Your Excess and surplus insurance images are ready in this website. Excess and surplus insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Excess and surplus insurance files here. Find and Download all free photos and vectors.

If you’re searching for excess and surplus insurance pictures information connected with to the excess and surplus insurance topic, you have visit the right site. Our site always provides you with suggestions for viewing the highest quality video and image content, please kindly search and find more informative video content and images that fit your interests.

Excess And Surplus Insurance. Excess & surplus lines insurance is a valuable type of insurance that is used for risks that standard companies may not want to get involved with. Excess and surplus lines subject to performing a diligent search and otherwise complying with the excess line law. In the most basic form, excess and surplus lines insurance is a unique type of insurance coverage that serves consumers who are unable to obtain coverage in the standard or admitted market. Insurance law §2105 and insurance regulation 41 (11 nycrr 27) at § 27.0 authorizes excess line brokers to place certain “kinds” of insurance as defined in insurance law §1113.

Access to Excess & Surplus is Essential From insurancemarketsource.com

Access to Excess & Surplus is Essential From insurancemarketsource.com

Specialty lines of insurance products and services, including package solutions,. Excess & surplus (4) excess & umbrella (1) excess & surplus. Excess and surplus lines insurance enable consumers. Simply put, excess & surplus lines (e&s) is a specialty market that insures things standard carriers won�t cover. Excess and surplus lines insurance is an alternative type of insurance coverage for consumers who cannot get coverage in the standard/admitted market. Excess and surplus lines is a form of insurance that covers businesses with high risk or an adverse loss history that can make it hard for them to obtain coverage in the traditional insurance marketplace.

Selective is proud to offer excess and surplus (e&s) insurance through mesa underwriters specialty insurance company (music.) music utilizes the industry expertise of specialized wholesale agents to deliver commercial insurance that meets the unique needs of business owners.

Westchester surplus lines insurance company is an eligible surplus lines insurer in 49 states, district of columbia, puerto rico, and u.s. Excess & surplus (4) excess & umbrella (1) excess & surplus. Typically, standard companies do not write policies for unusual or high risks. What is excess & surplus insurance? Specialty lines of insurance products and services, including package solutions,. Excess and surplus market what is surplus lines insurance?

![]() Source: businessinsurance.com

Source: businessinsurance.com

And our clients seem to be pretty happy about that. Excess and surplus lines is a form of insurance that covers businesses with high risk or an adverse loss history that can make it hard for them to obtain coverage in the traditional insurance marketplace. In the most basic form, excess and surplus lines insurance is a unique type of insurance coverage that serves consumers who are unable to obtain coverage in the standard or admitted market. Selective is proud to offer excess and surplus (e&s) insurance through mesa underwriters specialty insurance company (music.) music utilizes the industry expertise of specialized wholesale agents to deliver commercial insurance that meets the unique needs of business owners. Insurance law §2105 and insurance regulation 41 (11 nycrr 27) at § 27.0 authorizes excess line brokers to place certain “kinds” of insurance as defined in insurance law §1113.

Source: insurancejournal.com

Source: insurancejournal.com

Virgin islands, guam and puerto rico. Typically excess and surplus lines coverage offers policyholders with unique risk or poor loss history an opportunity to obtain insurance. In the most basic form, excess and surplus lines insurance is a unique type of insurance coverage that serves consumers who are unable to obtain coverage in the standard or admitted market. In addition to providing similar types of insurance, excess surplus insurance can provide additional coverages or structure insurance programs in a way that. For risks that may be too big, too unusual or substandard, a specially licensed producer called a surplus line.

Source: researchgate.net

Source: researchgate.net

Excess and surplus and specialty insurance products are available through wholesale general insurance agents, insurance brokers, and program managers. Simply put, excess & surplus lines (e&s) is a specialty market that insures things standard carriers won�t cover. Excess and surplus market what is surplus lines insurance? For risks that may be too big, too unusual or substandard, a specially licensed producer called a surplus line. Virgin islands, guam and puerto rico.

Source: graceybacker.com

Source: graceybacker.com

Selective is proud to offer excess and surplus (e&s) insurance through mesa underwriters specialty insurance company (music.) music utilizes the industry expertise of specialized wholesale agents to deliver commercial insurance that meets the unique needs of business owners. For risks that may be too big, too unusual or substandard, a specially licensed producer called a surplus line. The risk landscape is growing in complexity, creating more reasons to provide direct access to the excess and surplus (e&s) market. Excess and surplus lines subject to performing a diligent search and otherwise complying with the excess line law. E&s property and liability insurance coverage is available to small and.

Source: insurancejournal.com

Source: insurancejournal.com

Excess and surplus lines is a form of insurance that covers businesses with high risk or an adverse loss history that can make it hard for them to obtain coverage in the traditional insurance marketplace. Excess and surplus lines is a form of insurance that covers businesses with high risk or an adverse loss history that can make it hard for them to obtain coverage in the traditional insurance marketplace. Excess & surplus (4) excess & umbrella (1) excess & surplus. Selective is proud to offer excess and surplus (e&s) insurance through mesa underwriters specialty insurance company (music.) music utilizes the industry expertise of specialized wholesale agents to deliver commercial insurance that meets the unique needs of business owners. Insurance law §2105 and insurance regulation 41 (11 nycrr 27) at § 27.0 authorizes excess line brokers to place certain “kinds” of insurance as defined in insurance law §1113.

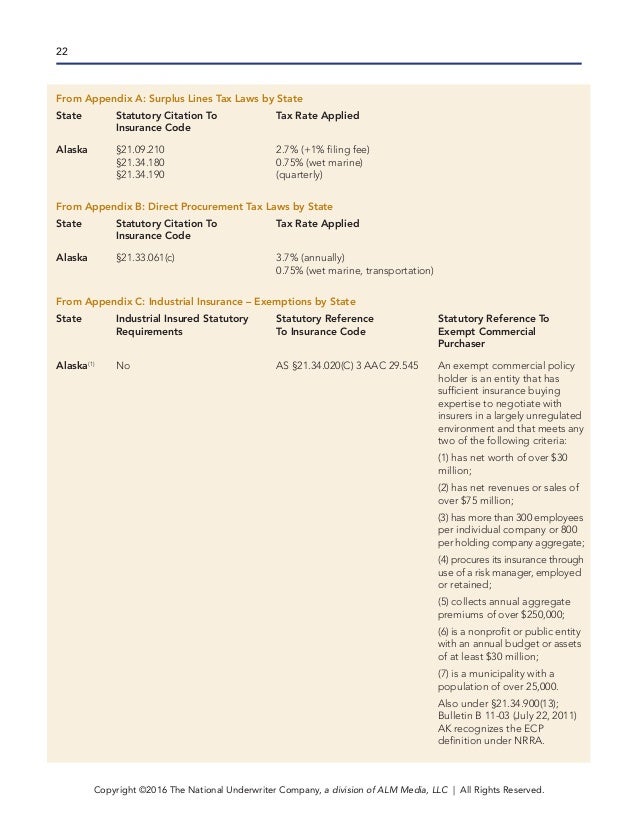

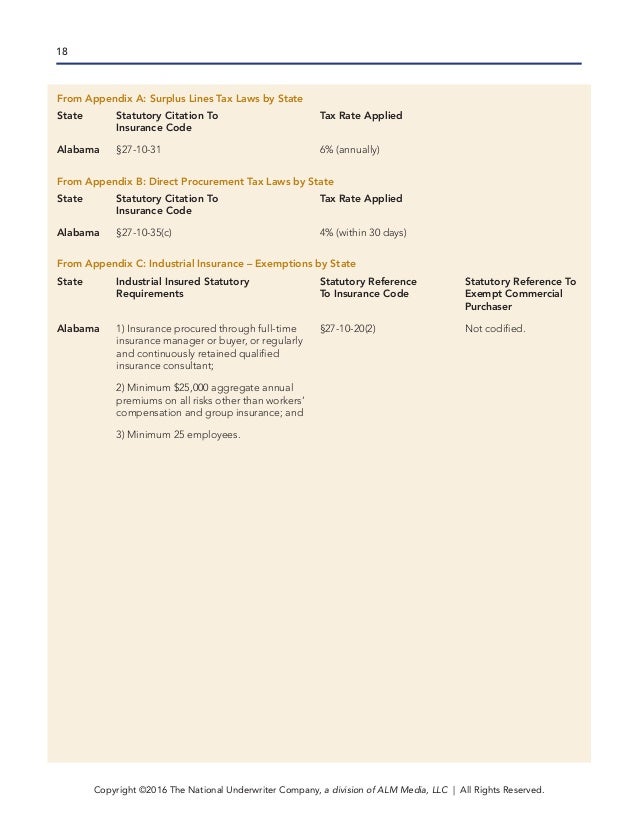

Source: slideshare.net

Source: slideshare.net

In the most basic form, excess and surplus lines insurance is a unique type of insurance coverage that serves consumers who are unable to obtain coverage in the standard or admitted market. Excess and surplus lines subject to performing a diligent search and otherwise complying with the excess line law. Typically, standard companies do not write policies for unusual or high risks. What is excess & surplus insurance? Excess and surplus and specialty insurance products are available through wholesale general insurance agents, insurance brokers, and program managers.

Source: insurancejournal.com

Source: insurancejournal.com

E&s property and liability insurance coverage is available to small and. Excess and surplus lines insurance — or e&s insurance — was created for specialized and complex risks traditional insurance doesn’t cover. In the most basic form, excess and surplus lines insurance is a unique type of insurance coverage that serves consumers who are unable to obtain coverage in the standard or admitted market. Excess & surplus lines insurance is a valuable type of insurance that is used for risks that standard companies may not want to get involved with. Typically excess and surplus lines coverage offers policyholders with unique risk or poor loss history an opportunity to obtain insurance.

Source: workspot.com

Source: workspot.com

In the most basic form, excess and surplus lines insurance is a unique type of insurance coverage that serves consumers who are unable to obtain coverage in the standard or admitted market. For risks that may be too big, too unusual or substandard, a specially licensed producer called a surplus line. In the most basic form, excess and surplus lines insurance is a unique type of insurance coverage that serves consumers who are unable to obtain coverage in the standard or admitted market. Excess & surplus lines insurance is a valuable type of insurance that is used for risks that standard companies may not want to get involved with. E&s property and liability insurance coverage is available to small and.

Source: slideshare.net

Source: slideshare.net

Excess & surplus lines insurance is a valuable type of insurance that is used for risks that standard companies may not want to get involved with. Excess and surplus market what is surplus lines insurance? E&s property and liability insurance coverage is available to small and. Excess and surplus lines insurance (e&s insurance) can insure folks who have been denied coverage because their homes are considered high risk. Typically excess and surplus lines coverage offers policyholders with unique risk or poor loss history an opportunity to obtain insurance.

Source: slideshare.net

Source: slideshare.net

Excess & surplus (4) excess & umbrella (1) excess & surplus. Specialty lines of insurance products and services, including package solutions,. Excess and surplus lines insurance enable consumers. And our clients seem to be pretty happy about that. For risks that may be too big, too unusual or substandard, a specially licensed producer called a surplus line.

Source: pt.slideshare.net

Source: pt.slideshare.net

Virgin islands, guam and puerto rico. Specialty lines of insurance products and services, including package solutions,. Excess and surplus lines insurance — or e&s insurance — was created for specialized and complex risks traditional insurance doesn’t cover. Typically, standard companies do not write policies for unusual or high risks. Excess and surplus lines subject to performing a diligent search and otherwise complying with the excess line law.

Source: admiralins.com

Source: admiralins.com

Excess and surplus market what is surplus lines insurance? In addition to providing similar types of insurance, excess surplus insurance can provide additional coverages or structure insurance programs in a way that. Excess and surplus lines insurance is an alternative type of insurance coverage for consumers who cannot get coverage in the standard/admitted market. Excess and surplus lines insurance (e&s insurance) can insure folks who have been denied coverage because their homes are considered high risk. Companies with unusual or elevated risks often need e&s insurance because the admitted market considers them too risky to cover.

![]() Source: businessinsurance.com

Source: businessinsurance.com

Typically excess and surplus lines coverage offers policyholders with unique risk or poor loss history an opportunity to obtain insurance. Excess and surplus lines is a form of insurance that covers businesses with high risk or an adverse loss history that can make it hard for them to obtain coverage in the traditional insurance marketplace. Excess and surplus lines subject to performing a diligent search and otherwise complying with the excess line law. For risks that may be too big, too unusual or substandard, a specially licensed producer called a surplus line. Westchester surplus lines insurance company is an eligible surplus lines insurer in 49 states, district of columbia, puerto rico, and u.s.

Source: insurancejournal.com

Source: insurancejournal.com

The risk landscape is growing in complexity, creating more reasons to provide direct access to the excess and surplus (e&s) market. What is excess & surplus insurance? Typically excess and surplus lines coverage offers policyholders with unique risk or poor loss history an opportunity to obtain insurance. And our clients seem to be pretty happy about that. Excess and surplus lines insurance enable consumers.

Source: slideshare.net

Source: slideshare.net

And our clients seem to be pretty happy about that. Companies with unusual or elevated risks often need e&s insurance because the admitted market considers them too risky to cover. Typically, standard companies do not write policies for unusual or high risks. Excess and surplus lines is a form of insurance that covers businesses with high risk or an adverse loss history that can make it hard for them to obtain coverage in the traditional insurance marketplace. Excess and surplus lines insurance is an alternative type of insurance coverage for consumers who cannot get coverage in the standard/admitted market.

Source: graceybacker.com

Source: graceybacker.com

Excess and surplus market what is surplus lines insurance? Typically, standard companies do not write policies for unusual or high risks. Westchester surplus lines insurance company is an eligible surplus lines insurer in 49 states, district of columbia, puerto rico, and u.s. Excess and surplus lines is a form of insurance that covers businesses with high risk or an adverse loss history that can make it hard for them to obtain coverage in the traditional insurance marketplace. As companies evolve their operations to adapt to the current environment, their exposures are also shifting.

Source: insurancemarketsource.com

Source: insurancemarketsource.com

Selective is proud to offer excess and surplus (e&s) insurance through mesa underwriters specialty insurance company (music.) music utilizes the industry expertise of specialized wholesale agents to deliver commercial insurance that meets the unique needs of business owners. What is excess & surplus insurance? Excess and surplus lines subject to performing a diligent search and otherwise complying with the excess line law. Excess and surplus lines is a form of insurance that covers businesses with high risk or an adverse loss history that can make it hard for them to obtain coverage in the traditional insurance marketplace. Companies with unusual or elevated risks often need e&s insurance because the admitted market considers them too risky to cover.

Source: sec.gov

Source: sec.gov

Companies with unusual or elevated risks often need e&s insurance because the admitted market considers them too risky to cover. Selective is proud to offer excess and surplus (e&s) insurance through mesa underwriters specialty insurance company (music.) music utilizes the industry expertise of specialized wholesale agents to deliver commercial insurance that meets the unique needs of business owners. This allows businesses and properties to still have coverage to protect their investments. Typically excess and surplus lines coverage offers policyholders with unique risk or poor loss history an opportunity to obtain insurance. Excess and surplus lines subject to performing a diligent search and otherwise complying with the excess line law.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title excess and surplus insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.