Your Event management public liability insurance images are ready. Event management public liability insurance are a topic that is being searched for and liked by netizens today. You can Download the Event management public liability insurance files here. Find and Download all royalty-free photos.

If you’re searching for event management public liability insurance images information connected with to the event management public liability insurance topic, you have visit the right site. Our site always provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Event Management Public Liability Insurance. Employers’ liability can cover claims if an employee or volunteer is injured. Entertainment & event liability provision of entertainmant & event insurance is currently limited as a result of our resticted ability to arrange insurance within binding authorities. Pi insurance will protect you in the event that this occurs. Event public liability insurance or entertainment insurance is essential to provide cover against a member of the public being hurt, or damaging their property, whilst attending your event.

Public Entertainment Events Insurance Is it Necessary From directfinancekey.com

Public Entertainment Events Insurance Is it Necessary From directfinancekey.com

Events insurance protects you and your company from the various risks you’re exposed to when conducting an event. Event liability insurance provides financial cover for situations where a company or business can be held liable for damages or injuries occurring at an event they are responsible for, have sponsored, hosted, or run. Insurance managing a public event includes ensuring the safety of event organisers, volunteers, contract staff, event staff and the public. Please discuss any significant placements with our staff or via insure@coversure.co.au for feedback on available placement opportunities. Employers’ liability can cover claims if an employee or volunteer is injured. What does event public liability insurance cover me for?

If you are an event manager, organising a one day or multi day event for your business, or represent a community group or.

How does public liability insurance work? Many venues require event organizers to carry liability insurance to: Help pay for medical expenses if a guest is injured protect venue property from damage, including the building(s) and any equipment Special conditions all service providers to your event are required to carry their own insurance. The company shall not be liable for any liability arising due to: In the event that the services you provide for a client lead to a claim against that client they will generally look at claiming against the provider.

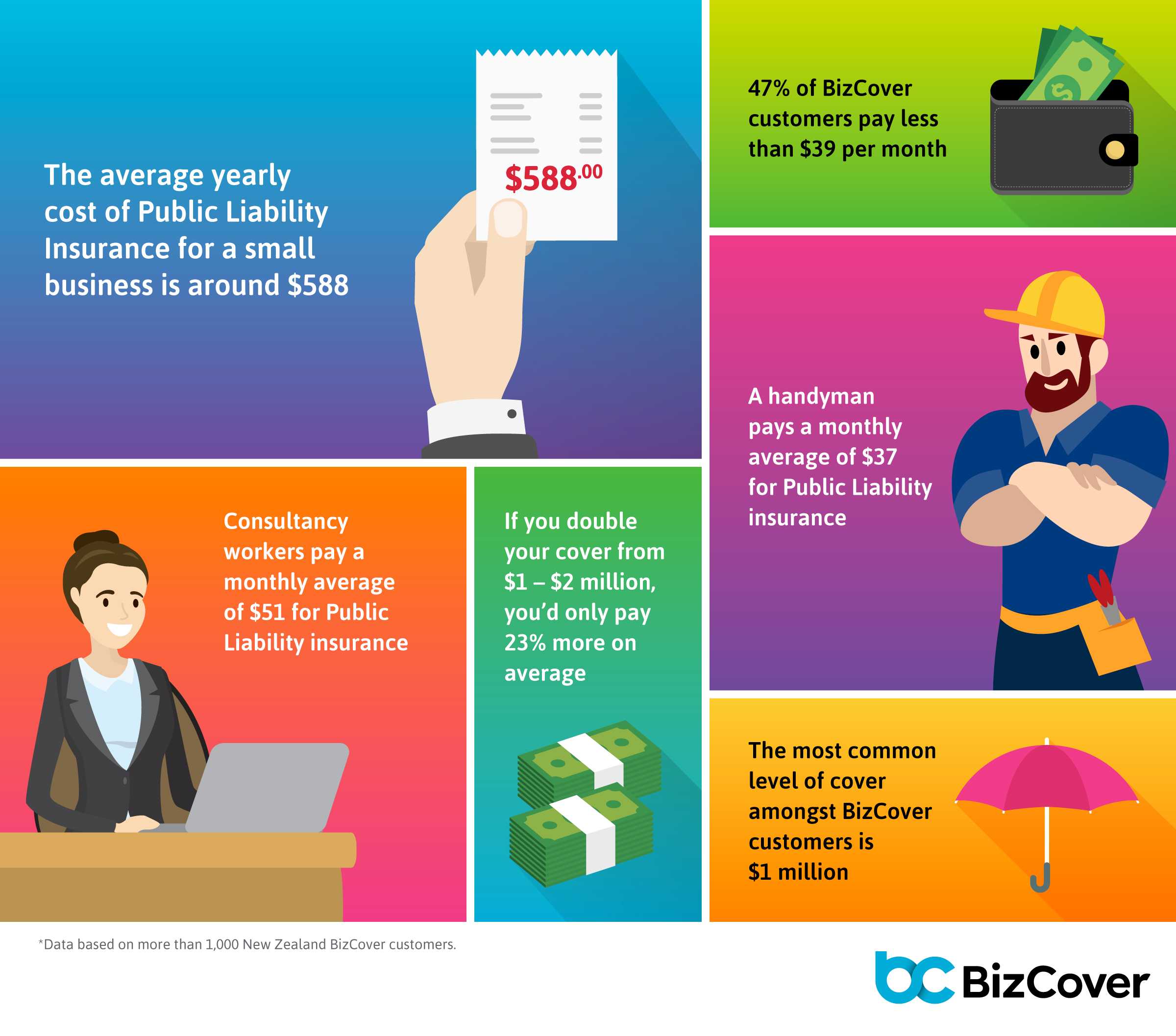

Source: bizcover.co.nz

Source: bizcover.co.nz

In many cases, venues will now require you to have your own public liability insurance or event insurance to cover possible injury to a member of the public. If you are an event manager, organising a one day or multi day event for your business, or represent a community group or. Please discuss any significant placements with our staff or via insure@coversure.co.au for feedback on available placement opportunities. With the scale of publicity involved from social media, tv broadcasts to marketing, your insurance needs will require broad, specialized cover like chubb’s event insurance. Events insurance protects you and your company from the various risks you’re exposed to when conducting an event.

Source: pinterest.com

Source: pinterest.com

Essential $60 to $111 per month on average. The law requires the organiser to have employers liability cover for all employees including unpaid helpers and public liability cover for your patrons. Employers’ liability can cover claims if an employee or volunteer is injured. Entertainment & event liability provision of entertainmant & event insurance is currently limited as a result of our resticted ability to arrange insurance within binding authorities. It covers a wide range of situations including protection against event cancellation, abandonment or postponement, protection for public liability exposures and personal accident cover for volunteers, crew and.

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

How does public liability insurance work? Depending on your policy event insurance may include cover for: What is event public liability insurance? It protects against claims of bodily injury or property damage and it includes medical cost reimbursement for injured parties. How do i get started?

Source: youtube.com

Source: youtube.com

What is event management insurance? Allowance for bump in (3 days) & bump out (3 days), in addition to event duration. The specific needs of your event should be discussed with an insurance company or broker to ensure that adequate cover is. Entertainment & event liability provision of entertainmant & event insurance is currently limited as a result of our resticted ability to arrange insurance within binding authorities. Public liability insurance a majority of event companies take up public liability insurance for their events and insure it on an event by event basis.

Source: tentguys.com

Source: tentguys.com

$250,000 goods in care custody & control. In terms of events, public liability insurance covers the policy holder for accidental damage or loss of property, injury or death of a member of the public at the policy holders event. In the event that the services you provide for a client lead to a claim against that client they will generally look at claiming against the provider. Depending on your policy event insurance may include cover for: The company shall not be liable for any liability arising due to:

Source: publicliability.ie

Source: publicliability.ie

Many venues require event organizers to carry liability insurance to: Normally the event organiser will be required to submit a public liability insurance certificate to the venue where the event is taking place because it’s unlikely the venue will want to cover any claims through their insurance caused by the organiser’s negligence. The law requires the organiser to have employers liability cover for all employees including unpaid helpers and public liability cover for your patrons. From a compliance perspective and for your own protection you should have a minimum level of professional indemnity(pi) insurance. In the event that the services you provide for a client lead to a claim against that client they will generally look at claiming against the provider.

Source: smartbusinessinsurance.com.au

Source: smartbusinessinsurance.com.au

How do i get started? $500 excess for each and every occurrence. It protects against claims of bodily injury or property damage and it includes medical cost reimbursement for injured parties. With the scale of publicity involved from social media, tv broadcasts to marketing, your insurance needs will require broad, specialized cover like chubb’s event insurance. Public liability insurance is crucial to protect you in case someone gets injured or has their property damaged on your property.

Source: sites.google.com

Employers’ liability can cover claims if an employee or volunteer is injured. Event public liability insurance or entertainment insurance is essential to provide cover against a member of the public being hurt, or damaging their property, whilst attending your event. You will be covered for incidents that you become legally liable for. Public liability insurance event management | bizcover. If you’re running an event, you may be liable for any damages that occur and you need to also consider the potential for accidents when clients attend your office.

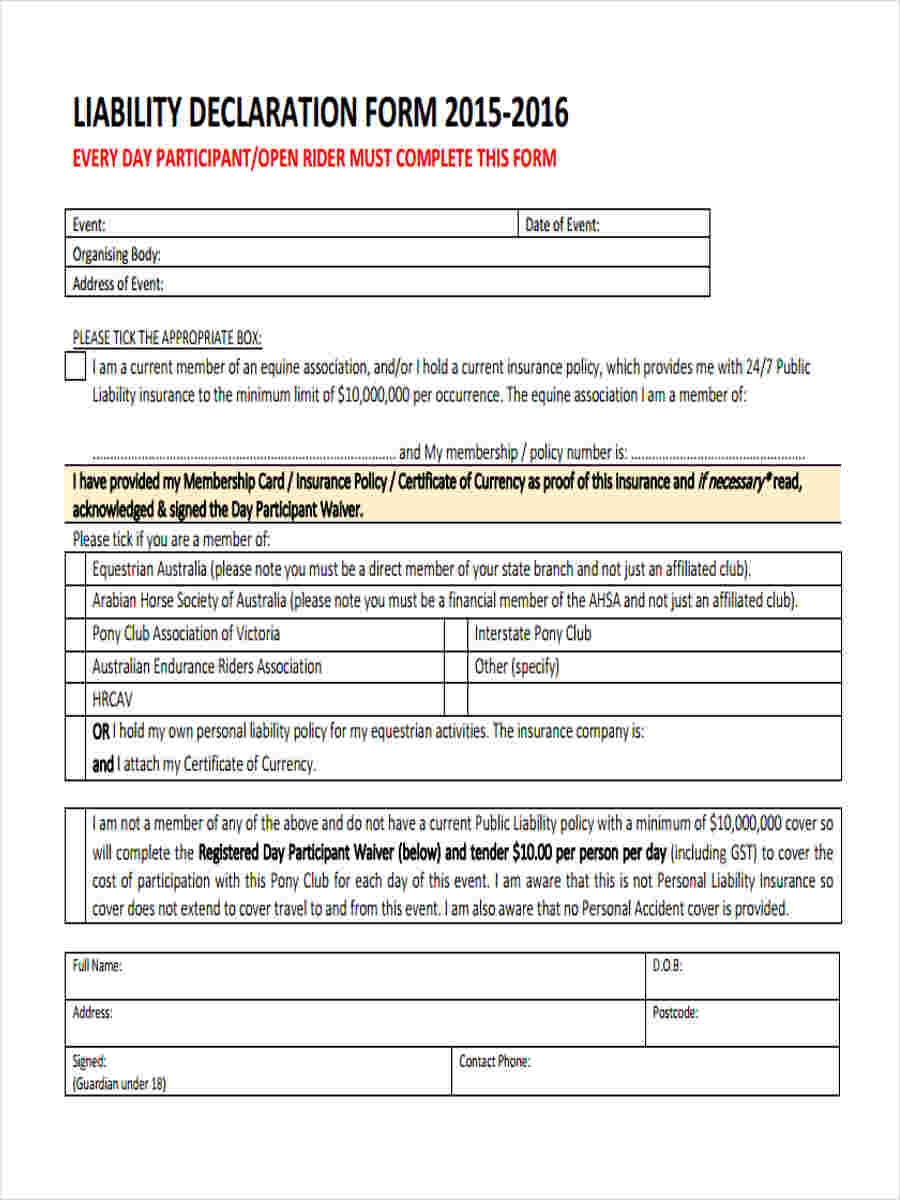

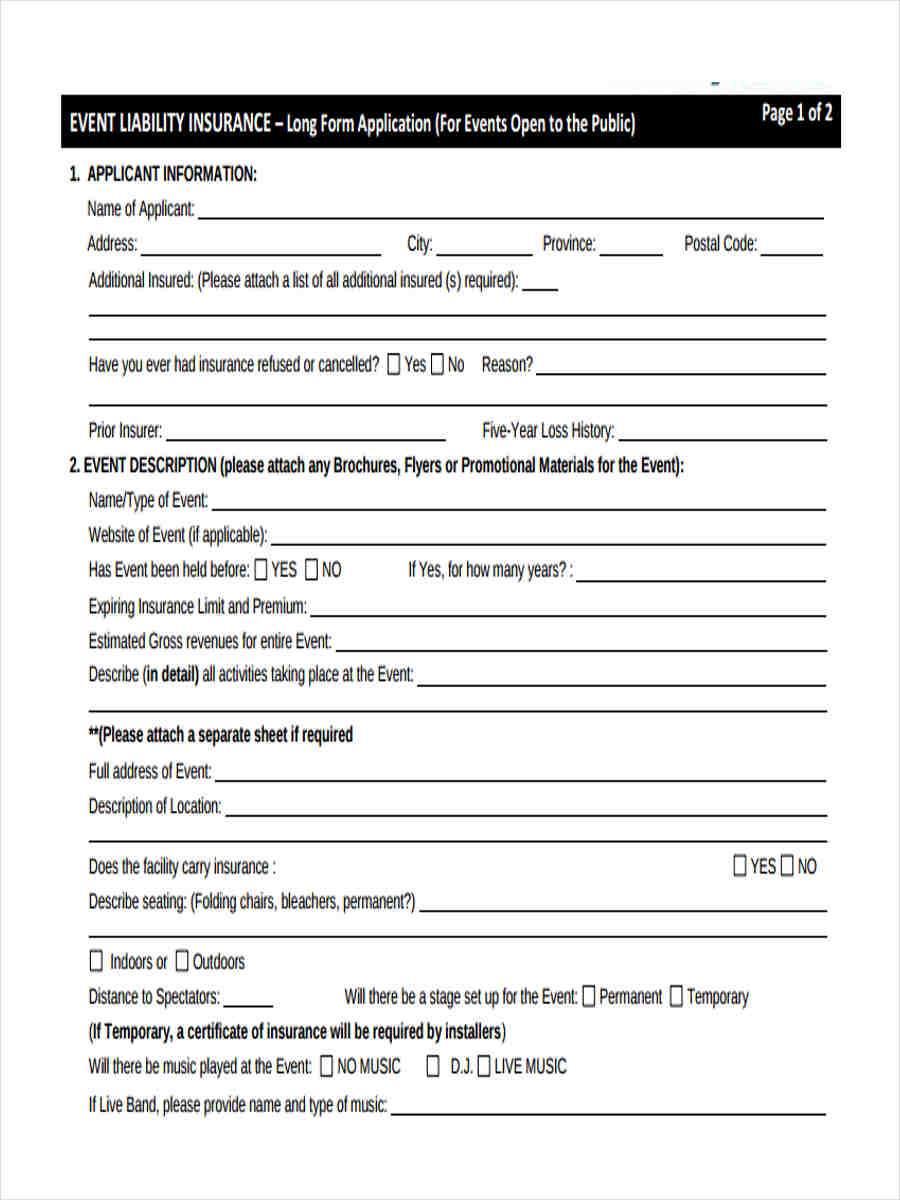

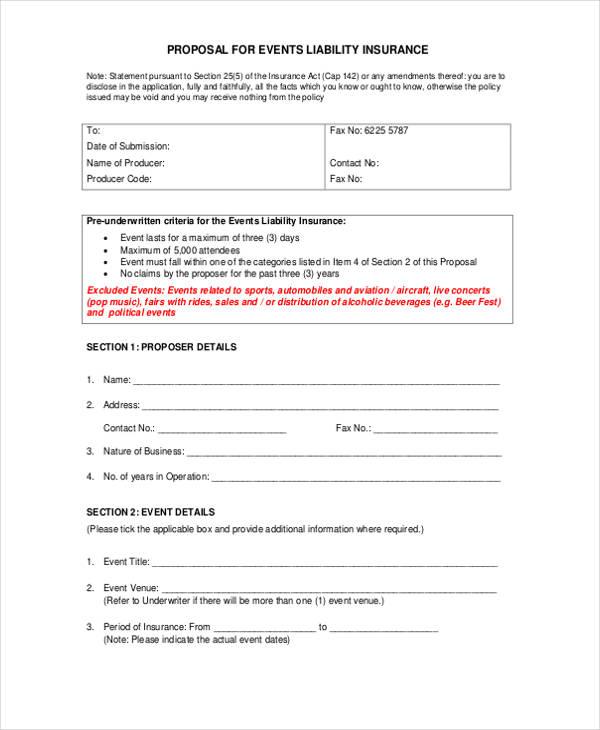

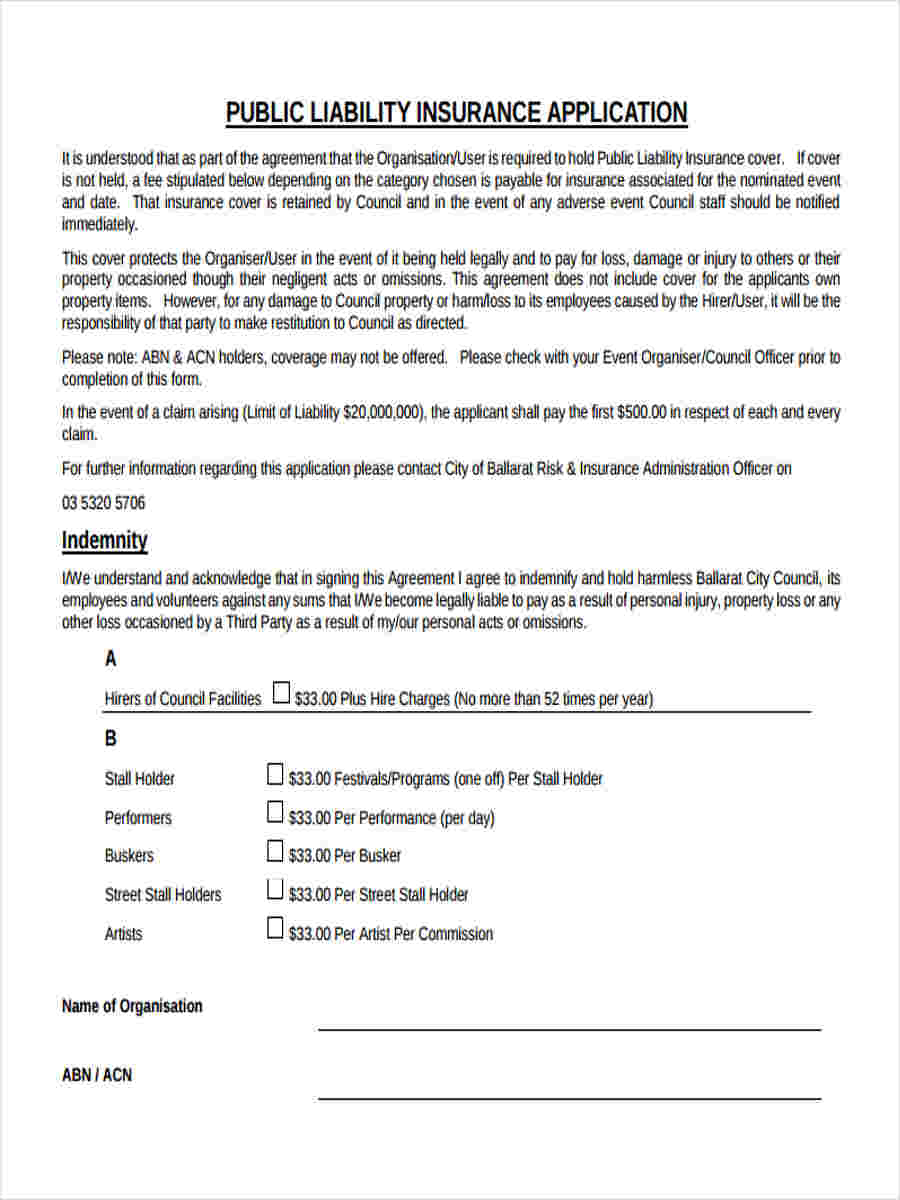

Source: sampleforms.com

Source: sampleforms.com

In terms of events, public liability insurance covers the policy holder for accidental damage or loss of property, injury or death of a member of the public at the policy holders event. It covers a wide range of situations including protection against event cancellation, abandonment or postponement, protection for public liability exposures and personal accident cover for volunteers, crew and. $250,000 goods in care custody & control. What is event public liability insurance? Liability towards third parties for any accidents resulting in injury or damage occurring at the venue of the event, in connection with the event, during the policy period.

Source: propertyinsurancecentre.co.uk

Source: propertyinsurancecentre.co.uk

$20 million public & products liability. To give an example if someone was to get injured at your event you will need to come up with a lot of money to defend yourself and also need a lot of money to pay for any claim that is made against you. $250,000 goods in care custody & control. In the event that the services you provide for a client lead to a claim against that client they will generally look at claiming against the provider. Event liability insurance provides financial cover for situations where a company or business can be held liable for damages or injuries occurring at an event they are responsible for, have sponsored, hosted, or run.

Source: slideshare.net

Source: slideshare.net

It protects against claims of bodily injury or property damage and it includes medical cost reimbursement for injured parties. In the event that the services you provide for a client lead to a claim against that client they will generally look at claiming against the provider. Without insurance, such a claim could threaten your assets. Business days and receive an indicative quote over the phone. $250,000 goods in care custody & control.

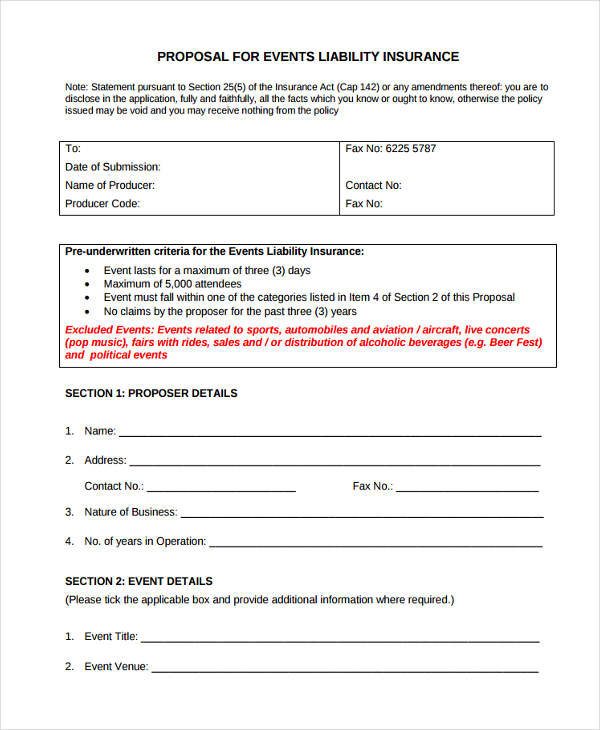

Source: sampleforms.com

Source: sampleforms.com

It protects against claims of bodily injury or property damage and it includes medical cost reimbursement for injured parties. Event public liability insurance or entertainment insurance is essential to provide cover against a member of the public being hurt, or damaging their property, whilst attending your event. In many cases, venues will now require you to have your own public liability insurance or event insurance to cover possible injury to a member of the public. Event public liability cover may provide the insured event manager or event management business cover against claims made against them by a third party, who suffer an injury or property damage, at any insured event. How does public liability insurance work?

Source: eventinsurance.ie

Source: eventinsurance.ie

It is highly recommended, and may be mandatory, that event managers have comprehensive public liability insurance and seek legal advice as part of their risk management strategy. Event organisers can choose to include public liability insurance within their overall policy, so the first decision to be made is which event policy is most appropriate. Insurance managing a public event includes ensuring the safety of event organisers, volunteers, contract staff, event staff and the public. If you are an event manager, organising a one day or multi day event for your business, or represent a community group or. The company shall not be liable for any liability arising due to:

Source: directfinancekey.com

Source: directfinancekey.com

From a compliance perspective and for your own protection you should have a minimum level of professional indemnity(pi) insurance. $250,000 goods in care custody & control. What does event public liability insurance cover me for? You will be covered for incidents that you become legally liable for. The company shall not be liable for any liability arising due to:

Source: sampleforms.com

Source: sampleforms.com

To give an example if someone was to get injured at your event you will need to come up with a lot of money to defend yourself and also need a lot of money to pay for any claim that is made against you. Allowance for bump in (3 days) & bump out (3 days), in addition to event duration. In the event that the services you provide for a client lead to a claim against that client they will generally look at claiming against the provider. Pi insurance will protect you in the event that this occurs. Public liability insurance a majority of event companies take up public liability insurance for their events and insure it on an event by event basis.

Source: smallbusiness.co.uk

Source: smallbusiness.co.uk

Allowance for bump in (3 days) & bump out (3 days), in addition to event duration. With the scale of publicity involved from social media, tv broadcasts to marketing, your insurance needs will require broad, specialized cover like chubb’s event insurance. Employers’ liability can cover claims if an employee or volunteer is injured. Allowance for bump in (3 days) & bump out (3 days), in addition to event duration. Public liability insurance is crucial to protect you in case someone gets injured or has their property damaged on your property.

Source: sampleforms.com

Source: sampleforms.com

$250,000 goods in care custody & control. To give an example if someone was to get injured at your event you will need to come up with a lot of money to defend yourself and also need a lot of money to pay for any claim that is made against you. Normally the event organiser will be required to submit a public liability insurance certificate to the venue where the event is taking place because it’s unlikely the venue will want to cover any claims through their insurance caused by the organiser’s negligence. From a compliance perspective and for your own protection you should have a minimum level of professional indemnity(pi) insurance. The specific needs of your event should be discussed with an insurance company or broker to ensure that adequate cover is.

Source: sampleforms.com

Source: sampleforms.com

Do i need public liability insurance for an event? In many cases, venues will now require you to have your own public liability insurance or event insurance to cover possible injury to a member of the public. Public liability insurance a majority of event companies take up public liability insurance for their events and insure it on an event by event basis. $500 excess for each and every occurrence. Public liability insurance is crucial to protect you in case someone gets injured or has their property damaged on your property.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title event management public liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.