Your Essential features of insurance contract images are ready in this website. Essential features of insurance contract are a topic that is being searched for and liked by netizens today. You can Download the Essential features of insurance contract files here. Find and Download all free images.

If you’re searching for essential features of insurance contract images information connected with to the essential features of insurance contract interest, you have come to the right blog. Our site frequently gives you suggestions for downloading the highest quality video and image content, please kindly search and find more informative video articles and images that match your interests.

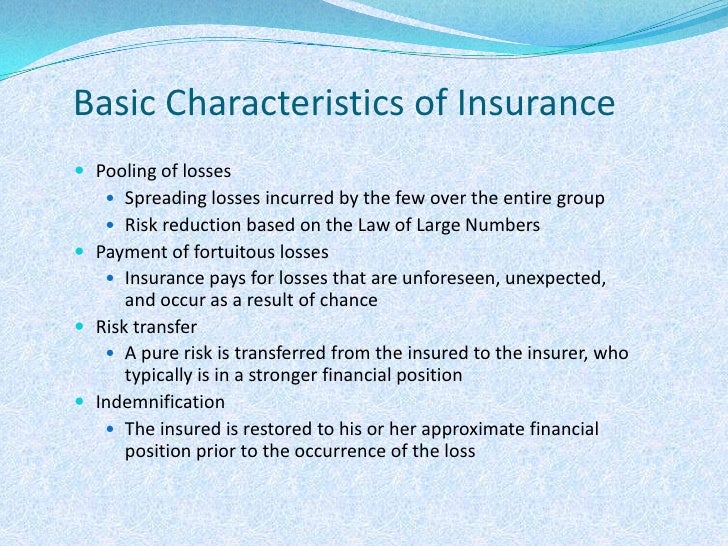

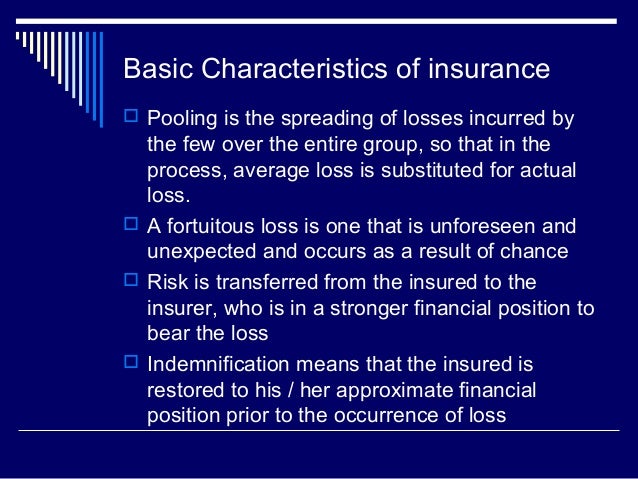

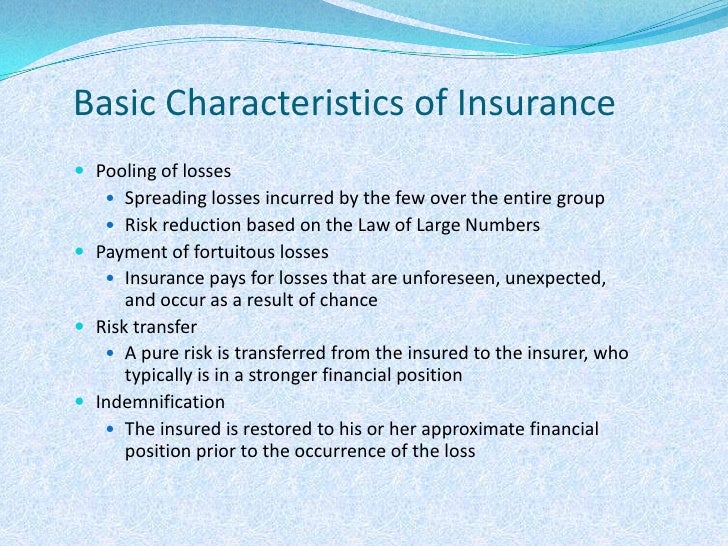

Essential Features Of Insurance Contract. Insurance is a device to share the financial losses which might befall an individual or his family on the happening of a specified event. For this contract to work, at least one party must assume the risk. In other words, the loss should be casual. Unlike a sale of goods, a contract of insurance is not governed by the principle of ” buyers be aware”, it is governed by the principle of “utmost good faith”.

General insurance From slideshare.net

General insurance From slideshare.net

Another feature of insurance is the cordial loss of payments. On the policy, not several. The insurer provides the risk that covers the ship owners or the cargo owners against the loss or the. Offer an expression on willingness to be bound on terms. Additionally, all insurance contracts specify: Aleatory contracts are a mutual agreement that is only triggered by the occurrence of an uncertain event.

Legal capacity to contract or competency 4.

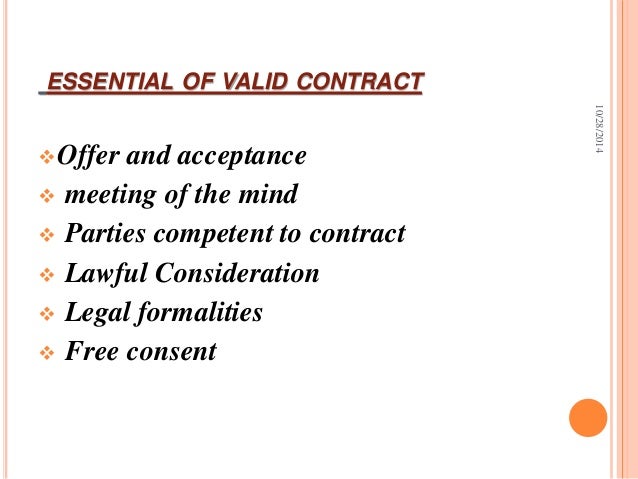

The purpose of insurance is to indemnify the insured, or to bring insured back to the same financial position insured were in before insured suffered the covered loss. Elements of general contract 1. You should note, however, that the classic doctrine of contract formation has been modified by developments in the law of estoppel, misleading conduct, misrepresentation, unjust enrichment, and power of acceptance. Above are the six essential elements of a valid contract. Aleatory contracts are a mutual agreement that is only triggered by the occurrence of an uncertain event. An amicable loss is that which is unpredictable and unpredictable and as a result of opportunity.

Source: cometinsure.com

Source: cometinsure.com

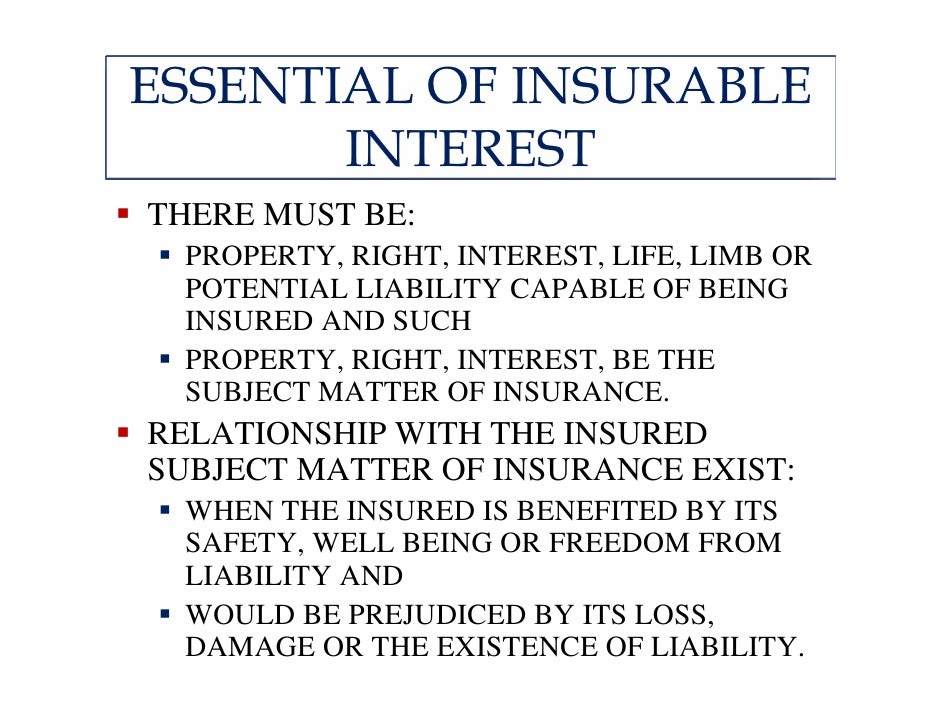

You should note, however, that the classic doctrine of contract formation has been modified by developments in the law of estoppel, misleading conduct, misrepresentation, unjust enrichment, and power of acceptance. The following features must be present in a contract to make it legally enforceable. Essential features of a contract. Insurable interest means the interest of the person in the subject matter of insurance the protection of which gives benefit and loss gives that person the loss and his. The essential elements of insurance are as follows :

Source: lawcorner.in

Source: lawcorner.in

The purpose of insurance is to indemnify the insured, or to bring insured back to the same financial position insured were in before insured suffered the covered loss. Above are the six essential elements of a valid contract. Such a group of persons may be brought together voluntarily or through publicity or through solicitation of the agents. (ii) the contract of life insurance is a contract of utmost good faith. 8 main elements of marine insurance contract the marine insurance has the following essential features which are also called fundamental principles of marine insurance, (1) features of general contract, (2) insurable interest, (3) utmost good faith, (4) doctrine of indemnity, (5) subrogation, (6) warranties, (7) proximate cause, (8) assignment and nomination of the policy.

Source: slideshare.net

Source: slideshare.net

Though all contracts share fundamental concepts and basic elements, insurance contracts typically possess a number of characteristics not widely found in other types of contractual agreements. Both the parties to the contract, that is the insured and the insurer have to disclose all the facts connected with the insurance contract. Another feature of insurance is the cordial loss of payments. The marine insurance has the following essential features which are also called fundamental principles of marine insurance, (1) features of general contract, (2) insurable interest, (3) utmost good faith, (4) doctrine of indemnity, (5) subrogation, (6) warranties, (7) proximate cause, (8) assignment and nomination of the policy. On the policy, not several.

Source: slideshare.net

Source: slideshare.net

Above are the six essential elements of a valid contract. An insurance contract is a document representing the agreement between an insurance company and the insured. In a contract of insurance the insured is in a advantageous position than that of the insurer. A marine insurance contract is a mechanism that supports to mitigate risks of the financial loss to the property such as ships, goods or the other movable maritime transport on the payment of the premium by the assured to the insurer for an easy insurance quote. Such a group of persons may be brought together voluntarily or through publicity or through solicitation of the agents.

Source: lebagroup.com

Source: lebagroup.com

On the policy, not several. Certain elements like offer and acceptance, free consent, capacity to enter into a contract, lawful consideration and lawful object must be present for the contract to be valid; The insured doesn’t get compensation unless the insured event occurs. Central to any insurance contract is the insuring agreement, which specifies the risks that are covered, the limits of the policy, and the term of the policy. The insurance contract involves—(a) the elements of the general contract, and (b) the element of special contract relating to insurance.

This occurrence of event is based on probability and occurrence of event is not controlled by any party. There are also paid high commissions. An affordable type of insurance. (ii) the contract of life insurance is a contract of utmost good faith. The marine insurance has the following essential features which are also called fundamental principles of marine insurance, (1) features of general contract, (2) insurable interest, (3) utmost good faith, (4) doctrine of indemnity, (5) subrogation, (6) warranties, (7) proximate cause, (8) assignment and nomination of the policy.

Source: slideshare.net

Source: slideshare.net

The contract also cannot be signed as a result of an error. Essential features of a contract. Central to any insurance contract is the insuring agreement, which specifies the risks that are covered, the limits of the policy, and the term of the policy. Elements of special contract relating to insurance 1. If one party to a contract might receive considerably more in value than he or.

Source: enterslice.com

Source: enterslice.com

Elements of special contract relating to insurance 1. The second essential element of an insurance contract is the existence of insurable interest, in absence of it the marine insurance contract becomes null and void. The insured doesn’t get compensation unless the insured event occurs. On the policy, not several. You should note, however, that the classic doctrine of contract formation has been modified by developments in the law of estoppel, misleading conduct, misrepresentation, unjust enrichment, and power of acceptance.

Source: slideshare.net

Source: slideshare.net

Parties to insurance contract insurer insured. The marine insurance has the following essential features which are also called fundamental principles of marine insurance, (1) features of general contract, (2) insurable interest, (3) utmost good faith, (4) doctrine of indemnity, (5) subrogation, (6) warranties, (7) proximate cause, (8) assignment and nomination of the policy. Requiring people to gamble away entire life span. You should note, however, that the classic doctrine of contract formation has been modified by developments in the law of estoppel, misleading conduct, misrepresentation, unjust enrichment, and power of acceptance. On the policy, not several.

Source: slideserve.com

Source: slideserve.com

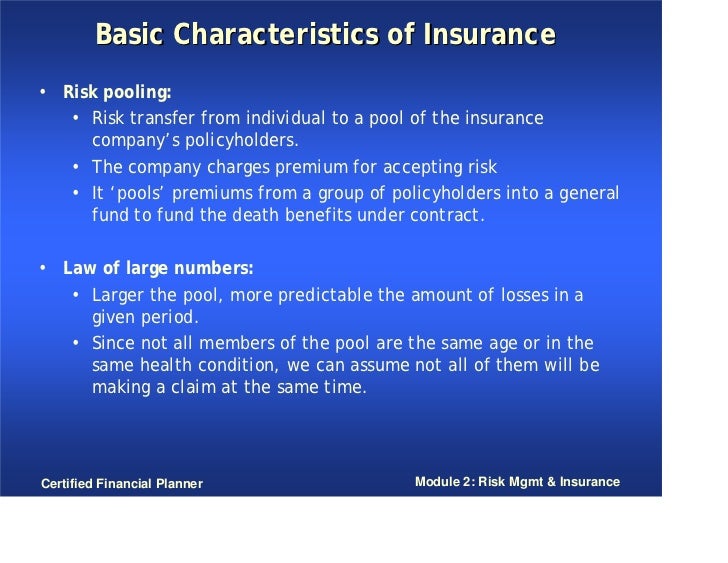

Z features of commercial contract z principles of contracts for insurance 3.2 essentials of commercial contract a. Additionally, all insurance contracts specify: Parties to insurance contract insurer insured. The law of a large number is based on the assumption that the losses are casual and occur randomly. From the above explanation, we can find the following characteristics, which are generally observed in life, marine, fire, and general insurances.

Source: noclutter.cloud

Source: noclutter.cloud

Contract of ‘uberrimae fidei’ or contract of utmost good faith. Insurance is a device to share the financial losses which might befall an individual or his family on the happening of a specified event. Z features of commercial contract z principles of contracts for insurance 3.2 essentials of commercial contract a. In other words, the loss should be casual. In order for an insurance contract to be legally binding, the document must meet the essential elements required of all legally binding contracts, plus a few special elements that are specific to and required by insurance contracts.

Source: enterslice.com

Source: enterslice.com

The main features of life insurance contract: An amicable loss is that which is unpredictable and unpredictable and as a result of opportunity. An insurance policy is a legal contract that is agreed upon by two or more parties. In order for an insurance contract to be legally binding, the document must meet the essential elements required of all legally binding contracts, plus a few special elements that are specific to and required by insurance contracts. The law of a large number is based on the assumption that the losses are casual and occur randomly.

Source: slideshare.net

Source: slideshare.net

Certain elements like offer and acceptance, free consent, capacity to enter into a contract, lawful consideration and lawful object must be present for the contract to be valid; The essential elements of insurance are as follows : The law of a large number is based on the assumption that the losses are casual and occur randomly. There cannot be any fraud, misrepresentation, intimidation or coercion involved when the contract is signed. Elements of special contract relating to insurance 1.

The most common of these features are listed here: The purpose of insurance is to indemnify the insured, or to bring insured back to the same financial position insured were in before insured suffered the covered loss. There are also paid high commissions. Central to any insurance contract is the insuring agreement, which specifies the risks that are covered, the limits of the policy, and the term of the policy. The special contract of insurance involves principles:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Requiring people to gamble away entire life span. Insurance contracts are aleatory as promise comes into picture only on occurrence of event. Legal capacity to contract or competency 4. Such a group of persons may be brought together voluntarily or through publicity or through solicitation of the agents. An insurance contract is a document representing the agreement between an insurance company and the insured.

Source: meganlysportfolio.blogspot.com

Source: meganlysportfolio.blogspot.com

Central to any insurance contract is the insuring agreement, which specifies the risks that are covered, the limits of the policy, and the term of the policy. A marine insurance contract is a mechanism that supports to mitigate risks of the financial loss to the property such as ships, goods or the other movable maritime transport on the payment of the premium by the assured to the insurer for an easy insurance quote. Parties to insurance contract insurer insured. Insurance contracts are aleatory as promise comes into picture only on occurrence of event. The most common of these features are listed here:

Source: slideshare.net

Source: slideshare.net

Requiring people to gamble away entire life span. (ii) the contract of life insurance is a contract of utmost good faith. Insurance contracts are aleatory as promise comes into picture only on occurrence of event. Another feature of insurance is the cordial loss of payments. The second essential element of an insurance contract is the existence of insurable interest, in absence of it the marine insurance contract becomes null and void.

Source: commercemates.com

Source: commercemates.com

Though all contracts share fundamental concepts and basic elements, insurance contracts typically possess a number of characteristics not widely found in other types of contractual agreements. Insuranceopedia explains elements of an insurance contract. An affordable type of insurance. Any person does have an insurable interest who is interested in a. This occurrence of event is based on probability and occurrence of event is not controlled by any party.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title essential features of insurance contract by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.