Your Expense ratio for insurance companies images are available. Expense ratio for insurance companies are a topic that is being searched for and liked by netizens now. You can Download the Expense ratio for insurance companies files here. Find and Download all royalty-free vectors.

If you’re looking for expense ratio for insurance companies images information linked to the expense ratio for insurance companies topic, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

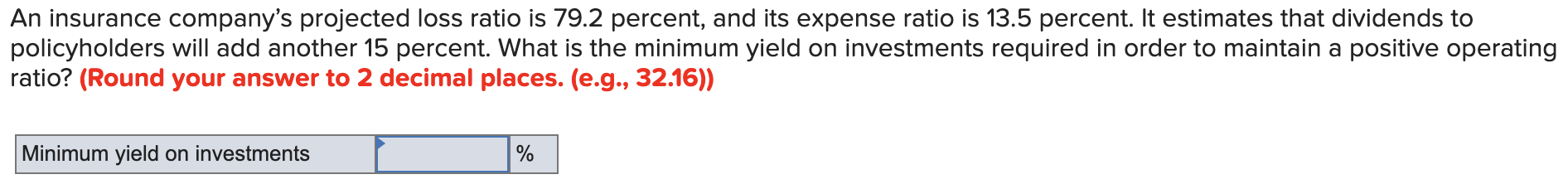

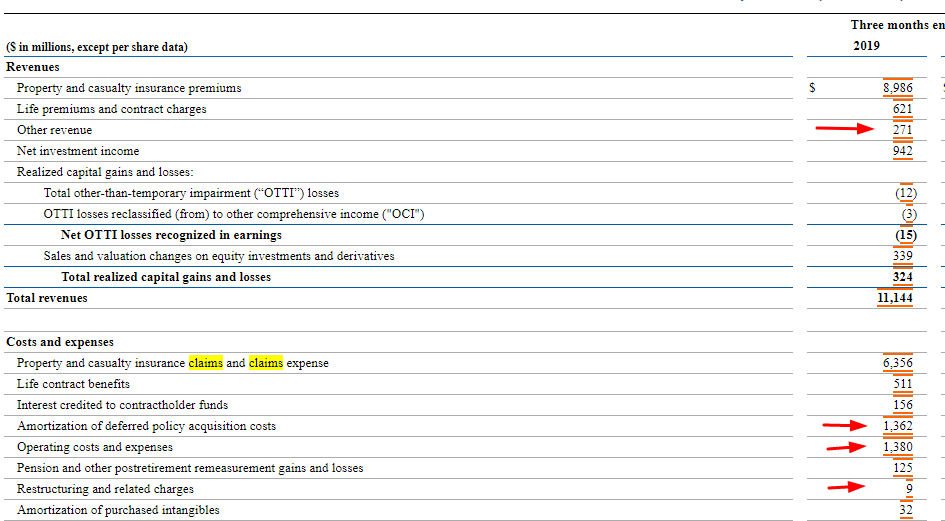

Expense Ratio For Insurance Companies. It is used to measure the profitability of an insurance company, specifically property and casualty based insurance companies. Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the an expense ratio under 100% signifies that the insurance company is either earning or writing more premiums than it is paying out in expenses to. The loss ratio is combined with the expense ratio (the combination thereof is called the combined ratio) to provide an indication of a company’s profitability. Get the best quote and save 30% today!

The Game of Expense Ratio Insurance Flavor From insuranceflavor.com

The Game of Expense Ratio Insurance Flavor From insuranceflavor.com

Expense ratio reflects the efficiency of insurance operations. It is the most effective and most straightforward way to measure how profitable the company is There are two methodologies to measure the expense ratio; The lower the expense ratio the better because it means more profits to the insurance company. The strategies and tactics identi€ed here are not intended to achieve some arbitrary percentage reduction in Faq what is the use of expense ratio?

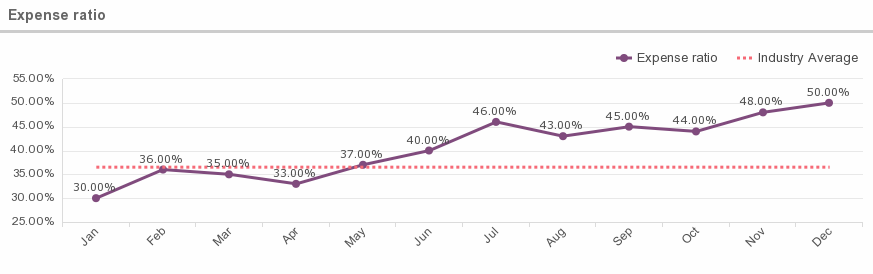

The expense ratio can be used to compare a company’s performance over a period of time.

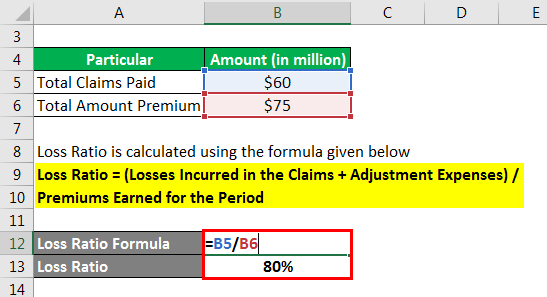

2 loss ratio looks at the ratio of losses to premiums earned. The underwriting expense ratio is a mathematical calculation used to gauge an insurance company�s underwriting success. A ratio below 100% will mean that an insurance company is earning more revenue from writing premiums than it is shelling out in the form of expenses and vice versa. Expense ratio is the ratio of underwriting expenses to earned premiums (expense ratio = expenses/premiums). It can be displayed as a. Insurance companies typically follow two methods for measuring their expense ratios:

Source: naiaesportes.blogspot.com

Source: naiaesportes.blogspot.com

It is calculated by taking insurance claims paid plus adjustment expenses divided by total earned premiums. It tells you how efficient an insurance company’s operations are at bringing in premium. A trade basis, which is expense divided by written premium and on a statutory basis when the expense is divided by earned premium. The strategies and tactics identi€ed here are not intended to achieve some arbitrary percentage reduction in It is the most effective and most straightforward way to measure how profitable the company is

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

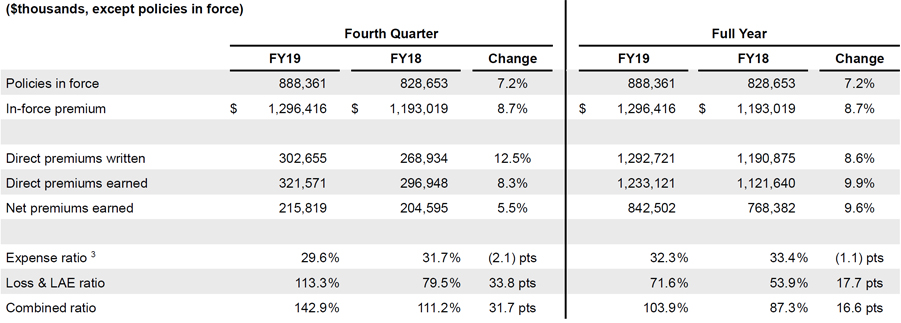

A trade basis, which is expense divided by written premium and on a statutory basis when the expense is divided by earned premium. Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the underwriting expense as well as operating expenses structure of the insurer The costs reflected are all operating expenses of the life insurance line of business except commissions and taxes. The loss ratio is combined with the expense ratio (the combination thereof is called the combined ratio) to provide an indication of a company’s profitability. It is used to measure the profitability of an insurance company, specifically property and casualty based insurance companies.

Source: universalinsuranceholdings.com

Source: universalinsuranceholdings.com

The expense ratio can be used to compare a company’s performance over a period of time. It can be displayed as a. Expense ratio is the ratio of underwriting expenses to earned premiums (expense ratio = expenses/premiums). A ratio below 100% will mean that an insurance company is earning more revenue from writing premiums than it is shelling out in the form of expenses and vice versa. Download a report with benchmark data, a definition, and details for tracking this metric.

Source: sec.gov

Source: sec.gov

Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the underwriting expense as well as operating expenses structure of the insurer Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the an expense ratio under 100% signifies that the insurance company is either earning or writing more premiums than it is paying out in expenses to. Underwriting expenses 10.8% 167,982 151,652 148,692 145,753 139,846 136,586 130,809 124,768 122,662 120,673 underwrting gain (loss) nm 2,967 (22,456) (1,700) 11,453 14,658 20,127 (13,762) (35,451) (8,828) 947 The combined ratio measures the losses made and expenses in relation to the total premium collected by the business. Underestimation of the risk profiles of clients tends to lead to a higher loss ratio.

1 expense ratio is the measure of an insurer�s pro€tability. The costs reflected are all operating expenses of the life insurance line of business except commissions and taxes. The expense ratio can be used to compare a company’s performance over a period of time. Get the best quote and save 30% today! Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the an expense ratio under 100% signifies that the insurance company is either earning or writing more premiums than it is paying out in expenses to.

Source: begintoinvest.com

Source: begintoinvest.com

2 loss ratio looks at the ratio of losses to premiums earned. Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the an expense ratio under 100% signifies that the insurance company is either earning or writing more premiums than it is paying out in expenses to. The formula involves dividing underwriting expenses by total premiums earned to arrive at the percentage of premiums spent on underwriting expenses. The loss ratio is combined with the expense ratio (the combination thereof is called the combined ratio) to provide an indication of a company’s profitability. The combined ratio measures the losses made and expenses in relation to the total premium collected by the business.

Source: insuranceflavor.com

Source: insuranceflavor.com

It can be displayed as a. A ratio below 100% will mean that an insurance company is earning more revenue from writing premiums than it is shelling out in the form of expenses and vice versa. Expense ratio is the ratio of underwriting expenses to earned premiums (expense ratio = expenses/premiums). The expense ratio can be used to compare a company’s performance over a period of time. P&c insurance underwriting expense ratio measures total company operating expenses (not including claims losses or loss adjustment expense) relative to total p&c premium earned.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

Faq what is the use of expense ratio? 2 loss ratio looks at the ratio of losses to premiums earned. A ratio below 100% will mean that an insurance company is earning more revenue from writing premiums than it is shelling out in the form of expenses and vice versa. The combined ratio measures the losses made and expenses in relation to the total premium collected by the business. Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the an expense ratio under 100% signifies that the insurance company is either earning or writing more premiums than it is paying out in expenses to.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

P&c insurance underwriting expense ratio measures total company operating expenses (not including claims losses or loss adjustment expense) relative to total p&c premium earned. The strategies and tactics identi€ed here are not intended to achieve some arbitrary percentage reduction in Los 12 (f) describe key ratios and other factors to consider in analyzing an insurance company. The expense ratio, which is the sum of expenses divided by premiums earned is a measure of profitability used to compare insurance markets. The underwriting expense ratio gauges the efficiency of money spent on obtaining new premiums.

Source: einvestingforbeginners.com

Source: einvestingforbeginners.com

2 loss ratio looks at the ratio of losses to premiums earned. Underwriting expenses are the costs of obtaining new policies from insurance carriers. The formula involves dividing underwriting expenses by total premiums earned to arrive at the percentage of premiums spent on underwriting expenses. Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the underwriting expense as well as operating expenses structure of the insurer Expense ratio — the percentage of premium used to pay all the costs of acquiring, writing, and servicing insurance and reinsurance.

Source: guidingmetrics.com

Source: guidingmetrics.com

This ratio provides insight into the quality of the policies an insurance company writes and the rates it charges. Expense ratio — the percentage of premium used to pay all the costs of acquiring, writing, and servicing insurance and reinsurance. In the same time period, the 100 largest us personal line insurers grew their net written premiums at 6.1% cagr, with average expense ratios at 24.9.% and average combined ratios at 100.7%. It can be displayed as a. It tells you how efficient an insurance company’s operations are at bringing in premium.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

It can be displayed as a. Get the best quote and save 30% today! The formula involves dividing underwriting expenses by total premiums earned to arrive at the percentage of premiums spent on underwriting expenses. The expense ratio, which is the sum of expenses divided by premiums earned is a measure of profitability used to compare insurance markets. Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the underwriting expense as well as operating expenses structure of the insurer

Source: naiaesportes.blogspot.com

Source: naiaesportes.blogspot.com

The expense ratio can be used to compare a company’s performance over a period of time. Underestimation of the risk profiles of clients tends to lead to a higher loss ratio. Underwriting expenses are the costs of obtaining new policies from insurance carriers. It tells you how efficient an insurance company’s operations are at bringing in premium. The strategies and tactics identi€ed here are not intended to achieve some arbitrary percentage reduction in

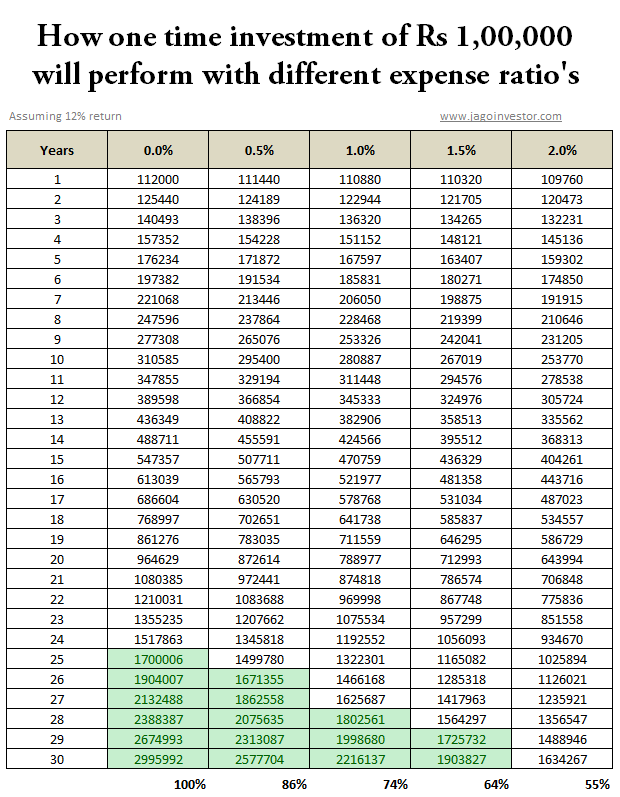

Source: jagoinvestor.com

Source: jagoinvestor.com

The costs reflected are all operating expenses of the life insurance line of business except commissions and taxes. The trade method, where insurance companies divide their expenses by the written premiums or, the statutory method, where insurance companies divide their expenses by the premiums they have earned Los 12 (f) describe key ratios and other factors to consider in analyzing an insurance company. The formula involves dividing underwriting expenses by total premiums earned to arrive at the percentage of premiums spent on underwriting expenses. The costs reflected are all operating expenses of the life insurance line of business except commissions and taxes.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Underwriting expenses 10.8% 167,982 151,652 148,692 145,753 139,846 136,586 130,809 124,768 122,662 120,673 underwrting gain (loss) nm 2,967 (22,456) (1,700) 11,453 14,658 20,127 (13,762) (35,451) (8,828) 947 Faq what is the use of expense ratio? The underwriting expense ratio is a mathematical calculation used to gauge an insurance company�s underwriting success. The expense ratio can be used to compare a company’s performance over a period of time. This ratio provides insight into the quality of the policies an insurance company writes and the rates it charges.

Source: sharesansar.com

The underwriting expense ratio gauges the efficiency of money spent on obtaining new premiums. Expense ratio = ( underwriting expenses / net premiums written ) The trade method, where insurance companies divide their expenses by the written premiums or, the statutory method, where insurance companies divide their expenses by the premiums they have earned The underwriting expense ratio is a mathematical calculation used to gauge an insurance company�s underwriting success. Expense ratio for an insurer would be analysed by class of business, along with the trend of the same combined ratio loss ratio + expense ratio combined ratio is a reflection of the underwriting expense as well as operating expenses structure of the insurer

Source: naiaesportes.blogspot.com

Source: naiaesportes.blogspot.com

Insurance companies typically follow two methods for measuring their expense ratios: 2 loss ratio looks at the ratio of losses to premiums earned. Get the best quote and save 30% today! The expense ratio of an insurance company is management expenses divided by the gross premium. The expense ratio can be used to compare a company’s performance over a period of time.

Source: inuranc.blogspot.com

Source: inuranc.blogspot.com

It is used to measure the profitability of an insurance company, specifically property and casualty based insurance companies. 2 loss ratio looks at the ratio of losses to premiums earned. Underestimation of the risk profiles of clients tends to lead to a higher loss ratio. Expense ratios at 30.2% and average combined ratios at 97.5%. 1 expense ratio is the measure of an insurer�s pro€tability.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title expense ratio for insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.