to be refined to avoid such a scenario, and experience rating falls under that category. It is also used, to a lesser extent, in other types of casualty insurance, such as general liability, commercial auto liability and professional liability. Experience ratings are commonly used by insurance companies to determine whether a client’s losses are average, above average or below average, and premiums are charged accordingly.

Source: slideserve.com

Source: slideserve.com

With experience rated standards, premiums are adjusted based on the health history of those covered. Premiums are typically lower for healthier groups and individuals. An experience rating is the amount of loss that an insured party experiences compared to the amount of loss that similar insured parties have. The group � s claim history). Experience rating, in the context of insurance, is a rating method that takes into account the amount of loss experienced by an insured party as compared to the amount of loss experienced by other insured parties with similar characteristics.

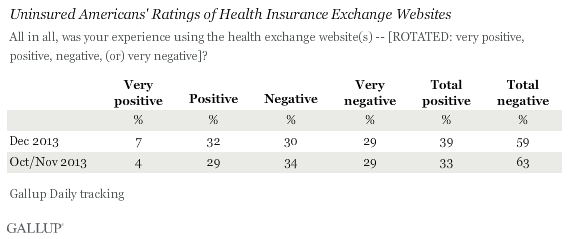

Source: gallup.com

Source: gallup.com

Click to see full answer. However, experience rating is designed to reflect individual differences. Experience rating is most commonly associated with workers� compensation insurance. Click to see full answer. With experience rated standards, premiums are adjusted based on the health history of those covered.

Source: revisi.net

Source: revisi.net

Experience ratings are commonly used by insurance companies to determine whether a client’s losses are average, above average or below average, and premiums are charged accordingly. In pennsylvania, employer groups with fewer than 50 eligible employees are community rated. Experience rating, in the context of insurance, is a rating method that takes into account the amount of loss experienced by an insured party as compared to the amount of loss experienced by other insured parties with similar characteristics. The system needs to be refined to avoid such a scenario, and experience rating falls under that category. What does experience rating mean?

Source: verywellhealth.com

Source: verywellhealth.com

This gives you an objective way to quickly compare plans, based on quality, as you shop. It is used to calculate the experience modification factor. Experience rating is commonly used in workers compensation insurance. Experience ratings are commonly used by insurance companies to determine whether a client’s losses are average, above average or below average, and premiums are charged accordingly. It is also used, to a lesser extent, in other types of casualty insurance, such as general liability, commercial auto liability and professional liability.

Source: slideshare.net

Source: slideshare.net

However, experience rating is designed to reflect individual differences. With experience rating, people pay different premiums based on differences in their demographics, past health care utilization, medical status, and other factors. However, experience rating is designed to reflect individual differences. Underwriting is the way in which insurance companies project what the expected covered health costs will be for a particular person of group. Normally, experience rating concepts used by insurance companies contemplate relatively large groups if experience rating is to be applied to one group standing alone.

Source: slideshare.net

Source: slideshare.net

It is also used, to a lesser extent, in other types of casualty insurance, such as general liability, commercial auto liability and professional liability. Premium after experience rating to the premium before experience rating. Experience rating refers to this process of adjusting insurance prices to reflect individual versus group experience. Normally, experience rating concepts used by insurance companies contemplate relatively large groups if experience rating is to be applied to one group standing alone. Experience rating tailors policies to the specific group or individual.

Source: marketingcharts.com

Source: marketingcharts.com

This gives you an objective way to quickly compare plans, based on quality, as you shop. It is important to note that the “experience” in question is not the individual’s satisfaction with the coverage, or even the length of time they have been enrolled on the policy, but is rather the policyholder’s claims history. Normally, experience rating concepts used by insurance companies contemplate relatively large groups if experience rating is to be applied to one group standing alone. Its development is described in detail by. A health insurance policy which is experience rated will calculate the plan’s premium based on the “experience,” or history an individual has under the policy.

Source: escolagersonalvesgui.blogspot.com

Source: escolagersonalvesgui.blogspot.com

Experience rating can still be used by large group plans. Experience rated policies do offer lower premiums for healthier individuals, but this also means higher costs for those who are less healthy. They also believe experience rating is philosophically correct, given a desire to keep health insurance and the practice of medicine essentially on a private basis. An experience rating system is used to estimate how much a specific individual or group will have to spend on medical care. Click to see full answer.

Source: slideshare.net

Source: slideshare.net

Premium after experience rating to the premium before experience rating. Experience rating, in the context of insurance, is a rating method that takes into account the amount of loss experienced by an insured party as compared to the amount of loss experienced by other insured parties with similar characteristics. A plan�s overall rating is based on 3 categories, each with its own star rating:. Experience ratings are commonly used by insurance companies to determine whether a client’s losses are average, above average or below average, and premiums are charged accordingly. It is important to note that the “experience” in question is not the individual’s satisfaction with the coverage, or even the length of time they have been enrolled on the policy, but is rather the policyholder’s claims history.

Source: marketingcharts.com

Source: marketingcharts.com

Experience rated policies do offer lower premiums for healthier individuals, but this also means higher costs for those who are less healthy. This rating is based on how much the person has already spent, what conditions are already present and what risks a person has. The group � s claim history). Its development is described in detail by. Each rated health plan has an “overall” quality rating of 1 to 5 stars (5 is highest), which accounts for member experience, medical care, and health plan administration.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title experience rating health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.