Your Excess insurance policy images are ready. Excess insurance policy are a topic that is being searched for and liked by netizens now. You can Download the Excess insurance policy files here. Download all royalty-free images.

If you’re looking for excess insurance policy images information related to the excess insurance policy interest, you have visit the right site. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

Excess Insurance Policy. Most insurance policies have a standard excess or a voluntary excess. It includes motor, home, pet and travel insurance claims, as well as claims on the select and cover options that feature an excess. In the event of a conflict, it is the underlying policy provisions that take precedence. The standard excess applies to every claim, while voluntary excess is chosen by you and can reduce your premium.if selected, this nominated higher excess will replace your standard excess.

Financial Planning with Excess Liability Insurance The From cpajournal.com

Financial Planning with Excess Liability Insurance The From cpajournal.com

The purpose of excess liability insurance is to close any gaps in coverage and provide an extra layer of protection should the primary insurance, such as a general liability policy, be exhausted. The total amount that your excess insurance will cover varies depending on the amount agreed between you and then insurer. In the most basic form, excess and surplus lines insurance is a unique type of insurance coverage that serves consumers who are unable to obtain coverage in the standard or admitted market. Excess insurance policy in consideration of the payment of the premium, in reliance upon all information and representations provided or made available by the insureds to the underwriters in connection with the underwriting of this policy, the underwriters and named insured, on behalf of all insureds, agree as follows: Excess insurance runs alongside your car insurance policy. This is because a higher excess means that the insured is contributing more in the event of a claim.

A typical insurance policy is usually a primary insurance policy, which covers the financial cost of an insurance claim up to a certain limit.

You will need to agree to an excess limit before you take out cover. A stock insurance company, herein called the insurer. (a) followed policy means the insurance policy set forth in item 4a. The higher the excess amount, the lower the premium payable by the insured. Excess insurance is a policy that’s separate to your motor insurance policy. Excess insurance that is subject to all of the terms and conditions of the policy beneath it.

Source: travelinsuranceexplained.co.uk

Source: travelinsuranceexplained.co.uk

It includes motor, home, pet and travel insurance claims, as well as claims on the select and cover options that feature an excess. In the event of a conflict, it is the underlying policy provisions that take precedence. Like the insurance equivalent of those russian nesting dolls. The excess protection option allows you to claim the excess back from other insurance policies, in the event a claim has been made. When buying motor insurance, you’re typically liable for a fixed amount that you’ll need to pay out if you make a claim.

Source: pibincaz.com

Source: pibincaz.com

Excess insurance is a form of insurance that works next to your traditional car insurance policies. At that point, insurer will cover losses in excess of that sum up to the policy limit. The total amount that your excess insurance will cover varies depending on the amount agreed between you and then insurer. Individual partnership corporation or item 4. You will need to agree to an excess limit before you take out cover.

Source: volarisinsure.com

Source: volarisinsure.com

When buying motor insurance, you’re typically liable for a fixed amount that you’ll need to pay out if you make a claim. The standard excess applies to every claim, while voluntary excess is chosen by you and can reduce your premium.if selected, this nominated higher excess will replace your standard excess. Excess and surplus lines insurance enable consumers. Individual partnership corporation or item 4. The total amount that your excess insurance will cover varies depending on the amount agreed between you and then insurer.

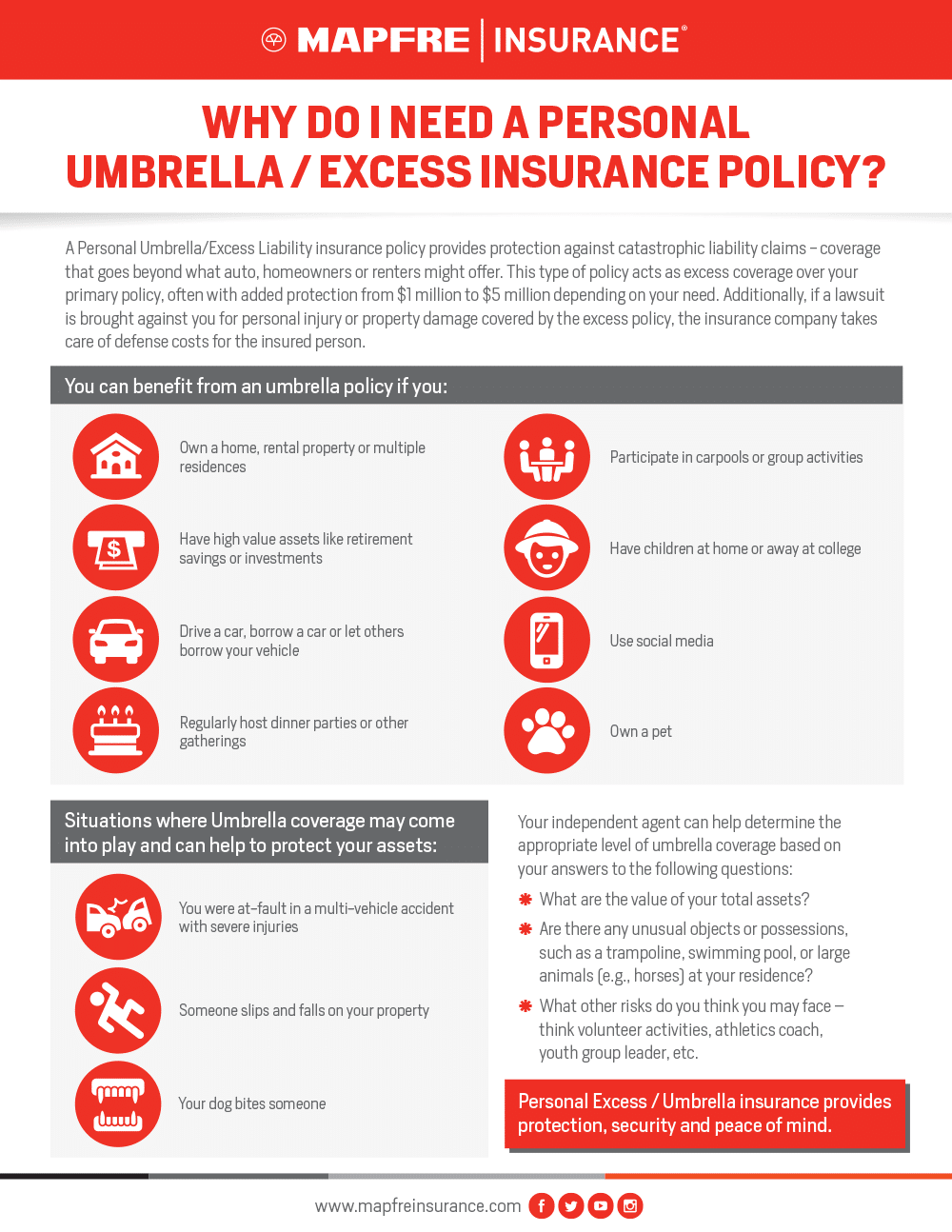

Source: mapfreinsurance.com

Source: mapfreinsurance.com

Most insurance policies have a standard excess or a voluntary excess. Excess insurance is a policy that covers your excess if you have to make a claim. An excess is therefore the amount that you contribute towards a claim. You choose the upper limit of your excess insurance. You will need to agree to an excess limit before you take out cover.

Source: mymoneyblog.com

Source: mymoneyblog.com

Most insurance policies have a standard excess or a voluntary excess. Many excess liability policies state that they are follow form except with respect to. An excess is therefore the amount that you contribute towards a claim. Excess insurance is a policy that covers your excess if you have to make a claim. (2) that portion of the amount insured that exceeds the amount retained by an entity for its own account.

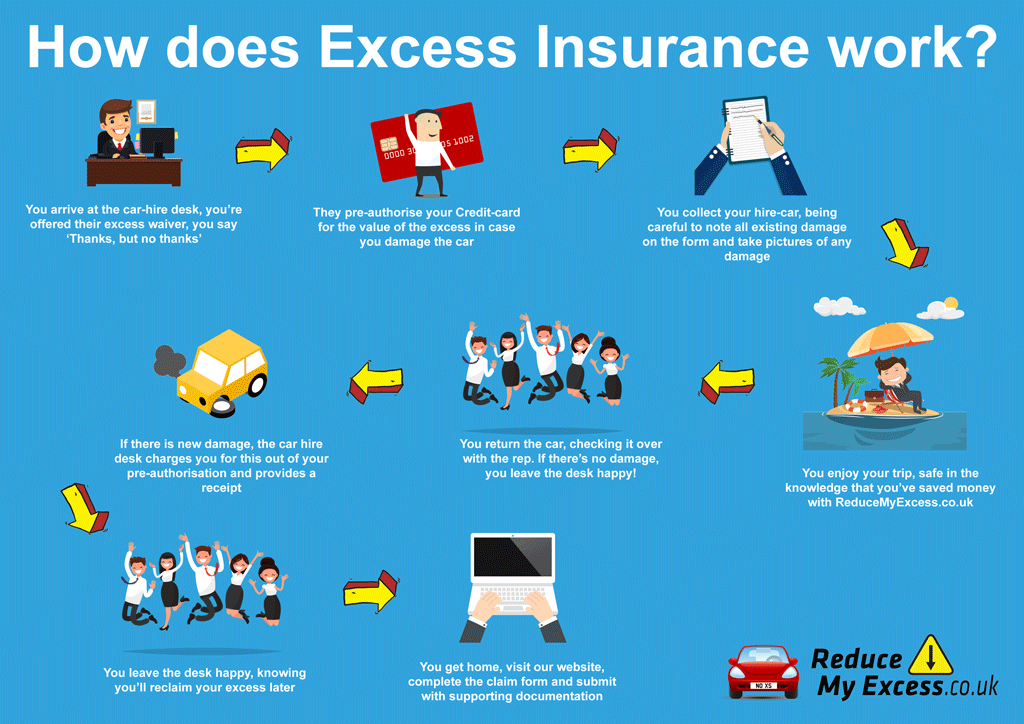

Source: reducemyexcess.co.uk

Source: reducemyexcess.co.uk

Excess insurance covers specific amounts beyond the. An excess is therefore the amount that you contribute towards a claim. When buying motor insurance, you’re typically liable for a fixed amount that you’ll need to pay out if you make a claim. Many excess liability policies state that they are follow form except with respect to. Some insurance policies have different excess amounts for different types of claim.

Source: smart-sure.com

Source: smart-sure.com

In the event of a conflict, it is the underlying policy provisions that take precedence. An excess policy in fire insurance is bought to cover additional risks which are beyond the cover of the first fire insurance. A typical insurance policy is usually a primary insurance policy, which covers the financial cost of an insurance claim up to a certain limit. Excess insurance is a policy that’s separate to your motor insurance policy. The purpose of excess liability insurance is to close any gaps in coverage and provide an extra layer of protection should the primary insurance, such as a general liability policy, be exhausted.

Source: cpajournal.com

Source: cpajournal.com

It includes motor, home, pet and travel insurance claims, as well as claims on the select and cover options that feature an excess. Some insurance policies have different excess amounts for different types of claim. You will need to agree to an excess limit before you take out cover. It will cover the cost of the excess you pay if you make a claim against your car insurance. Excess insurance is a policy that’s separate to your motor insurance policy.

Source: vipbluegroup.com

Source: vipbluegroup.com

Many excess liability policies state that they are follow form except with respect to. The excess protection option allows you to claim the excess back from other insurance policies, in the event a claim has been made. It protects against paying a large excess in the event of a claim. Excess liability insurance is a type of policy that provides limits that exceed the underlying liability policy. Excess and surplus lines insurance enable consumers.

Source: pinterest.com

Source: pinterest.com

In the event of a conflict, it is the underlying policy provisions that take precedence. It will cover the cost of the excess you pay if you make a claim against your car insurance. The purpose of excess liability insurance is to close any gaps in coverage and provide an extra layer of protection should the primary insurance, such as a general liability policy, be exhausted. Excess liability insurance is a type of policy that provides limits that exceed the underlying liability policy. At that point, insurer will cover losses in excess of that sum up to the policy limit.

Source: buildersinedinburgh.com

Source: buildersinedinburgh.com

Excess and surplus lines insurance enable consumers. Most insurance policies have a standard excess or a voluntary excess. The purpose of excess liability insurance is to close any gaps in coverage and provide an extra layer of protection should the primary insurance, such as a general liability policy, be exhausted. (a) followed policy means the insurance policy set forth in item 4a. Excess and surplus lines insurance enable consumers.

Source: fundera.com

Source: fundera.com

This insurance will pay for your excess in the case of an accident. This policy’s excess position or attachment point. It does not broaden the stated coverage, but will provide higher limits on top of the original policy. In the event of a conflict, it is the underlying policy provisions that take precedence. From information page self insured certificate no.:

Source: cpajournal.com

Source: cpajournal.com

At that point, insurer will cover losses in excess of that sum up to the policy limit. Excess insurance policy in consideration of the payment of the premium, in reliance upon all information and representations provided or made available by the insureds to the underwriters in connection with the underwriting of this policy, the underwriters and named insured, on behalf of all insureds, agree as follows: It includes motor, home, pet and travel insurance claims, as well as claims on the select and cover options that feature an excess. Therefore, policyholders with a primary insurance policy often purchase excess insurance as an additional layer of protection. Excess insurance is insurance coverage that kicks in when a particular loss reaches a certain amount.

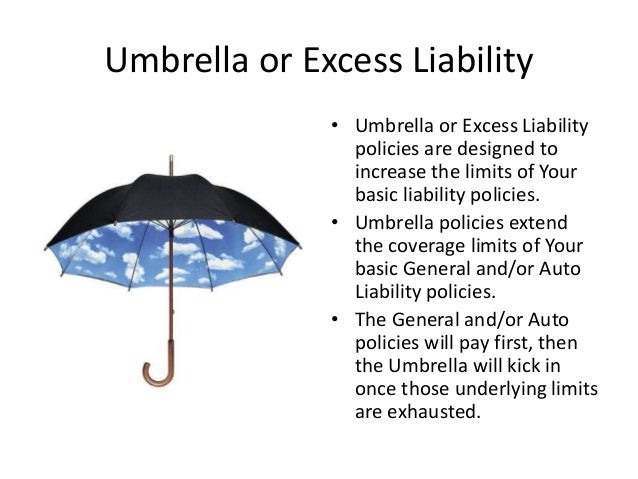

Source: slideshare.net

Source: slideshare.net

Excess insurance is a policy that’s separate to your motor insurance policy. You choose the upper limit of your excess insurance. The purpose of excess liability insurance is to close any gaps in coverage and provide an extra layer of protection should the primary insurance, such as a general liability policy, be exhausted. An excess insurance policy can cover compulsory and voluntary excesses on a range of insurance policies. Excess insurance that is subject to all of the terms and conditions of the policy beneath it.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

Your company’s cash flow, balance sheet and very survival could be at risk. Excess liability insurance is a type of policy that provides limits that exceed the underlying liability policy. (2) that portion of the amount insured that exceeds the amount retained by an entity for its own account. It will cover the cost of the excess you pay if you make a claim against your car insurance. In the event of a conflict, it is the underlying policy provisions that take precedence.

Source: hnagency.com

Source: hnagency.com

Excess insurance is a form of insurance that works next to your traditional car insurance policies. Excess and surplus lines insurance enable consumers. Excess insurance is a policy that’s separate to your motor insurance policy. Excess insurance is insurance coverage that kicks in when a particular loss reaches a certain amount. Like the insurance equivalent of those russian nesting dolls.

Source: cannabishempinsurance.com

Source: cannabishempinsurance.com

Like the insurance equivalent of those russian nesting dolls. The excess protection option allows you to claim the excess back from other insurance policies, in the event a claim has been made. The standard excess applies to every claim, while voluntary excess is chosen by you and can reduce your premium.if selected, this nominated higher excess will replace your standard excess. At that point, insurer will cover losses in excess of that sum up to the policy limit. Therefore, policyholders with a primary insurance policy often purchase excess insurance as an additional layer of protection.

Source: pinterest.com

Source: pinterest.com

Excess insurance is a policy that covers your excess if you have to make a claim. An excess is therefore the amount that you contribute towards a claim. Unless otherwise provided in the followed policy, this policy applies only to claims first made against the insured during the policy period or extended reporting period. Excess and surplus lines insurance enable consumers. From information page self insured certificate no.:

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title excess insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.