Your Excess of loss insurance definition images are available. Excess of loss insurance definition are a topic that is being searched for and liked by netizens now. You can Find and Download the Excess of loss insurance definition files here. Find and Download all royalty-free vectors.

If you’re searching for excess of loss insurance definition pictures information connected with to the excess of loss insurance definition keyword, you have pay a visit to the right site. Our site frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

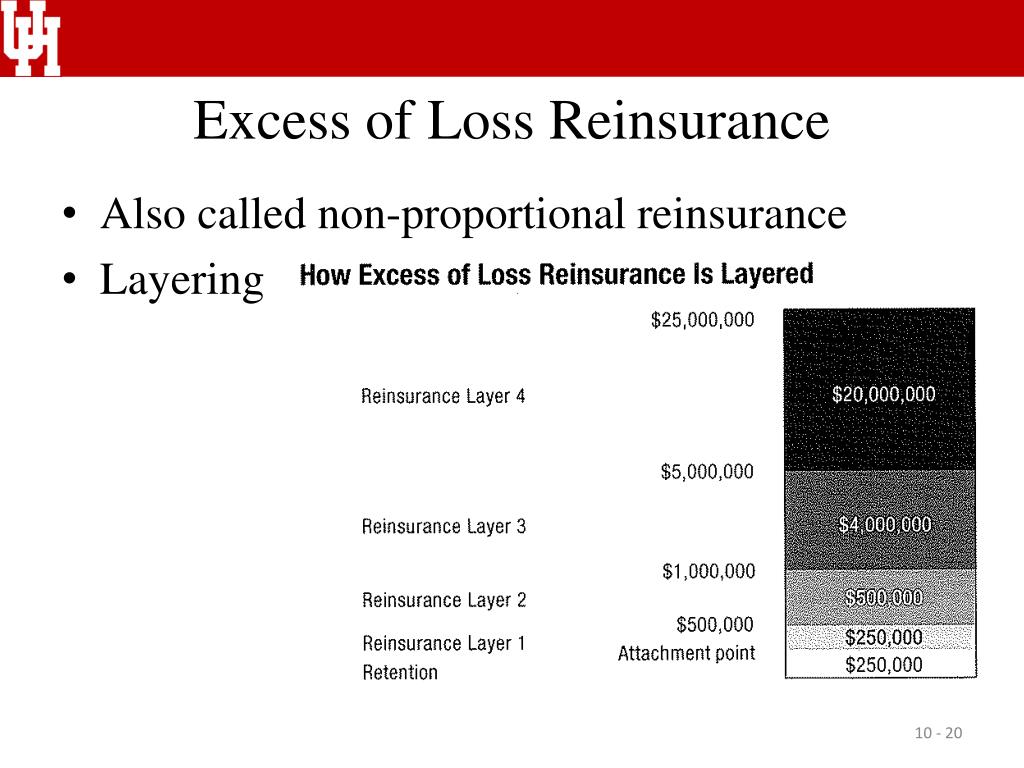

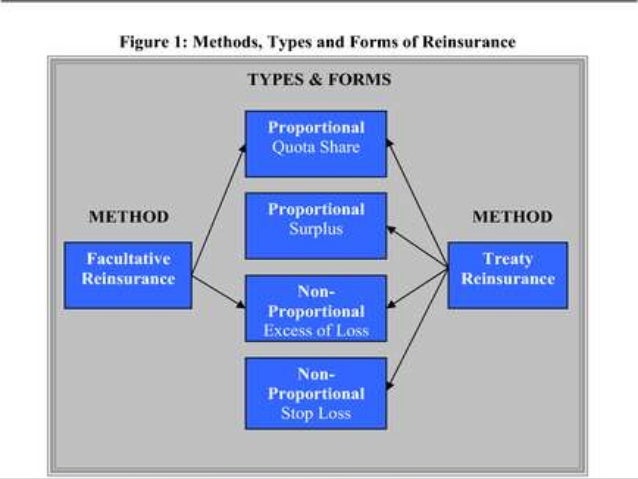

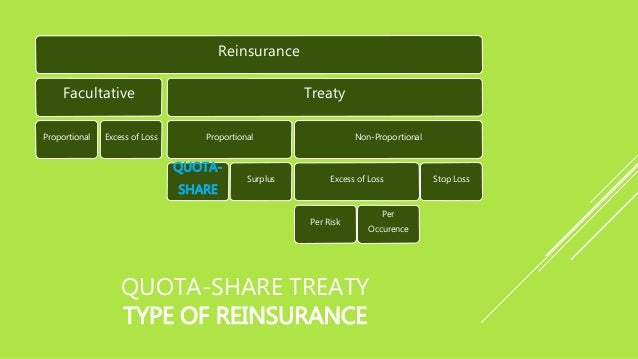

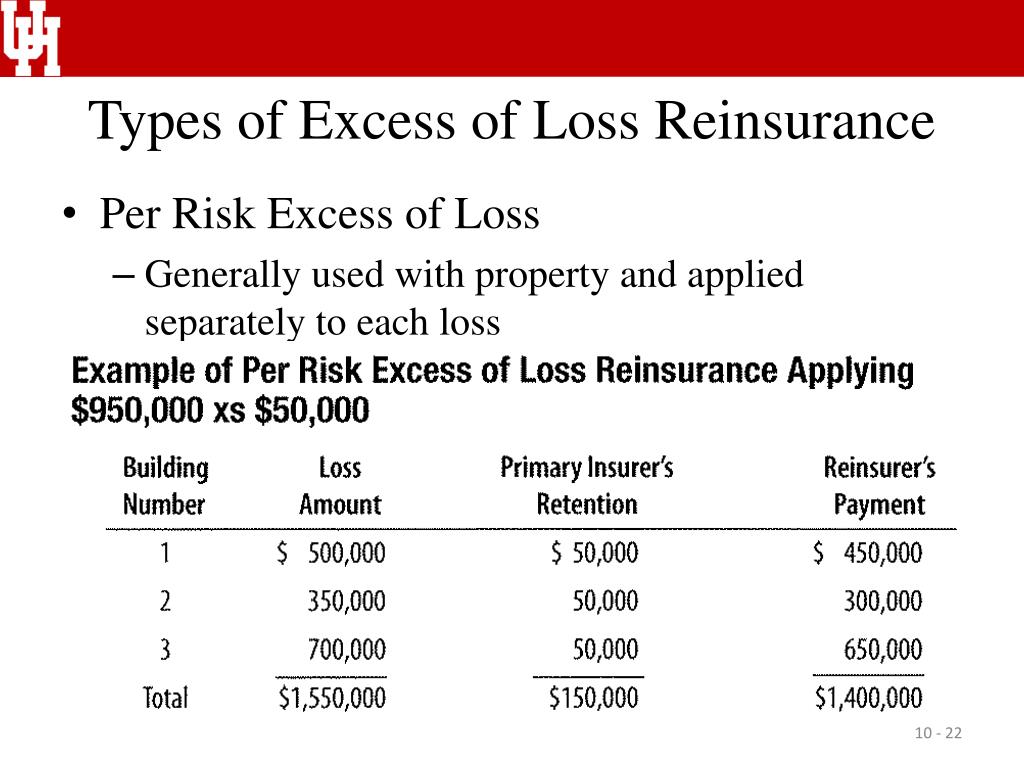

Excess Of Loss Insurance Definition. Excess of loss definition excess of loss — the reinsurance limit attaches above a per occurrence or aggregate limit. The coverage is excess of loss in structure and protects the provider group from significant financial impacts caused by individual catastrophic cases. In summary these are 2 types of reinsurance and each can have an upper limit c. It’s a way of you accepting a small portion of the risk yourself.

What Is Reinsurance With Example From bulleintime.com

What Is Reinsurance With Example From bulleintime.com

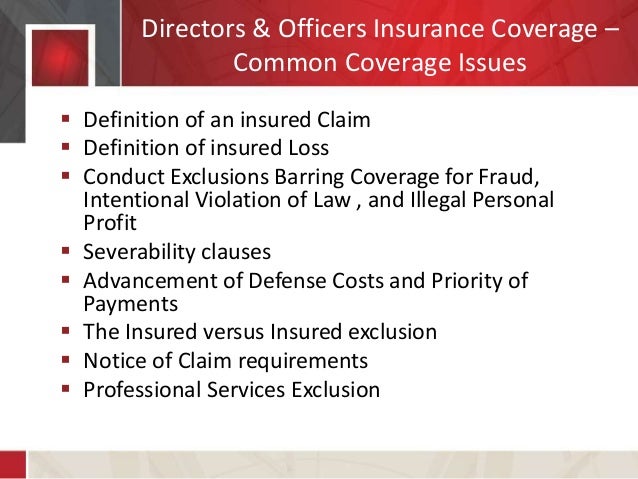

This article will attempt to educate a purchaser of provider excess insurance of the basic contractual structures and issues that should be considered when negotiating a contract. Citynet has the expertise to work with you across a broad range of industries. Excess of loss reinsurance excess of loss reinsurance excess of loss reinsurance is a specific type of reinsurance where the ceding company is compensated for losses that exceed a specified; This is called excess of loss insurance. Excess insurance is insurance coverage that kicks in when a particular loss reaches a certain amount. Excess of loss is a top up liability cover designed for a wide range of small, medium and large businesses across a broad spectrum of trades and industries.

Excess of loss definition excess of loss — the reinsurance limit attaches above a per occurrence or aggregate limit.

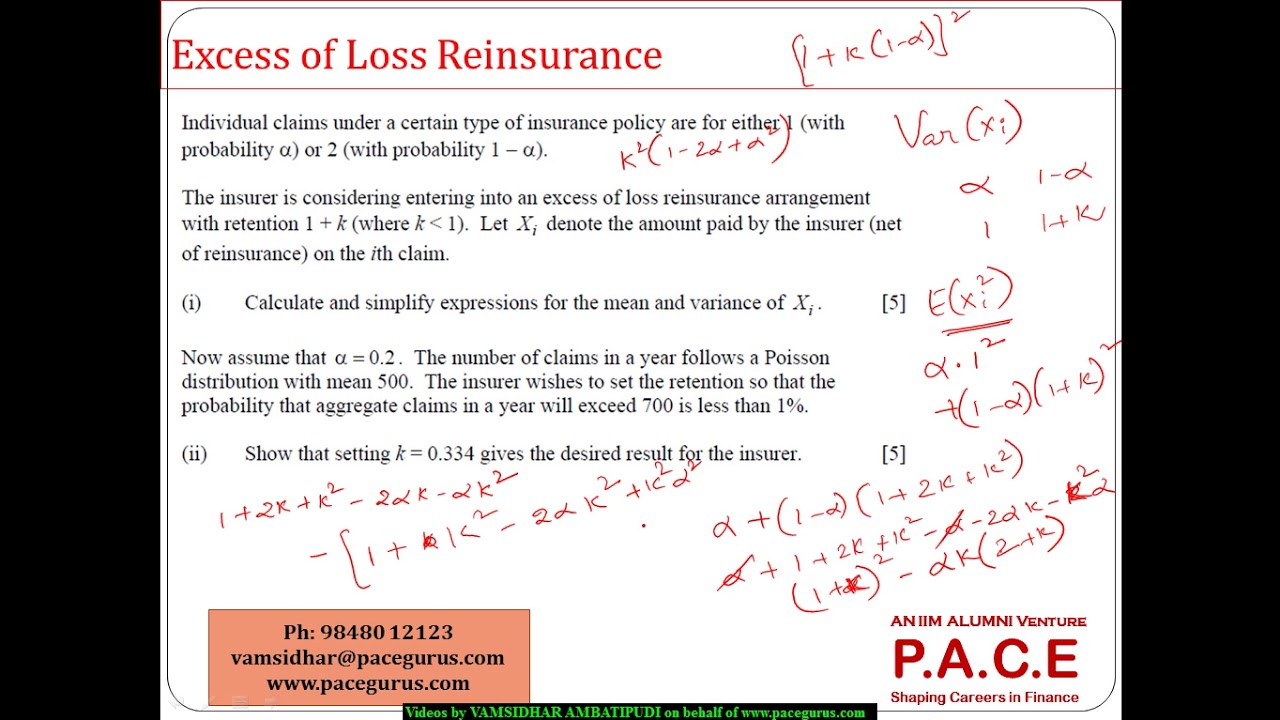

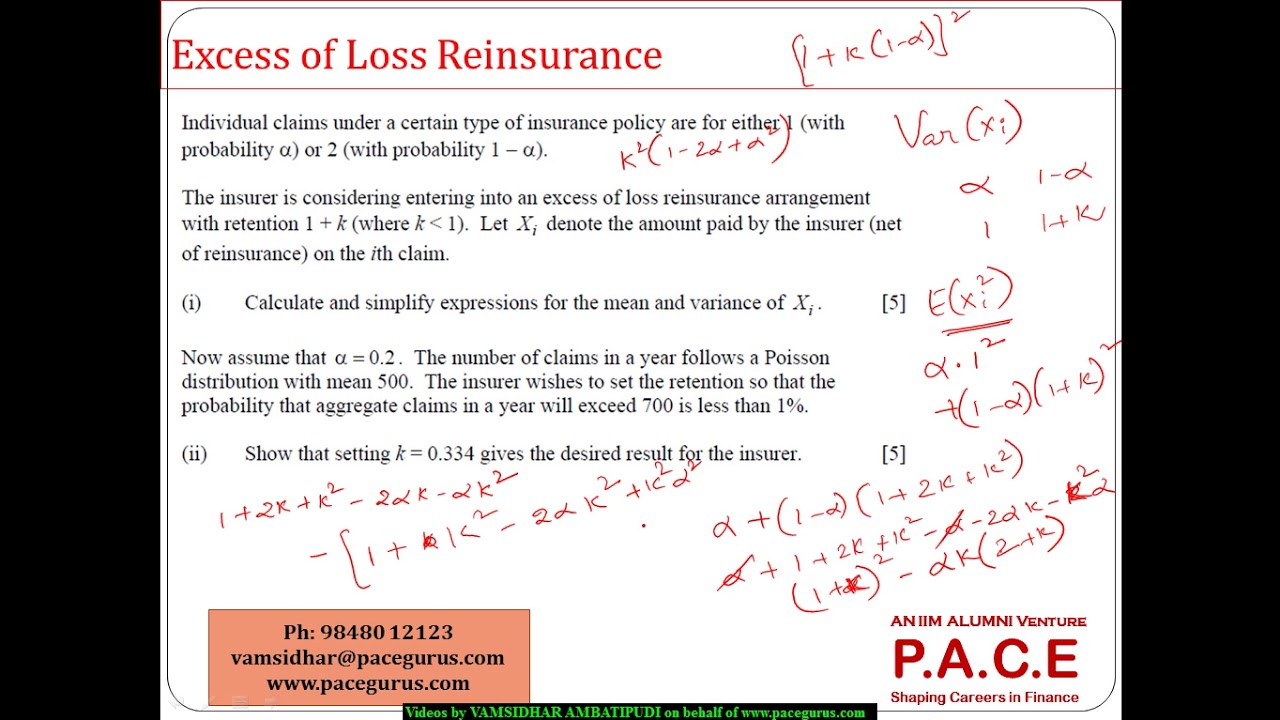

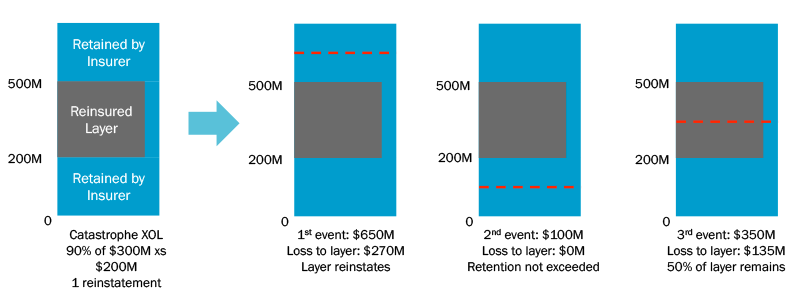

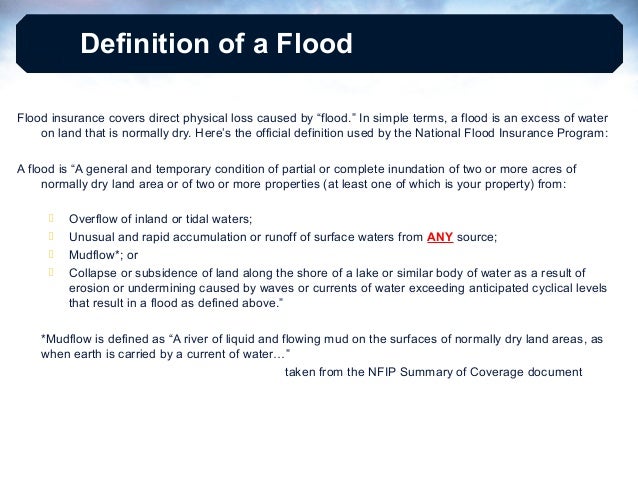

In this case the formula is ∑ ( x i − d) + with d=10. This could be across all risks involved in one event, across all policies for a given year, across all losses in a. Therefore, policyholders with a primary insurance policy often purchase excess insurance as an additional layer of protection. A form of excess of loss reinsurance, subject to a specific limit, which indemnifies the ceding company in excess of a specified retention for accumulation of losses from catastrophic occurrence. It may be calculated in a number of ways. Catastrophe excess of loss is a form of excess of loss reinsurance where the reinsurer agrees to reimburse the amount of a very large loss in excess of a particular sum.

Source: sec.gov

Source: sec.gov

The higher the excess amount, the lower the premium payable by the insured. Means an insurance policy obtained by the plan or the plan sponsor to provide coverage for individual claims at a specified stop loss limit and/or group claims at an aggregate stop loss limit that are incurred and paid during a defined period of time by the insurance policy. Excess of loss reinsurance is a type of reinsurance in which the reinsurance company is responsible for covering any losses that exceed a certain amount incurred by the ceding insurance company. Cede to transfer to a reinsurer all or part of the insurance risk written by a A reinsurer is a company that.

Source: bulleintime.com

Source: bulleintime.com

Many policies include an excess. At that point, insurer will cover losses in excess of that sum up to the policy limit. An excess can be imposed by the insurer or voluntarily chosen by the insured. Means an insurance policy obtained by the plan or the plan sponsor to provide coverage for individual claims at a specified stop loss limit and/or group claims at an aggregate stop loss limit that are incurred and paid during a defined period of time by the insurance policy. Deal with an excess of loss, the phrase is supposed to refer to the practice of providing indemnity over and above, i.e.

Source: contracts.justia.com

Source: contracts.justia.com

The mean excess loss function is defined only when the integral or the sum converges. Excess insurance is insurance coverage that kicks in when a particular loss reaches a certain amount. Cede to transfer to a reinsurer all or part of the insurance risk written by a The institute defines an aggregate excess of loss contract to be an excess of loss contract which aggregates losses across multiple risks in some way. Links for irmi online subscribers only:

Source: springgroup.com

Source: springgroup.com

Excess of loss is a top up liability cover designed for a wide range of small, medium and large businesses across a broad spectrum of trades and industries. Excess insurance is insurance coverage that kicks in when a particular loss reaches a certain amount. Many policies include an excess. Again an upper limit to the reinsurance equal to c can be introduced, slightly modifying the formula. An excess is therefore the amount that you contribute towards a claim.

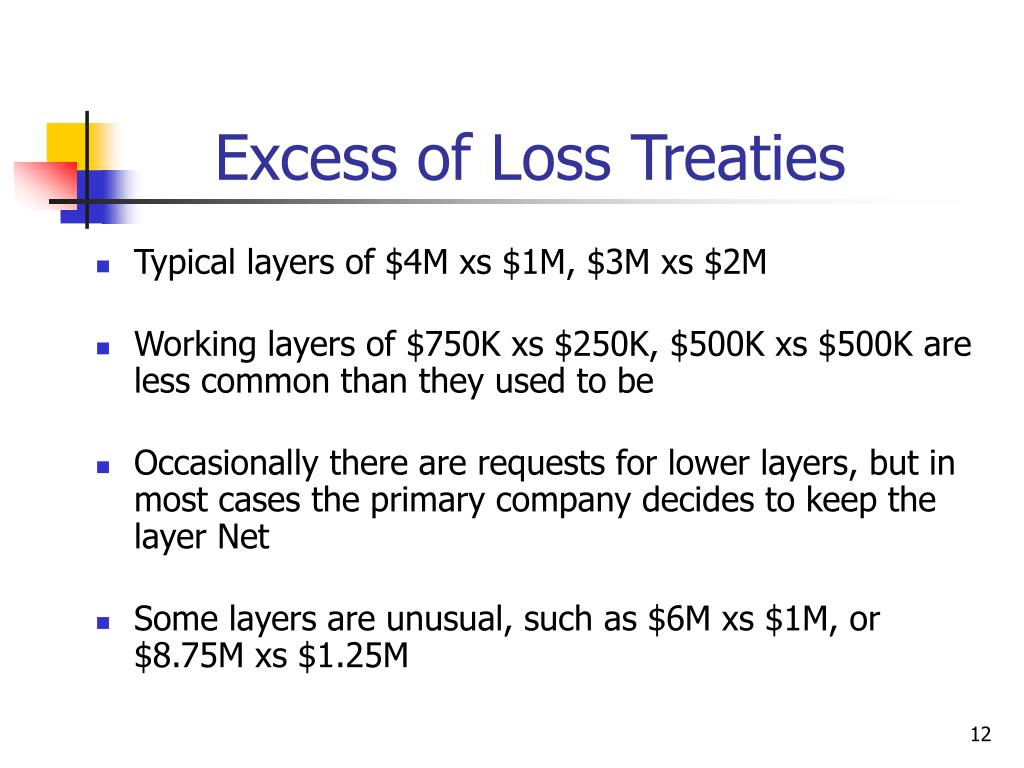

Source: slideserve.com

Source: slideserve.com

In both and , we assume that the support of is the set of nonnegative integers. Underlying premium the ceding company’s premiums (written or earned) to which the reinsurance premium rate is applied to produce the reinsurance premium. A reinsurer is a company that. The excess loss limit, called the loss fund, is set by the insurance company. Many policies include an excess.

Source: slideserve.com

Source: slideserve.com

The following is an equivalent calculation of that may be easier to use in some circumstances. Deal with an excess of loss, the phrase is supposed to refer to the practice of providing indemnity over and above, i.e. This could be across all risks involved in one event, across all policies for a given year, across all losses in a. Excess of loss reinsurance excess of loss reinsurance excess of loss reinsurance is a specific type of reinsurance where the ceding company is compensated for losses that exceed a specified; An excess is therefore the amount that you contribute towards a claim.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

In both and , we assume that the support of is the set of nonnegative integers. A reinsurer is a company that. Easy to do business with easy to trade as we do not require sight of the underlying policy. The coverage is excess of loss in structure and protects the provider group from significant financial impacts caused by individual catastrophic cases. In , we assume that the deductible is a positive integer.

Source: investopedia.com

Source: investopedia.com

Define stop loss or excess loss insurance. Again an upper limit to the reinsurance equal to c can be introduced, slightly modifying the formula. It is generally used in casualty lines. Easy to do business with easy to trade as we do not require sight of the underlying policy. This is called excess of loss insurance.

Source: analyzere.com

Source: analyzere.com

Deal with an excess of loss, the phrase is supposed to refer to the practice of providing indemnity over and above, i.e. Catastrophe excess of loss is a form of excess of loss reinsurance where the reinsurer agrees to reimburse the amount of a very large loss in excess of a particular sum. This article will attempt to educate a purchaser of provider excess insurance of the basic contractual structures and issues that should be considered when negotiating a contract. It may be calculated in a number of ways. Define stop loss or excess loss insurance.

Source: slideshare.net

Source: slideshare.net

Easy to do business with easy to trade as we do not require sight of the underlying policy. This is the amount you have to pay if you decide to make a claim on your policy. It is generally used in casualty lines. Therefore, policyholders with a primary insurance policy often purchase excess insurance as an additional layer of protection. Generally, these methods take into account the amount of losses that the.

Source: imbillionaire.net

Source: imbillionaire.net

It’s a way of you accepting a small portion of the risk yourself. It is generally used in casualty lines. In summary these are 2 types of reinsurance and each can have an upper limit c. Underlying premium the ceding company’s premiums (written or earned) to which the reinsurance premium rate is applied to produce the reinsurance premium. This could be across all risks involved in one event, across all policies for a given year, across all losses in a.

Source: imuwubemy9.neofile.ru.net

Source: imuwubemy9.neofile.ru.net

The amount of insurance or reinsurance on a risk (or occurrence) which applies to a loss before the next higher excess layer of insurance or reinsurance attaches. The following is an equivalent calculation of that may be easier to use in some circumstances. , in excess of a specific dollar or percentage amount called the ceding company’s retention (deductible) or the reinsurer’s attachment point. In summary these are 2 types of reinsurance and each can have an upper limit c. Generally, these methods take into account the amount of losses that the.

Source: slideshare.net

Source: slideshare.net

If your home is damaged in a storm, the cost of repairing the damage might be $4000. Again an upper limit to the reinsurance equal to c can be introduced, slightly modifying the formula. Many policies include an excess. Therefore, policyholders with a primary insurance policy often purchase excess insurance as an additional layer of protection. Standard insurance companies will usually not write insurance policies for.

Source: slideshare.net

Source: slideshare.net

Define stop loss or excess loss insurance. At that point, insurer will cover losses in excess of that sum up to the policy limit. Means an insurance policy obtained by the plan or the plan sponsor to provide coverage for individual claims at a specified stop loss limit and/or group claims at an aggregate stop loss limit that are incurred and paid during a defined period of time by the insurance policy. Citynet has the expertise to work with you across a broad range of industries. This type of reinsurance is designed to protect insurance companies from facing losses that they are not capable of dealing with.

Source: advancedontrade.com

Source: advancedontrade.com

This article will attempt to educate a purchaser of provider excess insurance of the basic contractual structures and issues that should be considered when negotiating a contract. Cede to transfer to a reinsurer all or part of the insurance risk written by a The amount of insurance or reinsurance on a risk (or occurrence) which applies to a loss before the next higher excess layer of insurance or reinsurance attaches. A reinsurer is a company that. An excess is therefore the amount that you contribute towards a claim.

Source: es.slideshare.net

Source: es.slideshare.net

Means an insurance policy obtained by the plan or the plan sponsor to provide coverage for individual claims at a specified stop loss limit and/or group claims at an aggregate stop loss limit that are incurred and paid during a defined period of time by the insurance policy. The coverage is excess of loss in structure and protects the provider group from significant financial impacts caused by individual catastrophic cases. If your home is damaged in a storm, the cost of repairing the damage might be $4000. It is generally used in casualty lines. The higher the excess amount, the lower the premium payable by the insured.

Source: worldoflies-liampayne1d.blogspot.com

Source: worldoflies-liampayne1d.blogspot.com

This article will attempt to educate a purchaser of provider excess insurance of the basic contractual structures and issues that should be considered when negotiating a contract. Easy to do business with easy to trade as we do not require sight of the underlying policy. The mean excess loss function is defined only when the integral or the sum converges. In the most basic form, excess and surplus lines insurance is a unique type of insurance coverage that serves consumers who are unable to obtain coverage in the standard or admitted market. The amount of insurance or reinsurance on a risk (or occurrence) which applies to a loss before the next higher excess layer of insurance or reinsurance attaches.

Source: slideserve.com

Source: slideserve.com

The mean excess loss function is defined only when the integral or the sum converges. Catastrophe excess of loss is a form of excess of loss reinsurance where the reinsurer agrees to reimburse the amount of a very large loss in excess of a particular sum. Insurance expense insurance expense insurance expense is the amount that a company pays to get an insurance contract and any additional premium payments. It’s a way of you accepting a small portion of the risk yourself. This could be across all risks involved in one event, across all policies for a given year, across all losses in a.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title excess of loss insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.