Your Expense ratio insurance images are available. Expense ratio insurance are a topic that is being searched for and liked by netizens now. You can Get the Expense ratio insurance files here. Download all royalty-free photos and vectors.

If you’re searching for expense ratio insurance pictures information connected with to the expense ratio insurance keyword, you have come to the right site. Our website frequently gives you suggestions for seeing the maximum quality video and image content, please kindly surf and find more enlightening video articles and graphics that match your interests.

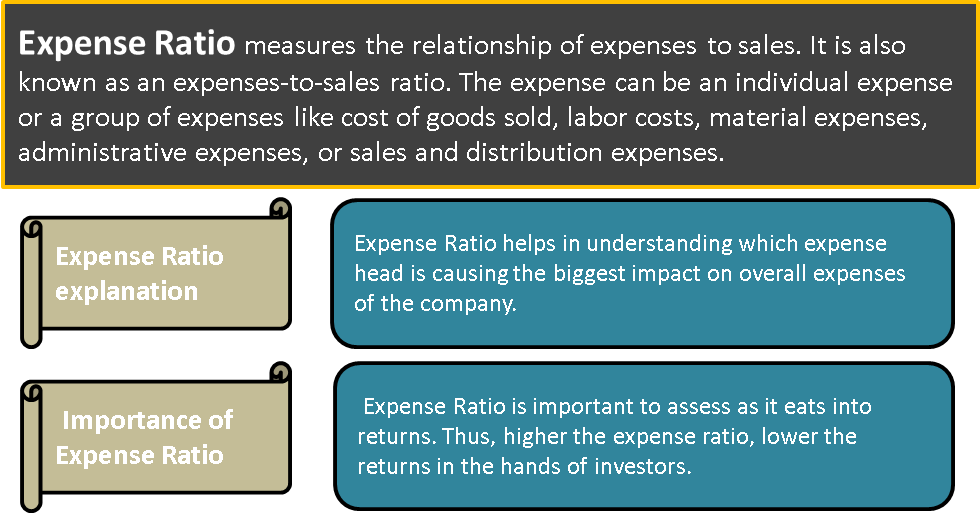

Expense Ratio Insurance. Each insurance company formulates its own target loss ratio, which depends on the expense ratio. This will include commissions, operational and administrative (27). The expense ratio of an insurance company is management expenses divided by the gross premium. For example, a company with a very low expense ratio can afford a higher target loss ratio.

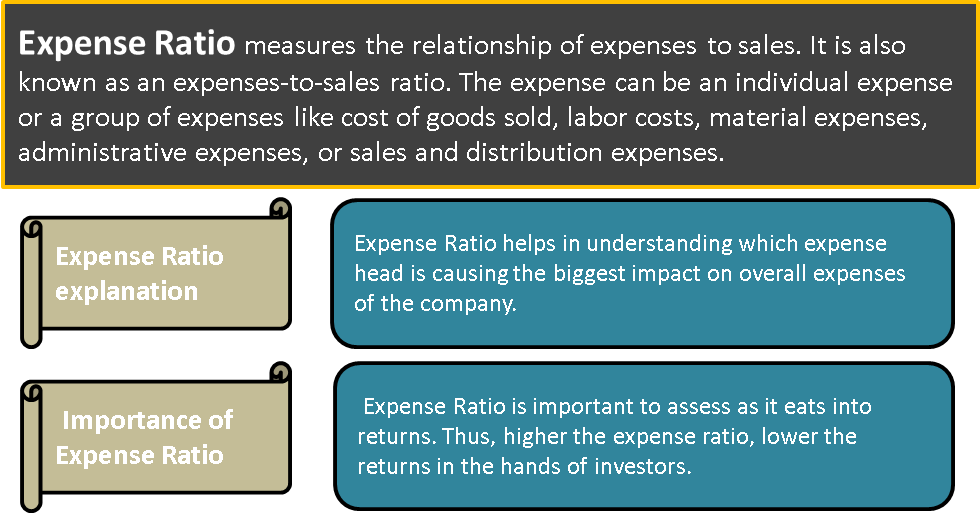

Operating Ratios or Expense to Sales Ratios Formula From efinancemanagement.com

Operating Ratios or Expense to Sales Ratios Formula From efinancemanagement.com

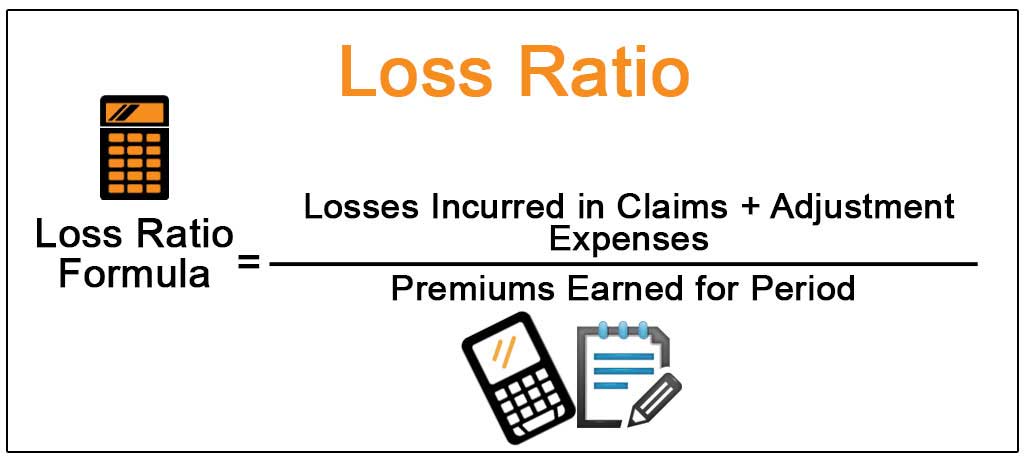

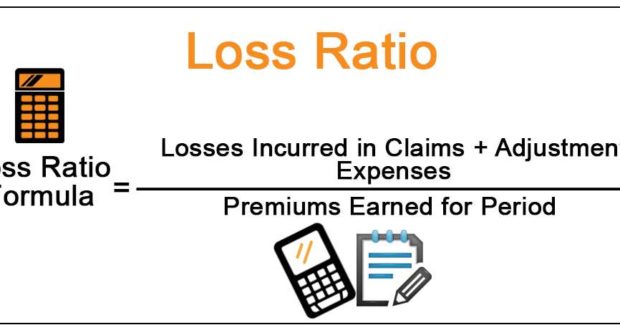

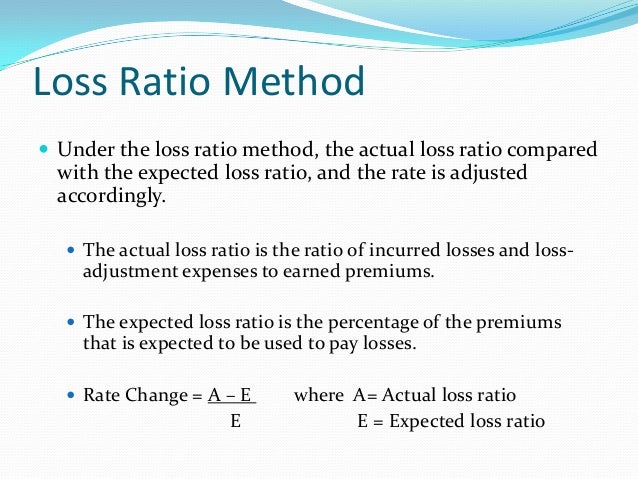

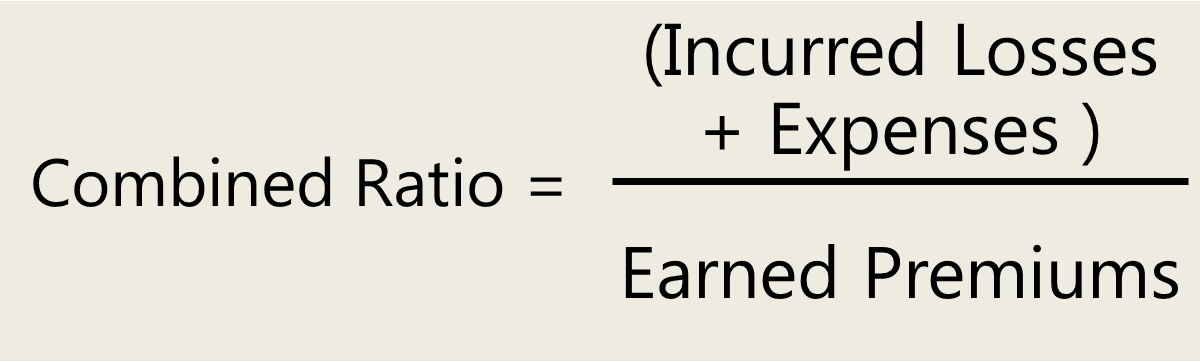

There are two ways to calculate expense ratios. We get the expense ratio after dividing the insurer’s expenses (marketing, commission, operational expenses, etc.) by the total premiums collected in a given year. For example, an insurance company realizes $5 million in the underwriting losses from its total insurance policies sold. In the same time period, the 100 largest us personal line insurers grew their net written premiums at 6.1% cagr, with average expense ratios at 24.9.% and average combined ratios at 100.7%. The underwriting expense ratio is a mathematical calculation used to gauge an insurance company�s underwriting success. The expense ratio of an insurance company is management expenses divided by the gross premium.

It is computed by dividing a particular expense or group of expenses by net sales.

The combined ratio measures the losses made and expenses in relation to the total premium collected by the business. Therefore, the expense ratio of the mutual fund was 1.05% for the year 2019. The expenses can include advertising, employee wages, and commissions for the sales force. The expense ratio serves as the ideal measure providing clarity on the logistics. The expense ratio of an insurance company is management expenses divided by the gross premium. Expense ratio — the percentage of premium used to pay all the costs of acquiring, writing, and servicing insurance and reinsurance.

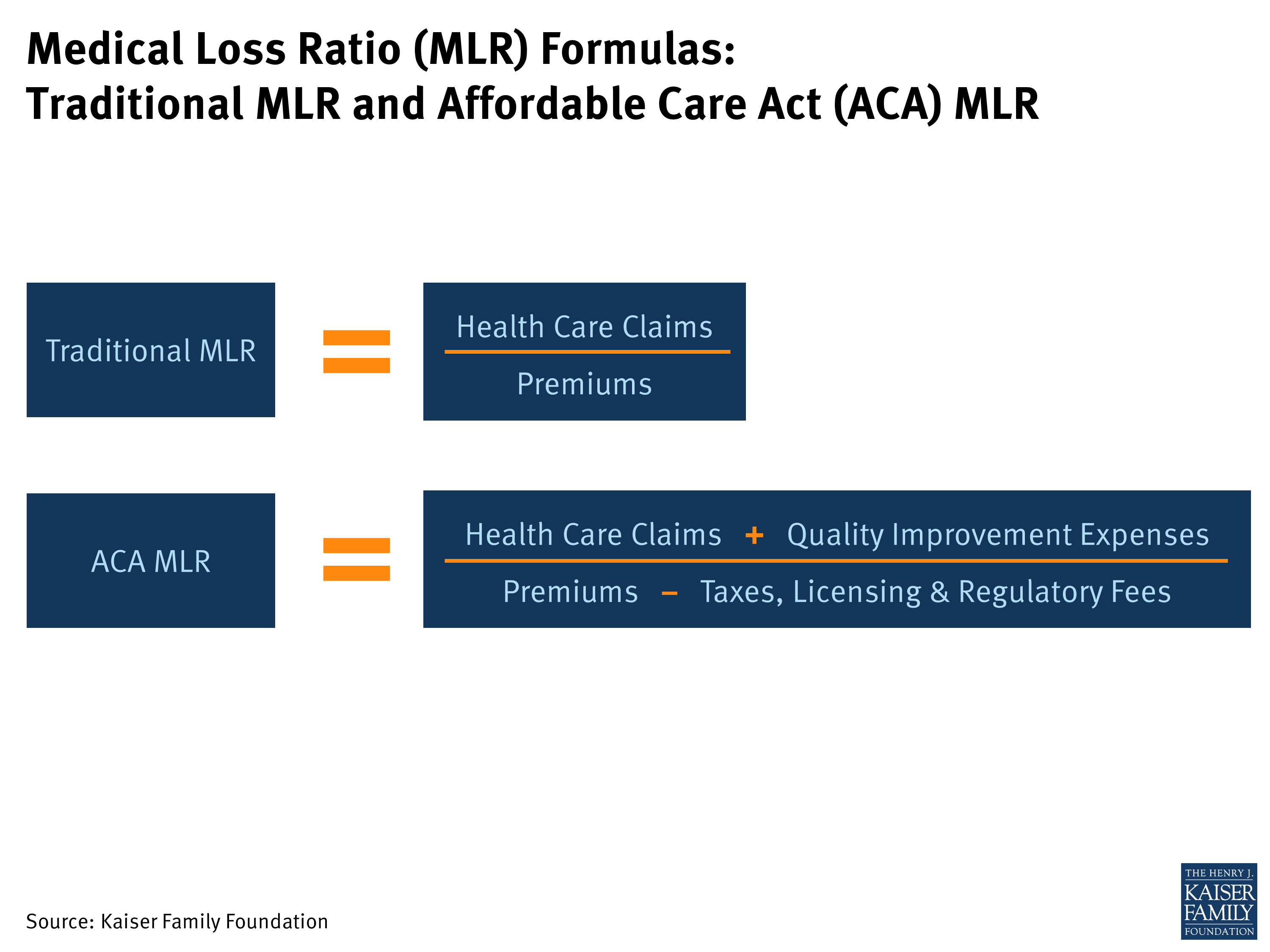

Source: kff.org

Source: kff.org

For example, a company with a very low expense ratio can afford a higher target loss ratio. Expense ratio is expressed in percentage. Expense ratio shows what percentage of sales is an individual expense or a group of expenses. Each insurance company formulates its own target loss ratio, which depends on the expense ratio. Expense ratio in insurance topic.

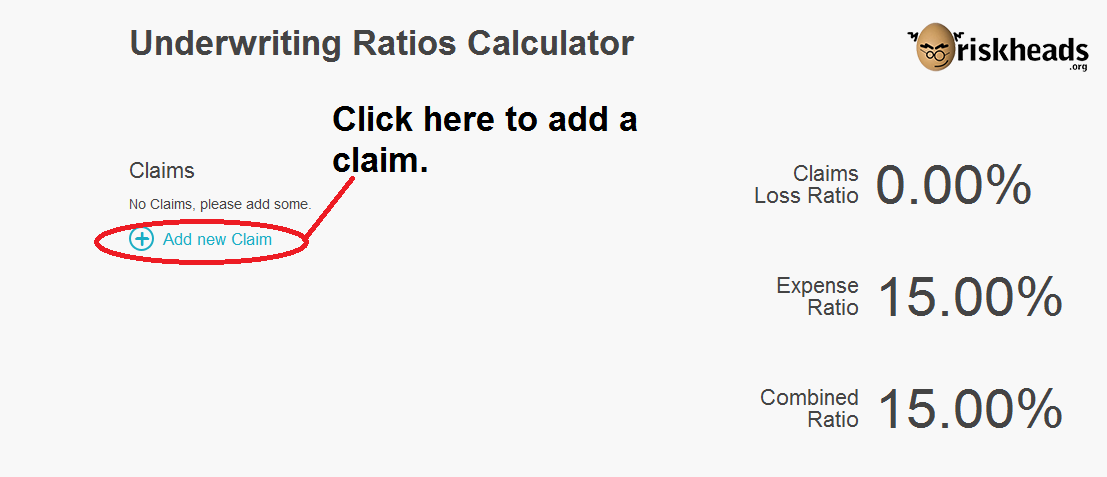

Source: riskheads.org

Source: riskheads.org

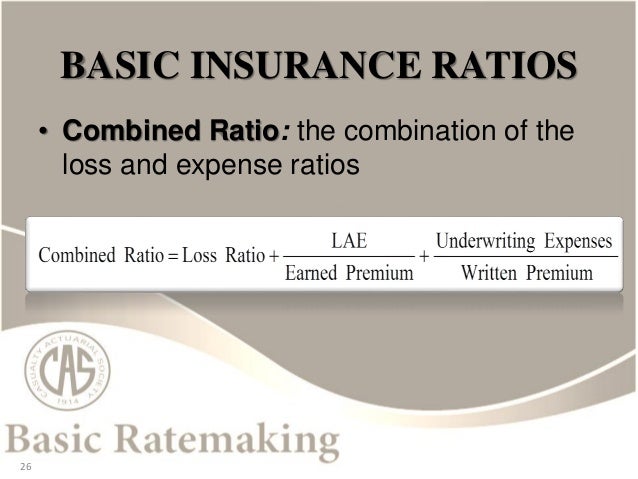

It is used to measure the profitability of an insurance company, specifically property and casualty based insurance companies. Expense ratio in insurance topic. A trade basis, which is expense divided by written premium and on a statutory basis when the expense is divided by earned premium. The expense ratio is combined with the loss ratio to give an insurance company�s combined ratio. Expense ratio — the percentage of premium used to pay all the costs of acquiring, writing, and servicing insurance and reinsurance.

It tells you how efficient an insurance company’s operations are at bringing in premium. The claim settlement ratio (or claims acceptance ratio or claims ratio) of the insurance company = 973/1000 = 97.3%. The combined ratio is the total of estimated claims expenses for a period plus overhead expressed as a percentage of earned premiums. It is the most effective and most straightforward way to measure how profitable the company is A trade basis, which is expense divided by written premium and on a statutory basis when the expense is divided by earned premium.

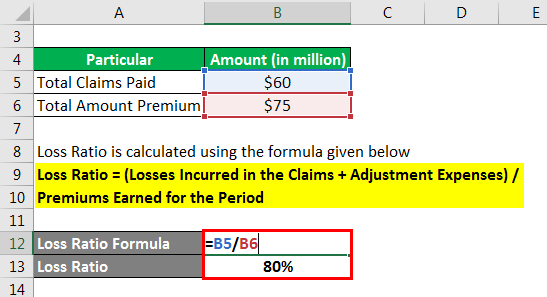

Source: naiaesportes.blogspot.com

Source: naiaesportes.blogspot.com

The formula involves dividing underwriting expenses by total premiums earned to arrive at the percentage of premiums spent on. Signifying the efficiency of an insurance company and measuring its profitability, the expense ratio gives a clearer picture of the financial aspects of the company. This will include commissions, operational and administrative (27). A trade basis, which is expense divided by written premium and on a statutory basis when the expense is divided by earned premium. The trade method, where insurance companies divide their expenses by.

Source: insuranceworld.gr

Source: insuranceworld.gr

The expense ratio can be used to compare a company’s performance over a period of time. The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring, underwriting, and servicing premiums by the net premiums earned by the insurance company. The combined ratio is the total of estimated claims expenses for a period plus overhead expressed as a percentage of earned premiums. For example, an insurance company realizes $5 million in the underwriting losses from its total insurance policies sold. The combined ratio measures the losses made and expenses in relation to the total premium collected by the business.

Source: insuranceflavor.com

Source: insuranceflavor.com

For example, an insurance company realizes $5 million in the underwriting losses from its total insurance policies sold. What does expense ratio mean? Expense ratio = management fees / total investment in the fund. The expense ratio of an insurance company is management expenses divided by the gross premium. The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring, underwriting, and servicing premiums by the net premiums.

Source: riskheads.org

Source: riskheads.org

The trade method, where insurance companies divide their expenses by. To explain this, if an insurance company received 1000 death claims between apr 1, 2019 and mar 31, 2020. The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring, underwriting, and servicing premiums by the net premiums earned by the insurance company. It is used to measure the profitability of an insurance company, specifically property and casualty based insurance companies. The expense ratio can be used to compare a company’s performance over a period of time.

Source: fool.com

Source: fool.com

The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring, underwriting, and servicing premiums by the net premiums. The expense ratio, which is the sum of expenses divided by premiums earned is a measure of profitability used to compare insurance markets. Feb 10, 2021 — statutory accounting practices define the combined ratio as the sum of the underwriting loss ratio and the expense ratio. The expense ratio serves as the ideal measure providing clarity on the logistics. This will include commissions, operational and administrative (37).

Source: insuranceworld.gr

Source: insuranceworld.gr

The expense ratio can be used to compare a company’s performance over a period of time. The expense ratio, which is the sum of expenses divided by premiums earned is a measure of profitability used to compare insurance markets. In the same time period, the 100 largest us personal line insurers grew their net written premiums at 6.1% cagr, with average expense ratios at 24.9.% and average combined ratios at 100.7%. Expense ratio % is the percentage of expenses associated with acquiring, underwriting, and servicing premiums to net premium earned. There are two ways to calculate expense ratios.

Source: hilmaninsurance.blogspot.com

Source: hilmaninsurance.blogspot.com

The trade method, where insurance companies divide their expenses by. A trade basis, which is expense divided by written premium and on a statutory basis when the expense is divided by earned premium. The claim settlement ratio (or claims acceptance ratio or claims ratio) of the insurance company = 973/1000 = 97.3%. It tells you how efficient an insurance company’s operations are at bringing in premium. It can be displayed as a.

Source: efinancemanagement.com

Source: efinancemanagement.com

Feb 10, 2021 — statutory accounting practices define the combined ratio as the sum of the underwriting loss ratio and the expense ratio. The formula involves dividing underwriting expenses by total premiums earned to arrive at the percentage of premiums spent on. The combined ratio is the total of estimated claims expenses for a period plus overhead expressed as a percentage of earned premiums. Expense ratio is expressed in percentage. The claim settlement ratio (or claims acceptance ratio or claims ratio) of the insurance company = 973/1000 = 97.3%.

Source: slideshare.net

Source: slideshare.net

The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring, underwriting, and servicing premiums by the net premiums. The underwriting expense ratio is a mathematical calculation used to gauge an insurance company�s underwriting success. The expense ratio of an insurance company is management expenses divided by the gross premium. There are two methodologies to measure the expense ratio; Feb 10, 2021 — statutory accounting practices define the combined ratio as the sum of the underwriting loss ratio and the expense ratio.

Source: slideshare.net

Source: slideshare.net

For example, a company with a very low expense ratio can afford a higher target loss ratio. The expenses can include advertising, employee wages, and commissions for the sales force. In the same time period, the 100 largest us personal line insurers grew their net written premiums at 6.1% cagr, with average expense ratios at 24.9.% and average combined ratios at 100.7%. For example, a company with a very low expense ratio can afford a higher target loss ratio. Expense ratio in insurance topic.

Source: fool.com

Source: fool.com

What does expense ratio mean? The formula involves dividing underwriting expenses by total premiums earned to arrive at the percentage of premiums spent on. Expense ratio is the ratio of underwriting expenses to earned premiums (expense ratio = expenses/premiums). The combined ratio is the total of estimated claims expenses for a period plus overhead expressed as a percentage of earned premiums. Expense ratio = management fees / total investment in the fund.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Expense ratio = management fees / total investment in the fund. The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring, underwriting, and servicing premiums by the net premiums. Each insurance company formulates its own target loss ratio, which depends on the expense ratio. Signifying the efficiency of an insurance company and measuring its profitability, the expense ratio gives a clearer picture of the financial aspects of the company. The expense ratio can be used to compare a company’s performance over a period of time.

Source: sec.gov

Source: sec.gov

The expense ratio serves as the ideal measure providing clarity on the logistics. There are two methodologies to measure the expense ratio; The lower the figure the better. The expense ratio of an insurance company is management expenses divided by the gross premium. Expense ratios at 30.2% and average combined ratios at 97.5%.

Source: fool.com

Source: fool.com

The expense ratio is combined with the loss ratio to give an insurance company�s combined ratio. It is computed by dividing a particular expense or group of expenses by net sales. What does expense ratio mean? Insurance companies typically follow two methods for measuring their expense ratios: Expense ratio is the ratio of underwriting expenses to earned premiums (expense ratio = expenses/premiums).

Source: slideshare.net

Source: slideshare.net

Expense ratio refers to the percentage of premium that insurance companies use for paying all the costs of acquiring, writing and servicing insurance, and reinsurance. In the same time period, the 100 largest us personal line insurers grew their net written premiums at 6.1% cagr, with average expense ratios at 24.9.% and average combined ratios at 100.7%. The expense ratio can be used to compare a company’s performance over a period of time. This will include commissions, operational and administrative (27). The expense ratio in the insurance industry is a measure of profitability calculated by dividing the expenses associated with acquiring, underwriting, and servicing premiums by the net premiums.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title expense ratio insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.