Your Event insured against life insurance contract images are ready in this website. Event insured against life insurance contract are a topic that is being searched for and liked by netizens today. You can Get the Event insured against life insurance contract files here. Download all free photos and vectors.

If you’re looking for event insured against life insurance contract images information linked to the event insured against life insurance contract topic, you have come to the ideal blog. Our site always gives you hints for downloading the maximum quality video and picture content, please kindly hunt and locate more informative video articles and graphics that fit your interests.

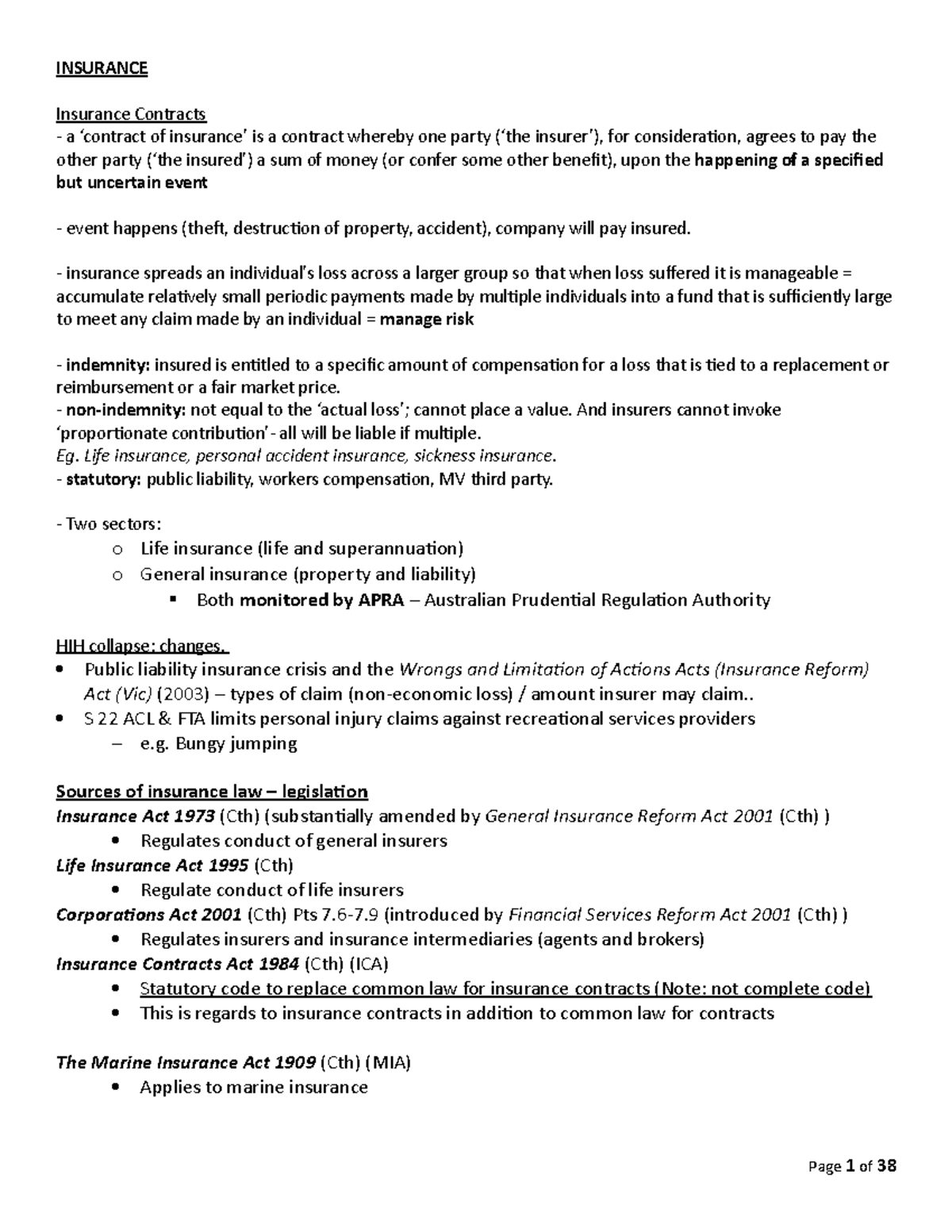

Event Insured Against Life Insurance Contract. [2] the insurer undertakes the obligation for a consideration, the premium paid by the insured. Insured event any event that would cause an insurer to pay a claim. Most companies set out to provide an exceptional service. For example, in car insurance, an insured event may be a car accident because it would cause the insurance company to compensate the policyholder for property damage and/or medical bills.

Pin on Laywers Template Forms Online From pinterest.nz

Pin on Laywers Template Forms Online From pinterest.nz

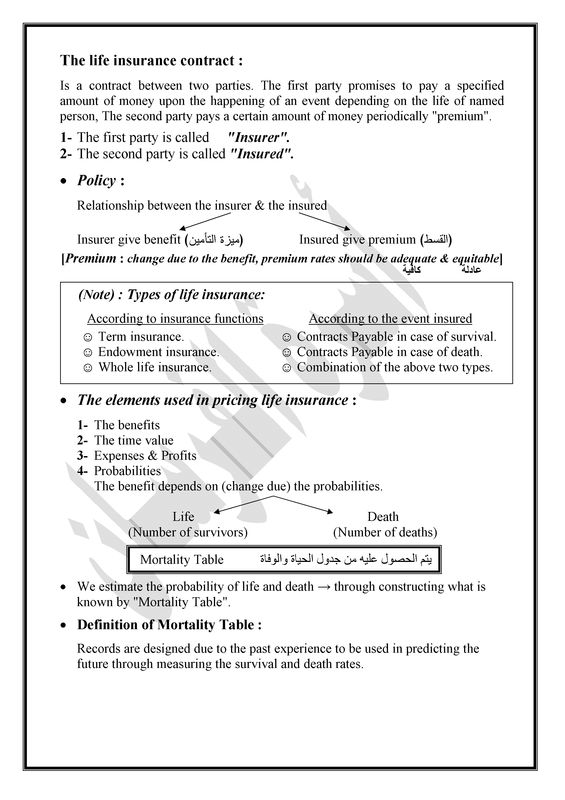

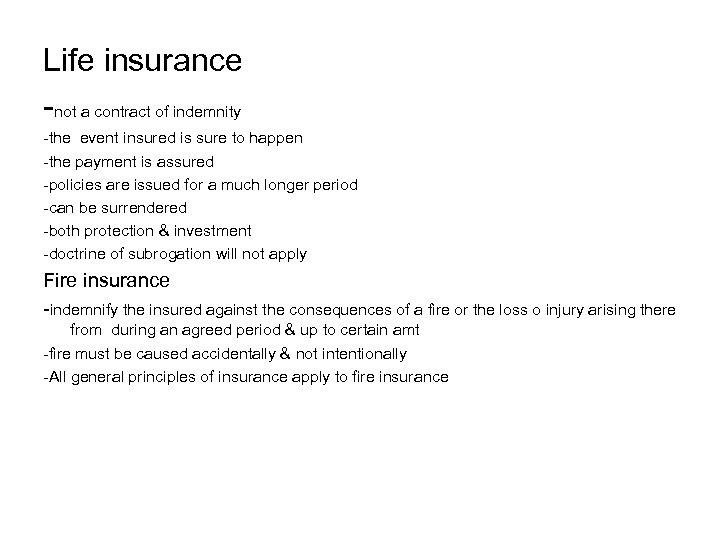

Uncertainty is the most stressful feeling in life, whereas, the most important thing in life is life itself. Against loss, 6 whereas in life insurance it is not intended for indemnification. 1.an insurance contract is a contract between an insurer and an insured which obligates the insurer, in consideration of insurance premium, to pay insurance benefits to the beneficiary upon the occurrence of the event insured against. A contract of insurance is an agreement whereby one undertakes for a consideration to indemnify another against loss, damage or liability arising from an unknown or contingent event. In life insurance, the event insured against is the death of the insured or of another, or his or another’s attaining a specific age, or some other event in his or another’s life other than an accident, sickness and disability. *a contract of life insurance is a continuing contract.it lapses if premium is not paid regularly at the specified times.

[3] the obligation is to indemnify another (the insured or beneficiary) against loss, damage, or liability.

When you tie the knot. Section 3 of the insurance code provides what may be insured against. Insured event in accordance with the insurance contract. For example, in car insurance, an insured event may be a car accident because it would cause the insurance company to compensate the policyholder for property damage and/or medical bills. The insurance, thus, is a contract whereby. [3] the obligation is to indemnify another (the insured or beneficiary) against loss, damage, or liability.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

And, they follow through with it. Now term insurance is more significant because someone else is financially dependent on you. A contract of suretyship shall be deemed to be an insurance contract, within the meaning of the insurance code, only if made by a surety who or which, as such, is. Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policy holder). Aditi saxena events, life assignment, nomination.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

Called premium, is charged in consideration. Against loss, 6 whereas in life insurance it is not intended for indemnification. When you tie the knot. So, the nomination is a right given to the life insurance policyholder using which appoints a. A contract of suretyship shall be deemed to be an insurance contract, within the meaning of the insurance code, only if made by a surety who or which, as such, is.

And, they follow through with it. Insured event any event that would cause an insurer to pay a claim. The event insured against, namely death occurs, the insurer is liable to pay normally under the contract. It provides significant protection from many types of claims. General features of an insurance contract.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

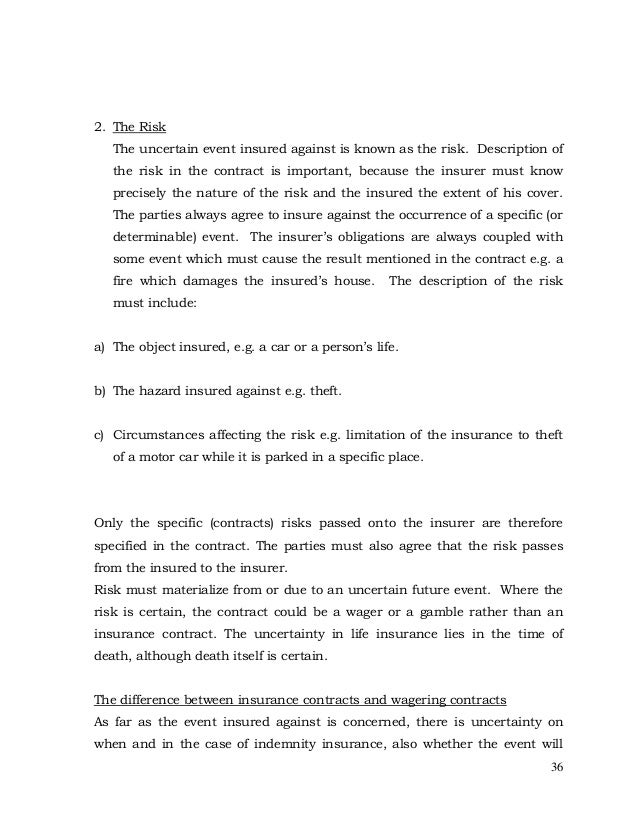

E.g., subsequently (a) an offer made by the insurance company to proposer that Not all contracts of insurance are indemnity contracts, where a contract provides that on the occurrence of an event insured against the insurer will pay a fixed sum or a sum calculated by the application of a particular formula or scale regardless of whether the assured has suffered a loss or not, or irrespective of the amount of loss in fact. Abandonment surrender to the insurer of all interest in insured property after an event insured against has occurred.not permitted under most property insurance contracts. An entity which provides insurance is known as an insurer, insurance company, insurance carrier. And, they follow through with it.

Source: fotorise.com

Source: fotorise.com

Basics of insurance contracts in the philippines. As a business owner, meeting all contract requirements is your goal. A contract of insurance is an agreement whereby one undertakes for a consideration to indemnify another against loss, damage or liability arising from an unknown or contingent event. Now term insurance is more significant because someone else is financially dependent on you. Depending on the contract, other events such as terminal illness or critical illness can.

Source: revisi.net

Source: revisi.net

A contract of suretyship shall be deemed to be an insurance contract, within the meaning of the insurance code, only if made by a surety who or which, as such, is. The insurance, thus, is a contract whereby. General features of an insurance contract. 1.an insurance contract is a contract between an insurer and an insured which obligates the insurer, in consideration of insurance premium, to pay insurance benefits to the beneficiary upon the occurrence of the event insured against. The event must be uncertain subject to the “principle of fortuitousness.” the instability can be either as to when the incident will occur (for example, in a life insurance.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

As a business owner, meeting all contract requirements is your goal. Insurance is a means of protection from financial loss. The insurance, thus, is a contract whereby. One of those claims may include breach of contract. A contract of insurance is an agreement whereby one undertakes for a consideration to indemnify another against loss, damage or liability arising from an unknown or contingent event.

Source: pinterest.nz

Source: pinterest.nz

The essentials of any insurance contract are discussed as under with reference to the life insurance only. One of those claims may include breach of contract. There must be an uncertain future event as no one knows when, or if, the event insured against will occur. [2] the insurer undertakes the obligation for a consideration, the premium paid by the insured. Now term insurance is more significant because someone else is financially dependent on you.

Source: revisi.net

Source: revisi.net

The insurance, thus, is a contract whereby. An entity which provides insurance is known as an insurer, insurance company, insurance carrier. Most business owners need general liability insurance. For example, in car insurance, an insured event may be a car accident because it would cause the insurance company to compensate the policyholder for property damage and/or medical bills. Uncertainty is the most stressful feeling in life, whereas, the most important thing in life is life itself.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

A contract of insurance does not remain a contract of indemnity if a fixed amount is to be paid by the insurer to the insured on the happening of the event insured against, whether he suffers a loss or not. The event insured against, namely death occurs, the insurer is liable to pay normally under the contract. General features of an insurance contract. Most companies set out to provide an exceptional service. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

A contract of insurance is an agreement whereby one undertakes for a consideration to indemnify another against loss, damage or liability arising from an unknown or contingent event. E.g., subsequently (a) an offer made by the insurance company to proposer that *a contract of marine insurance is for a particular voyage. Uncertainty is the most stressful feeling in life, whereas, the most important thing in life is life itself. However, a view has been expressed that life insurance is not a contract of indemnity.

Source: axley.com

Source: axley.com

So, the nomination is a right given to the life insurance policyholder using which appoints a. General features of an insurance contract. Most companies set out to provide an exceptional service. Insured event in accordance with the insurance contract. Insurance companies base their premiums on the likelihood that an insured event may happen.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

Most business owners need general liability insurance. Now term insurance is more significant because someone else is financially dependent on you. [2] the insurer undertakes the obligation for a consideration, the premium paid by the insured. Here are some common life stages that will have the greatest impact on your term insurance coverage. Insurance may be defined as a contract between two parties whereby one party called insurer undertakes, in exchange for a fixed sum called premiums, to pay the other party called insured a fixed amount of money on the happening of a certain event.

Often, ‘wedding bells’ ring in the need to relook at the term insurance coverage you were carrying when you were single. Not all contracts of insurance are indemnity contracts, where a contract provides that on the occurrence of an event insured against the insurer will pay a fixed sum or a sum calculated by the application of a particular formula or scale regardless of whether the assured has suffered a loss or not, or irrespective of the amount of loss in fact. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. Depending on the contract, other events such as terminal illness or critical illness can. A contract of insurance does not remain a contract of indemnity if a fixed amount is to be paid by the insurer to the insured on the happening of the event insured against, whether he suffers a loss or not.

Source: sampletemplates.com

Source: sampletemplates.com

[3] the obligation is to indemnify another (the insured or beneficiary) against loss, damage, or liability. Insurance is a means of protection from financial loss. Now term insurance is more significant because someone else is financially dependent on you. [2] the insurer undertakes the obligation for a consideration, the premium paid by the insured. A contract of insurance is an agreement whereby one undertakes for a consideration to indemnify another against loss, damage or liability arising from an unknown or contingent event.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

In life insurance an offer can be made either by the insurance company or the applicant (proposer) & the acceptance will follow. [2] the insurer undertakes the obligation for a consideration, the premium paid by the insured. The event insured against, namely death occurs, the insurer is liable to pay normally under the contract. Often, ‘wedding bells’ ring in the need to relook at the term insurance coverage you were carrying when you were single. Here are some common life stages that will have the greatest impact on your term insurance coverage.

Source: wisegeek.com

Source: wisegeek.com

Any contingent or unknown event, whether past or future, which may damnify a person having an insurable interest, or create a. A contract of insurance is an agreement whereby one undertakes for a consideration to indemnify another against loss, damage or liability arising from an unknown or contingent event. *a contract of life insurance is a continuing contract.it lapses if premium is not paid regularly at the specified times. • insured risk is the risk against which insurance is taken out. A contract of life insurance is not a contract of indemnity.

Source: myreallife1d.blogspot.com

Source: myreallife1d.blogspot.com

The insurer undertakes to pay a lump sum on the happening of a certain event, irrespective of the loss suffered by the insured. Here are some common life stages that will have the greatest impact on your term insurance coverage. For example, in car insurance, an insured event may be a car accident because it would cause the insurance company to compensate the policyholder for property damage and/or medical bills. When you tie the knot. [1] a contract of insurance is a contract of indemnity.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title event insured against life insurance contract by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.